Send Inquiry

Jan 13, 2022

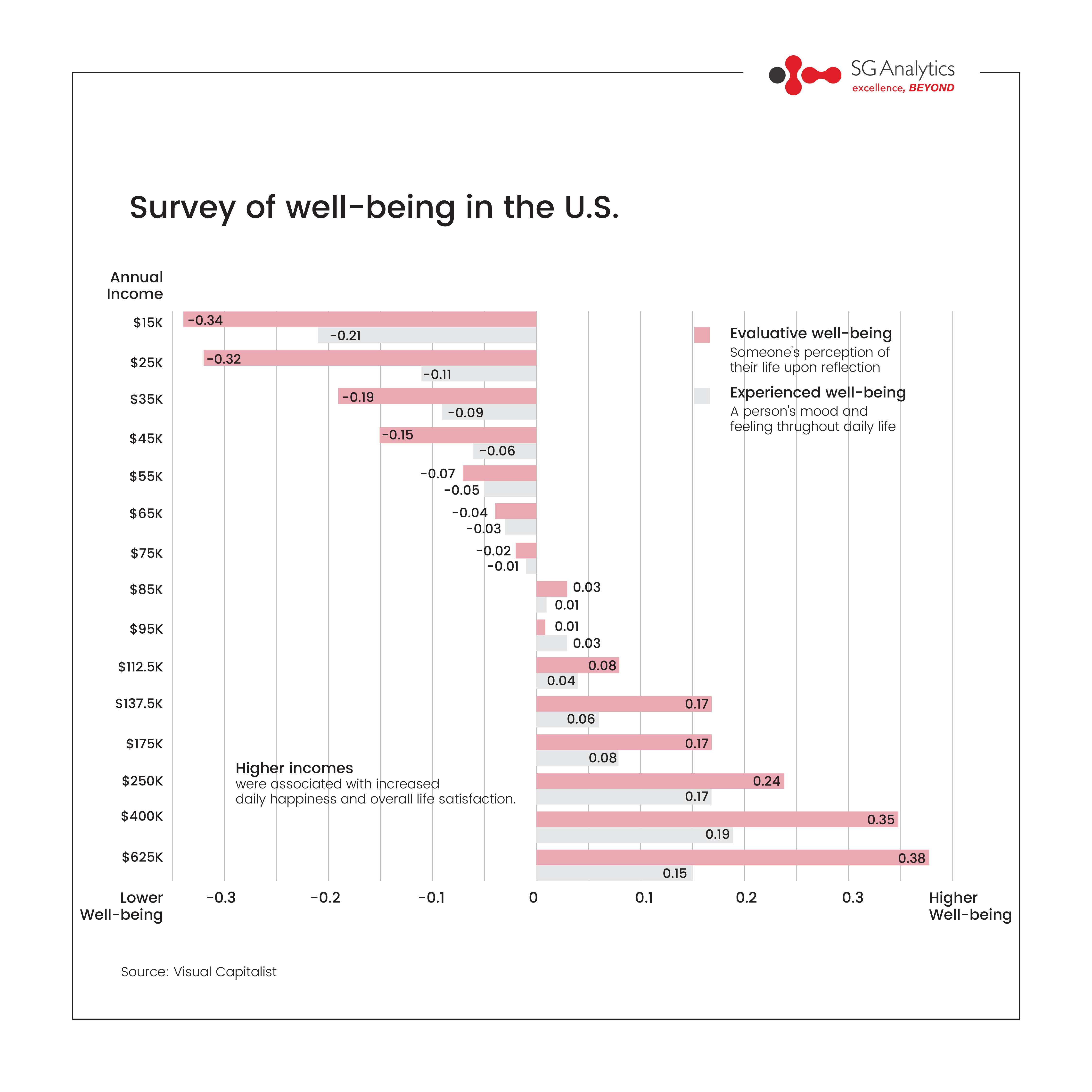

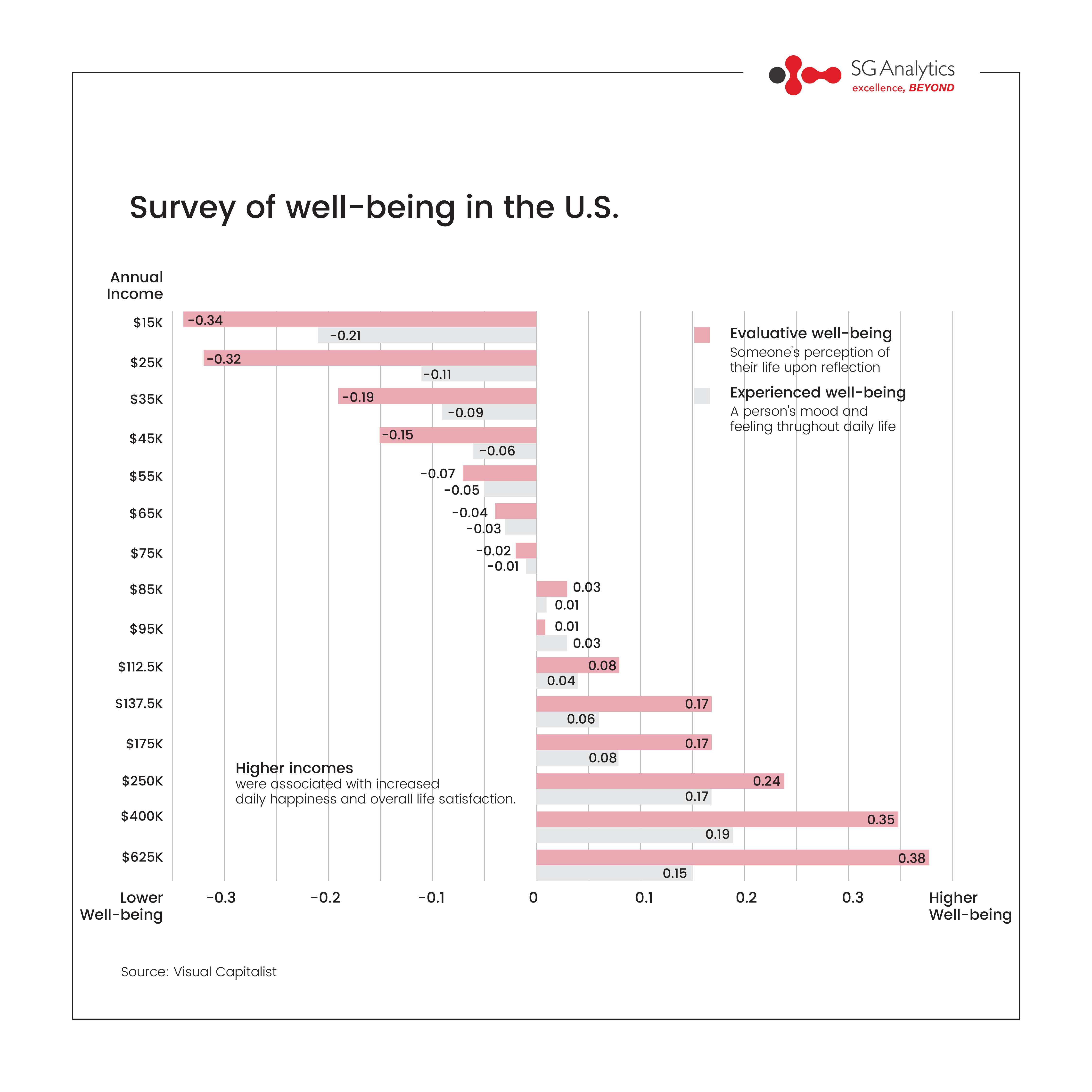

Money has a critical role to play in our lives. It’s a common notion that money can’t buy happiness, but not having it (or enough of it) can cause many sleepless nights. A reliable and comfortable income certainly makes life easier. It is negatively correlated with emotions like stress and is rather correlated with higher self-esteem, security, and dignity. So, yes, money can indeed buy happiness. The question is, how much money is enough? In 2010, a study published by Nobel laureates Daniel Kahneman and Angus Deaton stated that the quality of one's life increases as one earns more. However, the feeling flattens around USD 75,000 (annual income). Although, eleven years later, in 2021, a study published by Matthew Killingsworth of the University of Pennsylvania found that well-being rises with income—even beyond USD 75,000.

So, how much is enough? The truth is, money itself falls short. It is not the end-all-be-all for happiness. Killingsworth's study also found that people who equated money with success reported being less happy than those who didn't. That's because high income comes with tradeoffs. High earners report a heightened sense of achievement, but they are also more stressed. And lonely. Instead, here's the secret to happiness: money, yes, but also the right mix of good social relationships, exercise, and a sense of purpose. In fact, people who have a job they love and which gives them a sense of purpose report greater happiness—regardless of the money they earn.

Dec 17, 2021

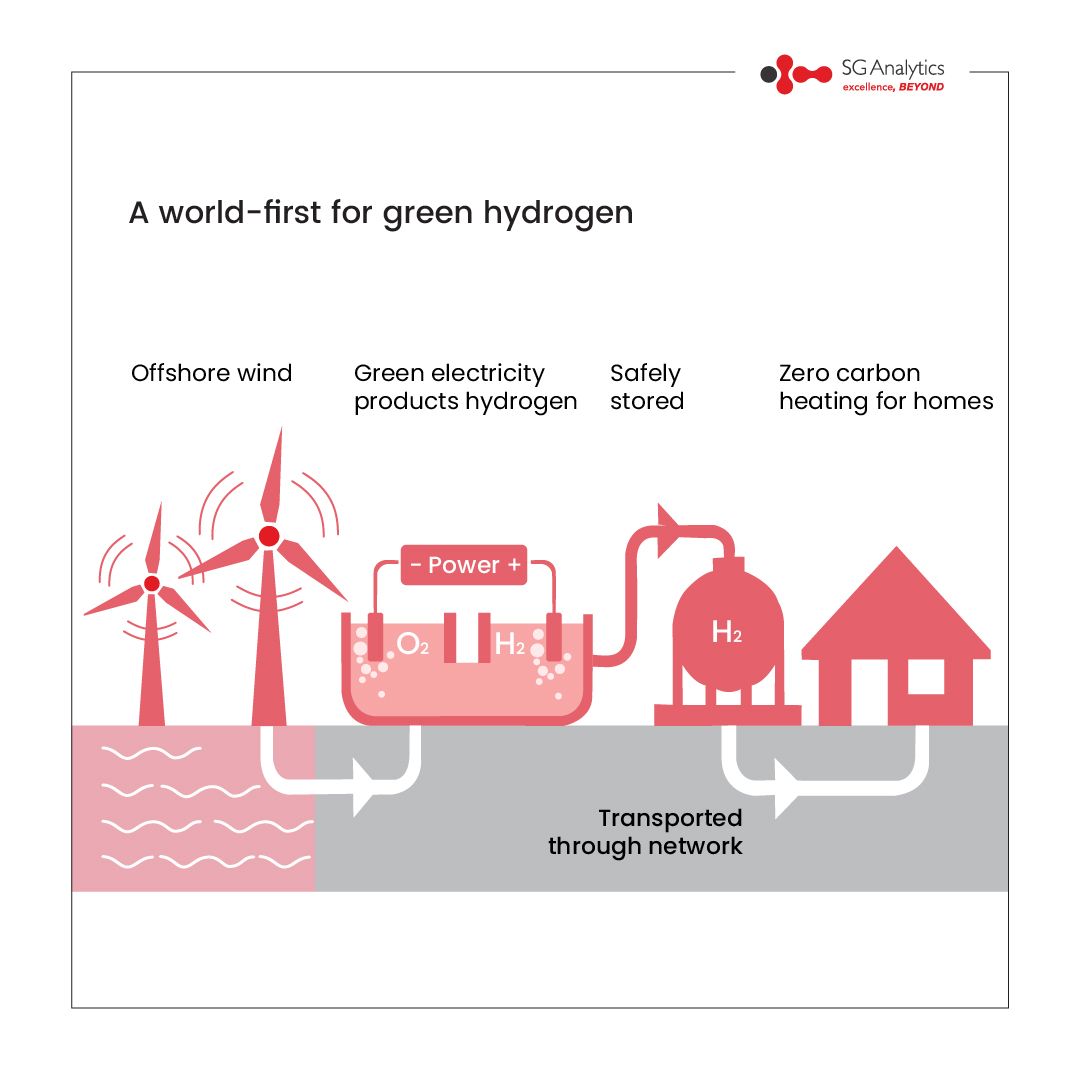

The world is racing against time to achieve the ambitious goal of attaining carbon neutrality by 2050. While solar and wind power have emerged as solid pillars in the transition away from fossil fuels, they are far from perfect. The world is increasingly looking for more efficient and sustainable options. So, what could be the solution? The answer is Green Hydrogen, which can emerge as a quick enabler toward a greener world.

Hydrogen gas (aka Grey Hydrogen) is widely used in various industrial applications. It is primarily produced using steam methane reforming, which uses natural gas and releases carbon dioxide and carbon monoxide. That is anything but eco-friendly. On the other hand, Green Hydrogen is produced using a simple, eco-friendly electrolysis process that leaves behind oxygen as its only by-product. It enables decarbonization and can significantly reduce our dependency on fossil fuels.

It is estimated that the production process would offset c.20% of the CO2 emitted per annum in producing Grey Hydrogen. It gets better. Green Hydrogen can be used in transportation, electricity generation, heat generation, infrastructure, energy storage, and much more. Accordingly, the demand for Green Hydrogen is expected to reach 500mn tons by 2050, making up for ~20% of the global energy demand.

However, the biggest impediment in its widespread adoption is its cost (USD 3-7 per kg, vs c.USD2.0 per kg for Grey Hydrogen). But like any other innovative technology, as it scales, it will become more affordable (estimated cost USD 1.4-2.4 per kg by 2030) provided we make a collective effort and ensure financial commitments from key stakeholders.

Dec 10, 2021

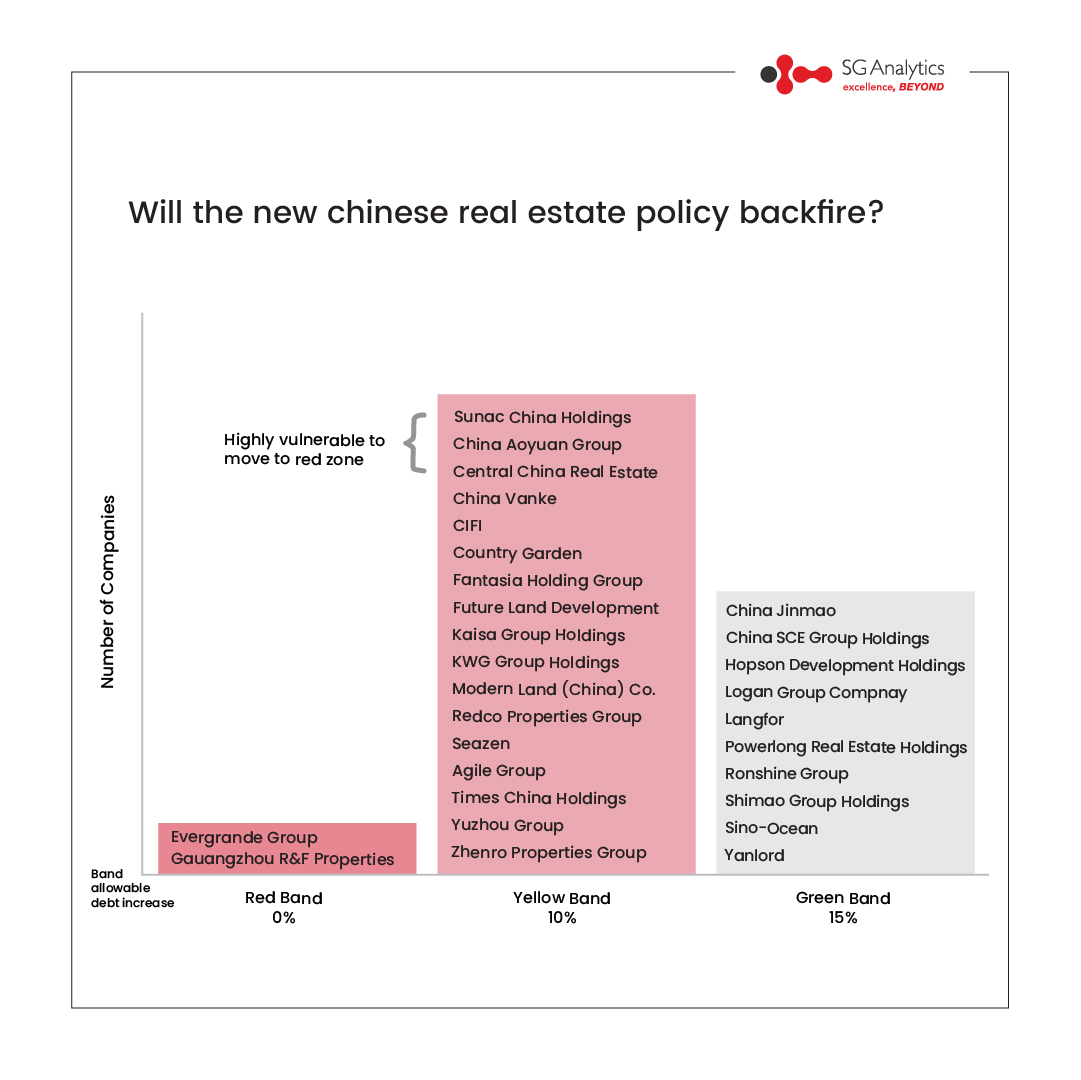

Chinese property developer Kaisa Group Holdings has become another victim of China’s deleveraging campaign under the “three red lines” rule. Yes, it, too, has failed to service its bond.

The much-criticized policy has shaken the foundation of the Chinese real estate sector, which, along with related industries, contributes c.30% to China’s GDP. After 20 years of rapid growth, the Chinese real estate sector is worth more than $50tn, or ~2x the US property market. In a previous SGA Beat, Will the New Chinese Real Estate Policy Backfire?, we highlighted the policy's possible implications on China’s real estate sector. Subsequently, we covered Evergrande's crisis in a much-shared blog. https://us.sganalytics.com/blog/chinas-perfect-storm-will-evergrande-swim-or-sink

China's Evergrande averted technical default by paying the interest at the fag-end of the grace period till last month. However, the tightening of the financial condition following the Evergrande crisis has led to several developers such as China Fortune Land Development (CFLD), Sunshine 100, Sichuan Languang, Sinic Holdings, and Fantasia Holdings Group, etc., failing to service debt, and leading to a default scenario. Now the likes of Kaisa, having a cash-to-short-term debt ratio of more than 1.5x, have come under pressure. Falling property prices and sales amid a sector rout have deteriorated liquidity and pushed the cash-to-short-term debt ratio lower. As more developers come under stress, the government looks prepared to support the sector rather than allowing more players to default. That said, a few companies still look vulnerable.

Nov 26, 2021

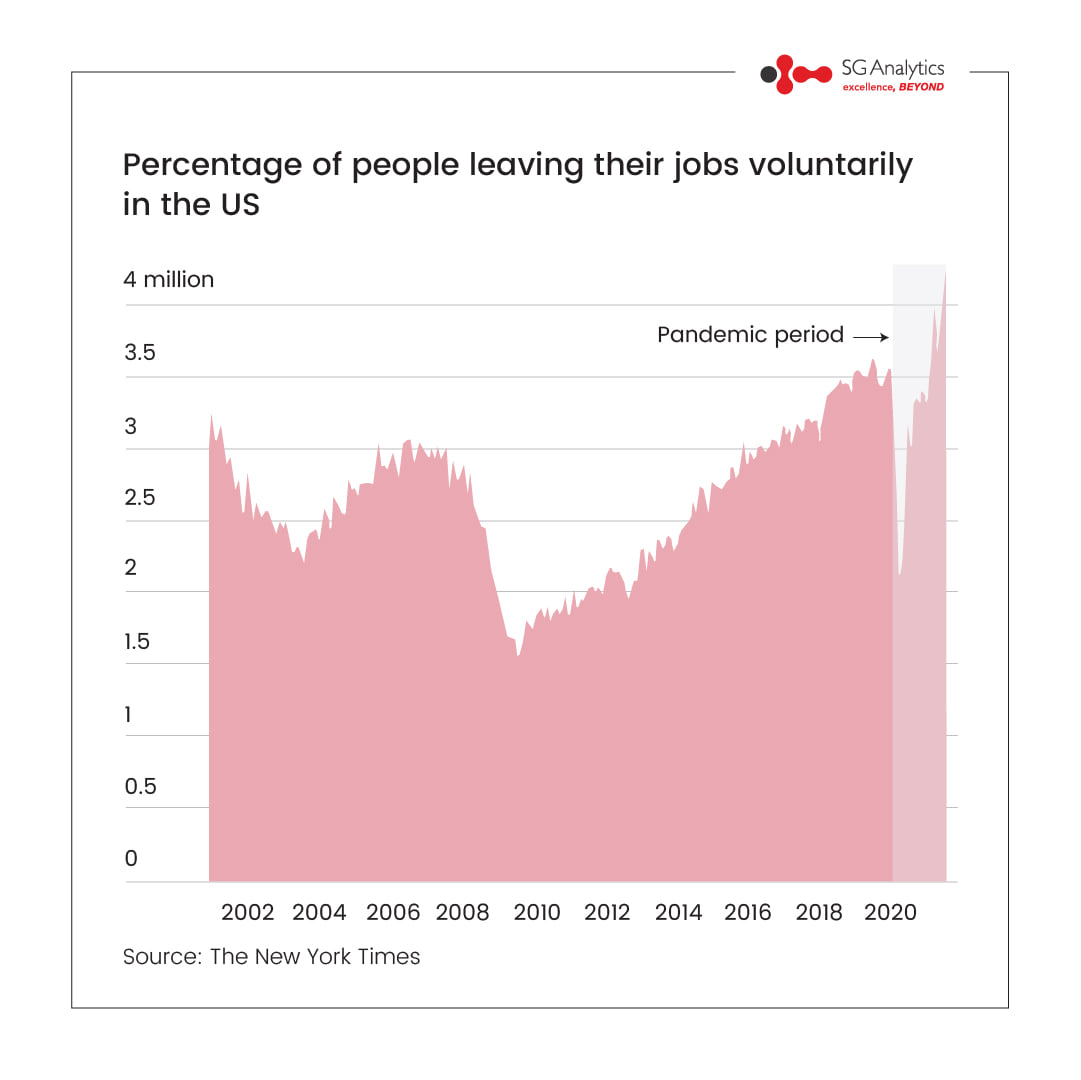

"The Great Resignation" has caught the imagination of many, and indeed for a reason. In September, a record 3% of the US workforce voluntarily left their jobs, taking the cumulative figure to over 20 million this year. Other regions are not far behind, with nearly 14 million quitting from the OECD region.

So, what’s driving the exodus? People are re-evaluating what they want to do with their lives and what work means to them. Some are resigning lest they catch the virus, while some have made a killing from the stock market and crypto boom. But the vast majority, largely mid-level employees in their mid-30s and early 40s, are quitting due to burnout, low pay, or they're just looking to explore other opportunities. Hospitality & Leisure and the Education industries are worst hit. Still, the Professional and Business services are also not far behind.

The ongoing saga may paint a gloomy picture, but it is indeed not. The hiring in September was at 6.5 million, which is over 2 million more than the quit rate indicating the job market looks strong in the US. Yet, employers have a lot at stake, with some estimates suggesting the cost of replacing employees is ~1.2x more than that of finding and training new ones. Companies need to adapt quickly and offer solutions that make employees feel valued and cared for to avoid situations going out of hand.

While it can be debated whether the ongoing trend is transient or permanent, one thing is sure: the pandemic has changed the way we think. As they say, our experiences shape our choices, and the pandemic has changed how we look at our lives

Nov 22, 2021

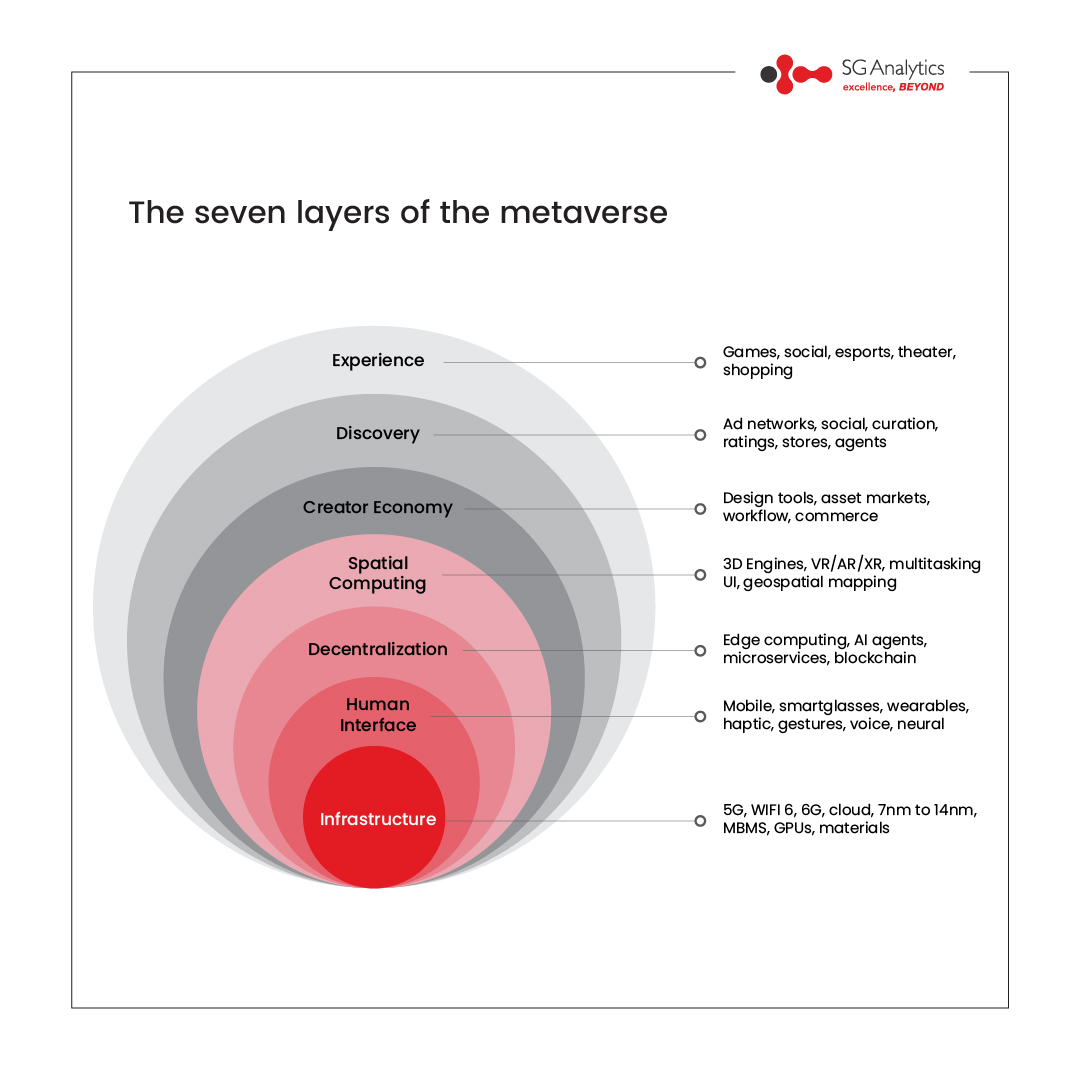

The word 'Metaverse' caught people’s imagination after Facebook changed its corporate identity to Meta Platforms. However, the term Metaverse isn’t that new and dates back to 1992, when it was coined by author Neal Stephenson in his Sci-fi novel “Snow Crash.” So, what exactly is Metaverse? To begin with, it means a seamless shared virtual reality, offering experiences identical to those we find in the real world. Metaverse is the next generation of the internet powered by augmented and virtual reality. And we may see a fully formed one in a decade.

The key features of such a space are real-time persistency (to continue functioning even when the user has left), economies (users can earn and spend in digital and fiat currencies), and communities. But also, digital avatars, immersion (engaging user’s all senses), multi-device compatibility, inter-operability (open architecture instead of closed ones), and the existence of multiple metaverses at the same time. That may seem quite futuristic. However, some early forms of Metaverse already exist in today’s world in the form of social media, NFTs, blockchain technology, and online gaming platforms like Roblox, etc.

Metaverse is often seen as a big tech revolution that could reach approximately a trillion-dollar opportunity by 2024 from USD 500bn in 2020. However, it also comes with its own set of concerns such as data privacy, separation of human beings from the real world, societal changes, etc. In the end, its impact depends on how we put it to use, just like other technological innovations.

Nov 12, 2021

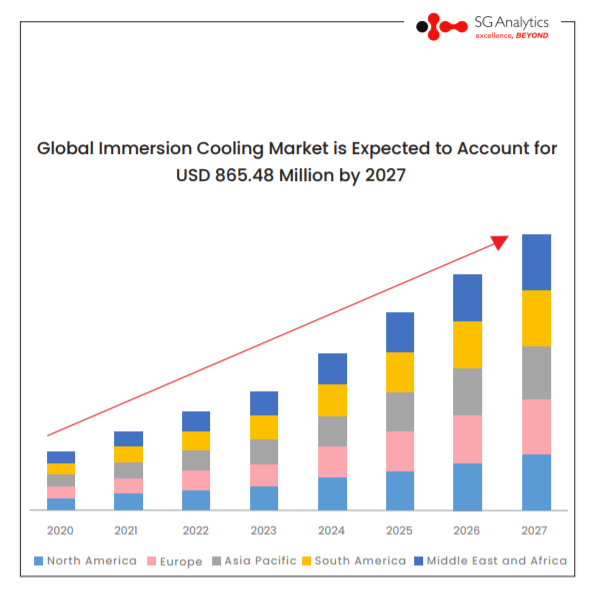

Crypto mining is highly energy-intensive and generates a lot of heat. That's because it involves solving complex algorithms with accuracy, high speed, and efficiency using specialized high-performance machines housed in big data centers. To run the machines efficiently, the data centers are required to have an effective cooling mechanism. Air and water cooling are common, but they are far from ideal. According to estimates, data centers consumed over 660 billion liters of water in 2020 alone. That, along with high energy intensity, makes it far from sustainable, despite the crypto-mining industry using more renewable energy to run operations (from 3% in 2Q21 to c.58 in 3Q21).

Immersion Cooling Technology, however, has the potential to make mining more sustainable. Immersion cooling involves submerging mining ASICs (Application-Specific Integrated Circuit) into a specialized fluid that absorbs and recycles heat from data centers. The fluid dissipates 1600x more heat than air. The technology is expected to help increase the hash rate by 25-55% and ASIC’s performance by 50%. It is estimated that the technology can help reduce heat and noise by 95%. In fact, 40% of the heat absorbed can be reclaimed to generate power. The capital intensity for the same output level can be brought down by as much as 50%.

With plenty to offer, immersion cooling technology can be a game-changer for the crypto-mining industry. It could help the industry achieve carbon neutrality by 2030.

Good things come in small packages! SGA Beat comprises insights-fuelled short stories on the hottest industry trends and topics, based on the latest information straight off our latest research endeavors. Beat is packaged in bite-sized, short-form nuggets and presented to you as quick reads – enriched with facts and insights that are easy to absorb and assimilate. Catch-up on the latest buzz around, one refreshing read at a time!

Money has a critical role to play in our lives. It’s a common notion that money can’t buy happiness, but not having it (or enough of it) can cause many sleepless nights. A reliable and comfortable income certainly makes life easier. It is negatively correlated with emotions like stress and is rather correlated with higher self-esteem, security, and dignity. So, yes, money can indeed buy happiness. The question is, how much money is enough? In 2010, a study published by Nobel laureates Daniel Kahneman and Angus Deaton stated that the quality of one's life increases as one earns more. However, the feeling flattens around USD 75,000 (annual income). Although, eleven years later, in 2021, a study published by Matthew Killingsworth of the University of Pennsylvania found that well-being rises with income—even beyond USD 75,000.

So, how much is enough? The truth is, money itself falls short. It is not the end-all-be-all for happiness. Killingsworth's study also found that people who equated money with success reported being less happy than those who didn't. That's because high income comes with tradeoffs. High earners report a heightened sense of achievement, but they are also more stressed. And lonely. Instead, here's the secret to happiness: money, yes, but also the right mix of good social relationships, exercise, and a sense of purpose. In fact, people who have a job they love and which gives them a sense of purpose report greater happiness—regardless of the money they earn.