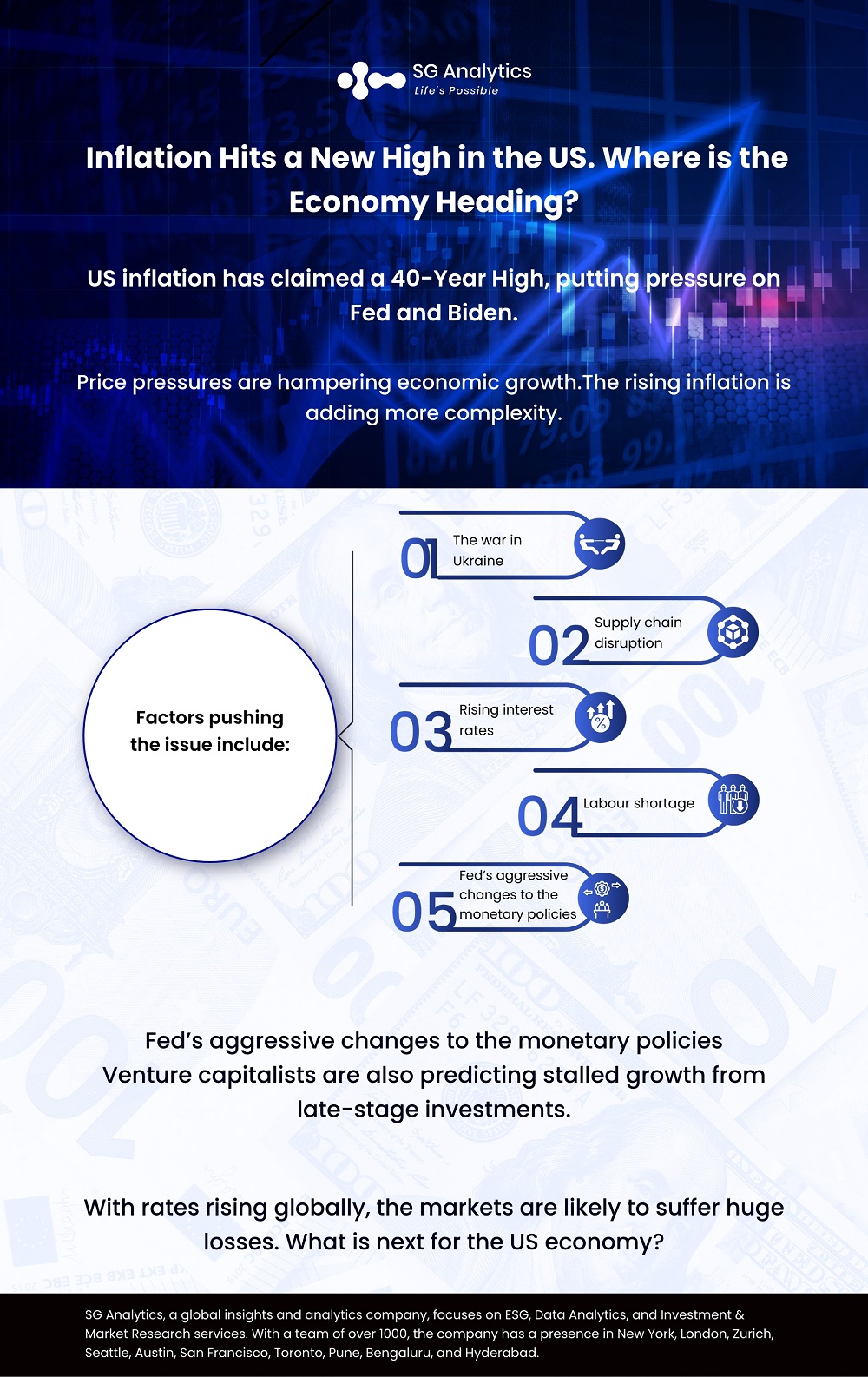

Rising inflation emerged as a big issue in the spring of 2021 when the U.S. government was imposing strict COVID-19 protocols. A mix of factors, including recovering demand, supply chain issues, and labor shortages pushed the prices up, and the onward graph is still rising.

A year on, the US inflation has accelerated to a fresh 40-year high. Price pressures are hampering economic growth. This is pushing the Federal Reserve to step up its tightening cycle with a series of steep interest-rate hikes, which in turn are expected to add to the political problems for the White House.

The consumer price index surged to 8.6% Y/Y and 1% sequentially in May 2022, after a 0.3% rise in April 2022, beating all estimates. Shelter, food, and gas contributed the most to the rise.

Driven by surging mortgage rates, registering a nearly twofold increase over the last six months, rising to roughly 6% from 3.2%, the US real estate market is starting to cool off. While home prices still seem overvalued, higher borrowing costs and declining sales could very likely compress prices by 5% by June 2023, per data from Capital Economics.

The economic uncertainty has left the stock market jittery. As markets have tumbled, investors have sought to increase allocation to more defensive asset classes, including high-rated and low-duration products in the fixed income category. In terms of equities, investors are gravitating toward low-growth companies with relatively lower P/E multiples that provide the cushion of low beta.

Moreover, persistent inflation is likely to drive fund managers to reduce allocation to equities, which can hurt public market valuations and have a knock-on effect on startup valuations, which are often valued relative to their public peers. This could understandably lead to tightened partner allocations to VC funds and possibly funds downsizing their expectations for future fundraising.

Read more: Looming Fears of Inflation, The Fed, and Recession: Where are The Financial Markets Heading?

Runaway Inflation

Due to quantitative easing and ensuing supply-demand imbalances, businesses globally have started raising prices at a pace not seen in decades. Multiple factors drove inflation, including pandemic-induced supply disruptions, higher food prices due to severe storms and drought, the Russia-Ukraine conflict, and the lockdowns in China.

The rising demand was exacerbated by the massive $5 trillion in spending by the US government to shield households as well as businesses from the economic shock of the pandemic. While the aid’s purpose was to cushion family finances enabling people to keep buying, this contributed to a 3 percentage points rise in inflation, per the Federal Reserve Bank of San Francisco.

Accordingly, goods like furniture, cars, and electronics saw a surge in demand. However, this unusually high demand collided with the supply chain issues originating from COVID-19, leading to record inflation.

Inflation Remains Fed's Key Challenge

Faced with inflation growing at one of the highest annualized rates globally, the Federal Open Market Committee (FOMC) has made aggressive changes to its monetary policy. However, the general view is that the Fed was a little behind the curve in doing so, rendering taming inflation and preventing recession increasingly challenging.

While inflation is broad-based across many different categories, per BLS data, the problem lies deeper due to the supply chain bottlenecks and the ongoing war in Ukraine. Owing to this situation, the Fed is likely to face increasing pressure to get inflation under control. The CPI data suggests that inflation is likely to remain elevated with more surprise possible to the upside with the jury still out as to whether inflation has peaked in the US. Against this backdrop, the Federal Reserve envisions further equally steep rate hikes taking the federal funds rate from its current 1.50-1.75% to 3.4% by the year-end.

Private Market Activity to be Subdued

Choppy public markets have made private investors more circumspect. Investing in companies going for “growth at all costs” has understandably taken a backseat, albeit till the uncertainty persists, and investors are being more selective and discerning in making their investment decisions, a sentiment recently echoed by the Managing Partner of SoftBank Vision Fund, Nagraj Kashyap. SoftBank, a major global tech investor, registered a nearly $27 billion loss in its Vision Fund Unit’s investments.

Faced with the prospect of below-average or even negative returns, investors could pull back on their investments, especially in late-stage companies with high cash burn and an unclear path to profitability. For instance, Softbank plans to reduce its investments by up to 50-75% Y/Y in 2022. Broadly, VC funding globally fell to its lowest level in the past 12 months, with $47 billion being raised in April 2022, per Crunchbase data. The slowdown in funding will likely increase pressure on founders with question marks over their next fundraises.

Looking ahead, due diligence before investments will likely become more robust and normalization of inflated valuations could lead to a rise in value deals, both of which would be a net positive for the VC ecosystem.

Read more: Tech Stocks Slump is Triggering the Withdrawn of ESG Funds: Here's Why

Could Inflation Spark a Recession?

The Fed is faced with a difficult balancing act with an urgent need to raise interest rates aggressively to help bring down inflation without triggering a recession. A difficult task, given that rising interest rates lead to a rise in borrowing costs for organizations as well as consumers, which could lead to a further slowdown. While investors are not anticipating a U.S. recession in 2022, they are positioning their portfolios for the time being.

Growth stocks have seemed more sensitive to rising interest rates as higher discount rates are rendering future cash flows – a key component of DCF models used to determine the price targets for growth stocks – less valuable. Accordingly, in 1H22, the Russell 1000 Growth Index has fallen nearly 29%, outpacing the 14% fall in the Russell 1000 Value Index (as of June 21, 2022), per FactSet data.

In addition to the economic and business landscape, unrelenting inflation has emerged as a mounting threat to the government and President Joe Biden. With approval ratings declining to 39% as of June 14, 2022, Democratic Party is at risk of losing control over at least one chamber of Congress in the November mid-term election.

Biden administration has also put forth plans to rein in soaring gas prices by announcing a historic release of oil from their strategic reserves. However, it remains unclear how much relief it will bring to the consumers.

Sector Spotlight

Similar to how technology companies triumphed in the pandemic, a few sectors are expected to fare better than others in the current economic downturn. With businesses reconsidering their supply chain strategies in response to the disruption caused by the pandemic and the ongoing war in Ukraine, the supply chain tech sector is a natural winner. By offering solutions such as increased freight visibility, improved collaboration, and predictive capabilities through data analytics, AI and ML, the supply chain tech companies are perfectly poised to benefit from a shift in supply chain strategy by businesses.

While clean tech has been in focus for some time, the geopolitical events in Europe have put the sector under the spotlight. As the EU nations try to cut their reliance on Russian energy, the need for clean energy is more than ever. Further tailwinds including (1) the ongoing innovation, (2) businesses’ increased focus on ESG targets, (3) and increasing clean energy spending by governments are likely to power the growth of the clean tech sector.

As digital transformation gains momentum, the frequency and cost of cyber-attacks are also picking pace. Increasing number and magnitude of cyber-attacks – prevalent among all industries – cost companies tens of millions of dollars. According to Cybersecurity Ventures, the cost of global cybercrime is expected to increase 15% per year, reaching $10.5 trillion annually by 2025. To safeguard themselves from the surging threat of cyber-attacks, businesses are implementing a robust cyber security program, offering growth opportunities for cybersecurity companies.

Key Takeaways

-

Shelter, food, and gas are emerging as the biggest contributors to the rising inflation

-

US inflation has claimed a 40-Year High, putting pressure on Fed and Biden

-

The consumer price index rose 8.6% in May annually

-

Property values are falling across the US due to Inflation

-

The US office market has been hit the hardest due to the US inflation

Read more: Is Silicon Valley Still Dominating Global Innovation?

What is Next for the US Economy?

The immediate fallout of the persistently rising prices has been a shift away from the Fed’s unequivocal focus on supporting economic growth and increasing the employment rate. On the GDP front, a second consecutive quarter of negative GDP growth could, to many, indicate that the US economy is falling into recession. With COVID-19 still lingering and cases rising in some parts of the world, recession in the US seems more a matter of when and how severe.

For Fed the focus now is strongly on bringing the inflation back to the 2% range and, if possible, avoiding a hard landing. A still strong labor market - with roughly half a million jobs being added per month to the economy (per Deloitte) - could help in stalling recession at least till late 2022. Moreover, research by Deloitte shows that it takes at least 20 months from the onset of the Fed tightening to a recession, which strengthens the arguments of the FED maneuvering the economy toward a soft landing.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in the BFSI space, SG Analytics assists businesses with insightful relevant research along with sophisticated technology solutions. Contact us today if you are in search of an efficient market research service provider to make critical data-driven decisions.