The artificial intelligence race between the US and China reflects a transformative rivalry, as each nation executes different strategies to drive technological innovation and global influence in AI. While the US continues to have a commanding lead, China's relentless focus on AI-driven innovation, backed by substantial government investment and a thriving tech ecosystem, rapidly narrows the gap.

Venture capital (VC) funding has significantly contributed to the US’s current lead over China in AI development. OCED data shows that over the last five years, VCs have invested around $290 billion in the AI space in the US compared to $120 billion in China. Even though China lags in securing private funding compared to the US, it predominantly invests in targeted AI projects directly from the state’s exchequer.

The US’s resilient infrastructure and enhanced access to GPUs are essential to strengthening its current position in this sector. A handful of major players, such as OpenAI, Meta, Google, and Anthropic, lead the AI sector in the US, leveraging partnerships with hyperscalers to access advanced computing power. Unable to legally obtain AI chips like NVIDIA’s 100, China is turning to domestically designed and produced alternatives. Huawei’s AI chip, Ascend 910, is the closest competitor, and although it has achieved significant advancement in chip design and production, US export restrictions have hindered its progress.

Barriers Holding Back China in the AI Race

AI ecosystem in China faces notable hurdles, including lags in chip production and strict censorship. This creates data shortages and possible bias for training large language models (LLMs), hindering AI innovation. China’s larger pool of AI companies demonstrates diluted investments and resources. As of August 2024, over 180 LLMs have been approved in China, heightening market share and funding competition amid economic slowdowns and a drop in venture capital.

From October 2022, the US started issuing export controls restricting the sale of supercomputer chips and semiconductor equipment necessary for developing AI chips in China. In October 2024, the US Treasury Department finalized regulations prohibiting US investments in Chinese companies involved in semiconductors, quantum computing, and AI technologies. Nestor Maslej, research manager at Stanford HAI, notes that while US policies like chip export controls have hindered Chinese AI progress, the US must continually assess further actions needed to maintain the lead.

Read more: Continuation Funds: Fueling the Rise in Secondaries

Bridging the Gap in AI with the US

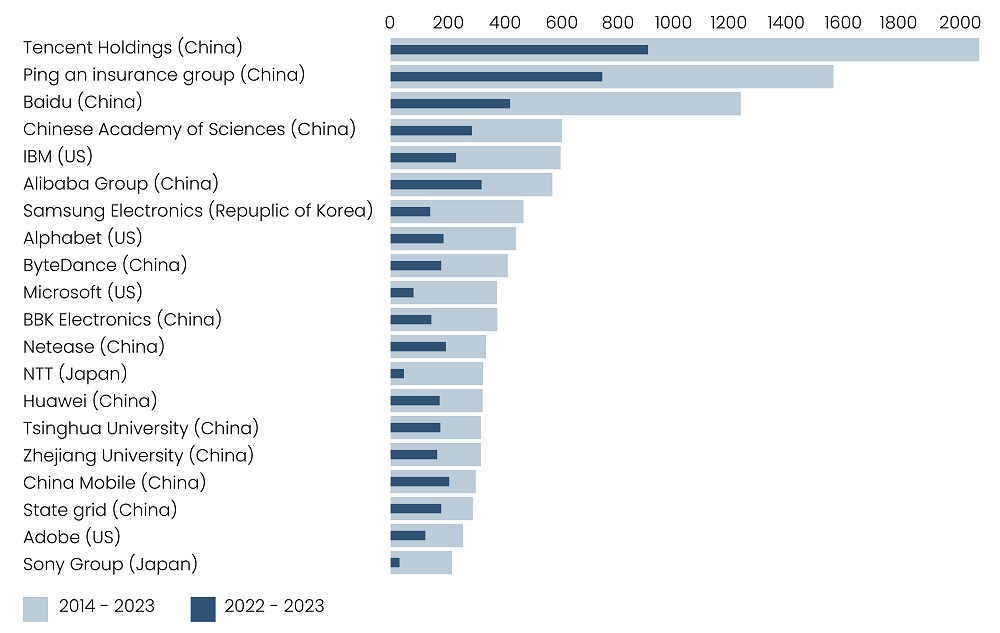

Despite the US’s current lead in generative AI, a September 2024 study from ITIF reveals that China is closing the gap in AI with the US, driven by strong academic institutions and innovation research. Since OpenAI launched ChatGPT in late 2022, China has ramped up investments in generative AI. Chinese firms and institutions, including Tencent, Alibaba, ByteDance, Baidu, Ping An, and the Chinese Academy of Sciences, comprise six of the top 10 global patent applicants in the field, according to the WIPO 2024 report.

Figure: Top patent owners in GenAI, 2014-2023

Note: Published patent families in Gen AI

Source: WIPO, based on patent data from EconSight/IFI Claims, April 2024

China has surpassed the US in AI and ML patents since 2021, with a two-fold increase in 2023, as per Govini’s 2024 National Security Scorecard. Tata Murphy, CEO of Govini, adds that the US government’s $12 billion AI investment over five years is relatively small, indicating a potential risk of falling behind in AI innovation.

According to the ASPI’s tracker, China is ahead of the US in AI-related research papers being published. From 2019 to 2023, China’s share of advanced analytics research papers was 33.2%, nearly double the US’s share of 13%. This is likely a result of more top undergraduate researchers in China than in the US. China’s command economy has driven rapid growth in clean energy, adding over 200 gigawatts annually compared to 40 in the US. Though chip access remains the focus, China’s economy and extensive data resources make it a key player in global AI advancement.

Future Outlook

China’s strategic emphasis on developing advanced productive capabilities aligns with its goals of modernizing manufacturing, energy, and logistics industries. China aims to integrate AI into the traditional sectors to promote operational efficiency with minimum wastage and enhance product standards. Initiatives like Lighthouse Factories have reduced energy consumption by 24% and waste by 50%. Such AI integration efforts will strengthen China’s economy, reinforcing its position as a global leader in advanced industries.

Despite competitive tensions, in 2024, the UN General Assembly passed a China-led resolution to strengthen international cooperation in AI capacity-building and a US-led resolution on promoting safe and reliable AI systems for sustainable development. Both received broad support, signaling a shift toward cooperative AI governance.

Read more: AI’s Power Conundrum: Will Renewables Save the Day?

Conclusion - AI Between US & China

The AI race between the US and China has sparked an unparalleled surge in research, investment, and policy-making, shaping each country’s standing in AI development. While the US leads with private innovation, China’s centralized approach and vast data resources continue to close the gap. Striking the perfect balance between competition and cooperation will be crucial to ensure that AI innovation advances in a way that promotes global security and collective progress.

Partner of choice for lower middle market-focused investment banks and private equity firms, SG Analytics provides offshore analysts with support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.

About SG Analytics

SG Analytics (SGA) is an industry-leading global data solutions firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company with a team of over 1200 employees and a presence across the U.S.A., the UK, Switzerland, Poland, and India.

Apart from being recognized by reputed firms such as Gartner, Everest Group, and ISG, SGA has been featured in the elite Deloitte Technology Fast 50 India 2023 and APAC 2024 High Growth Companies by the Financial Times & Statista.