BUSINESS SITUATION

- A secondaries private equity firm, wanted to send customized emails to source meetings with potential North American institutional investors that actively endorse and invest in private credit funds.

- Log emails/calls response summary, schedule for follow-up meeting, etc. into the CRM.

ENGAGEMENT

- The team created a list of potential investors and their contact information that align with the client's investment strategy for outreach.

- Configured client’s business email outbox using the automated tool and sent customized emails to potential investors.

SGA APPROACH

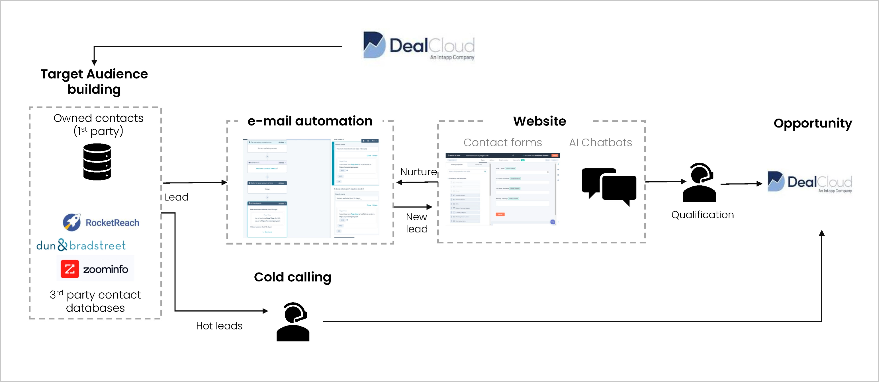

- Investor targeting: Coampiled and categorized potential investor contacts from client’s CRM based on type (e.g., pension funds, family offices, etc.)

- Enhanced CRM utilization and expansion: Expanded CRM list using databases (RocketReach, Zoominfo, Dun & Bradstreet), and desktop search to identify asset managers aligning with client's strategy

- Investor outreach automation: Developed a workflow-based tool to optimize outreach, tailoring strategies for each investor to maximize deal conversion

- Lead management: Directed positive leads to the client’s business development team and facilitated scheduling of calls through effective calendar management

Snapshot of the workflow implemented by the tool for the outreach process

Click on the image to view enlarged

BENEFITS & OUTCOME

- Automated email outreach: Made the email outreach process efficient by saving ~ 60% of manual time spent

- Data enhancement: Enriched client’s CRM with a curated list of potential investors screened from third-party databases

KEY TAKEAWAYS

- Enabled the client to prioritize their focus on investor conversion by optimizing the outreach process

- Effectively leveraged multiple databases to screen and expand prospects