As we approach the last quarter of 2023, the US VC ecosystem is showing initial signs of stabilization. Despite the banking stresses of early 2023, the industry has shown resiliency – thanks in part to strong funding in areas such as generative AI and biotech. Cutting-edge technologies like generative AI hold the promise of delivering substantial value across various sectors of the economy. Notably, legislative advancements such as the CHIPS and Science Act are also amplifying the prospects for growth in innovation and entrepreneurship.

The venture capital industry plays a crucial role in fostering innovation, and this principle holds steadfast regardless of macroeconomic circumstances. With a history spanning decades, venture capital firms have consistently nurtured groundbreaking ideas, resulting in both transformative industry shifts and substantial returns for these firms. Notably, four of the five largest public companies in terms of market capitalization at the close of 2022 can attribute their origins to vital VC funding. Technologies like generative AI, standing at the forefront of innovation, underscore the vital role venture capital plays in propelling progress. This reiterates the fact that supporting innovation and selecting the right startups consistently leads to tangible value creation for venture capital firms.

Read more: Navigating Supply Chain Challenges through Innovation and Investment.

“Innovation and disruption are constant and not subject to the whims of the overall economy,” said Bill Gurley, General Partner at venture capital provider Benchmark. (In December 2008, amid the Global Financial Crisis).

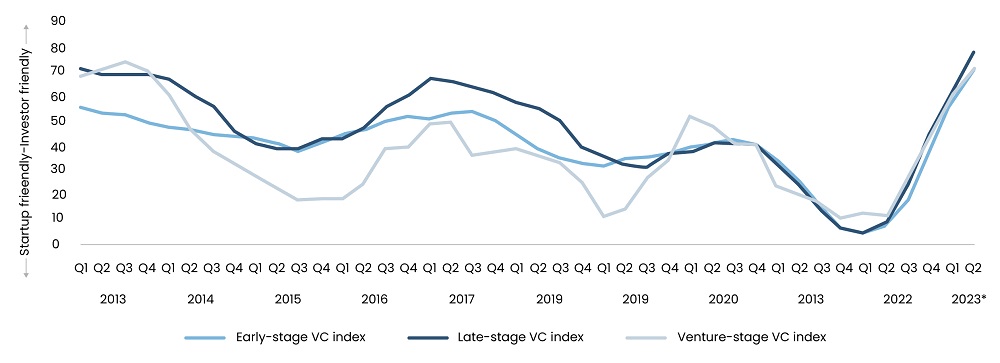

However, the dynamics of venture investment have certainly changed with the shifting landscape of venture capital investment, leading to the most investor-friendly funding environment in a decade. In 1Q23, almost 9% of 899 deals recorded by capitalization table management and valuation specialist Carta had a liquidation preference above 1x, up from under 2% a year ago. Additionally, cumulative dividends, which signify accruing unpaid dividends, increased from about 20% to 26% between 2022 and Q1 2023, per PitchBook. Pitchbook's funding demand-to-supply model also shows a significant imbalance at the late stage, with a deficit of nearly threefold. This indicates that companies are currently seeking approximately three times the capital available in the market, underscoring the investor-friendly nature of the VC market.

Figure 1: Funding Environment Turns Investor-Friendly

Source: Pitchbook NVCA Venture Monitor

Read more: US-China Tech Rivalry: Implications for Venture Capital and the Chips Ecosystem

IPO Momentum to Offer Confidence

After an 18-month period marked by a sluggish US IPO market characterized by waning tech valuations and changing investor sentiment causing a pause in IPO activity, a shift appears to be underway. There have been 68 IPOs priced this year as of 25th August 2023 in the US, up 21.4% year-on-year, per Renaissance Capital. Additionally, the cumulative capital raised this year stands at $9.9 billion by 25 August 2023, reflecting a substantial growth of 118.2% from the same date in the previous year. Companies such as Softbank-backed Arm, grocery-delivery entity Instacart, and Shopify-supported marketing platform Klaviyo are now poised for IPOs. This could very well break the backlog of unicorn IPOs. Bolstered by factors like sustained inflation moderation, a temporary halt in interest rate hike deceleration, and the stabilization of commodity prices, the IPO market is primed for a potential resurgence in the fourth quarter, and possibly returning to a state of normalcy by 2024.

Read more: Secondary Deals to Heat Up as IPO Slowdown Continues

Goldman Sachs' assessment also aligns with an optimistic trajectory for the US IPO landscape, as demonstrated by the GS IPO Issuance Barometer. The metric, which serves as an insightful gauge of the macroeconomic conditions conducive to IPOs, reached a level of 93 in June 2023 – the highest since March 2022. Comprising five critical components—S&P 500 drawdown, CEO confidence, the ISM Manufacturing Index, the six-month shift in two-year Treasury note yields, and the S&P 500's trailing enterprise value-to-sales ratio—the barometer reached its lowest point of 7 in September 2022. This resounding upswing suggests a compelling outlook for IPOs within the overarching macroeconomic framework.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.