The fintech sector has faced an unprecedented shift lately, with global macroeconomic pressures significantly reshaping the funding landscape. The difficulty in raising new funds and slowed growth against a negative market backdrop have given rise to an increase in distressed businesses seeking out sales. Strategic acquisitions, in such a climate, are expected to experience a surge.

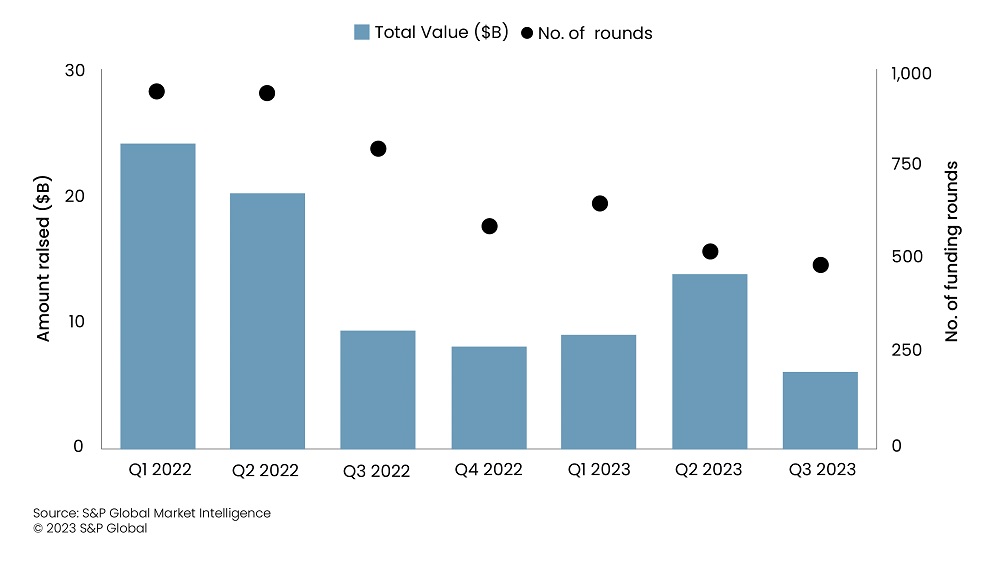

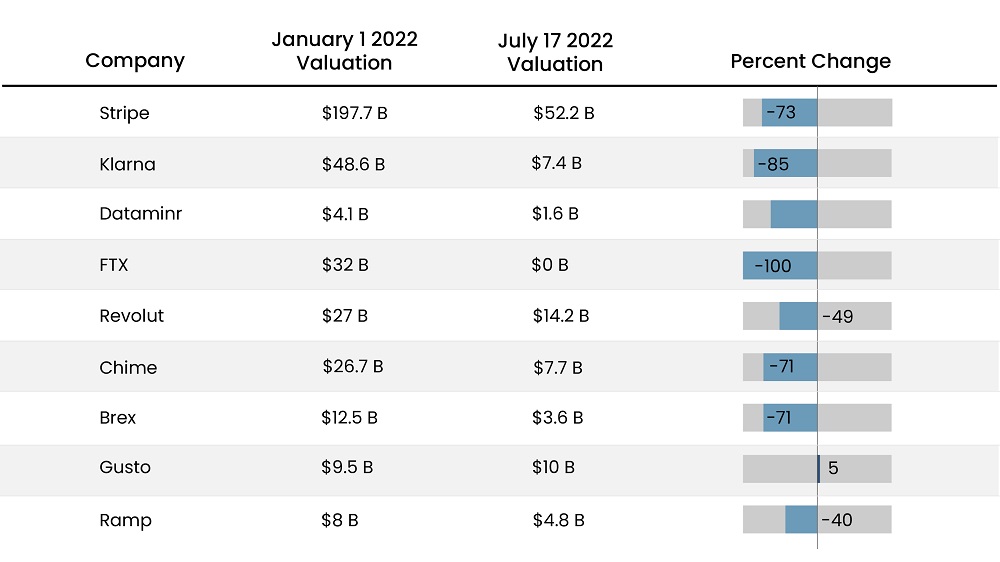

In 2021, fintech accounted for 20% of all global venture funding, per CB Insights. 3Q23 experienced a contraction of approximately 76% to $7.4 billion from $31.1 billion in Q321. Additionally, Shares of major publicly listed fintech firms fell by an average of 50% in 2022. Valuations of startups such as Klarna and Stripe have taken a hard hit, with an 85% and 50% decline, respectively.

Driven by this funding pullback, a large number of fintech startups have been struggling to stay afloat. In extreme cases, distressed companies have declared bankruptcy. Plastiq, with a valuation close to $1 billion, declared bankruptcy in May. In more moderate situations, firms have scaled back on business operations and scaled down their workforce. Affirm, a buy-now-pay-later company, laid off 19%, and Synapse, a banking-as-a-service startup, let go of 40% of its workforce.

Figure 1: Decline in Fund-Raising Activity for Fintech

Source: S&P Global

Figure 2: Fall in Fintech Valuations in the Secondary Market

Source: Techcrunch

Read more: Investment Outlook: Private Equity Market Trends 2023

Strategic Acquisition of Distressed FinTech Firms

In such a climate, a large number of struggling startups are eyeing sales for survival. The growing competition within the industry has also added to the stress of their sustenance. McKinsey reports that the number of fintech unicorns increased to 272 in 2023 from 39 in 2019, a sevenfold increase. Petal Cards, a New York-based credit card startup that secured a $200 million debt facility and $20 million equity funding three months ago, is seeking buyers amidst doubts about its survival, as reported by Fortune. The company has undergone two rounds of layoffs and is expected to go out of business if it does not find a buyer. Australian fintech Joust has been laying off staff and restructuring its sales process in the past year. Recently, the company announced it was looking for a potential buyer to stop it from perishing.

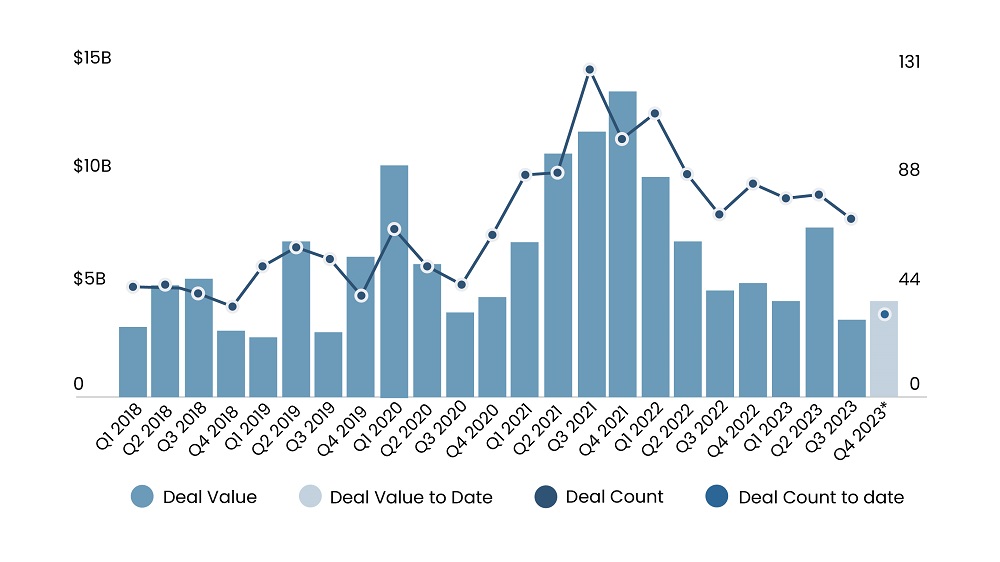

Overall, merger and acquisition (M&A) volumes in fintech rose to $33 billion in 3Q23, an increase of 33% from 2Q23, per FT Partners. The number of deals larger than $500 million increased to thirteen compared to only five in 1Q23. M&A deals for VC-backed companies in 3Q23 totaled $3.4 billion across 71 deals, according to Pitchbook.

Figure 3: VC-backed M&A Deal Activity

Source: Pitchbook

Strategic acquisitions, specifically in recent times, have been gaining attraction and are likely to be at the forefront in the upcoming months. Zillow, a real estate portal firm, acquired Spruce, a tech-enabled title and escrow company, as a building block for its housing super app. The acquisition came on the heels of Zillow closing the shutter on its in-house business division while Spruce hadn’t raised any new funding rounds since June 2021. Eazyknock, a prop-tech startup, acquired Ribbon, a tech-enable provider of power buying and cash offer solutions, to accelerate the development of its marketplace. Struggling paytech company Till Payments, valued at $500 million, was recently bought by payment processor Nuvei for $30.5 million. The company is to be broken up and integrated into Nuvei’s technology infrastructure.

Read more: From Recovery to Reliability: Technology's Impact on Supply Chains

Looking ahead, the current interest rate environment and valuation corrections present a unique opportunity for established players to strengthen their market position by acquiring distressed yet innovative fintech firms. These acquisitions are not just financial transactions but strategic maneuvers to acquire cutting-edge technologies, expand market reach, and reinforce business models. As the market continues to recalibrate, we expect to see more such strategic alignments, reshaping the fintech landscape.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.