Send Inquiry

By Steve Salvius

Head of Investment Banking and Private Equity

Reports have indicated a potential cutback of US investment in the Chinese tech start-ups in key sectors, including semiconductors, artificial intelligence, and quantum computing. This year, the amount of investment activity in China by US investors is projected to be the lowest in recent years, according to data from Crunchbase.

Notable investment firms such as Blackstone, KKR, Sequoia, Carlyle Group, Bain Capital, Silver Lake, General Atlantic, and Warburg Pincus have substantial exposure to China. For instance, General Atlantic has over 34 portfolio companies in China accounting for over $6.7 billion of investment, highlighting how big a market China has been for US VC firms. However, the impending investment pullback looms as a harbinger of transformation, potentially upending the intricate financial interplay between the two of the largest economies.

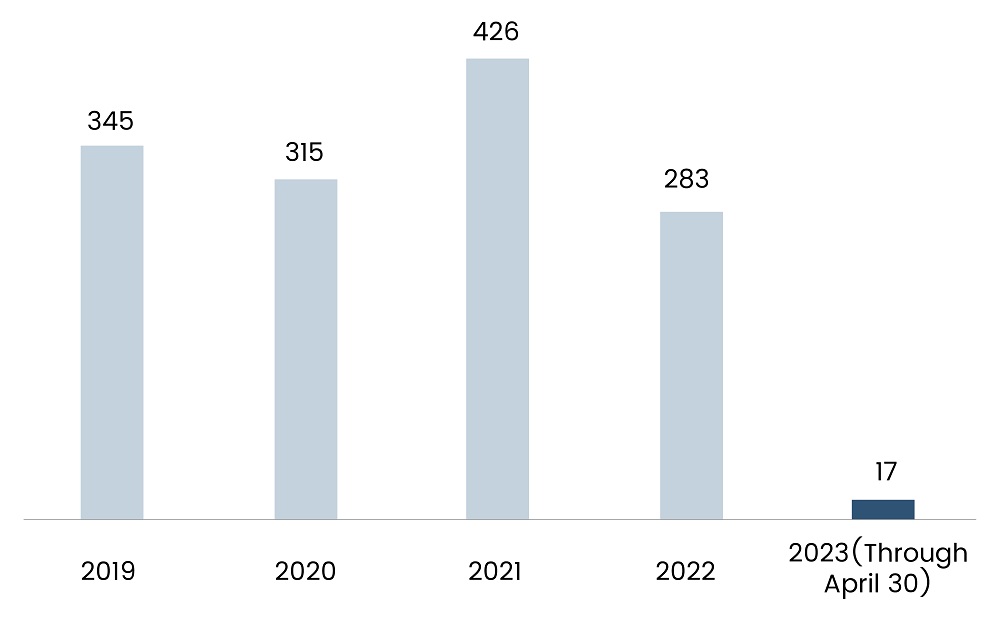

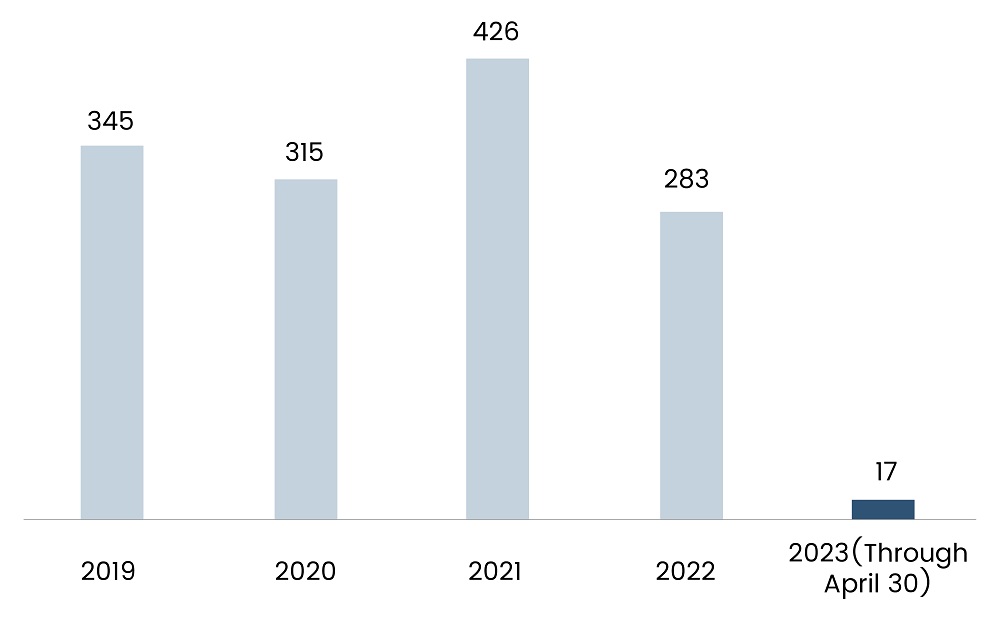

As political tensions intensified, the number of investment deals between US-based investors and China-based tech startups declined significantly. In 2022, the number of deals dropped to 283, a 34% decline from 2021. This decline serves as a stark reflection of the mounting impact exerted by the prevailing political headwinds. Furthermore, the trend continued into the current year, with US-based investors participating in only 17 deals with China-based tech startups as of April.

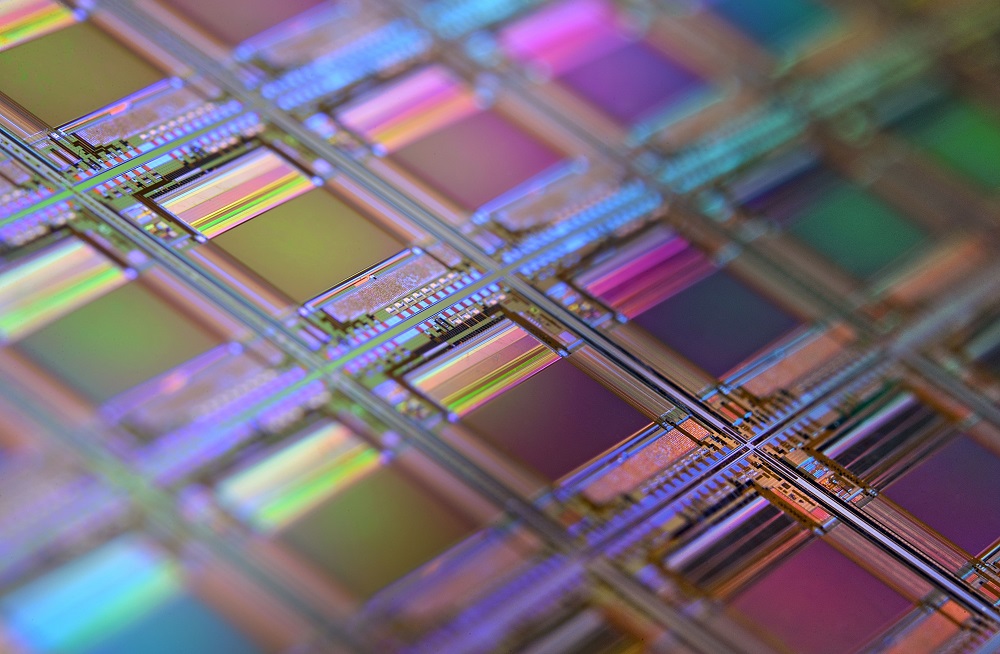

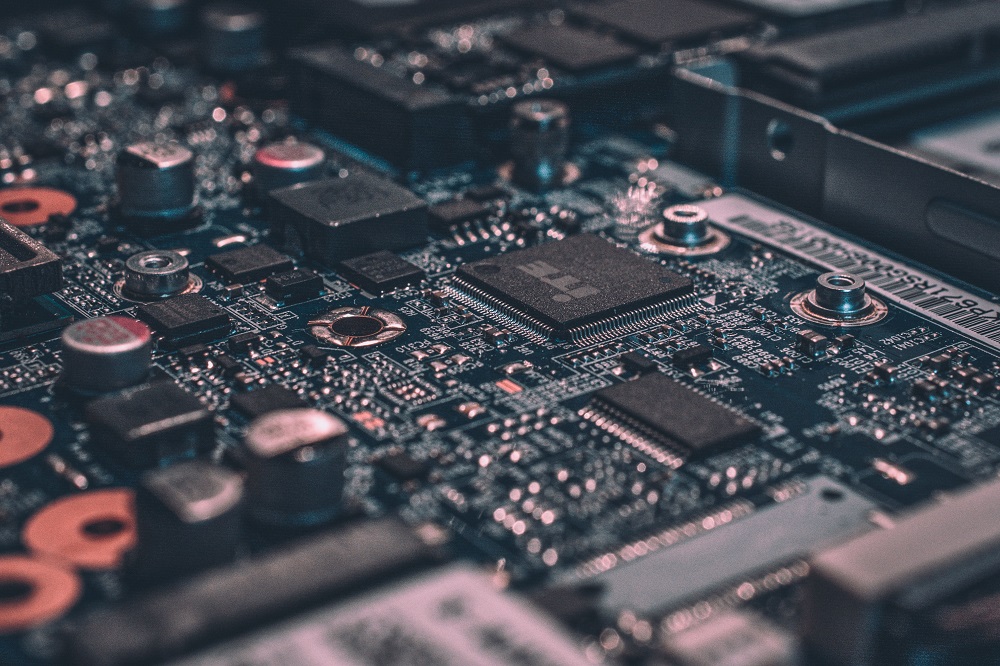

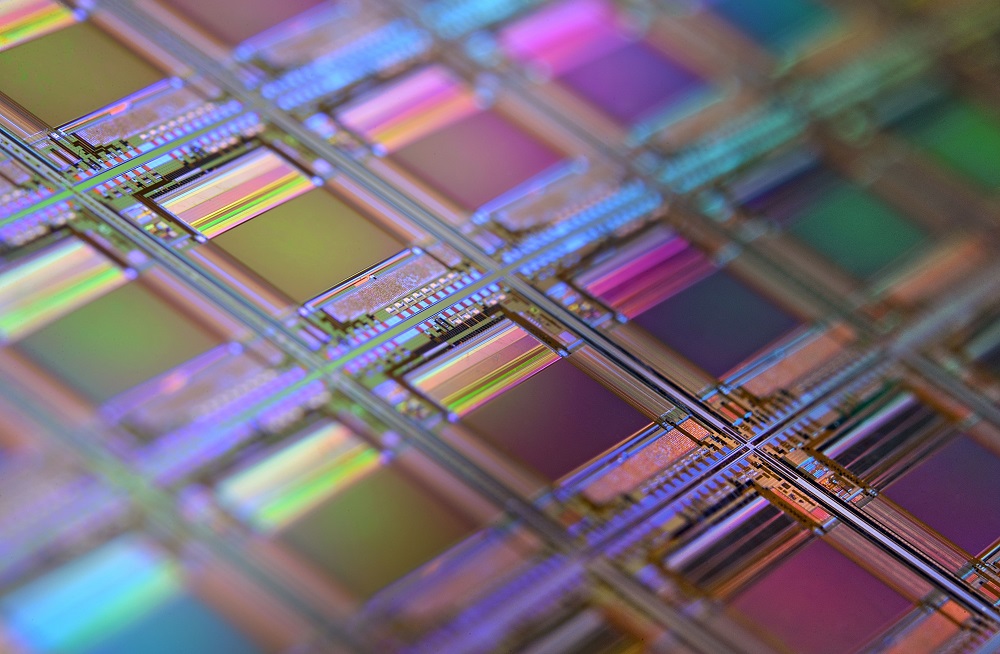

The semiconductor industry has emerged as a focal point in the intense competition between China and the US for global technological supremacy. Recognizing the significance of this battleground, the US government, in addition to imposing export bans, has shifted its focus towards bolstering domestic semiconductor manufacturing capabilities, with the aim of reducing reliance on Chinese counterparts.

In a bid to curtail Beijing's strides in scientific and military advancements, the US Commerce Department has unveiled a comprehensive plan to deny China access to semiconductor chips created anywhere in the globe using US technology. In reprisal for the US blocking Chinese chip makers' access to crucial tools and advanced chips, the Chinese government barred Micron Technology, a US-based semiconductors company. China's authoritarian rule allows for quick bans, giving them an advantage over the US in tech policy enforcement. Both China and the US have been vying for global technological leadership, with the semiconductor industry becoming a focal point. In addition to export bans, the US government is focusing on boosting domestic manufacturing of semiconductors to reduce reliance on Chinese counterparts.

Recognizing the importance of packaging for smaller chips, the US government introduced the CHIPS Act, a $52 billion subsidy package aimed at revitalizing domestic chip manufacturing, including investments in advanced packaging factories. The concept of chiplets, smaller chips packaged tightly together to function as one microprocessor, has gained significant traction in the semiconductor industry. Companies like AMD, Apple, Amazon, Tesla, IBM, and Intel have embraced chiplets due to their cost-effectiveness and superior performance compared to traditional large microprocessors. However, chip packaging is dominated by Asian companies, with the US accounting for only 3% of chip packaging despite contributing 12% to global semiconductor production. The CHIPS Act is well-equipped to improve the position of the US in this space.

![]()

The US Department of Commerce is currently accepting applications for manufacturing grants under the CHIPS Act, with a focus on chip packaging factories. Several chip packagings companies, such as Integra Technologies and Amkor Technology, are vying for federal subsidies and considering establishing production facilities in the US.

Chinese tech companies such as Baidu and Tencent have been making significant strides in the field of AI. Baidu operates the ERNIE-ViLG model, a 10-billion parameter model trained on a dataset of 145 million Chinese image-text pairs. Tencent's Different Dimension Me, on the other hand, has gained attention for its ability to transform photos of people into anime characters. Another notable Chinese text-to-image model is Taiyi, an open-source AI model trained on 20 million filtered Chinese image-text pairs and boasts one billion parameters.

However, such firms are finding it difficult to train large neural networks due to export restrictions imposed by the US government on high-end AI chips. For instance, in August 2022, the US government barred Nvidia from selling the A100 and H100 data center GPU to Chinese clients without permission. Currently, Kunlun, an AI chip by Baidu, improves efficiency in performing text and image recognition tasks on its AI platform by 40% and reduces total costs by 20% to 30%. The future success of Kunlun and other Chinese AI chips will determine whether China gains an advantage in the generative AI race.

Recent developments indicate the emergence of two distinct semiconductor ecosystems, with the US leading the way in enforcing an ecosystem excluding China. American companies like Nvidia and Intel have already restructured their Chinese operations to comply with US restrictions, while Korean companies such as Samsung and SK Hynix have followed suit. In response, China has targeted American companies in China through stalled mergers and increased surveillance.

Support for the US vision of an exclusive chip ecosystem is also evident from its allies, including Japan, the Netherlands, Taiwan, and South Korea. Japan and the Netherlands have announced their intentions to limit the export of advanced lithography tools to China, and Taiwan's TSMC has committed to complying with the CHIPS Act and establishing a foundry in Arizona to bolster US domestic chip manufacturing.

The protection of intellectual property and human capital is expected to become the next battleground in the US-China competition. Chinese personnel are already being excluded from R&D fields, as seen with Marvell's decision to lay off its entire China R&D team. Countries like India and Vietnam are actively competing to absorb the functions currently performed in China, with India implementing the Product Linked Incentive scheme to boost domestic semiconductor manufacturing.

By Steve Salvius

Head of Investment Banking and Private Equity

Reports have indicated a potential cutback of US investment in the Chinese tech start-ups in key sectors, including semiconductors, artificial intelligence, and quantum computing. This year, the amount of investment activity in China by US investors is projected to be the lowest in recent years, according to data from Crunchbase.

Notable investment firms such as Blackstone, KKR, Sequoia, Carlyle Group, Bain Capital, Silver Lake, General Atlantic, and Warburg Pincus have substantial exposure to China. For instance, General Atlantic has over 34 portfolio companies in China accounting for over $6.7 billion of investment, highlighting how big a market China has been for US VC firms. However, the impending investment pullback looms as a harbinger of transformation, potentially upending the intricate financial interplay between the two of the largest economies.

As political tensions intensified, the number of investment deals between US-based investors and China-based tech startups declined significantly. In 2022, the number of deals dropped to 283, a 34% decline from 2021. This decline serves as a stark reflection of the mounting impact exerted by the prevailing political headwinds. Furthermore, the trend continued into the current year, with US-based investors participating in only 17 deals with China-based tech startups as of April.

The semiconductor industry has emerged as a focal point in the intense competition between China and the US for global technological supremacy. Recognizing the significance of this battleground, the US government, in addition to imposing export bans, has shifted its focus towards bolstering domestic semiconductor manufacturing capabilities, with the aim of reducing reliance on Chinese counterparts.

In a bid to curtail Beijing's strides in scientific and military advancements, the US Commerce Department has unveiled a comprehensive plan to deny China access to semiconductor chips created anywhere in the globe using US technology. In reprisal for the US blocking Chinese chip makers' access to crucial tools and advanced chips, the Chinese government barred Micron Technology, a US-based semiconductors company. China's authoritarian rule allows for quick bans, giving them an advantage over the US in tech policy enforcement. Both China and the US have been vying for global technological leadership, with the semiconductor industry becoming a focal point. In addition to export bans, the US government is focusing on boosting domestic manufacturing of semiconductors to reduce reliance on Chinese counterparts.

Recognizing the importance of packaging for smaller chips, the US government introduced the CHIPS Act, a $52 billion subsidy package aimed at revitalizing domestic chip manufacturing, including investments in advanced packaging factories. The concept of chiplets, smaller chips packaged tightly together to function as one microprocessor, has gained significant traction in the semiconductor industry. Companies like AMD, Apple, Amazon, Tesla, IBM, and Intel have embraced chiplets due to their cost-effectiveness and superior performance compared to traditional large microprocessors. However, chip packaging is dominated by Asian companies, with the US accounting for only 3% of chip packaging despite contributing 12% to global semiconductor production. The CHIPS Act is well-equipped to improve the position of the US in this space.

![]()

The US Department of Commerce is currently accepting applications for manufacturing grants under the CHIPS Act, with a focus on chip packaging factories. Several chip packagings companies, such as Integra Technologies and Amkor Technology, are vying for federal subsidies and considering establishing production facilities in the US.

Chinese tech companies such as Baidu and Tencent have been making significant strides in the field of AI. Baidu operates the ERNIE-ViLG model, a 10-billion parameter model trained on a dataset of 145 million Chinese image-text pairs. Tencent's Different Dimension Me, on the other hand, has gained attention for its ability to transform photos of people into anime characters. Another notable Chinese text-to-image model is Taiyi, an open-source AI model trained on 20 million filtered Chinese image-text pairs and boasts one billion parameters.

However, such firms are finding it difficult to train large neural networks due to export restrictions imposed by the US government on high-end AI chips. For instance, in August 2022, the US government barred Nvidia from selling the A100 and H100 data center GPU to Chinese clients without permission. Currently, Kunlun, an AI chip by Baidu, improves efficiency in performing text and image recognition tasks on its AI platform by 40% and reduces total costs by 20% to 30%. The future success of Kunlun and other Chinese AI chips will determine whether China gains an advantage in the generative AI race.

Recent developments indicate the emergence of two distinct semiconductor ecosystems, with the US leading the way in enforcing an ecosystem excluding China. American companies like Nvidia and Intel have already restructured their Chinese operations to comply with US restrictions, while Korean companies such as Samsung and SK Hynix have followed suit. In response, China has targeted American companies in China through stalled mergers and increased surveillance.

Support for the US vision of an exclusive chip ecosystem is also evident from its allies, including Japan, the Netherlands, Taiwan, and South Korea. Japan and the Netherlands have announced their intentions to limit the export of advanced lithography tools to China, and Taiwan's TSMC has committed to complying with the CHIPS Act and establishing a foundry in Arizona to bolster US domestic chip manufacturing.

The protection of intellectual property and human capital is expected to become the next battleground in the US-China competition. Chinese personnel are already being excluded from R&D fields, as seen with Marvell's decision to lay off its entire China R&D team. Countries like India and Vietnam are actively competing to absorb the functions currently performed in China, with India implementing the Product Linked Incentive scheme to boost domestic semiconductor manufacturing.