The private credit market is rapidly transforming the lending landscape, offering customized financing that appeals to borrowers. As the syndicated loan market faces uncertainty and banks retreat from riskier deals, private credit is stepping in to meet the demand.

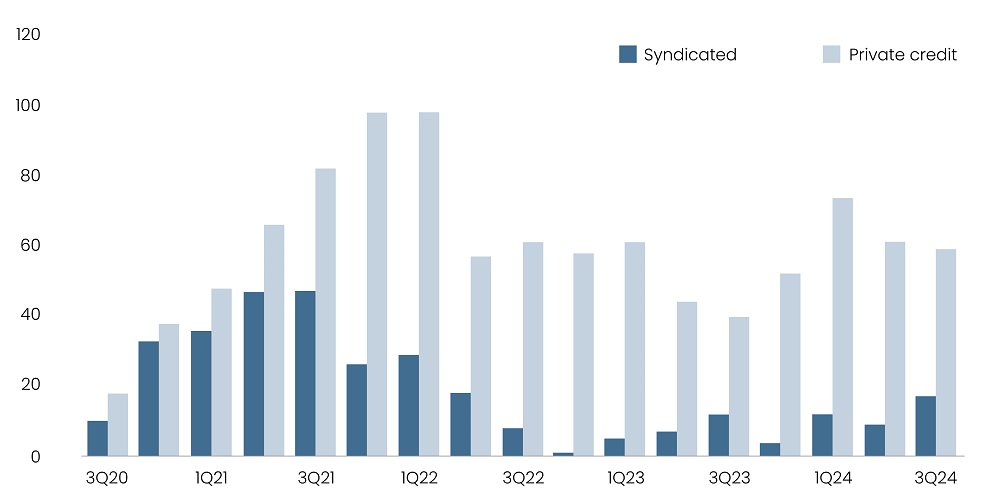

Since the end of 2023, the private debt market expanded by 5%, reaching $1.7 trillion, while the broadly syndicated loans (BSLs) market declined by 1%, according to PitchBook. Over the longer period, the difference in growth becomes more pronounced as private debt grew by 52% since the end of 2019, compared to a 17% increase in the loan market index. Due to the smaller-sized borrowing entities, private credit-financed leveraged buyouts (LBOs) continued to outnumber BSL-financed deals in 3Q24, maintaining a ratio of 3.5 to 1, according to PitchBook. This highlights the sector’s growing significance in providing customized financing solutions.

Figure: Count of LBO financed in BSL and Private Credit Market

Source: PitchBook, as of September 25, 2024

Borrowers are turning to private credit to avoid formal credit ratings, expedite deal closures, and secure predetermined pricing. Private debt lending has become prevalent in financing higher-risk, lower-rated transactions that have declined in the BSL market. As of September 2024, the share of B-minus-rated deals in the BSL market dropped to 26% from 30% in February 2023, according to the Morningstar LSTA US Leveraged Loan Index.

Read more: Black Friday and Cyber Monday 2024: E-commerce Soars to Record Heights

On November 18, 2024, Silver Point Capital, a Connecticut-based credit investor, closed its specialty credit fund III, raising over $8.5 billion and focusing on providing loans to mid-sized companies. On October 29, 2024, Blackstone closed its semi-liquid US direct lending fund, raising around $22 billion in capital and focusing on providing direct loans to large-cap and middle-market companies. Such capital commitments indicate a growing appeal of private credit as an asset class among institutional investors.

Rising Refinancing and Dividend Transactions

Refinancing became a leading focus in private credit, with 158 deals recorded by September 2024, surpassing the 118 deals in all of 2023, according to PitchBook. Refinancing accounts for nearly 20% of the market, marking the highest share in five years. This is owing to the reduced spreads in the new market deals. This trend is reflected in a few repricing deals, where private equity (PE) sponsors and borrowers renegotiate spreads with existing lenders to align with current market conditions. In 3Q24, Higginbotham and Galway Holdings repriced their private credit loans to S+450.

Dividend transactions have emerged as another notable trend in the private credit market for 2024, surpassing any full-year total in at least five years with 14 deals tracked by PitchBook. PE sponsors prefer keeping these discreet deals, contrasting with the BSL market, where they are more visible.

Read more: Reasoning Redefines AI as Scaling Hits Plateau

Technology and ESG Integration

Technology is becoming a critical enabler in the private credit market’s growth, enhancing scale and efficiency. On November 19, 2024, Arc launched Arc Intelligence, the first AI platform for private credit that automates tasks like data room review, financial analysis, and credit memo generation. Machine learning and AI optimize underwriting and portfolio tracking, while alternative data refines risk evaluation and pricing models. As private credit grows, online lending solutions lower costs, streamline loan processes, and support securitization, solidifying their position as a versatile alternative to traditional lending methods.

The integration of ESG in private credit has evolved beyond due diligence, with lenders increasingly tying loan terms to ESG targets. ESG factors influence a borrower's financial health over time; for instance, environmental regulations impact operational costs, while governance issues affect management stability. In 1H23, Energy Capital Partners and former GIP Credit Partners launched ECP Forestar, a $2.5 billion platform targeting attractive ESG-focused private credit opportunities, emphasizing decarbonization goals. Rigorous evaluation is essential for balancing returns with meaningful ESG outcomes.

Future Outlook

The direct lending market benefits from the large US middle market, significant PE reserves, and strong borrower demand. Direct lending yields remain attractive at 10%, with credit performance stable and defaults in low single digits despite narrowing spreads. PitchBook LCD’s Q424 Global Private Credit Survey predicts further tightening of spreads and a loosening of covenant protections as demand for credit investments surpasses the supply. Activity in the middle market, particularly in sponsor-based add-ons and financing, has remained robust, reflecting the sector's adaptability. As interest rate trends stabilize, direct lenders will be well-positioned to capitalize on increased LBOs and broader deal flow.

Read more: China Closing AI-Innovation Gap with the US

The private credit offers significant opportunities, but navigating its growth requires addressing challenges like data transparency, volatile rates, and evolving regulations. With rising competition from insurance companies, asset managers, and banks, success hinges on disciplined risk management, clear investor communication, and adaptability to this evolving landscape.

Partner of choice for lower middle market-focused investment banks and private equity firms, SG Analytics provides offshore analysts with support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.

About SG Analytics

SG Analytics (SGA) is an industry-leading global data solutions firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company with a team of over 1200 employees and a presence across the U.S.A., the UK, Switzerland, Poland, and India.

Apart from being recognized by reputed firms such as Gartner, Everest Group, and ISG, SGA has been featured in the elite Deloitte Technology Fast 50 India 2023 and APAC 2024 High Growth Companies by the Financial Times & Statista.