Nowadays, several businesses are increasingly turning towards addressing environmental, social, and economic problems. Leading companies understand that the key to resolving the complex sustainability issues is to collaborate with peers & organizations within the industry, consumers, governments, society and non-profit organisations.

The Sustainable Development Goals (SDGs) provide a broadly accepted and progressive framework for global collaboration and action, bringing many stakeholders together to tackle and solve these problems in a constructive manner.

2021 will mark six years since the member states of United Nations (UN) unanimously adopted the Sustainable Development Goals (SDGs) as a framework for peace and prosperity for people and the world by 2030 – a deadline that is beginning to appear bigger on the horizon.

![]()

What are the Sustainable Development Goals (SDGs)?

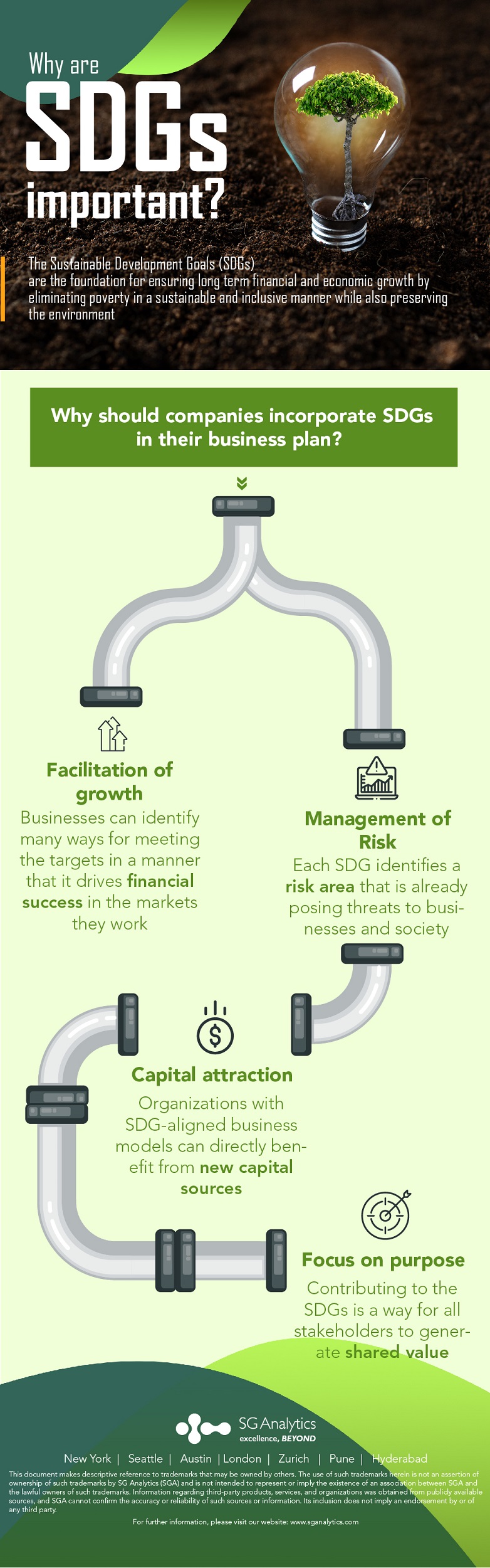

The Sustainable Development Goals (SDGs) are the foundation for ensuring long term financial and economic growth by eliminating poverty in a sustainable and inclusive manner while also preserving the environment.

In a world of rising inequality, poverty, and climate change, it is difficult to run a successful business. The SDG agenda provides a rare opportunity for business to adopt and acknowledge it as a catalyst of business strategies, growth, and investment decisions. It benefits the company in gaining competitive advantage over their rivals. The SDGs encompass a once-in-a-lifetime economic opportunity. The potential value that can be achieved for communities is absolutely immense – with an approximate investment of $5-7 trillion per year. It is currently valued hundreds of billions of dollars in some industries and much more in others. The pay-out for these agendas is very high and therefore, markets are beginning to react to it.

Why should companies incorporate SDGs in their business plan?

Companies are constantly faced with obstacles that restrict their growth potential, such as scarce natural resources, poor capital markets, limited local purchasing power, and a shortage of skilled talent. Organizations can leverage the SDGs to establish opportunities and address challenges across the following prime themes:

Facilitation of growth

At a macro level, the achievement of the SDGs is linked to the business strategy; however, businesses can identify many ways for meeting the targets in a manner that it drives financial success in the markets they work in, to act at a local level.

Although SDGs 8, 9 and 12 specifically address economic growth, employment opportunities, sustainable industrial development innovation, and sustainable production, several other SDGs often benefit businesses by allowing them to expand into new markets, attract talent, and reduce operational risk. For example, beverage companies’ strategy aligns with SDG No. 6 – Clean Water and Sanitation. They look forward to investing in developed watersheds thereby attempting to replenish the aquifer water being used by them, thus pledging to provide safe water to regions which are water-stressed. They are making investments in their social licence to function and thus strengthening their brands in these communities while providing water systems to maintain their bottling franchises around the watersheds.

According to a report by Business & Sustainable Development Commission, SDGs related sustainable business models could create up to $12 trillion in economic opportunities and 380 million jobs by 2030.

Management of Risk

Each SDG identifies a risk area that is already posing threats to businesses and society, and if not tackled, these risks are only going to get worse. When making investment decisions, investors are addressing the ESG risks at an increased rate. According to a survey by EY, investors’ decisions are most likely to be affected by ineffective corporate governance, low environmental performance, scarcity of resource, climate change, and risks to human rights.

Supply chains are particularly vulnerable to the impacts of climate change and natural resource depletion, which are addressed in SDGs 12, 13, 14, and 15. The potential of these emerging markets is limited by the instability of the geopolitical landscape (SDG No. 16), inequality (SDG No. 10) and shortfall in development in several regions (SDG Nos. 1, 2, 3 and 4).

Stakeholders consider businesses accountable for generating or alleviating these risks, so addressing these as well as other risks makes good business sense. Responding to stakeholder concerns in these areas allows businesses to retain their social licence to continue their operations.

Capital attraction

The United Nations reports that achieving the SDGs would cost between US$3.3 and US$4.5 trillion per year. Transformative finance models will be created which are expected to be based on cash (both government & private sector) which has been channelized to projects through multilateral public funds dedicated to climate change – this is known as climate finance. Additionally, innovative financial products in the private sector, known as green bonds will be launched.

According to BNP Paribas, the stock performance of firms listed in the Solactive Sustainable Development Goals World Index of acknowledged leaders in their sectors on sustainability issues of society and environment is directly related to the ROI of the bonds. This shows how organizations with SDG-aligned business models can directly benefit from new capital sources.

Focus on purpose

The SDGs would almost certainly have a huge effect on the purpose of many businesses around the world. Contributing to the SDGs is a way for all stakeholders to generate shared value, so that companies can be a powerful force in rallying stakeholders around a common goal. Companies that concentrate on a purpose that is centred around creating value for others, developing the world we live in, and empowering the company at all levels can enhance the capability of driving profits and generating sustainable value.

The SDGs will help a company’s mission be focused on problems that drive growth, engage, and inspire workers, unlock new markets and opportunities, and protect the company from a variety of risks. The SDGs will assist an organisation in identifying its ambitious purpose in a form that is meaningful and encouraging to stakeholders, enabling purpose to become the cornerstone for its strategy, and sparking long-term positive change that can increase shareholder value over time.

Conclusion

SDGs provide a roadmap for businesses to work with stakeholders to develop sustainable solutions and strategies that can drive the transformation of business models, products and services, and various communities in which they operate. We understand that the SDGs can necessitate a change of perspective. The goals are complicated and intertwined, and their achievement is expected to be driven by new alliances between industry, government, and civil society. However, valuable tools are evolving to help businesses understand the ways in which they can contribute to the SDGs holistically.

Businesses would most certainly be held accountable for the consequences of their operations, especially progress toward SDG-related goals. Companies can concentrate on building visible shared value by integrating the SDGs into their core business and reporting cycle. Collaboration is essential, both within sectors and across industries, because a single organisation cannot solve all these problems on its own. Collaboration will certainly be the most crucial factor in achieving the SDGs and boosting the efforts.