Indian companies are finding it challenging to enforce environmental, social, and governance ratings proposed by the capital market regulator and authorities. The proposed changes coming amid the rising concerns about climate change are making many nations, including India, commit to mitigating this challenge.

The government is now pushing the Securities and Exchange Board of India Sebi to roll out a series of regulations to create a standardized ESG framework for the country’s top 1000 listed companies. India has pledged to more than a 45% reduction in carbon intensity by 2030. If the country switches to incorporating power generation from renewable sources, the net-zero target can be achieved.

Indian companies are also showing an eagerness to embrace clean energy. However, they are facing difficulties trying to purchase renewable energy as the country’s ailing power distributors pose a challenge. The proposed ESG rules by Sebi are aimed to offer organizations accrediting ratings, thereby putting into action a regulated framework that is trustworthy as well as will help Indian companies attract more green capital.

Read more: New SEBI Guidelines to Tackle the ESG Ratings Conundrum in India – An Analysis

Driving Sustainability

ESG or Environment, social, and governance aspects were first incorporated into business models in India in 2009. Subsequently, other frameworks were presented to incorporate the concept of ESG into business reporting regimens. The latest framework, the Business Responsibility and Sustainability Report (BRSR), offers more comprehensive and quantitative disclosures.

BRSR is incorporated to ensure that company-wise ESG data is documented and made available on a yearly basis. However, there are a few liabilities to the current reporting system.

-

There are no benchmarks for parameters that are to assess the performance.

-

The information made available is company-specific and not plant-specific.

To regulate the ESG framework, investors need to upscale their operations as well as be mindful of greenwashing. Asset management companies are incorporating a clause to invest only in securities having BRSR disclosures. While BRSR guidelines may not be adequate for proofing against greenwashing, company-level reporting can assist in offering key data points to mask the on-ground reality.

Establishing a Relation: Green Finance and ESG

With ESG (environmental, social, and governance) investments in India growing quickly, investors have options available for investment categories. From venture capital and private equity to institutional investors, family businesses, and high-net-worth individuals, ESG investment is on the rise. The expanding relevance of sustainable investment in India is now reflected even in the capital-raising efforts.

Green financing is also gaining significant momentum, and the tide is expected to go strong in 2022, as well. Investors have increased their efforts to promote green finance to build a sustainable future. As compared to 2019, fund flows into ESG investments increased in 2020. Green finance bonds achieved an annual high of $544.3 billion in 2020, and the investment graph has been trending upward ever since. In 2022, investors are eying an optimistic onward growth for sustainable investment in India that will support the evolution of ESG agendas.

Read more: Trends that are Empowering the ESG Revolution in 2022

The Role of Banks in Tackling the Crisis

The banking sector has always been the backbone of India’s transition into a major economic powerhouse. It is still perceived as a major source of funding for industries. Its role as a major driver is also to mitigate the impact of climate change.

Today, it is important for financial institutions to strengthen this transition toward net-zero emissions through continued efforts to finance green infrastructure. Although banks do not play a major direct role in climate change, as financial institutions, they play an integral part as financiers to industries.

Technology is emerging as a pivotal factor in supporting the net-zero transition for several industries. From electrifying transportation to building energy-efficient buildings, reducing GHG emissions from industrial and agricultural sectors, transforming the power grid to supply clean electricity, and expanding carbon capture, use, and storage – technology is assisting in building mechanisms for the faster transition towards net-zero.

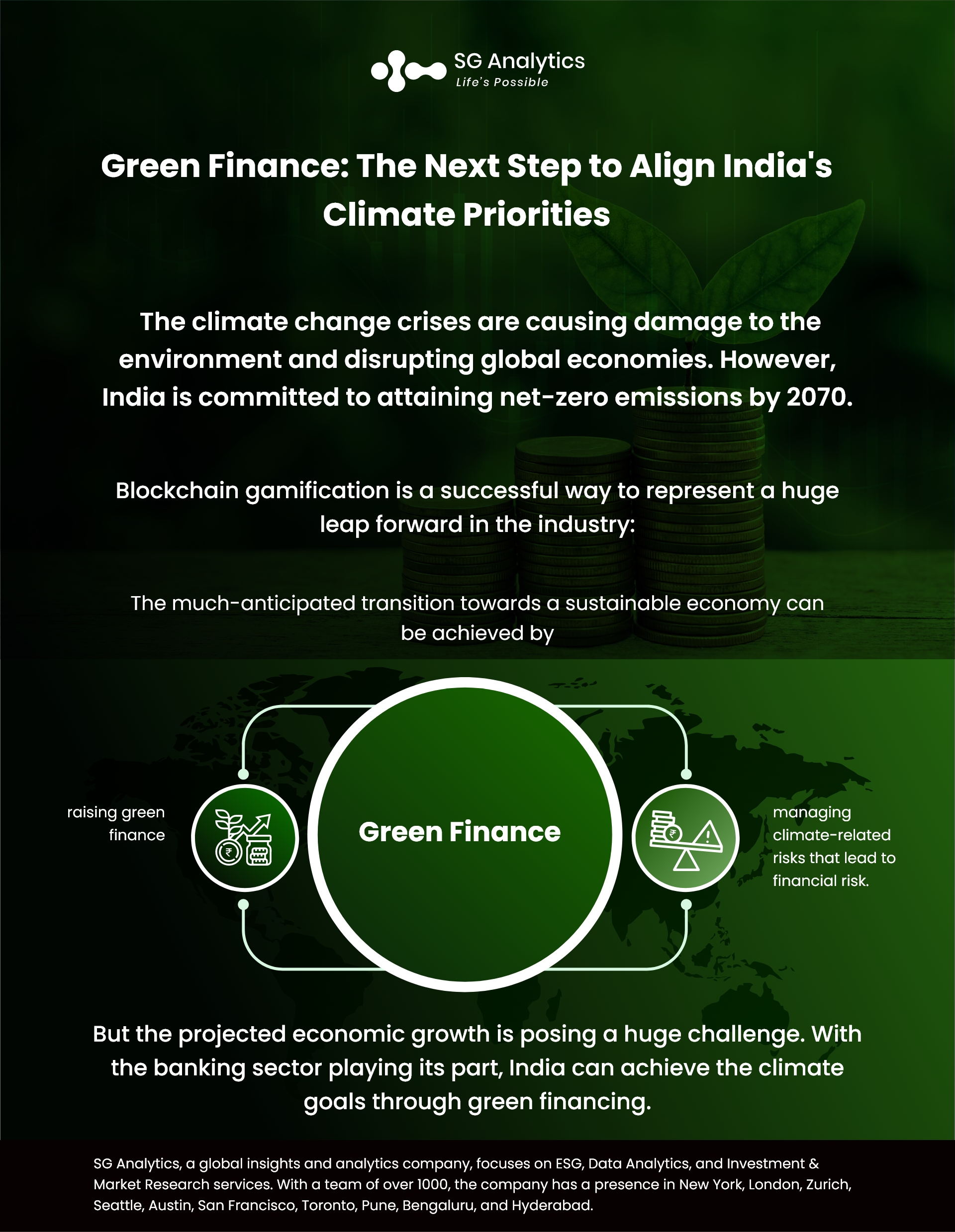

The financial system plays a critical role in a country’s transition to a sustainable economy as it is the driving force behind unlocking private investments required to bridge the gap between demand and supply. Today, the much-anticipated transition towards a sustainable economy requires a major focus on two primary objectives:

-

raising green finance

-

managing climate-related risks that lead to financial risk

However, targeting both these objectives is creating a potential dilemma for organizations. An increase in green finance through policy and regulation tends to raise the overall financial risk, as green loans and assets are perceived to be of lower credit quality. Expanding green finance can lead to an overall higher credit risk profile for individual banks and asset managers.

Banks are also issuing green bonds to push work on economically sustainable projects. However, the value of these bonds is still small when compared with the total size of bond issuance in India.

To focus on managing financial risks through climate policy and regulation, organizations need to contribute toward reducing green finance flows. Based on the current model, it is important to place a balancing act to address this potential dilemma.

Advancing to Achieve Net-zero Ambitions

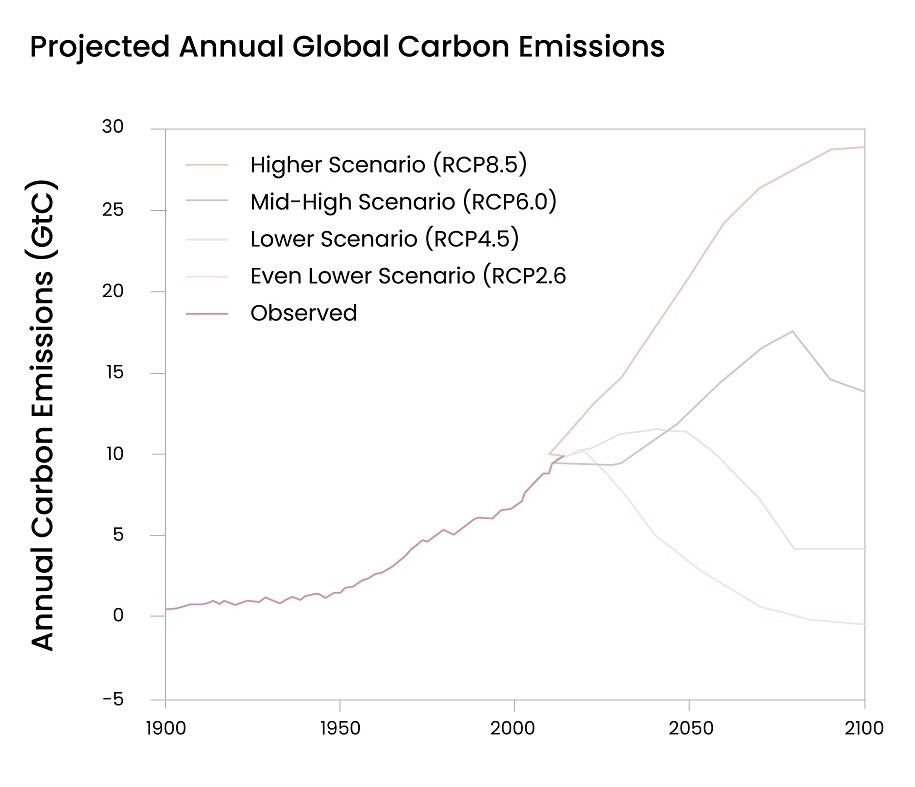

At the COP26 conference in Glasgow, Indian Prime Minister Narendra Modi committed to achieving net-zero emissions by 2070. As part of the five-pronged commitment titled Panchamrit, he outlined a lofty aim that India will be producing 500 GW of energy from non-fossil sources by 2030 to reduce carbon intensity to 45%. The Prime Minister also committed to bringing down projected carbon emissions by 1 billion tonnes by 2030.

As per the Council on Energy, Environment, and Water (CEEW), to achieve the goal, upward investments of $10 trillion will be required to achieve net zero by 2070. These investments would assist in decarbonizing India’s power, industrial, and transport sectors. The CEEW has also evaluated that India could face a significant investment shortfall of $3.5 trillion. Banks are expected to play a critical role in meeting these investment targets or bridging the gaps.

Read more: ESG & Sustainability: Top ESG Challenges for Companies to Tackle in 2022

Key Takeaways

-

The ongoing climate change crises are causing damage to the environment and disrupting global economies.

-

India is committed to attaining net-zero emissions by 2070. However, the projected economic growth is posing a huge challenge.

-

The banking sector will likely play a critical role in achieving the climate goals set forth by India through green financing.

The Way Forward for India

With efforts being taken, it is now time to work towards gaining greater momentum. The increase in ESG awareness and policies have helped investors and organizations to navigate the transition toward a greener tomorrow. However, it is now time for Indian banks to catch up.

Sustainable change is directed by sustained efforts. It is important for individuals as well as organizations to be aware of their role and responsibility towards social, economic, and environmental causes. With a strong and continuing focus on sustainability driven by the private-public partnership, India will steer towards a better-shared future that will be driven by a collective goal of a healthier planet.

India made a significant commitment regarding EGS and net-zero emission in the Paris Agreement as well as in the SDGs program. More disclosures will now drive the corporate objectives to align with the national objectives in the future. This unified approach will help strengthen developments around ESG investments, green guidelines, and financial products, along with the roles of the private sector, public sector, bankers, and asset managers.

India is in a race to accomplish its climate goals, and green finances are also becoming a priority. This calls for a cohesive approach and a shared vision among investors, policymakers, regulators, and participants in the financial sector. The way forward is to elevate the conversation to the highest levels and bring the paradigm shift by emphasizing sustainable financing. This collective urge to make a sustainable change will help make a real difference.

These new actions will stimulate and align the entire financial system with green finance as well as will drive the engine of sustainable growth in India.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in ESG Consulting services, SG Analytics offers bespoke sustainability consulting services and research support for informed decision-making. Contact us today if you are in search of an efficient ESG integration and management solution provider to boost your sustainable performance.