Dividend recapitalization (recap) has seen a sharp rise in 2024, which is unusual in a high-interest rate environment. Private equity (PE) firms turn to dividend recap to generate returns, though it carries potential risk for portfolio companies due to the challenging exit environment.

What Is Dividend Recapitalization

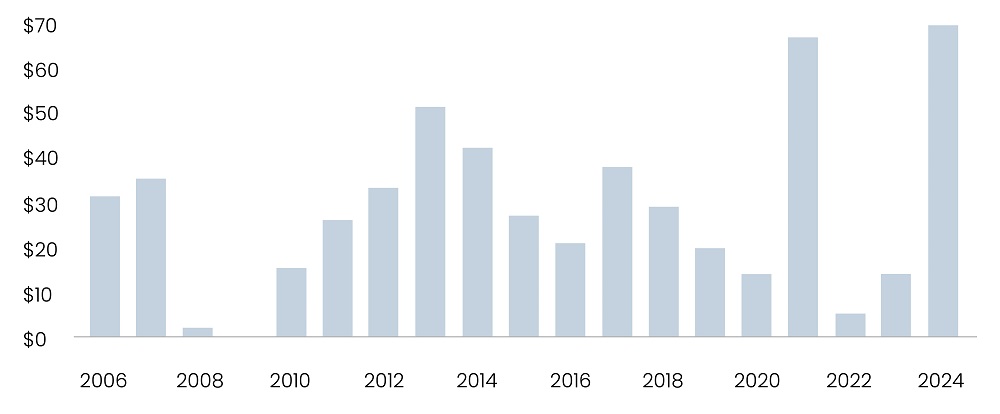

This comes after a two-year lull in such activity, after the peak of 2021 when interest rates were low. The trend occurred at a time when central banks kept their interest rates at record highs, making borrowing more expensive. The YTD dividend recap volume through September reached $69.3 billion, surpassing the $66.4 billion recorded during the same period in 2021 and nearing the annual record of $76 billion set that year, according to Pitchbook.

Figure 1: Dividend Recap Institutional Loan Volume ($B) Jan. 1-Sept.24

Source: Pitchbook, Data through Sept.24, 2024

Why Is Dividend Recap Surging Despite High Interest Rates?

Dividend recaps by PE generally increase during periods of low interest rates, as seen in 2021, when companies can borrow at lower costs to fund dividend payments. However, despite high borrowing rates currently, PE sponsors are indulging in this. According to Pitchbook, PE-backed companies accounted for 86% of the leveraged loans issued to fund dividends in early 2024.

Read more: Unlocking M&A Potential: The Impact of Fed’s Rate Strategy

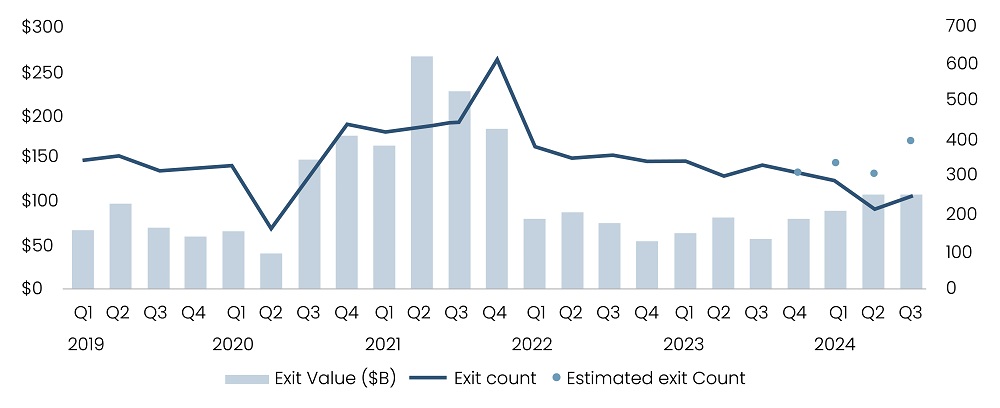

The primary reason for this is the limited opportunities for PE firms to exit their investments through other alternatives such as mergers and Acquisitions (M&A) and IPOs. In 2023, US corporate M&A activity for deals exceeding $100 million dropped by 17% from 2022 and was roughly 45% below its peak in 2021, per EY. US IPO exits in 2023 amounted to $21.5 billion, significantly lower than the $295.9 billion recorded in 2021, reflecting a subdued year, per Pitchbook. High interest rates have stifled deal-making activity, reducing the number of exits for PE investors from 1,893 in 2021 to 1,243 in 2023, according to Pitchbook.

The trend in the US PE exit continued with a slow start, with 316 exits totaling $66.7 billion in 1Q24, a 19% drop in value from 4Q23, highlighting persistent volatility. In 3Q24, the exit value increased 50.5% YoY, but the number of exits remained flat compared to the previous year on an annualized basis, per Pitchbook. The exit-to-investment ratio dropped to a record low of 0.36x in 2Q24 and is yet to show improvement in 3Q24. Ongoing valuation gaps between buyers and sellers have been a key factor behind the subdued exit activity.

Figure 2: PE Exit Activity by Quarter

Source: Pitchbook *As of September 30, 2024

With fewer exits, PE sponsors have turned to dividend recap to return capital to their limited partners (LPs). This allows PE firms to deliver returns while waiting for more favorable conditions for exits. Moreover, many LPs have been patient throughout these prolonged holding periods and are eager to see a return on their capital. For the year ending 2023, distribution rates hit their lowest level since 2009. Using dividend recaps, PE firms can meet LP's expectations without being forced to exit at suboptimal valuations.

Short-Term Outlook: Will This Trend Continue?

The recent 50 bps rate cut by the Fed accelerated the trend of dividend recap. Fitch Ratings project the fed rate to fall to 3.5% by the end of 2025. The decision to cut rates by 50 bps instead of the expected 25 bps signals the Fed’s commitment to easing monetary policy, especially now that inflation appears to be under control. In the short term, this rate reduction lowers the cost of borrowing, making dividend recap more financially viable. With the burden of debt servicing lessened, PE firms are likely to continue using this strategy to generate returns for LPs, especially as we head into the final quarter of the fiscal year. The increased cash returns to LPs would allow general partners (GPs) to attract new funds by showcasing steady interim performance.

Read more: Google Search and Generative AI: Navigating the Paradigm Shift

Long-Term Perspective: M&A Recovery and Lender Preferences

While dividend recap is poised to continue in the near term, the distant outlook is expected to differ. According to a Grant Thornton survey of M&A professionals, 67% anticipate an increase in US deal volume in the upcoming months. As the economic environment improves and M&A activity picks up, PE sponsors will have more opportunities to exit alternatives. With this, the need for dividend recaps as a tool for giving returns to investors might decline.

Moreover, lenders are likely to shift their preference toward providing leverage for M&A deals or leveraged buyouts rather than for dividend recaps. M&A deals generally involve healthier uses of leverage, as they facilitate growth or consolidation; in comparison, dividend recaps are viewed as riskier, benefiting only investors but adding debt to the company without a corresponding increase in value.

Potential Risks

While dividend recaps offer short-term benefits, they also bring potential risks, especially for portfolio companies that take on excessive debt. Even in a low-rate environment, companies with weaker financial profiles may struggle to pay interest expenses and principal repayment, potentially leading to bankruptcies. If interest rates were to rise again, although the chances seem low, companies with high leverage from dividend recaps could face severe financial distress.

In addition, excessive use of dividend recap is likely to attract regulatory scrutiny. Companies that consistently distribute dividends by leveraging capital borrowed at the cost of their financial strength usually face legal challenges, mostly in scenarios of bankruptcy or default.

Read more: US Merger and Acquisition (M&A) 2H24 Outlook

Conclusion - Dividend Recapitalization

Dividend recap has emerged as an efficient tool for delivering returns to LPs, particularly in a competitive environment where GPs compete for capital. Nevertheless, financial sponsors must assess their portfolio companies’ capacity to generate sustainable cash flows and service the added debt over time. Although imminent rate cuts by the Fed may offer some relief, GPs must still start exploring alternative exit routes. Maintaining a balance between liquidity and leverage is crucial, as taking excessive debt by portfolio companies to enhance returns can endanger their financial stability.

Partner of choice for lower middle market-focused investment banks and private equity firms, SG Analytics, provides offshore analysts with support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.

About SG Analytics

SG Analytics (SGA) is an industry-leading global data solutions firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company with a team of over 1200 employees and a presence across the U.S.A., the UK, Switzerland, Poland, and India.

Apart from being recognized by reputed firms such as Gartner, Everest Group, and ISG, SGA has been featured in the elite Deloitte Technology Fast 50 India 2023 and APAC 2024 High Growth Companies by the Financial Times & Statista.