Send Inquiry

Rajib Das

VP Investment Insights

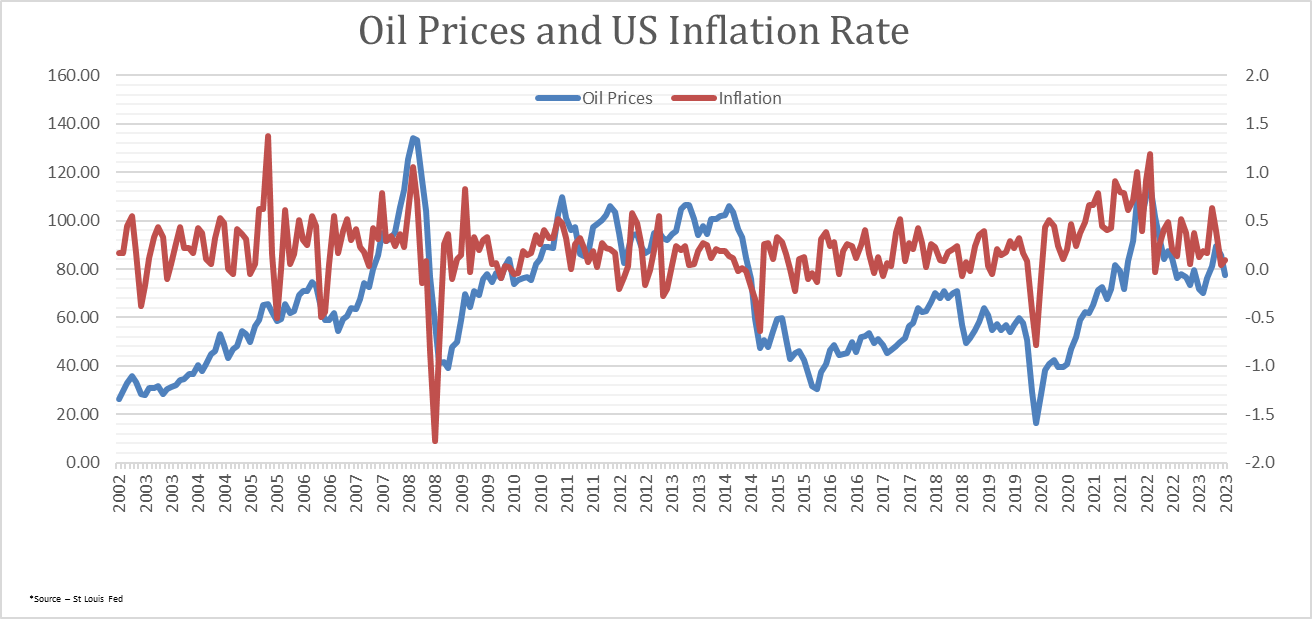

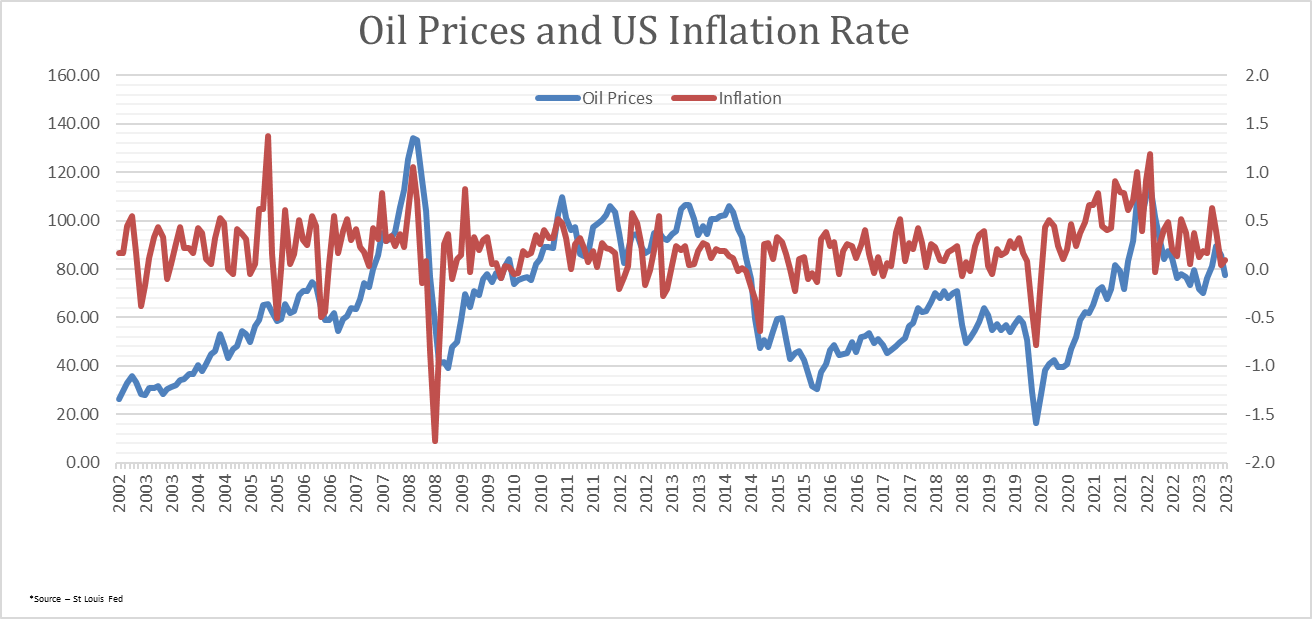

As we welcome 2024, oil prices have come down significantly amidst demand concerns on the back of an economic slowdown. However, a spurt in oil prices remains one of the major risks in 2024 given the expectations of OPEC+ member's supply cuts and geopolitical concerns. Although the Federal Reserve and other major central banks track core inflation (which excludes food and energy sectors), the persistent level of high oil prices had a significant impact on the inflation in past.

Historically, there has been a correlation between increased oil prices and inflation. As oil prices rise, there is a corresponding increase in the prices of goods that rely on oil as a crucial component. The direct effect lies in the fact that oil is a crucial input in various industries, affecting production and transportation costs. When oil prices rise, businesses often pass on these increased costs to consumers, leading to higher prices for goods and services. This phenomenon can contribute to inflationary pressures.

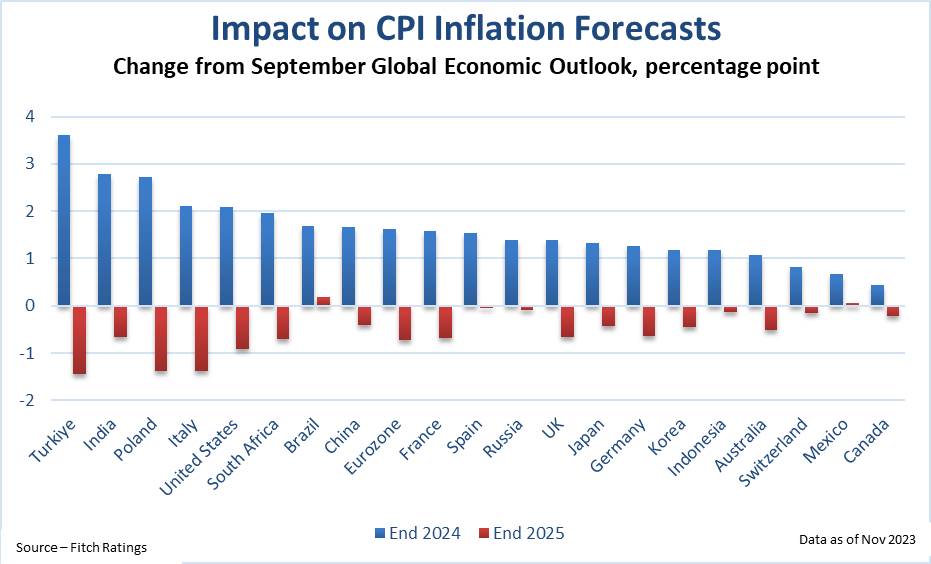

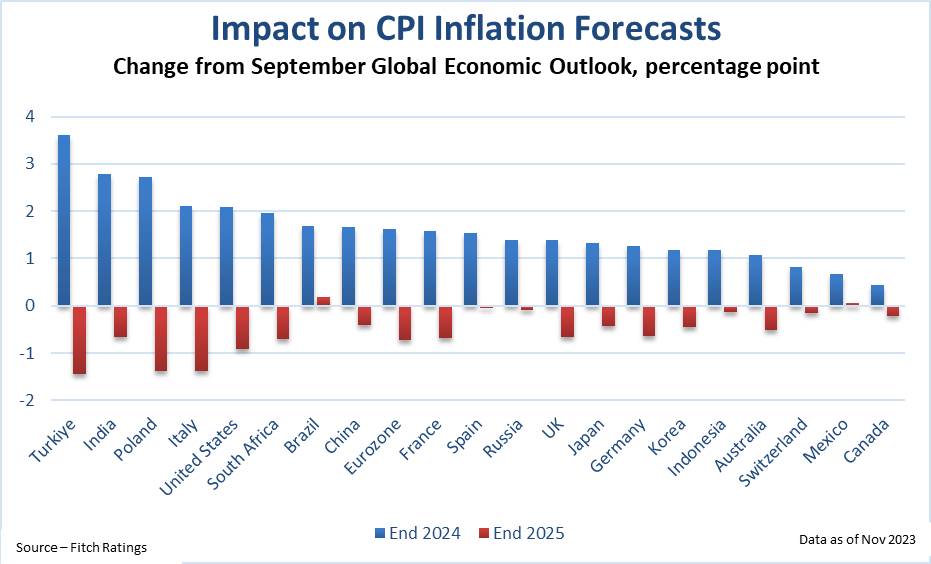

As per the Fitch report published in November 2023, rising oil prices would lead inflation rates in 2024 to be higher than expected, with corrections following in 2025. The country with the biggest percentage point increase in expected inflation is Turkey, followed by Poland and India. However, relative increases for Poland and India would be substantially higher. That said the impact is expected to be muted for developed economies such as Switzerland, Canada, and Germany. given the elevated level of inflation. Notably, the heightened oil prices are poised to influence the monetary policy decisions of major central banks, potentially slowing down the deflationary trends and postponing subsequent monetary policy easing aimed at bolstering economic growth.

Rajib Das

VP Investment Insights

As we welcome 2024, oil prices have come down significantly amidst demand concerns on the back of an economic slowdown. However, a spurt in oil prices remains one of the major risks in 2024 given the expectations of OPEC+ member's supply cuts and geopolitical concerns. Although the Federal Reserve and other major central banks track core inflation (which excludes food and energy sectors), the persistent level of high oil prices had a significant impact on the inflation in past.

Historically, there has been a correlation between increased oil prices and inflation. As oil prices rise, there is a corresponding increase in the prices of goods that rely on oil as a crucial component. The direct effect lies in the fact that oil is a crucial input in various industries, affecting production and transportation costs. When oil prices rise, businesses often pass on these increased costs to consumers, leading to higher prices for goods and services. This phenomenon can contribute to inflationary pressures.

As per the Fitch report published in November 2023, rising oil prices would lead inflation rates in 2024 to be higher than expected, with corrections following in 2025. The country with the biggest percentage point increase in expected inflation is Turkey, followed by Poland and India. However, relative increases for Poland and India would be substantially higher. That said the impact is expected to be muted for developed economies such as Switzerland, Canada, and Germany. given the elevated level of inflation. Notably, the heightened oil prices are poised to influence the monetary policy decisions of major central banks, potentially slowing down the deflationary trends and postponing subsequent monetary policy easing aimed at bolstering economic growth.