Send Inquiry

Jun 13, 2022

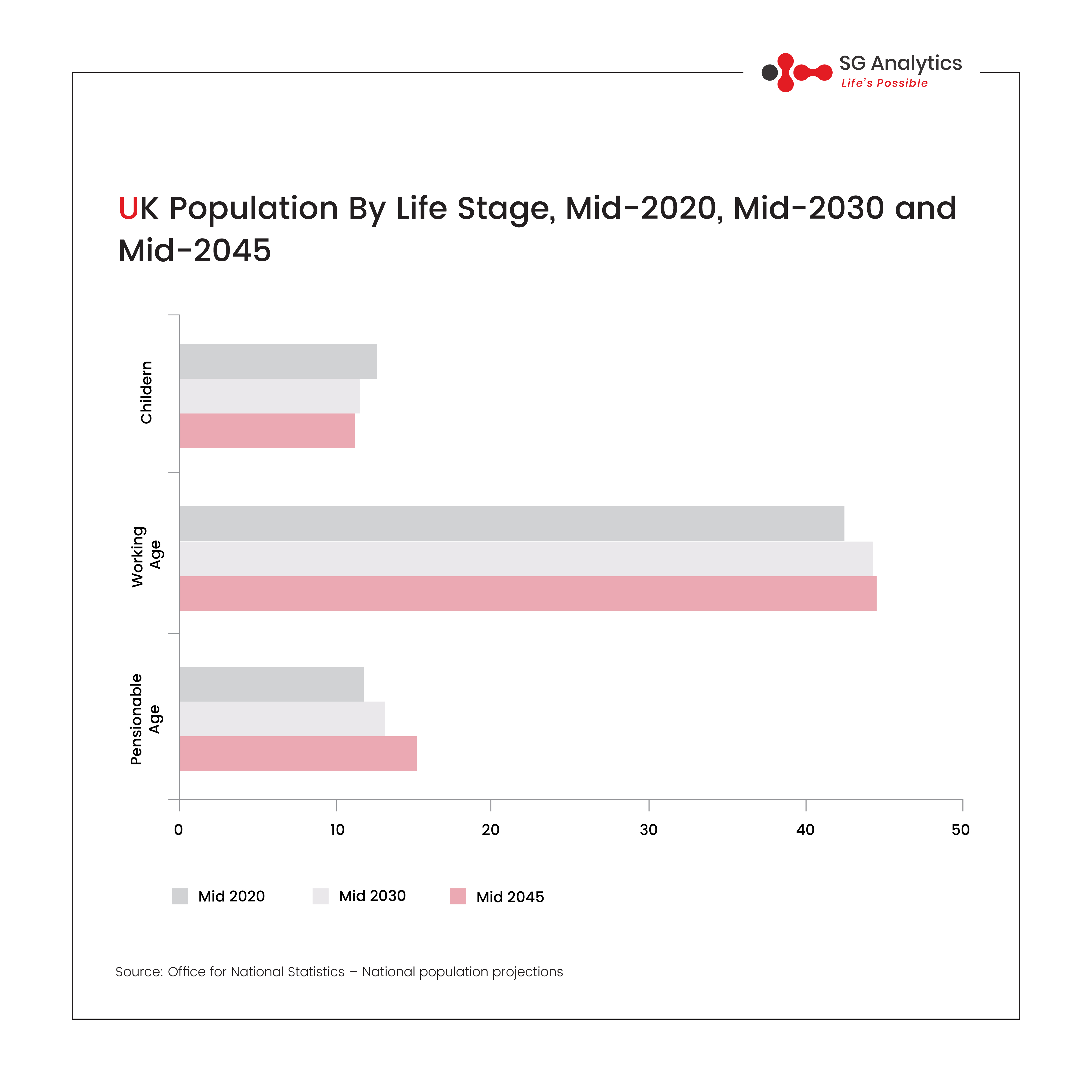

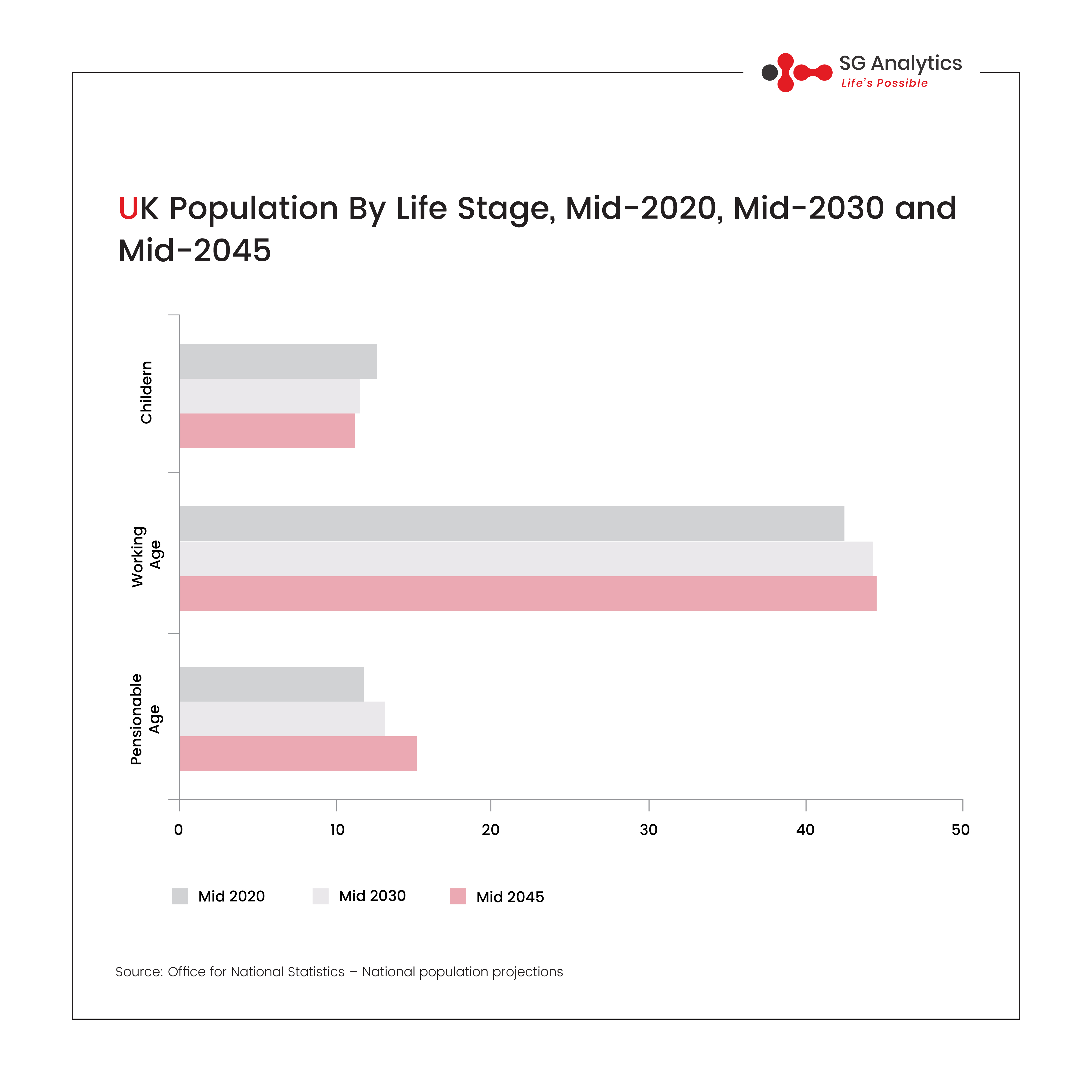

Every nation in the world is experiencing an increase in the size and proportion of older people in the population as people are living longer. Population ageing began in high-income countries due to high standards of living. It is now shifting to low- and middle-income countries. The UK is no exception, as people are living longer than ever before. In 2019, one in every five people in the UK was 65 or older, accounting for ~19% of the population of 12.3mn people. Between 2009 and 2019, the population of this age group increased by 23%, compared to a 7% increase in the overall population.

According to Office for National Statistics, the number of people aged 85 and over is expected to nearly double to 3.1mn by 2045 (4.3% of the UK population), from an estimated population of 1.7mn in 2020 (2.5% of the UK population). There are expected to be many more people in their later years by 2045, owing in part to the fact that the baby boomers of the 1960s are now approaching the age of 80, as well as an overall rise in life expectancy.

All English residents have access to free public health care through the National Health Service (NHS). This includes hospitalisation, physician care, and mental health treatment. The National Health Service budget is supported by general taxation. The number of working-age people and children is projected to remain around mid-2030 levels by mid-2045. During the same time period, the number of people of pensionable age will rise to 15.2mn (28% jump compared to the 2020 level). This increase in the ageing population can put pressure on the NHS’s spending as they are likely to avail of the benefit and not contribute much through tax. However, the ageing population can continue to make an increasing contribution to society if they remain healthy, mould themselves to changing working conditions in the workplace, and access the training to adapt to evolving labour market. Nevertheless, employers must also step up and adapt to an ageing workforce.

What do you think? Are you ready to recruit ageing employees?

Apr 18, 2022

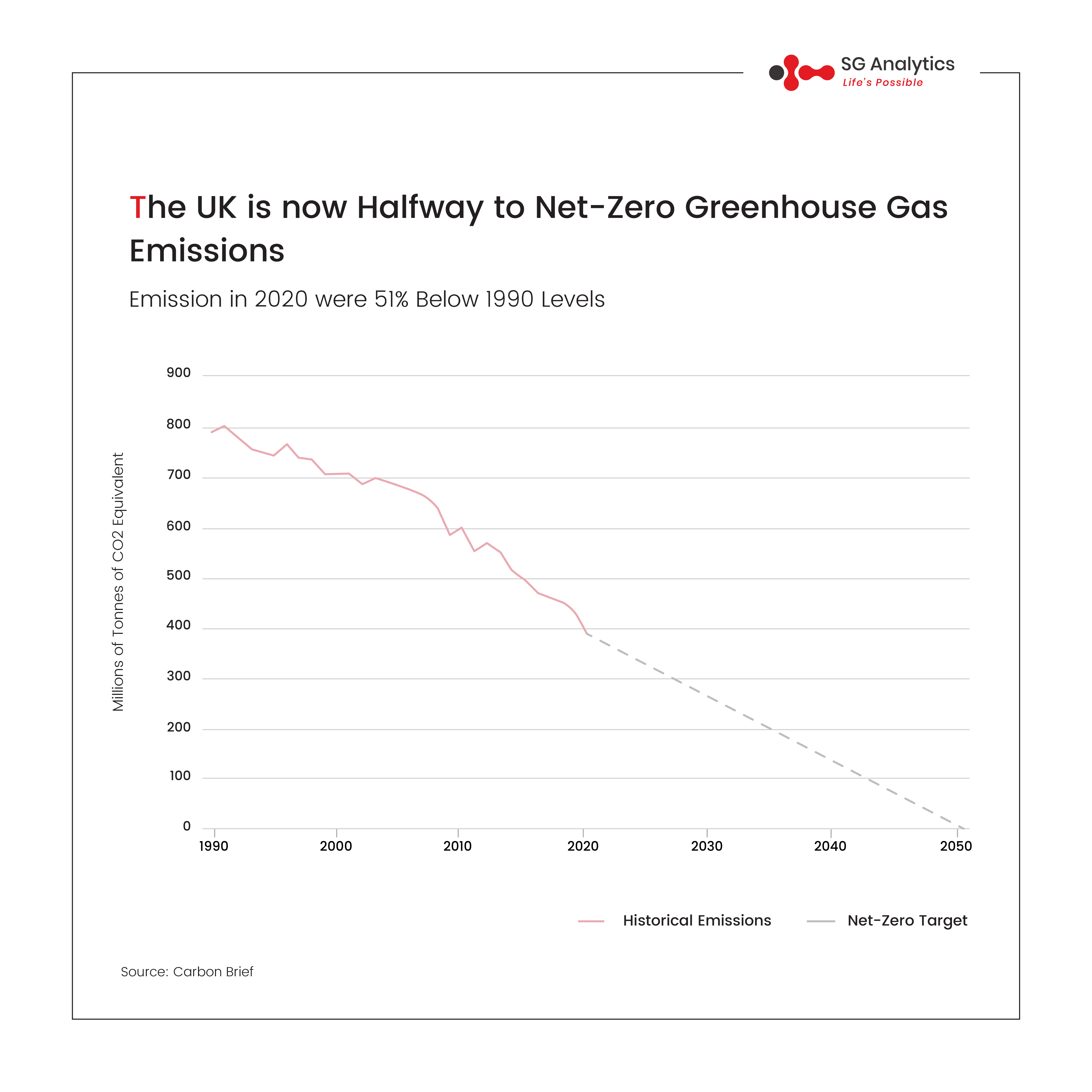

Starting April 6th, it has become mandatory by law for 1300 of the largest UK-registered companies and financial institutions to disclose climate-related financial information, making the UK the first G20 country to enact ESG disclosure laws aligned with the TCFD (Taskforce on Climate-Related Financial Disclosures). The TCFD, launched in 2015 at the Paris COP21 by the Financial Stability Board (FSB) can be used by companies, banks, and insurers to provide consistent and transparent climate-related risk disclosures to relevant stakeholders.

The law came into effect for UK’s largest traded companies, banks, insurers, and private companies with at least £500 million in turnover and over 500 employees, thereby enabling investors and businesses to align their long-term strategies with UK’s net-zero commitments. Companies will have to start collecting ESG data beginning April 6th and disclose them in annual reports.

The UK Energy and Climate Change Minister Greg Hands said that if the UK was to meet its ambitious net-zero commitments by 2050, the financial system including the largest businesses and investors will have to put climate change at the heart of their activities and decision making.

The companies will have to disclose four key areas: Governance, Plans & Strategies, Risk Management, and Metrics & Targets. Companies will also have to provide data on their Scope 1, 2, and 3 GHG emissions with targets and plans to reduce these GHG emissions.

Is your country next?

Apr 11, 2022

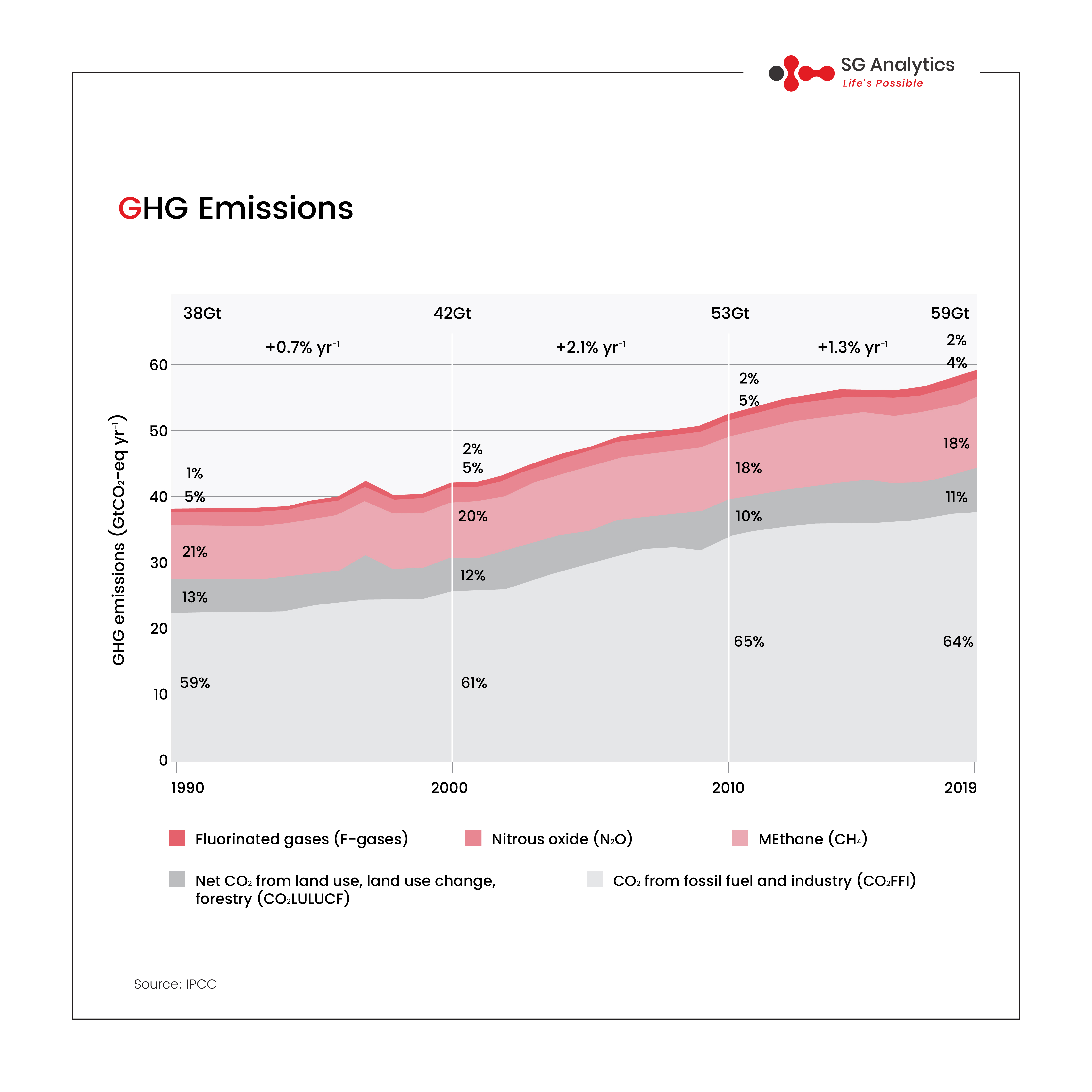

The latest Assessment Report (AR6) by the United Nations’ Intergovernmental Panel on Climate Change (IPCC) makes it clear that it is “now or never” for the planet. The report warns that the global emissions are going to peak by 2025 unless there is a decline of 50% on a global scale to limit global warming to 1.5 °C by 2100. Based on the current trends, the global temperature is estimated to increase by 3 °C. To prevent climate devastation, drastic steps will have to be taken to reduce emissions. To limit global warming to 1.5 °C, GHG emissions will have to be reduced by 43% by 2030, and methane emissions will have to be reduced by 34% by 2030. To limit global warming to 2 °C, GHG emissions will have to be reduced by 27% by 2030.

On the other hand, the report also states the positive impacts of some mitigation efforts. Renewables have taken the center stage in mitigating climate change risks. Solar and wind energy usage has significantly increased globally, having a cleansing effect on climate. Few countries have achieved a steady decrease in emissions consistent with the goal to limit global warming to 2 °C. Zero emissions targets have been adopted by at least 826 cities and 103 regions around the world.

The way forward for the entire world to reduce negative climate impacts is to curb the usage of fossil fuels. Climate models have suggested that emissions from existing and planned fossil fuel projects have already exceeded tolerable carbon emissions. The efforts put in by nations to meet committed goals and targets should not be limited only to curbing emissions but should also focus on expanding green covers such as forests and improved agricultural practices. Also, under-developed nations will require financial aid to make the transition from a fossil fuel-based economy to a greener and more sustainable economy.

Mar 24, 2022

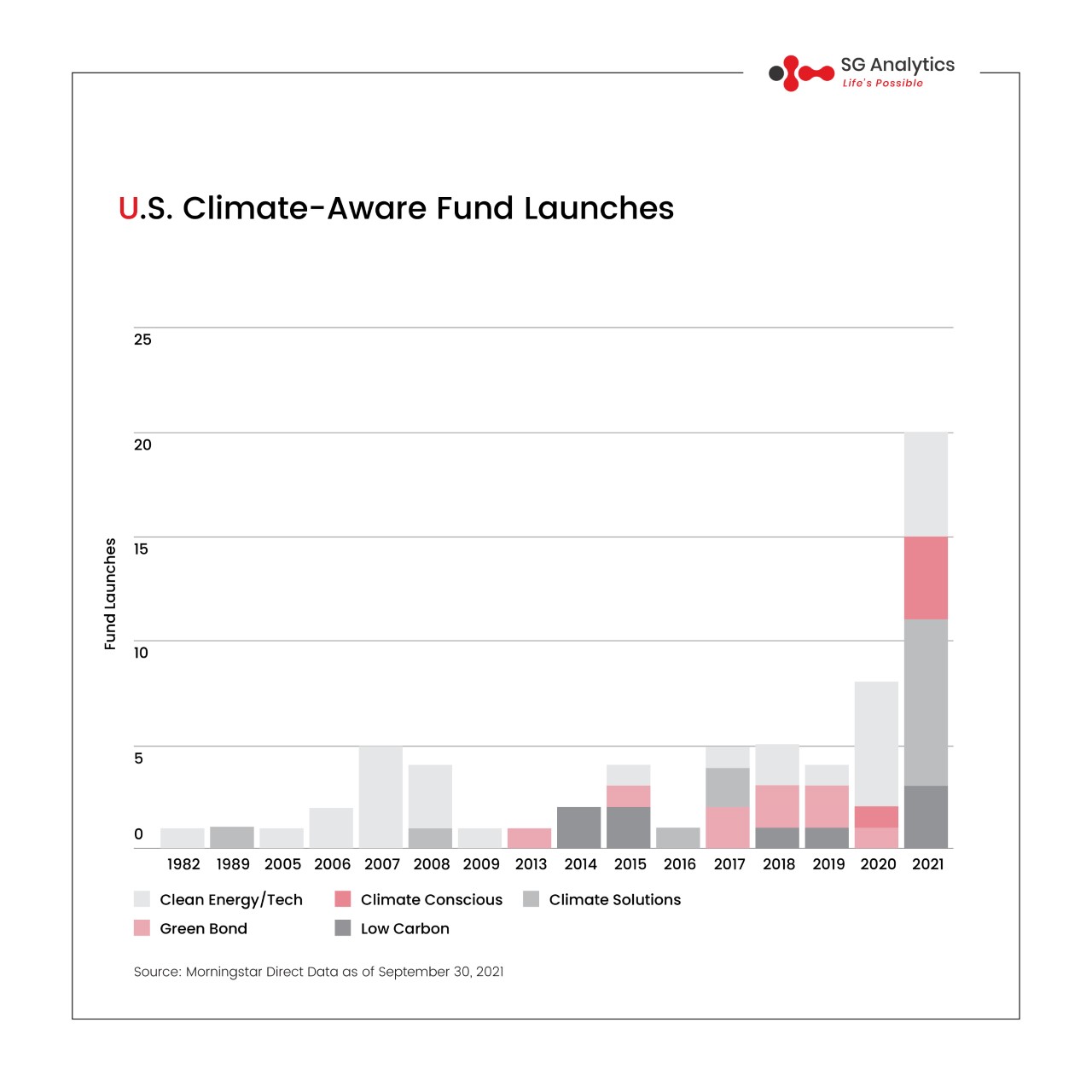

On Monday, the Securities and Exchange Commission (SEC), U.S.’s financial regulator, for the first-time proposed a climate disclosure rule that would require U.S. public companies to report on climate-related risks and impacts from their business activities in their annual reports and stock registration statements. The proposal aims to improve environmental public disclosures of corporate America, increasing transparency and holding companies accountable for their business’ climate impact. SEC chair, Gary Gensler said that the proposal was drafted in response to increasing investor demand for information on climate change factors that could affect the financial performance of the investee companies. Mr. Gensler said, “Investors with $130 trillion in assets under management have requested that companies disclose their climate risks.”

According to Morningstar, 2021 saw a record US$71 billion flow into U.S. ESG focused funds. While companies will have to disclose Scope 1 and Scope 2 greenhouse gas (GHG) emissions, it is still unclear which companies will have to disclose the more extensive and complicated Scope 3 GHG emissions. According to S&P Global, 35% of North American companies have already set GHG targets, but Scope 3 emissions are not included in these targets. Legal challenges are anticipated to the proposed rule, with concerns being raised about SEC’s authority, being a financial regulator to require disclosure of corporate emissions data. The public including companies, investors, and the legal community, will have up to 60 days to give their feedback on the plan, which is likely to be finalized later this year.

Mar 16, 2022

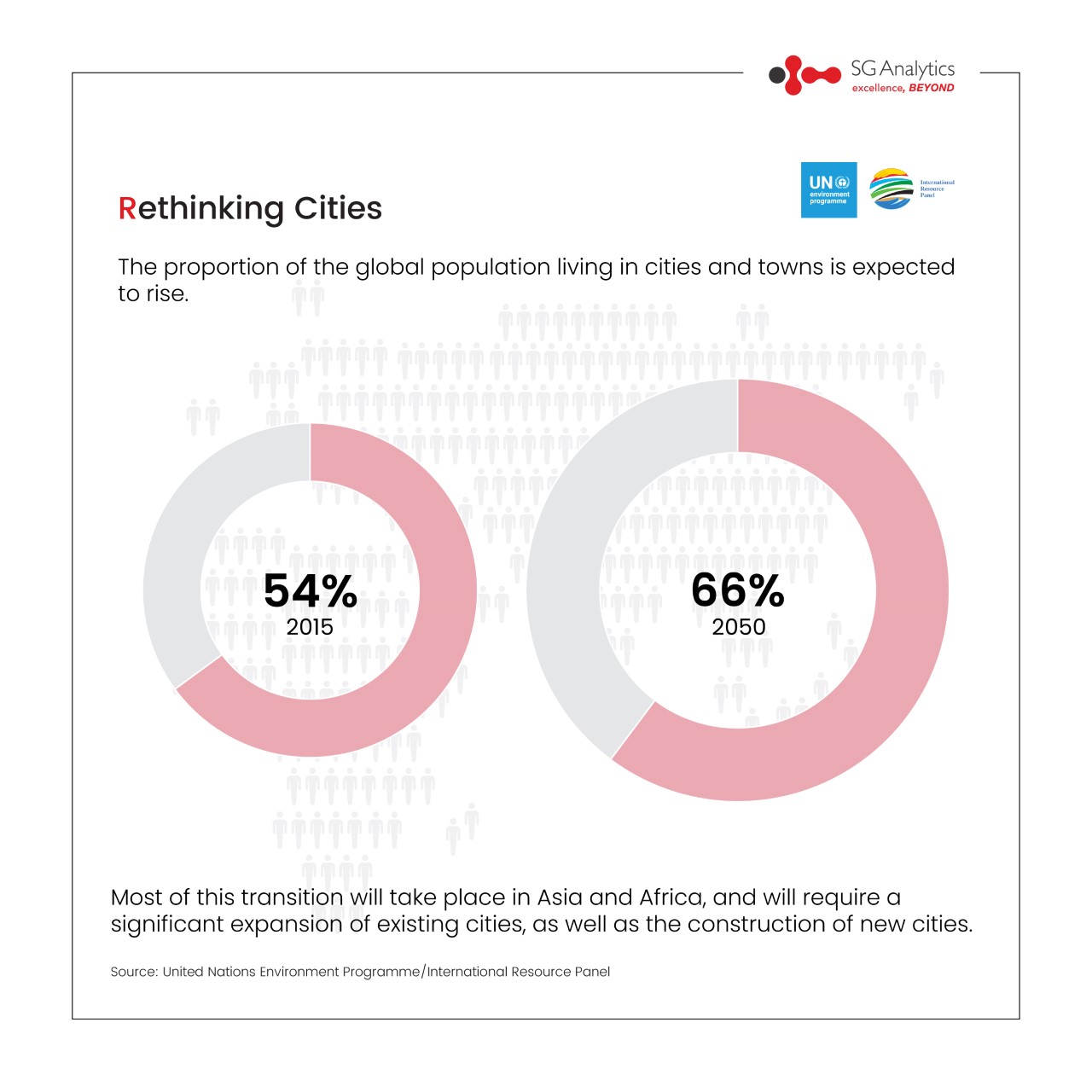

On Sunday, #Mumbai, India’s financial center, announced the Mumbai Climate Action Plan (MCAP) to achieve net-zero by 2050, becoming South Asia’s first city to do so. The detailed plan puts Mumbai two decades ahead of India’s national goal commitment of achieving net-zero by 2070 made at COP26 in Glasgow.

A coastal city, Mumbai is at a high risk of major flooding from rising sea levels. Mumbai’s plan is even more pressing considering that Indian cities will have to brace for a massive influx of migrants from rural areas. Rising temperatures are expected to increase crop failures and major water scarcity over the next few decades.

The plan was finalized with support from World Resources Institute, India, and C40 cities network after conducting a vulnerability assessment and a GHG & natural green inventory over the past six months.

The plan focuses on six key sectors – energy & buildings, #sustainable mobility, urban greening and #biodiversity, air quality, and urban flooding & water resource management. The largest investments will have to be made in the #energy sector which accounts for approximately 72% of the 23.42 million tons of the city’s total #GHG emissions in 2019. BMC (Brihanmumbai Municipal Corporation) commissioner, IS Chahal said that the civic body is currently working on infrastructure projects worth INR 40,000 crores to mitigate the potential effects of climate change on Mumbai and make the city more climate-resilient for its 19 million residents.

Is your city next?

Mar 16, 2022

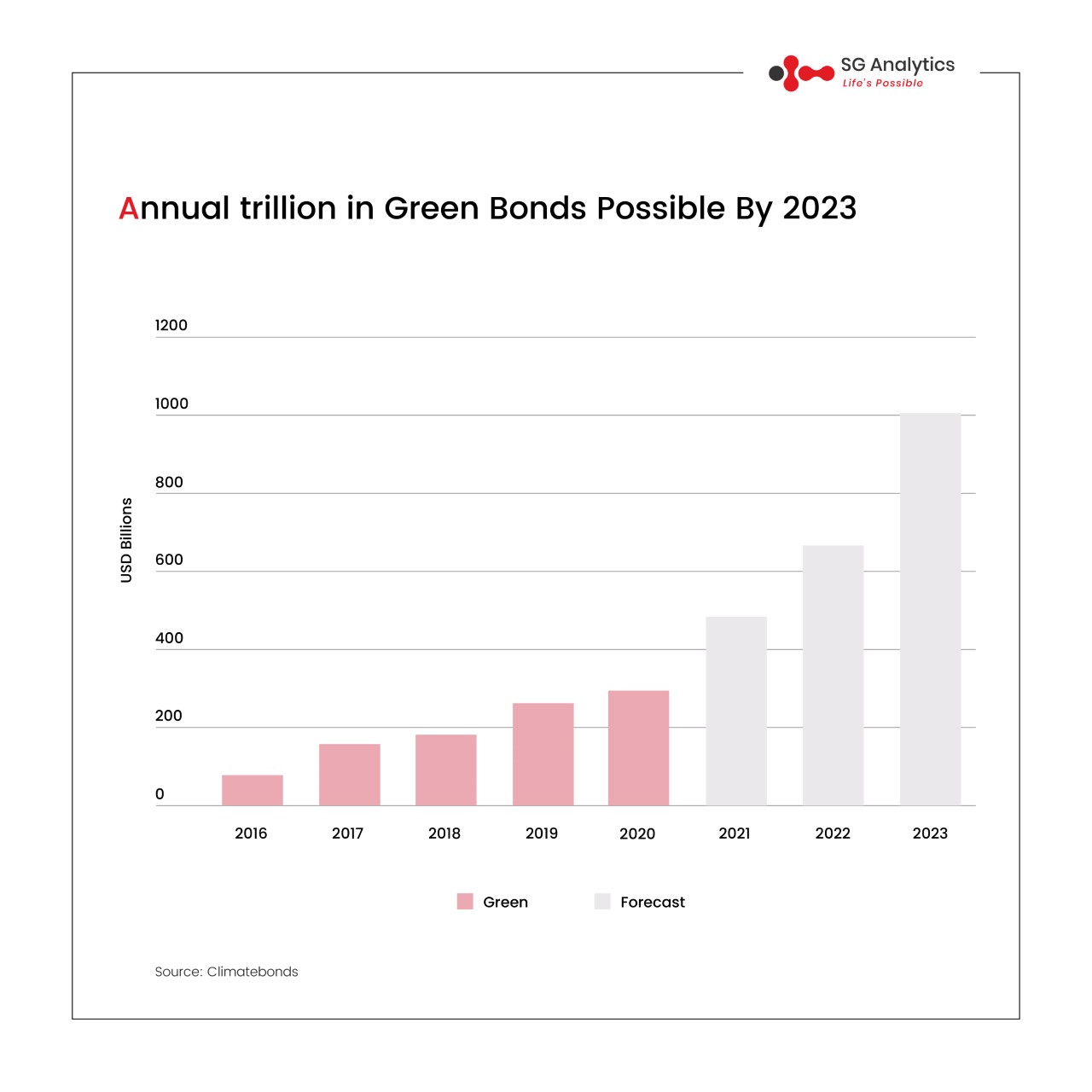

India has forayed into the green bond space amid the global boom in sustainable investments, as committed by the Indian Finance Minister, Ms. Nirmala Sitaraman in the Union budget for FY2022-23. The green bond market has been growing steadfastly since its inception in 2007. This is in line with India’s commitment to achieving net-zero by 2070, as pledged by India in the Conference of Parties (COP 26) at Glasgow.

As part of the Indian government’s borrowing program in FY2022-23, the country plans to issue sovereign green bonds worth at least USD 3.3 Billion (~INR 25,000 Crores). Although the government has historically seen lower yields on green bonds, which closed at 6.85% on Monday (14 March 2022), it could prove attractive to foreign investors. The initial issuance will start in the first half of FY2022-23 and may increase green debt depending on the stakeholders’ response to the debut sale of the bonds.

India, being one of the world’s largest emitters of greenhouse gases (GHG), is looking forward to funding renewable energy projects with the money raised, thereby helping reduce its carbon intensity and having a positive environmental impact.

India is making aggressive strides towards a low-carbon economy, setting ambitious targets of achieving 175 GW of renewable energy capacity by the end of 2022, and quadrupling its current renewable power generation capacity by 2030. Indian companies in the renewable energy sector have raised debt worth INR 1,760 Crores in February this year.

Will Indian sovereign green bonds help mitigate its climate risks?

Good things come in small packages! SGA Beat comprises insights-fuelled short stories on the hottest industry trends and topics, based on the latest information straight off our latest research endeavors. Beat is packaged in bite-sized, short-form nuggets and presented to you as quick reads – enriched with facts and insights that are easy to absorb and assimilate. Catch-up on the latest buzz around, one refreshing read at a time!

Every nation in the world is experiencing an increase in the size and proportion of older people in the population as people are living longer. Population ageing began in high-income countries due to high standards of living. It is now shifting to low- and middle-income countries. The UK is no exception, as people are living longer than ever before. In 2019, one in every five people in the UK was 65 or older, accounting for ~19% of the population of 12.3mn people. Between 2009 and 2019, the population of this age group increased by 23%, compared to a 7% increase in the overall population.

According to Office for National Statistics, the number of people aged 85 and over is expected to nearly double to 3.1mn by 2045 (4.3% of the UK population), from an estimated population of 1.7mn in 2020 (2.5% of the UK population). There are expected to be many more people in their later years by 2045, owing in part to the fact that the baby boomers of the 1960s are now approaching the age of 80, as well as an overall rise in life expectancy.

All English residents have access to free public health care through the National Health Service (NHS). This includes hospitalisation, physician care, and mental health treatment. The National Health Service budget is supported by general taxation. The number of working-age people and children is projected to remain around mid-2030 levels by mid-2045. During the same time period, the number of people of pensionable age will rise to 15.2mn (28% jump compared to the 2020 level). This increase in the ageing population can put pressure on the NHS’s spending as they are likely to avail of the benefit and not contribute much through tax. However, the ageing population can continue to make an increasing contribution to society if they remain healthy, mould themselves to changing working conditions in the workplace, and access the training to adapt to evolving labour market. Nevertheless, employers must also step up and adapt to an ageing workforce.

What do you think? Are you ready to recruit ageing employees?