Customer analytics became an important source of information in decision-making. One of its main benefits is to show the price-sensitivity of customers towards a particular product, which can be seen by developing a price-elasticity model with sales revenue as the dependent variable and price as the major independent variable. This price-elasticity is usually a regression model, and it includes other independent variables (apart from price) representing one or some or all of the following:

- Store-specific information

- Demographic information

- Promotion and discount information

- Competitor details

- Cannibalization information

- Special events, festivals, and holidays

- Macroeconomic factors

How to tweak variables?

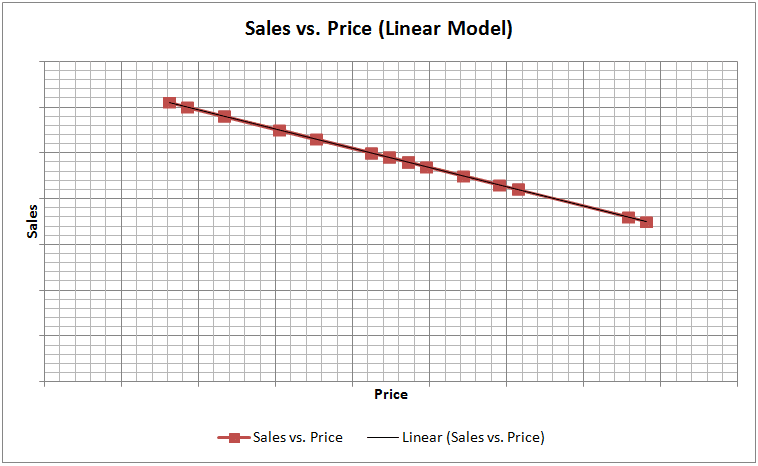

Quite often, the price-elasticity model does not end up as a normal multivariate linear regression model. It requires understanding the relationship between sales and price, and tweaking the dependent variable of sales and the independent variable of price accordingly through variable transformation. There is a good reason for that, as there is empirical evidence that models with such transformed variables provide better accuracy and stand up to model diagnostics tests in a much more respectable manner. However, a discussion on empirical evidence is beyond the scope of this article.

Three types of transformations are definitely explored while constructing a price-elasticity model:

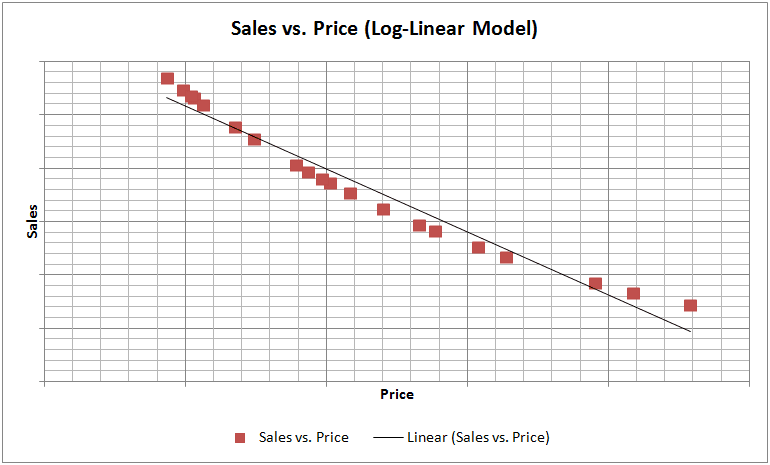

- Logarithmic transformation of dependent variable (sales), no transformation of independent variable (price) (Log-Linear Model)

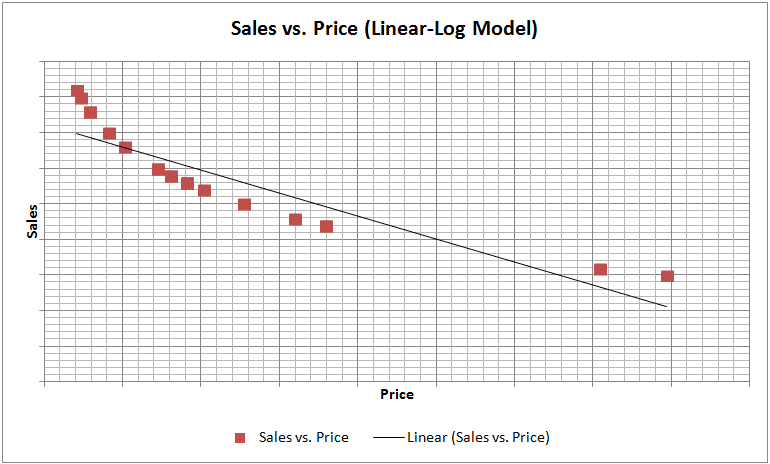

- No transformation of dependent variable (sales), logarithmic transformation of independent variable (price) (Linear-Log Model)

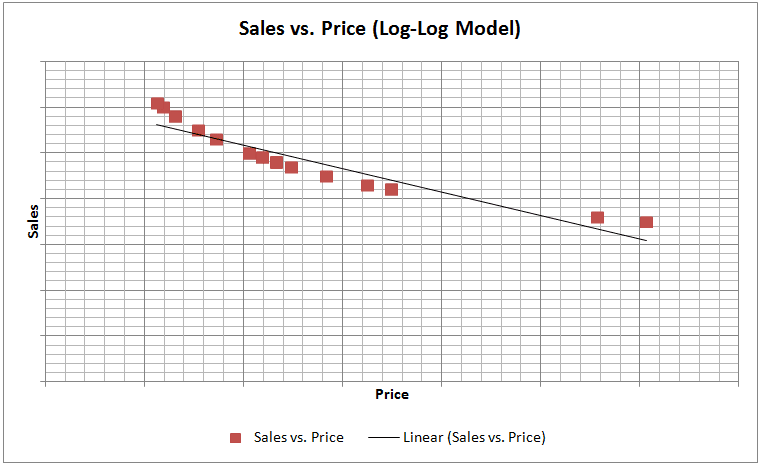

- Logarithmic transformation of dependent variable (sales), logarithmic transformation of independent variable (price) (Log-Log Model)