US stocks rose Thursday; however, global stocks slipped. Investors are now grappled with fears about a recession after Federal Reserve Chair Jerome Powell said it is likely to be on the cards. Powell also acknowledged that the US recession is a possibility and said it is a risk. He also stressed that the central bank is strongly committed to bringing down inflation. The Dow Jones added 0.49%, and S&P 500 futures put on 0.76%. The tech-heavy Nasdaq was up 1.13% as the major US stock markets closed lower.

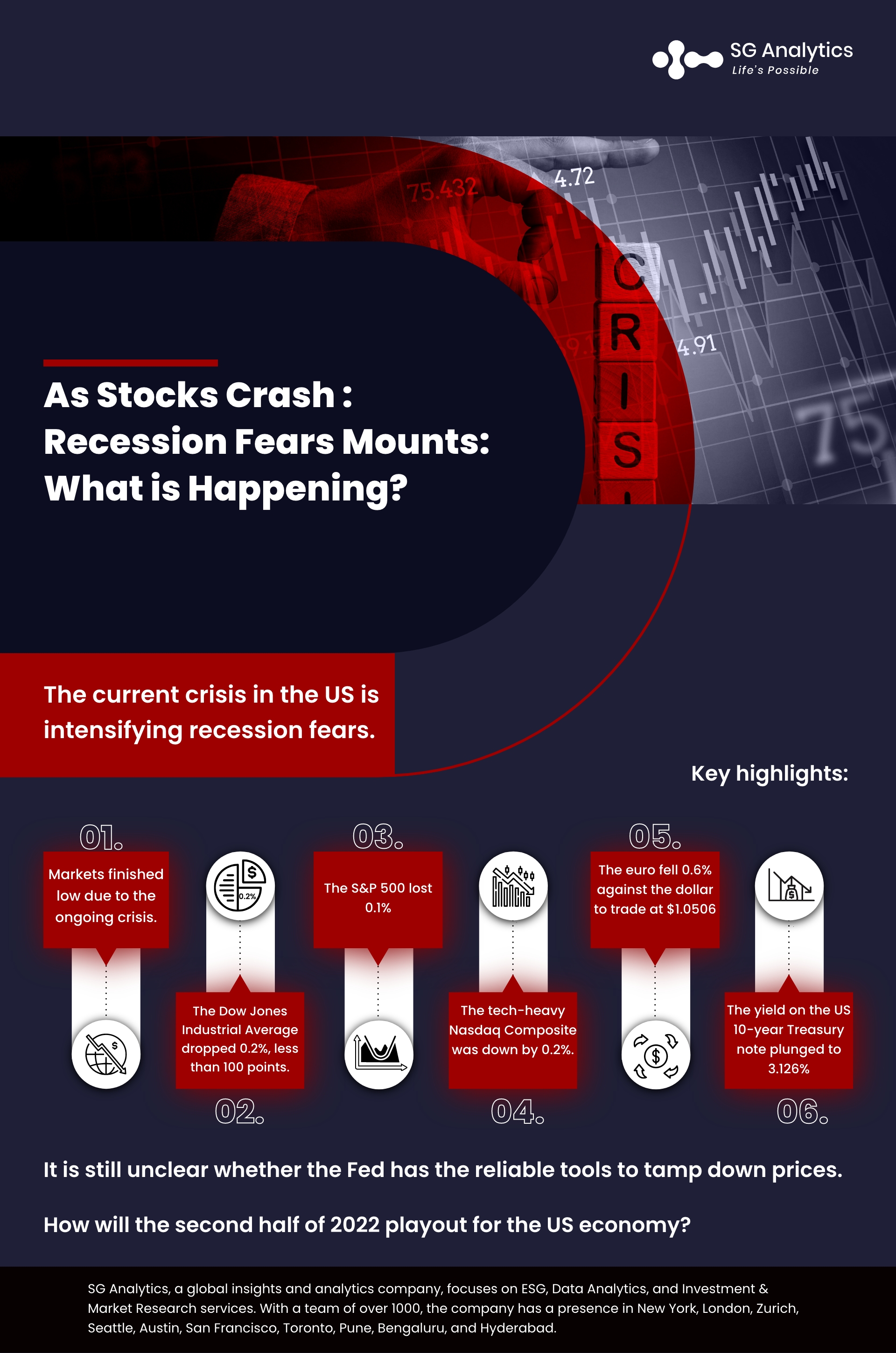

The current crisis in the US is intensifying recession fears. The dollar fell, and as per the latest US data, weekly jobless claims were estimated more. Manufacturing and services activity in the US saw a significant drop in June, lagging estimates and adding to worries concerning the forthcoming recession. The treasury yields dropped, with the 10-year yield hovering at 3.01%.

The Federal Reserve is moving to raise interest rates and is strongly committed to normalizing inflation, quoted Fed Chair Jerome Powell. He further stated that the central bank’s plan is to combat decades-high inflation and that the Fed will be raising rates at a fast pace if surging inflation continues to persist.

Commodities are expected to deliver breathtaking returns amid consolidated supplies and low inventories. However, volatility is likely to stay elevated. Oil is expected to touch $150 per barrel in the short-term, whereas corn can reach $13 a bushel -- a record price.

The Economic Downturn

Energy stocks are among the hardest hit as oil prices are plunging. Shares of Occidental Petroleum, Exxon Mobil, and Marathon Oil also declined by almost 3%. Despite the losses, the S&P 500 energy sector stayed the best-performing area of the market in 2022, rising over 30%.

President Joe Biden has expressed plans to enact a gasoline tax holiday to cool soaring pump prices to alleviate the pressure on consumers.

Experts are expressing their fears that the Fed's decision will likely plummet the economy into a recession as it is continuously hiking interest rates. The central bank inflated rates by 75 basis points last week, which is the biggest increase in 28 years. The situation is also hinting at a similarly large rate hike at the next policy meeting in July.

Despite the decisive action from the Fed last week, markets plunged to their worst weekly performance since March 2020, with the S&P 500 falling 6%.

Read more: Looming Fears of Inflation, The Fed, and Recession: Where are The Financial Markets Heading?

Key Highlights

-

Markets finished low due to the ongoing crisis. The Dow Jones Industrial Average dropped 0.2%, less than 100 points, whereas the S&P 500 lost 0.1%, and the tech-heavy Nasdaq Composite was down by 0.2%.

-

The Dow was down by 400 points; however, stocks pared back losses due to the comments from Fed Chair Powell. The central bank is now working to take the essential measures to restore price stability, and this is likely to increase the ongoing rates.

-

Citigroup is now the latest Wall Street bank to increase its recession odds, meanwhile forecasting a 50% chance of a downturn due to softening consumer demands.

-

Goldman Sachs stressed the odds of a recession at 30% in the next year while also slashing GDP estimates to 2% due to tighter monetary policy from the Fed.

-

Morgan Stanley forecasted a 35% chance of a recession in the next year. They also stressed that the S&P 500 is likely to plunge by another 20% due to surging inflation.

-

The US recession is emerging as a possibility. Meanwhile, oil prices retreated, increasing concerns about an economic downturn that will drag on fuel demand.

While the Federal Reserve's interest rates hike is likely to onset a recession, policymakers believe that there is a risk that it will also break the economy. The outlook for risk assets in a year of steep drops across markets is garnering skepticism from investors and organizations alike. Stocks are predicted to face more losses amid dimming economic prospects.

Read more: The Changing Dynamics of International Investment in India

The Stock Market Rally

The stock market rally attempt made progress, especially on the Nasdaq, hinting that inflation is peaking. These inflation-peaking hints comprised plunging copper and other commodity prices, which are also reflecting the rising recession risks. On Thursday, the commodity-related stocks were hard-hit.

The stock market rally attempt staggered yet again, but the major indexes ultimately closed near session highs. U.S. crude oil prices retreated. Copper prices plunged more than 5%, a fresh 16-month low. Other metal futures and crop prices also dropped. The small-cap Russell 2000 climbed 1.1%. Markets are priced in slightly less tightening. Investors are now overwhelmingly anticipating another 75-basis-point rate hike.

While the major asset averages moved higher, there were some big losers beneath the surface. Recession fears are also slamming oil and other commodity prices. However, energy stocks, miners, and fertilizer makers are selling off hard. The market rally is exhibiting some positive action, though there are plenty of warnings.

What lies ahead?

Stocks tumbling across the globe are adding to the fears of recession resurfacing. The Federal Reserve, struggling to stay on top of inflation, has proved more persistent and widespread.

The S&P 500 closed the lowest for the first time since December 2020. The Dow Jones Industrial Average also tumbled more than 2.4%, pushing it below 30,000 points, a first since January 2021. Energy companies that were deemed to fall in the event of an economic slowdown also dropped.

Markets were already in shaky territory due to the recurring COVID-19 wave and the ongoing geographical crisis. Investors fear that the moves will tip the global economy into a sustained slowdown. While inflation is being predicted as 'out of control,' the Fed is doing the best it can with its limited tools. Despite the stock carnage, valuations still have a long way to go before they fall.

The dollar fell as central banks in Europe tightened up their monetary policies, promising to narrow the gap between rates in Europe and in the US. Bitcoin also dropped below $21,000 amid its longest slide.

The S&P 500 is now stressing an 85% chance of a US recession amid fears of a policy error by the Fed. The warning is basis the average 26% decline for the gauge during the past 11 recessions, along with the collapse into a bear market.

Here is what the other major assets are up to:

-

The euro fell 0.6% against the dollar to trade at $1.0506, whereas the US dollar index strengthened 0.39% at 104.60.

-

The yield on the US 10-year Treasury note plunged to 3.126%.

-

Treasury yields declined, leading to the dollar falling after earlier gains

-

First-half losses for the S&P 500 are being deemed as the biggest since the 1970s

Investors are expecting that the Fed will reinforce the commitment to fight price pressures. A backdrop of tightening financial conditions is leading delegates and investors to question - whether this economic slowdown will turn into a soft-landing or a recession?

Key Takeaways

-

The Fed is open to accepting the recession risk to deliver below-trend economic growth.

-

Concerns among organizations as well as investors are mounting about where the Fed is headed, probably towards a policy mistake.

-

Despite the continuous assurance, it is unclear whether the Fed has the reliable tools to tamp down prices.

Read more: Tech Stocks Slump is Triggering the Withdrawn of ESG Funds: Here's Why

In Conclusion

It is time to address inflation. The supply-side factors are also showing no signs of easing, as the central banks are tightening monetary policy. Investors are sensing the looming fears due to the Fed's revised policies. The US market is also facing another crisis - the overheating labor market. The crisis has also accelerated the integration of environmental, social, and governance factors into money funds.

The 10-year yield fell below 3.10% just nine days after spiking to 3.50%. Commodities ranging from oil to copper remained under pressure as the signs of the economy waning are mounting. Policymakers are now raising their rates to slow the demand in hopes of easing the pressures pushing up consumer prices.

How will the second half of 2022 playout for the US economy?

How will the major asset classes react to the crisis?

The turmoil and volatility of the economic market in the past few months have made Americans as well as organizations skeptical of what lies ahead.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in the BFSI space, SG Analytics assists businesses with insightful relevant research along with sophisticated technology solutions. Contact us today if you are in search of an efficient market research service provider to make critical data-driven decisions.