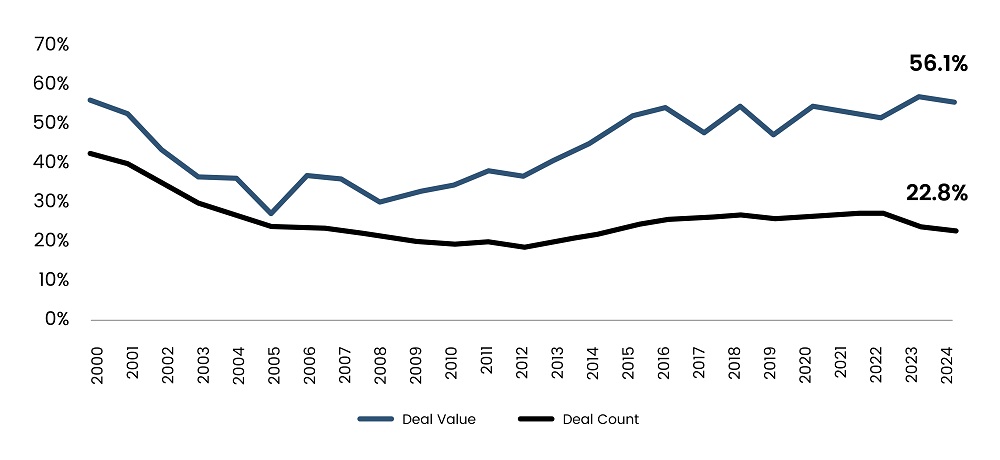

Corporate Venture Capital (CVC) plays a major role in U.S. venture dealmaking, yet it remains surprisingly ineffective as a pipeline for acquisitions. Between 2014 and 2024, CVCs participated in over 46% of total US VC deal value annually, but their conversion rate into acquisitions has remained stubbornly low—just 2-4% of startups backed by CVCs were later acquired by their corporate investors, according to PitchBook. This disconnect raises critical questions about the role of CVC in corporate strategy and the challenges hindering its conversion into M&A activity.

Figure 1: Share of US VC Deals Involving CVC Participation

Source: PitchBook, data as of December 31, 2024

The answer lies in a mix of high valuations, late-stage investment focus, strategic misalignment, and shifting corporate priorities. A major reason for the low acquisition rate is CVCs’ preference for late-stage investments. These startups, while more mature and at lower risk, often command sky-high valuations, making them difficult acquisition targets. Many opt for IPOs rather than selling to their CVC backers.

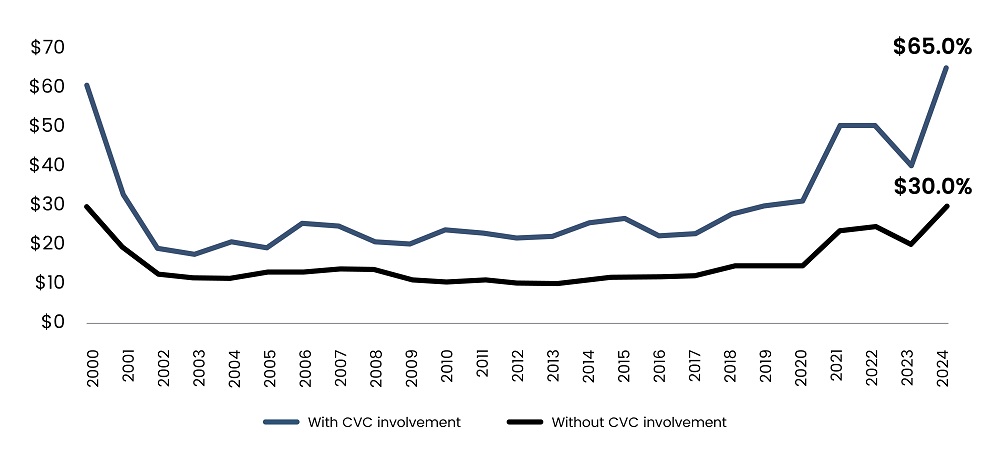

In 2024, the median US VC deal size with CVC participation was $13 million, three times higher than deals without CVC involvement, as per PitchBook. This cost escalation makes it financially impractical for CVC-backed corporations to acquire their portfolio companies.

Read more: US Venture Capital (VC) Outlook 2025

Although CVCs have increased their presence in early-stage investments, from 5.6% of US VC deals in 2009 to 26.3% in 2024, acquisitions at this level remain rare, as per PitchBook. Early-stage companies will likely be easier acquisition targets due to their smaller size and lower valuations, but they also carry substantial risks. Many fail before reaching a stage where they get effectively integrated into a larger corporation. Additionally, startups at this stage often develop in directions that misalign with the corporate sponsor’s strategic vision, reducing the likelihood of an acquisition.

From M&A Pipeline to Market Intelligence

As CVCs mature, their strategic focus often shifts away from acquisitions. A 2024 survey by Counterpart Ventures found that 42% of established CVCs now prioritize access to emerging technology and partnerships over direct acquisitions. These CVCs emphasize market intelligence and trend monitoring, using investments to gain insights into emerging technologies rather than directly planning acquisitions. This shift reflects corporate priorities, where internal business units will likely resist acquisitions due to integration challenges and cultural mismatches.

Salesforce Ventures, the CVC arm of Salesforce, provides an example of selective but effective acquisitions. Despite deploying over $6 billion across 630 startups, only a fraction of its portfolio companies have been acquired. Notable acquisitions include Vlocity and Quip, which align directly with Salesforce’s core business. However, most of its investments serve as a mechanism to track emerging software trends rather than as a direct acquisition pipeline. This demonstrates that even among active CVC investors, acquisitions are not always the end goal.

High Valuations Pricing Out Acquisition Prospects

Figure 2: Median US VC Pre-money Valuation by CVC Investment (in Millions)

Source: PitchBook, data as of December 31, 2024

A significant obstacle to CVC-backed acquisitions is the steep rise in startup valuations. According to PitchBook, the median pre-money valuation for VC deals with CVC participation reached $65 million in 2024, compared to just $30 million for deals without CVCs. When startups become highly valued, they often seek an IPO or alternative acquirer willing to pay a premium. As a result, CVCs that initially invested for strategic alignment will likely find themselves unable to justify the acquisition price.

Read more: Tech Industry Outlook 2025: What’s on the Horizon?

Challenges in Acquiring Varies Across Industries

CVCs are most active in the technology and life sciences sectors, but these industries present unique acquisition challenges. In tech, rapid innovation cycles mean that by the time a corporation is ready to acquire a startup, its technology will likely already be outdated or non-strategic. For life sciences, high R&D costs and regulatory hurdles delay commercialization, making acquisitions uncertain. Many life science startups prefer IPOs to maintain independence, and biopharma firms often use CVC as a scouting tool rather than a direct pipeline for acquisitions.

Looking ahead, the broader M&A landscape is expected to improve in 2025, potentially increasing acquisitions of CVC-backed startups. Lower inflation and stabilized interest rates will encourage corporations to pursue M&A for strategic expansion. Additionally, pressure on venture-backed startups to secure exits will likely make them more receptive to acquisition offers. However, for CVCs to become a more reliable acquisition pipeline, corporations must address internal hurdles, align investment strategies with acquisition goals, and leverage their information advantage more effectively.

Partner of choice for lower middle market-focused investment banks and private equity firms, SG Analytics, provides offshore analysts with support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.

About SG Analytics

SG Analytics (SGA) is an industry-leading global data solutions firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company with a team of over 1200 employees and a presence across the U.S.A., the UK, Switzerland, Poland, and India.

Apart from being recognized by reputed firms such as Gartner, Everest Group, and ISG, SGA has been featured in the elite Deloitte Technology Fast 50 India 2023 and APAC 2024 High Growth Companies by the Financial Times & Statista.