In 2025, data centers will face rising rental rates and mounting energy challenges, forcing operators to seek alternative power sources. While hyperscale growth continues, efficiency breakthroughs like DeepSeek are optimizing data center performance and reshaping infrastructure needs.

Rising Rental Rates Push Data Center Growth into Secondary Markets

Rental rates for data centers are expected to climb in 2025 as demand continues to exceed supply. Developers are passing rising construction and operational costs onto tenants, driving lease prices higher. CBRE projects preleasing rates will surpass 90%, meaning most new capacity will be committed before construction is complete. Much of this new space is already preleased to cloud giants like Microsoft, Google, AWS, Meta, and Oracle, limiting availability for smaller tenants. With vacancy rates at a record low of 2.8% and power constraints affecting key markets, securing affordable space is becoming more difficult, prompting businesses to rethink expansion plans and location strategies.

As costs rise in primary markets, operators are turning to secondary regions for expansion. These markets offer lower land costs, better power availability, and regulatory benefits, making them attractive for large-scale projects. Hyperscale providers are also shifting toward these markets, with Meta planning a $10 billion data center campus in Richland Parish, Louisiana, signaling a growing trend of investments outside major hubs. Meanwhile, developers are increasing colocation capacity to serve small and mid-sized tenants, who typically pay higher rates per kilowatt. Moody’s expects a temporary rise in vacancy rates as new colocation space enters the market, but overall supply constraints will keep rental prices high.

Read more: The Rise of AI Agents in Enterprise SaaS

Developers Turn to Alternative Energy Sources as Data Center Demand Surges

As global data center energy consumption is expected to double over the next five years, the industry is facing growing challenges in securing reliable power while meeting sustainability targets. Renewable energy remains the long-term goal, but grid limitations and rising AI-driven workloads are pushing developers to explore alternative solutions. Nuclear energy is increasingly viewed as a viable option, yet its large-scale adoption remains distant. JLL projects that commercial deployment in the US will not happen until 2030, leaving operators searching for immediate alternatives. In the meantime, the industry must weigh the trade-offs between energy reliability, cost, and environmental impact while navigating growing regulatory and public scrutiny.

Natural gas is emerging as a critical bridge fuel for data centers. In January 2025, Chevron announced a partnership with Engine No. 1 to develop up to 4GW of natural gas power capacity for US data centers. In the same month, Constellation agreed to acquire Calpine to expand its gas power portfolio. ExxonMobil is also advancing in this space, having announced plans in December 2024 for a 1.5GW gas-fired power plant dedicated to data centers. S&P Global estimates that the demand for natural gas in the data center is set to grow to 3 billion cubic feet per day by the year 2030, possibly doubling under certain scenarios. While these investments secure reliable power, they risk prolonging the industry’s reliance on fossil fuels, making it harder to fully transition to renewable energy.

Liquid Cooling to Gain Momentum in 2025

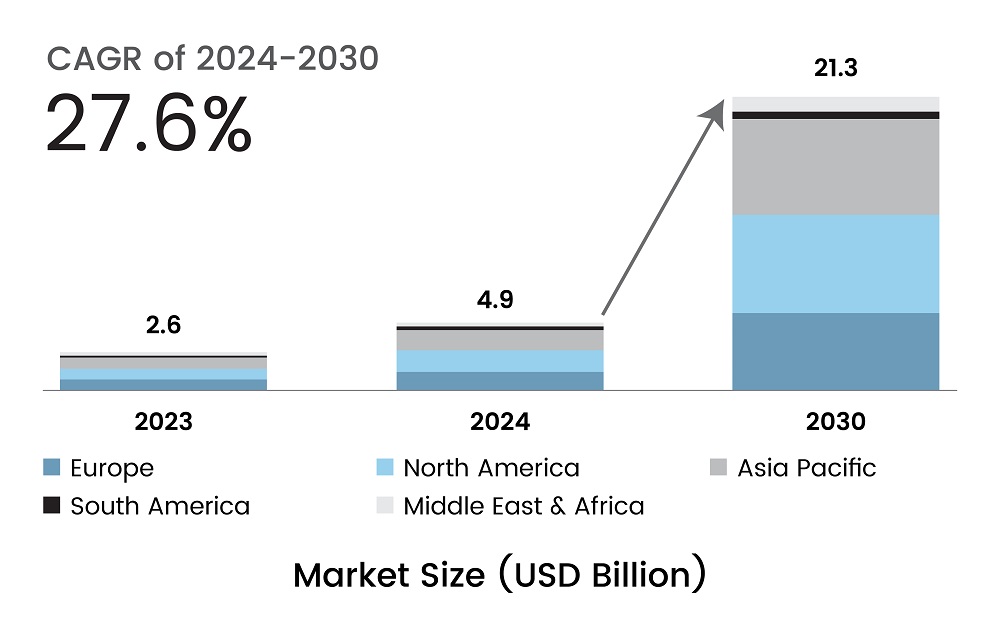

The increasing reliance on AI and high-performance computing (HPC) is transforming data center cooling strategies. As power densities rise, traditional air cooling is becoming less effective, making liquid cooling a necessity. According to the report by MarketandMarkets, the global liquid cooling market is expected to grow from $4.9 billion in 2024 to $21.3 billion by 2030, with a CAGR of 27.6%. In the US, it is expected to grow at 17.1% CAGR by 2033, as per IMARC Group. Direct-to-chip liquid cooling (DLC) is widely adopted, while immersion cooling is gaining attention for its efficiency in managing AI-driven workloads.

Read more: DeepSeek Takes on the Silicon Valley

Figure 1: Data Center Liquid Cooling Market Trend

Source: MarketandMarkets

While immersion cooling offers significant advantages, including improved thermal management and sustainability benefits, its widespread adoption still faces some challenges, like regulatory concerns, high initial investment costs, and structural adjustments for heavier cooling systems. However, it is expected to reduce energy consumption by up to 30%, making it an attractive solution for data centers to manage increasing electricity demands. As AI workloads grow, immersion cooling will likely become a mainstream solution, integrating into infrastructure to support higher power densities and long-term energy savings.

Hyperscale Growth Accelerates with Utility Partnerships

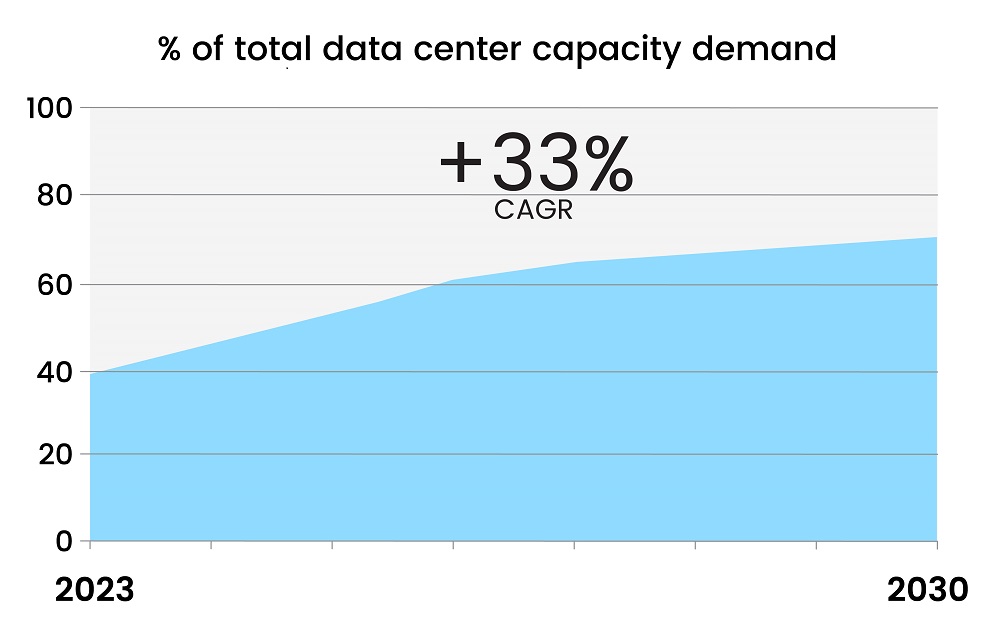

Figure 2: Growing Demand for Advanced AI Capacity

Source: McKinsey

Hyperscale data center expansion is set to intensify in 2025 as AI and cloud computing drive major infrastructure investments. According to McKinsey, AI workloads are projected to account for 70% of total data center demand by 2030, with AI-ready capacity expected to grow at an annual rate of 33%. Operators are racing to secure power and scale capacity, pushing hyperscale developments into multi-gigawatt territory. Lancium is scaling its Texas campuses to 6 GW, while Panattoni plans to add 1 GW of data center capacity in five years. Moreover, private capital is fueling this expansion, as seen in KKR and ECP’s $50 billion partnership in October 2024 to develop power infrastructure for hyperscalers. However, as energy demand surges, hyperscalers that secure long-term utility partnerships will have an advantage, while others will struggle to access enough power to sustain their rapid growth.

Read more: Tech Industry Outlook 2025: What’s on the Horizon?

AI Efficiency Gains Reshape Data Center Growth Trajectory in 2025

The rise of more efficient AI models like DeepSeek is set to reshape the data center landscape in 2025. While advancements in AI processing reduce energy requirements per task, they do not diminish overall data center demand. Instead, lower costs and increased accessibility will likely accelerate AI adoption, fueling both hyperscale expansion and distributed edge infrastructure. According to Sean Farney, Vice President of Data Center Strategy at JLL, AI GPU-focused data centers are growing at a 39% CAGR, nearly double the sector’s average growth rate of 20%. As AI inferencing becomes more widespread, demand for strategically placed edge data centers will rise alongside centralized facilities, reinforcing the industry’s long-term expansion trajectory.

Partner of choice for lower middle market-focused investment banks and private equity firms, SG Analytics, provides offshore analysts with support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.

About SG Analytics

SG Analytics (SGA) is an industry-leading global data solutions firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company with a team of over 1200 employees and a presence across the U.S.A., the UK, Switzerland, Poland, and India.

Apart from being recognized by reputed firms such as Gartner, Everest Group, and ISG, SGA has been featured in the elite Deloitte Technology Fast 50 India 2023 and APAC 2024 High Growth Companies by the Financial Times & Statista.