Send Inquiry

Vikram Shanbhag

Vice President - Life Sciences & Healthcare

The Chinese pharmaceutical market is the second-largest market in the world, driven by rising healthcare needs. An increasing aging population represents a plethora of opportunities for biopharmaceutical companies. However, accessing this lucrative market requires navigating a regulatory and reimbursement maze. This article explores the major factors needed to access the Chinese market, including the all-pervasive National Drug Reimbursement List (NRDL).

The Entry Door — Marketing Approval

Every drug/device has to go through the rigorous National Medical Products Administration (NMPA) to validate product efficacy and safety before the go ahead to market in China.

The Silver Bullet — NRDL Inclusion

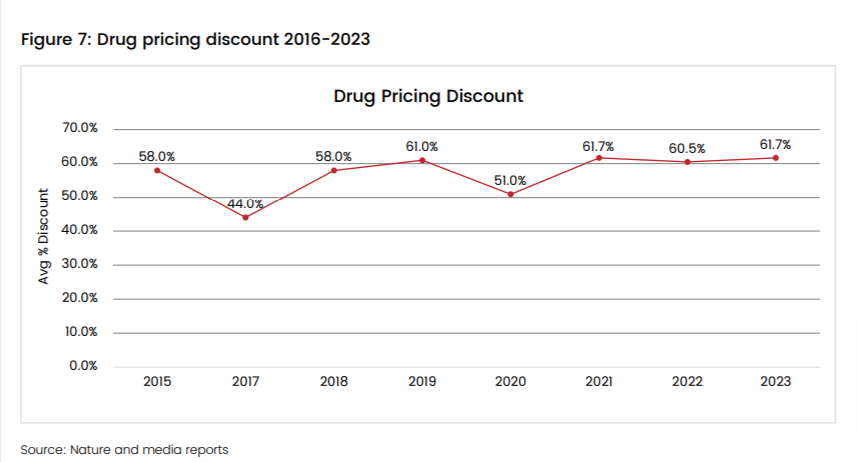

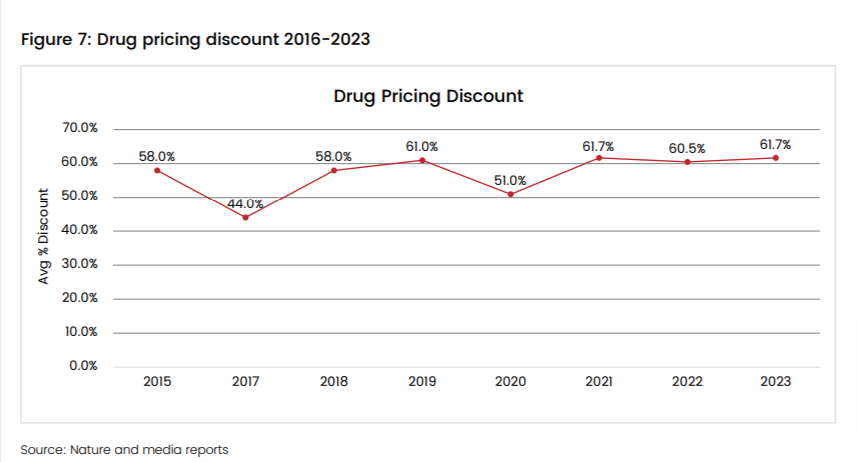

The NRDL, with its coverage of over 90% of the Chinese population, ensures partial or full reimbursement for all drugs on the list. However, all products need to go through a strict negotiation process to be on the list. Companies should offer significant discounts, most often exceeding 60%, to book a spot and ensure reach to the vast Chinese market. Inclusion in the NRDL can be a double-edged sword. While access will be highly enhanced, profit margins will be squeezed. Moreover, owing to NRDL’s inherent public nature, it can be a leading influencer for pricing strategies in neighboring markets.

A Multidimensional Approach

China has the second-highest rate of cancer. Additionally, the increasing shift toward Western lifestyles will fuel the demand for high-value innovative medicines. Innovator companies unwilling to trade off the value of their innovation for access can look at other approaches like commercial health insurance and other very China-specific approaches. There are a growing number of opportunities to explore early access via Hainan, the Great Bay Area, and Special Development Zones like Shanghai and Shenzhen.

These allow clinical utilization locally before formal regulatory approval. More importantly, real-world evidence (RWE) collected during early access programs can help accelerate eventual approval. Some innovative therapies, including YUTIQ, went through this process and succeeded. In September 2022, EyePoint Pharmaceuticals and OcuMension Therapeutics partnered with Boao Lecheng Super Hospital (part of the Hainan pilot zone) to study YUTIQ as a treatment for chronic non-infectious uveitis and the evidence collected helped in being included in the reimbursement list.

Manufacturers can also focus on other affordability axes, including commercial health insurance (CHI), innovative programs such as crowdfunding, rebate programs, and patient assistance programs. Of this, city CHI has emerged as a popular option with increased enrolment, moving from a few cities to over 150 cities and giving access to over 100 million people to their formularies.

A proven method of expanding access and reimbursement is looking at label expansion for already-covered products. For example, within a year in the market, abemaciclib, the first cyclin-dependent kinases (CDK)4/6 inhibitor to be covered in the list, was able to get broader approval to include adjuvant treatment for early breast cancer.

The focus needs to be on the following:

Unmet needs of the Chinese population

The shift from traditional to Western lifestyles and better healthcare facilities have improved diagnosis rates and the ability to detect diseases at an earlier stage. There are multiple disease areas that are underserved and can be tapped into. Moreover, using real-world data and evidence can be a key driving factor.

Longer term view

The rare diseases area is a small market but has significant attention from the Chinese authorities. While funds at the province level have dried up, there are efforts to push this at a national level, but given the priority, this might be a valuable pathway for manufacturers.

Understand and look for leverage

The dynamic Chinese healthcare market always has newer and improved access avenues. Thus, manufacturers need a strong market intelligence mechanism to pick up these cues at national and provincial levels.

Conclusion

There is hope for innovator products as China continues to align more with common practices in the developed markets regarding HTA, value communication, and pricing. Steps such as doing away with the provincial reimbursement bodies help in centralizing the decision-making process for coverage and reimbursement. However, the prospect of a low-digit GDP growth (for the first time in many years) will force a hand on cost containment measures.

Vikram Shanbhag

Vice President - Life Sciences & Healthcare

The Chinese pharmaceutical market is the second-largest market in the world, driven by rising healthcare needs. An increasing aging population represents a plethora of opportunities for biopharmaceutical companies. However, accessing this lucrative market requires navigating a regulatory and reimbursement maze. This article explores the major factors needed to access the Chinese market, including the all-pervasive National Drug Reimbursement List (NRDL).

The Entry Door — Marketing Approval

Every drug/device has to go through the rigorous National Medical Products Administration (NMPA) to validate product efficacy and safety before the go ahead to market in China.

The Silver Bullet — NRDL Inclusion

The NRDL, with its coverage of over 90% of the Chinese population, ensures partial or full reimbursement for all drugs on the list. However, all products need to go through a strict negotiation process to be on the list. Companies should offer significant discounts, most often exceeding 60%, to book a spot and ensure reach to the vast Chinese market. Inclusion in the NRDL can be a double-edged sword. While access will be highly enhanced, profit margins will be squeezed. Moreover, owing to NRDL’s inherent public nature, it can be a leading influencer for pricing strategies in neighboring markets.

A Multidimensional Approach

China has the second-highest rate of cancer. Additionally, the increasing shift toward Western lifestyles will fuel the demand for high-value innovative medicines. Innovator companies unwilling to trade off the value of their innovation for access can look at other approaches like commercial health insurance and other very China-specific approaches. There are a growing number of opportunities to explore early access via Hainan, the Great Bay Area, and Special Development Zones like Shanghai and Shenzhen.

These allow clinical utilization locally before formal regulatory approval. More importantly, real-world evidence (RWE) collected during early access programs can help accelerate eventual approval. Some innovative therapies, including YUTIQ, went through this process and succeeded. In September 2022, EyePoint Pharmaceuticals and OcuMension Therapeutics partnered with Boao Lecheng Super Hospital (part of the Hainan pilot zone) to study YUTIQ as a treatment for chronic non-infectious uveitis and the evidence collected helped in being included in the reimbursement list.

Manufacturers can also focus on other affordability axes, including commercial health insurance (CHI), innovative programs such as crowdfunding, rebate programs, and patient assistance programs. Of this, city CHI has emerged as a popular option with increased enrolment, moving from a few cities to over 150 cities and giving access to over 100 million people to their formularies.

A proven method of expanding access and reimbursement is looking at label expansion for already-covered products. For example, within a year in the market, abemaciclib, the first cyclin-dependent kinases (CDK)4/6 inhibitor to be covered in the list, was able to get broader approval to include adjuvant treatment for early breast cancer.

The focus needs to be on the following:

Unmet needs of the Chinese population

The shift from traditional to Western lifestyles and better healthcare facilities have improved diagnosis rates and the ability to detect diseases at an earlier stage. There are multiple disease areas that are underserved and can be tapped into. Moreover, using real-world data and evidence can be a key driving factor.

Longer term view

The rare diseases area is a small market but has significant attention from the Chinese authorities. While funds at the province level have dried up, there are efforts to push this at a national level, but given the priority, this might be a valuable pathway for manufacturers.

Understand and look for leverage

The dynamic Chinese healthcare market always has newer and improved access avenues. Thus, manufacturers need a strong market intelligence mechanism to pick up these cues at national and provincial levels.

Conclusion

There is hope for innovator products as China continues to align more with common practices in the developed markets regarding HTA, value communication, and pricing. Steps such as doing away with the provincial reimbursement bodies help in centralizing the decision-making process for coverage and reimbursement. However, the prospect of a low-digit GDP growth (for the first time in many years) will force a hand on cost containment measures.