Leading the race US-based automotive manufacturers are focusing on achieving Level 5 automation in the next one or two years. Currently, most of the top players have attained Level 2 (partial automation) and Level 3 (conditional automation).

Electric vehicles are the future, however, affordability and manufacturing cost have been key issues in 2019. The good news is that lithium-ion battery prices have come down 73% per kilowatt-hour from 2010 to 2018. Though this trend is expected to continue till EVs become cheaper to buy than their fossil-fuel-powered counterparts, it’s a long road ahead and may become a practical choice only after 2025.

So what are the OEMs planning in 2019-2020? Should they focus more on AI, Data analytics and connectivity or should they invest more in technology up-gradation and move towards electric vehicles?

Some of the early thought leaders have already started the process in 2019 and investing in the adoption of newer technologies and here are some glimpses of their effort.

#1. Daimler, USA

To stay ahead of peers, a company has to adopt technology at the right time and welcome disruption. Daimler is one of the early adopters of technology and AI and understands the power of data analytics in today’s context. Looking back in Europe, the company had initiated its data modeling process in Berlin with a heat map to predict in which area the highest potential A-Class driver would buy a car. The company had 100,000 customer records in its database and using AI it actually zeroed down the list to 5,000 potential buyers of an A-Class Mercedes. Daimler used a combination of AI and analytics to test out their algorithms and visualizations and validated their in-house predictions combined with deep mining in their datasets. The findings of this process helped Daimler to build a counter-strategy plan for customers who already owned an S-Class owner but had a high propensity to purchase an A-Class Mercedes. The result was ‘increase in sales’.

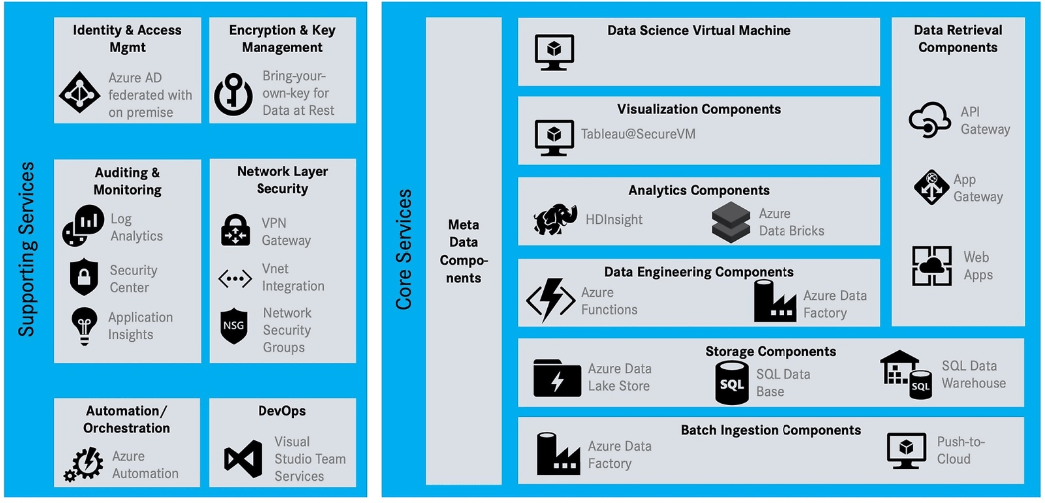

The company wanted to safeguard its internal data and surveys and that was one of the reasons why they invested heavily and moved to a more advanced analytics system in 2019. The company adopted Microsoft Azure (Azure HDInsights and Data Bricks) and “eXtollo” for extensive analysis in February 2019. Azure Data Lake Store and Azure Data Factory were additionally employed to understand the supply chain, store data and other gaps in their system.

The company is expected to use eXtollo platform to develop blueprint rather than focus on a monolithic product. Of late, the company has been able to interpret user perception to offer better and personalized services for loyal customers.

The switch from conventional to AI platform was initiated in February 2019. Earlier, the company was using IBM® SPSS® software, to analyze the large volume of data obtained in the production process and understand the key factors that could influence product quality within each individual process step.

While on one side AI and data analytics are now part of the company’s eco-system, the company is also consciously moving away from conventional production to electric vehicles (especially trucks). Based on recent announcements by the CEO, in ACT Expo California in May 2019, the company is investing heavily in electric vehicles.

“The road to emissions-free transportation is going to be driven by battery-electric vehicles. I believe the future is electric,” says Neilson.

Moving forward as the electric vehicle is gaining momentum, the company just upgraded itself for future complexities of data.

- The Azure platform will enable the company to migrate data to the cloud while maintaining enterprise-grade security.

- Improve cloud-based security

- Company intends to apply the power of Azure to convert massive amounts of data into insights that will fuel innovation.

The Daimler Group is one of the market leaders of premium cars and the world’s biggest global manufacturer of commercial vehicles, with divisions such as Mercedes-Benz Cars, Daimler Trucks, Mercedes-Benz Vans, Daimler Buses, and Daimler Financial Services.

#2. Fiat Chrysler Automobiles NV

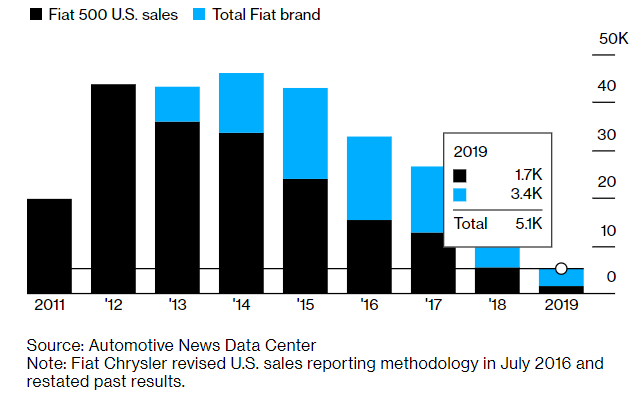

Some companies learn from their past and improvise immediately. Fiat has a similar case in 2018-2019. In 2018, Fiat sold more than 15,000 cars in the U.S., down from a high in 2014 of over 46,000. In September 2019, Fiat Chrysler Automobiles NV announced that it would stop the production of its Fiat 500 and electric 500e hatchbacks in North America.

As part of the new strategic plan to counter the slow-down in the US market, the company has decided to continue with its 500CX crossover, 500L wagon, and 124 Spider roadster series and focus more on segments such as Jeep SUVs and Ram Trucks.

Fiat reported that its sales were down 38% in the first half of 2019 in the USA, with deliveries of the 500 dropping 25% to 1,692. Sales of the 500 fluctuated by more than half last year to just 5,370.

Some of the key reasons for the poor performance of Fiat in the USA are plunging interest in passenger cars, a lack of body style variety, a reputation for poor quality and a general lack of consumer awareness and the company’s lack of attention for consumer insights and data analytics.

However, since the focus is on larger vehicles and trucks, FCA has finally shifted its focus on upgrading its technology and adopting smart tech. In June 2019, it announced its tie-up with Aurora, which is backed by Amazon and Sequoia Capital, to integrate its technology into Ram Truck vehicles, and later into the cargo vans segments. As of now, FCA’s Fiat Professional brand is not part of the agreement. So is it too late and too little?

Yes, the 500 series which was one of the best- selling models in the US, was lost due to lack of adoption of technology, lack of interest to understand what the customer finally wants? Finally, due to the lack of AI and data analytics, the company registered a heavy loss. Now they plan to adopt AI and tech to revive the lost market.

The company wants to deviate from the traditional selling model. Once the cars are manufactured, they could potentially be used by any third-party company, (e.g. it can sell its finished products to Amazon for self-driving delivery vans)

#3. Ford Motor Company

Among the early adopters of data analytics and AI, Ford Motor companies moved from being a conventional manufacturer to a “mobility service” company. Ford uses AI to track inventory, automate quality assurance as well; detect wrinkles in car seats. In addition, neural networks help support Ford’s supply chain through resource management.

Car Story the platform implemented by Ford uses AI technology to understand the inventory data for used cars. Ford car’s dealers can learn details about the condition of vehicles, owner history and see how pricing is in the marketplace using this tool. In 2019, Ford introduced the Edge Model which comes with artificial intelligence as part of its all-wheel-drive system. By using dozens of high-tech sensors, the system can determine faster than a human brain whether an all-wheel drive is needed or not. It’s able to shift between two- and four-wheel drive automatically. Machine learning techniques added to vehicles help provide the new features, personalization and product improvement consumers desire. Ford plans to connect AI with all its mobile services in China by the end of 2019.

At Ford, the GDI&A plays an important role in the preparation for machine learning usage. By working on data analytics projects, the GDI&A team of Ford delivers insights that are readily applicable to process improvements or product development and simultaneously lays the ground for future machine learning projects by having the data sorted. This saves cost, helps them come closer to consumer needs and establishes themselves stronger among peers.

#4. General Motors Company

Market leader in every sense, the company has adopted AI and technology not only to streamline its business but also to improvise on its product design. Advancements like 3-D printing technology have enhanced the company’s prototyping facilities, which are said to have constructed more than 250,000 experimental parts in the last decade alone.

General Motors has built a predictive analytics platform that generates insights into several core business strategies, including anticipating market demand for autonomous vehicles. Maxis — shorthand for maximizing insights — represents a multi-million-dollar investment in data-crunching technologies that coincides with the company’s IT strategy overhaul. Among its key attributes is self-service analytics, which allows employees to query a Google-like search interface for information about specific business needs, including pricing, incentives, and marketing optimization, sales lead management and forecasting, and problem detection.

#5. Tesla

Tesla reported third-quarter revenue of $6.3 billion. Tesla, the electric car maker specialist has given investors plenty to look forward in 2020. The company announced that it was ahead of schedule on its long-awaited Model Y crossover, expected to launch by the summer of 2020. At the same time, Tesla says it is planning to make a limited run of its Tesla Semi truck next year and hopes to soon announce the location of its European Gigafactory, where it aims to begin making electric vehicles in 2021. Tesla though started as an environmental friendly tech company has moved on to promote and boost more of its own achievements.

Earlier in November 2019, the company claimed to have received 250K order of cyber trucks as pre-book. There are a lot of promises that continue to make headlines some of these are an entry in the India market in 2020, the launch of robotaxi network and more. Whether the plans get smashed like cybertruck glass window or shines in the market remains to be seen. Still, Tesla does stand out among its peers when it comes to technology adoption and disruption in the automotive market.

Thought Leaders and Their Role in Bringing About Transformation in 2019

#1 @Tesla

Elon Musk does not need any introduction. Musk has been instrumental in changing the perception of buyers and investors towards its products. For example, while the market is raving about 750 horsepower enabled Turbo S model, limited people have taken a not of Porsche Taycan that is expected to deliver 90 miles per gallon while driving in the city. His magic drives the buyer even after the failure of window test on cyber trucks in November 2019. In spite of the debacle, Musk tweets “250k,” indicating the number of pre-orders Tesla has received for the Cybertruck on November 2019.

That’s the magic of thought leaders who drive technology and transformation in the market. Elon Musk has promised robo taxis and so many other technologically advanced products to the world that it has created hype among the new generation. It remains to be seen if he can deliver on his promises.

#2 @Daimler, USA

Kristi Langdon – Ms. Langdon Heads the Customer Experience Division at Daimler Trucks North America and leads the customer-centric processes in the company. A few of her recent achievements are leading the Voice of the Customer’ program, design thinking tools and training, customer satisfaction measurement, and employee experience programs.

(Outside USA – Walid Mehanna who heads the Data & Analytics was able to demonstrate more sale of products using AI and Data Analytics in Europe)

#3 @General Motors

Les Copeland – Les drives Global Data Strategy, Artificial Intelligence & Analytics Services. In close partnership with GM’s new Corporate Data Council, Chief Data Officer, and Chief Strategy Officer, Les and his team are designing and implementing strategies to maximize GM’s use of its enterprise data, IoT, autonomous and connected vehicle data and vast amounts of other external data.

Les’s goal is to help GM make its big data and analytics platform one of its most valuable and highly leveraged corporate assets. Earlier in his GM career, Les was responsible for collaborating with GM’s global president and regional presidents in designing and executing GM’s global sales and marketing innovation portfolio.

The Road Ahead

Electric vehicle sales were only 1.2% in the U.S. in 2018, but things have changed in 2019. Automakers from Ford to Tesla are building a new generation of electric vehicles that is faster and more powerful than almost anything else on the road. Since 2010 onwards, electric vehicles have been the prime focus of major markets and governments. However, the progress has been slower than expected but the good news is that it is still happening.

There is a lot of excitement over new launches planned for 2020. Audi, Ford Motor, Porsche, and Volkswagen are among the brands expected to debut all-electric vehicles while others such as Lincoln and Karma Automotive also are expected to tout the performance of new plug-in hybrid electric vehicles, giving competition to the tech-auto leaders in the US.

Hope and optimism are growing in spite of a slow 2019, buyers and market will decide whether they will switch to electric vehicles more in 2020? Or they will just wait and watch for another year.

Stay Tuned, as we will come back to you with another perspective of the young buyers in 2020 and help you gather the directions of the US automotive industry, next year.