Send Inquiry

By Steve Salvius

Head of Investment Banking and Private Equity

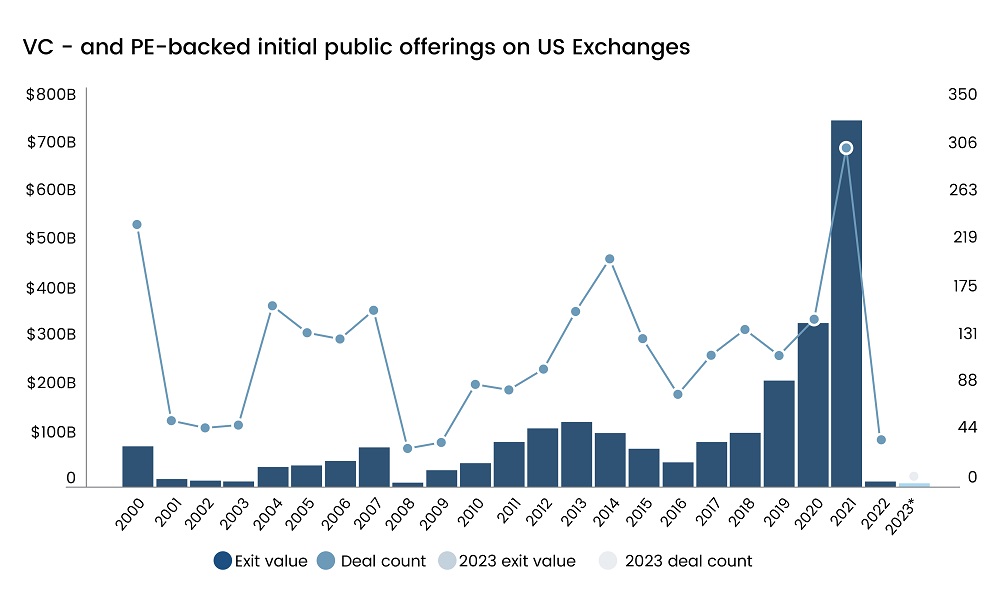

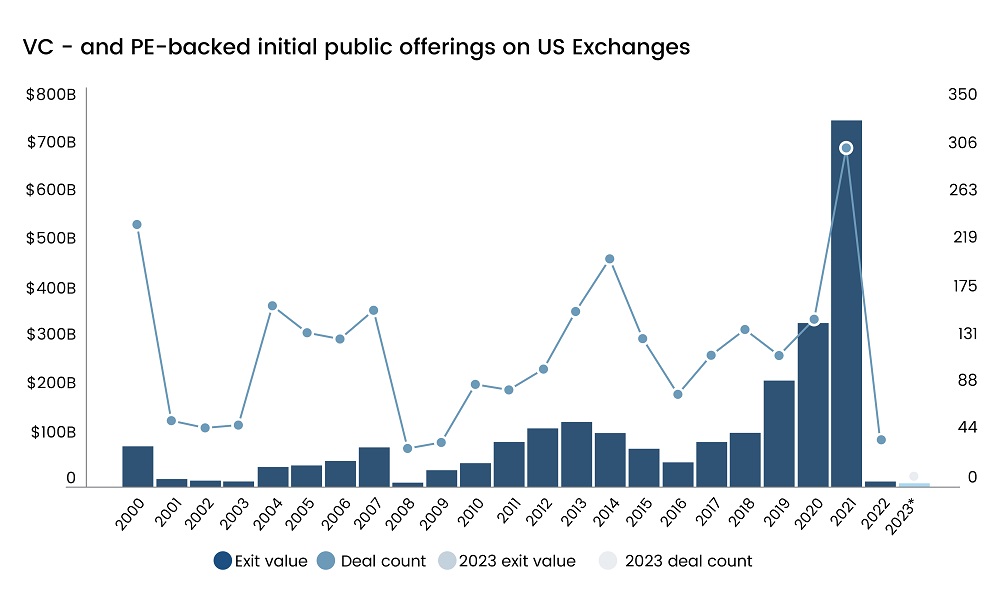

Even considering 2021 to be an outlier, the drop is huge, with the total proceeds at the lowest level since 2009.

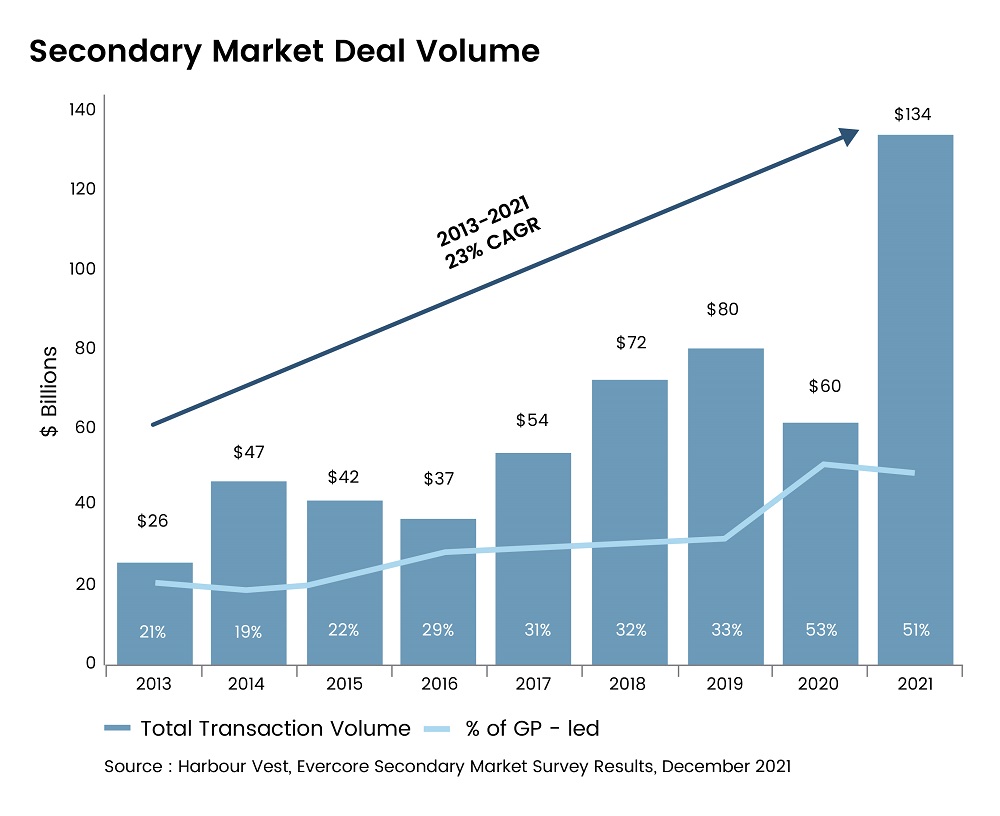

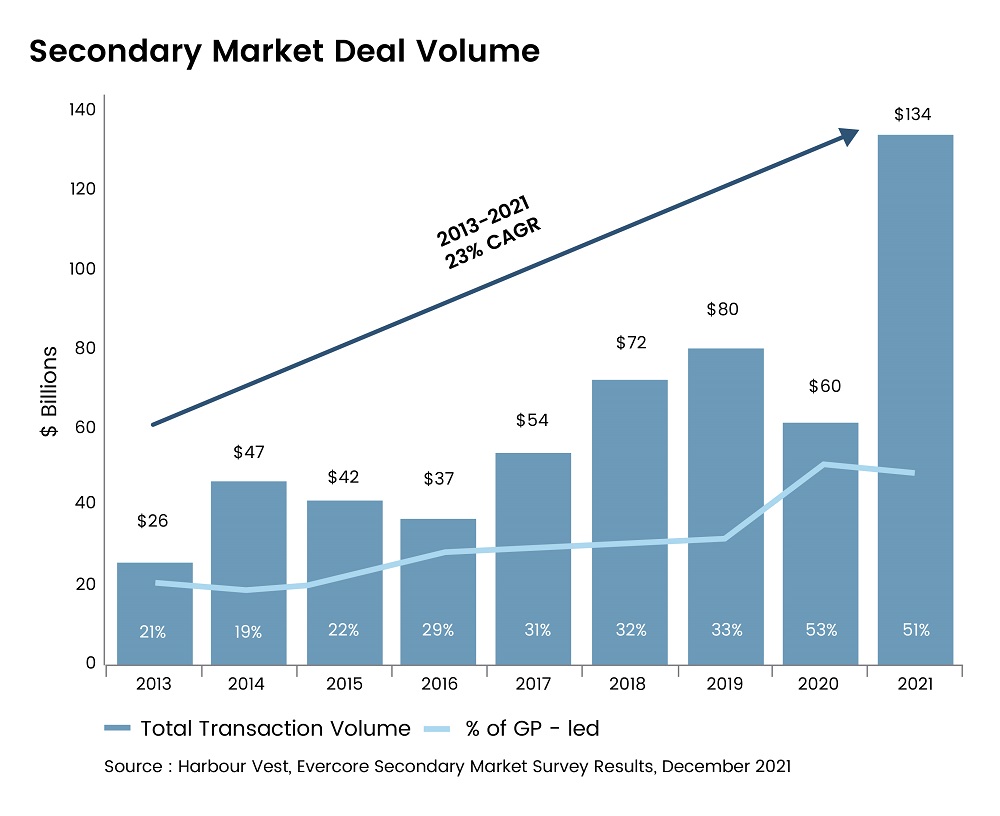

As the sharp pullback in the IPO market is leading to a liquidity crunch, secondary markets – where buyers and sellers can trade pre-IPO stock – are in the spotlight. Once considered a rather niche segment with limited participants and a focus on distressed sellers, the secondary private market has grown into a large market with deal volume reaching $134 billion in 2021, nearly 5x from 2013, per data from HarbourVest and Evercore Secondary Market Survey Results.

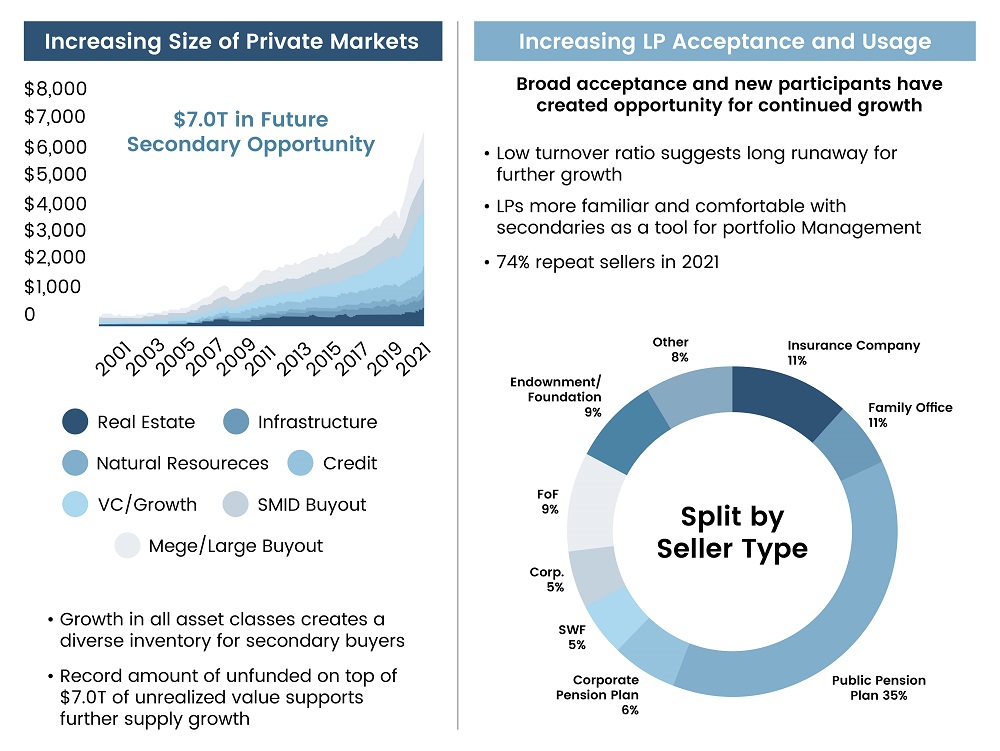

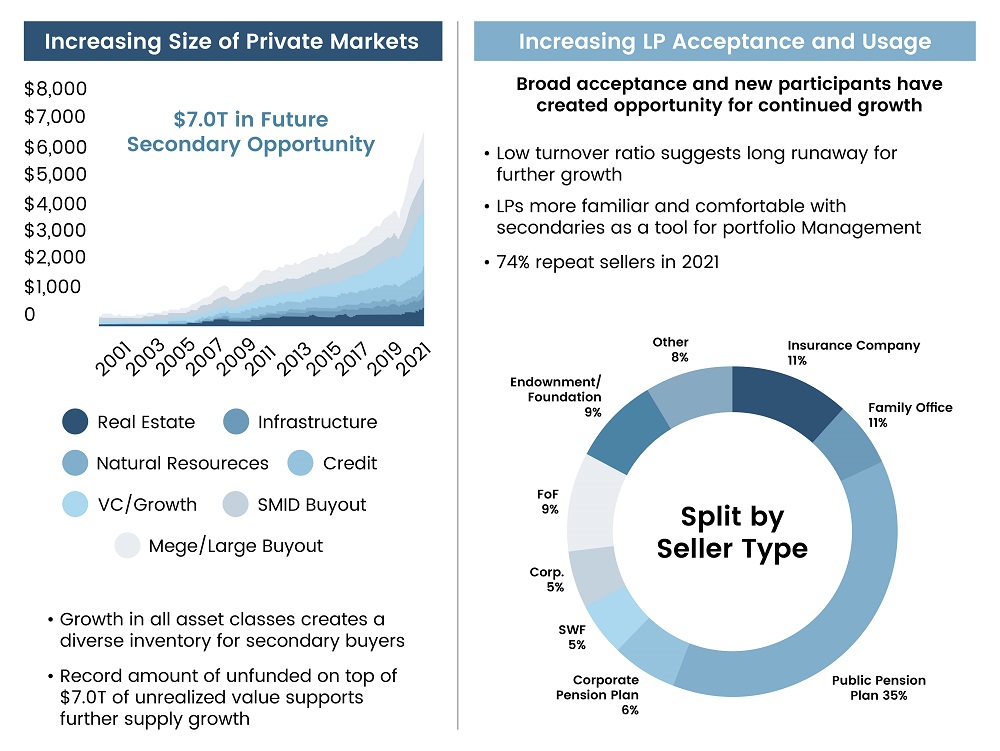

Over the last decade, secondary transactions have gained prominence in the VC world due to a number of reasons. For one, the tremendous growth of private capital and the subsequent rise in demand and supply of liquidity is capturing the attention of the big secondary players. According to estimates from Hamilton Lane, the net asset value in the entire private market is $6.5 trillion today. Additionally, a longer timeline for an IPO makes it hard for early investors to exit within their fund’s lifecycle, necessitating the need for alternative exit options. With median time-to-IPO now touching 11 years (per research by the University of Florida Professor Jay Ritter), the typical 10-year fund structure doesn’t fit the exit-at-IPO strategy. Moreover, the proliferation of new secondary deal structures has contributed to the growth of the venture secondary market. A survey from Evercore suggests that a diverse range of players, such as family offices, insurance companies, and funds of funds, are getting familiar with secondaries. These investors often have large portfolios and are looking for ways to rebalance their holdings.

Additionally, the increasing value accumulation in unicorns could drive more secondary activity. Per CB Insights, there are around 1,170 unicorns globally as of July 2022. Companies like SpaceX and ByteDance are now valued at more than a large majority of their public counterparts and have billions of dollars in unrealized gains. Industry Ventures estimates around $1.1 trillion of unrealized NAV in VC funds of 2016 vintage and older. And while not all LPs are willing to wait for the IPO market to open, secondaries could serve as a meaningful source of liquidity.

To take advantage of the thriving secondaries market and strengthen their presence in the industry, investors are either raising new funds for secondaries or considering doing so. In 2022, Apollo Global Management launched its $4 billion secondary platform, called S3, with capital commitments from investors, including Abu Dhabi Investment Authority. Ardian and BlackRock too raised new funds for buying secondary shares in private equity.

According to research by Oxford Economics and the Beneficient Company Group, more rebalancing opportunities in private markets would lead to better returns and reduced risks for investors. Secondaries allow investors to rejig their private markets portfolios based on economic cycles and macroeconomic factors. The US secondary private market has also become more efficient and accessible in recent years, with the growth of technology platforms and specialized secondary funds. These platforms and funds provide liquidity to investors by matching buyers and sellers, and they often have more flexible investment criteria than traditional venture capital firms.

As we navigate 2023, the outlook for the secondary private markets appears bright. The latest 4Q22 secondary data from Caplight, a startup that monitors secondary activity, reveals an increase in the number of bids, indicating that buyers are more willing to offer better prices for shares in companies. This trend is a positive sign for the secondary market and reflects renewed confidence among investors. The increased interest in secondary activity is also reflective of a broader trend in the investment landscape, with investors seeking new opportunities to diversify their portfolios. As a result, the secondary market is becoming an increasingly attractive option, offering investors the chance to access high-quality assets at more competitive prices.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.

By Steve Salvius

Head of Investment Banking and Private Equity

Even considering 2021 to be an outlier, the drop is huge, with the total proceeds at the lowest level since 2009.

As the sharp pullback in the IPO market is leading to a liquidity crunch, secondary markets – where buyers and sellers can trade pre-IPO stock – are in the spotlight. Once considered a rather niche segment with limited participants and a focus on distressed sellers, the secondary private market has grown into a large market with deal volume reaching $134 billion in 2021, nearly 5x from 2013, per data from HarbourVest and Evercore Secondary Market Survey Results.

Over the last decade, secondary transactions have gained prominence in the VC world due to a number of reasons. For one, the tremendous growth of private capital and the subsequent rise in demand and supply of liquidity is capturing the attention of the big secondary players. According to estimates from Hamilton Lane, the net asset value in the entire private market is $6.5 trillion today. Additionally, a longer timeline for an IPO makes it hard for early investors to exit within their fund’s lifecycle, necessitating the need for alternative exit options. With median time-to-IPO now touching 11 years (per research by the University of Florida Professor Jay Ritter), the typical 10-year fund structure doesn’t fit the exit-at-IPO strategy. Moreover, the proliferation of new secondary deal structures has contributed to the growth of the venture secondary market. A survey from Evercore suggests that a diverse range of players, such as family offices, insurance companies, and funds of funds, are getting familiar with secondaries. These investors often have large portfolios and are looking for ways to rebalance their holdings.

Additionally, the increasing value accumulation in unicorns could drive more secondary activity. Per CB Insights, there are around 1,170 unicorns globally as of July 2022. Companies like SpaceX and ByteDance are now valued at more than a large majority of their public counterparts and have billions of dollars in unrealized gains. Industry Ventures estimates around $1.1 trillion of unrealized NAV in VC funds of 2016 vintage and older. And while not all LPs are willing to wait for the IPO market to open, secondaries could serve as a meaningful source of liquidity.

To take advantage of the thriving secondaries market and strengthen their presence in the industry, investors are either raising new funds for secondaries or considering doing so. In 2022, Apollo Global Management launched its $4 billion secondary platform, called S3, with capital commitments from investors, including Abu Dhabi Investment Authority. Ardian and BlackRock too raised new funds for buying secondary shares in private equity.

According to research by Oxford Economics and the Beneficient Company Group, more rebalancing opportunities in private markets would lead to better returns and reduced risks for investors. Secondaries allow investors to rejig their private markets portfolios based on economic cycles and macroeconomic factors. The US secondary private market has also become more efficient and accessible in recent years, with the growth of technology platforms and specialized secondary funds. These platforms and funds provide liquidity to investors by matching buyers and sellers, and they often have more flexible investment criteria than traditional venture capital firms.

As we navigate 2023, the outlook for the secondary private markets appears bright. The latest 4Q22 secondary data from Caplight, a startup that monitors secondary activity, reveals an increase in the number of bids, indicating that buyers are more willing to offer better prices for shares in companies. This trend is a positive sign for the secondary market and reflects renewed confidence among investors. The increased interest in secondary activity is also reflective of a broader trend in the investment landscape, with investors seeking new opportunities to diversify their portfolios. As a result, the secondary market is becoming an increasingly attractive option, offering investors the chance to access high-quality assets at more competitive prices.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.