The 21st-century business landscape is ever-evolving and has changed in fundamental ways. Today the term 'capitalism' has become 'stakeholder capitalism.' And in this business landscape, environmental, social, and governance (ESG) is a hot topic of discussion. However, there is still a misunderstanding about what exactly ESG is and what it signifies.

For starters, ESG is not a corporate social responsibility. ESG can only be achieved when enterprises thrive by engaging authentically with their stakeholders - including investors, customers, employees, regulators, partners, and communities - for long-term value creation.

The other factors, like climate crisis and pandemic, are playing a major role and heightening the interest of consumers, investors, and stakeholders in environmental, social, and governance (ESG) issues. Yet, many organizations are still struggling to understand the link between their level of commitment to ESG factors and long-term value propositions.

With ESG becoming a key boardroom topic that has a direct link to organizational value, it is becoming more critical for organizations to assess the role of ESG in their corporate strategy. Companies today need to truly incorporate ESG principles rather than just greenwashing their current strategies with token actions. But how can they embrace ESG and integrate it into their corporate practices to make a difference in their valuations?

Read more: Sustainability in Tech: 3 Ways for Companies to Become More Sustainable

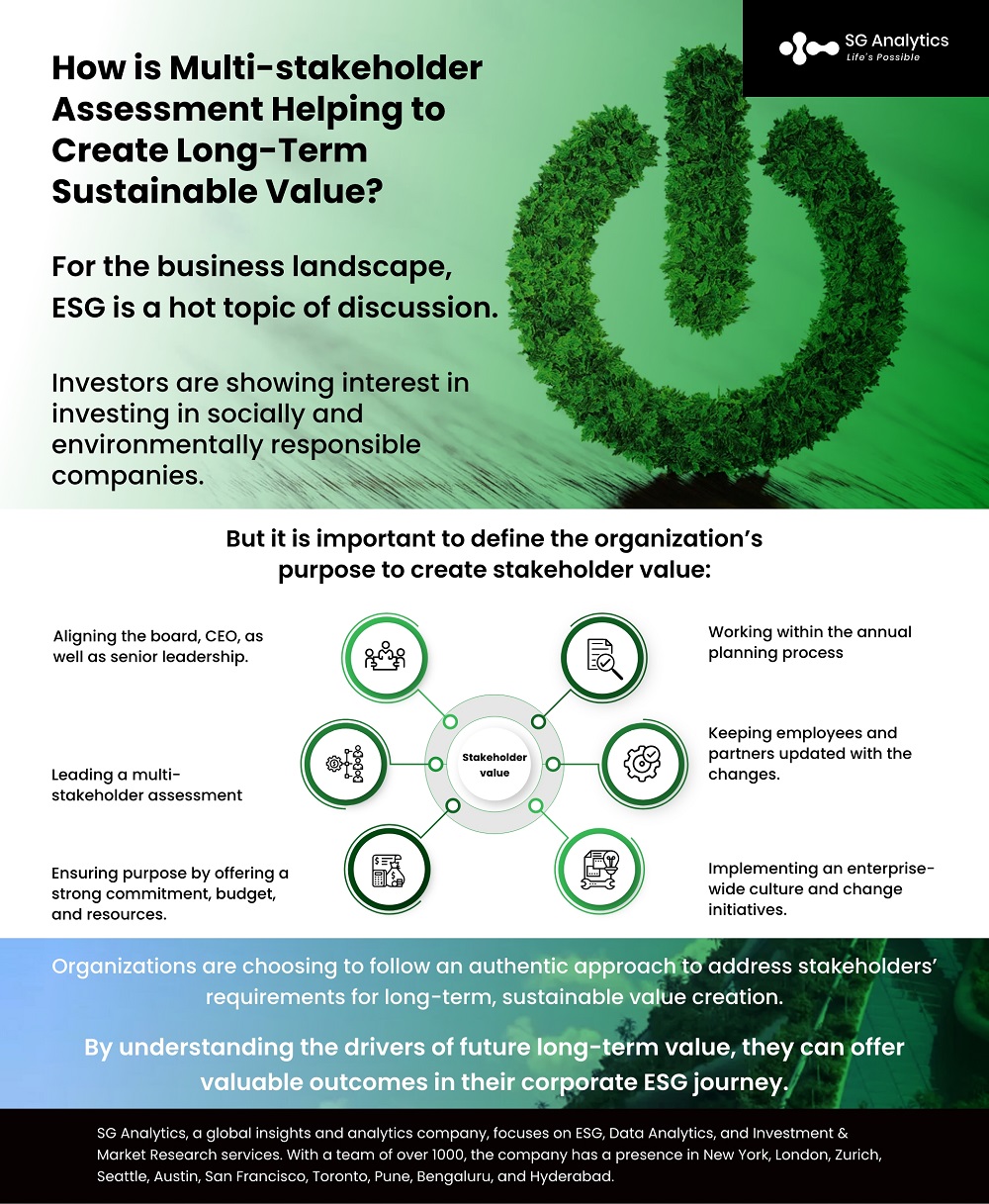

The new generation of employees today care deeply about the higher purpose of the enterprises they work for, and even the customers are motivated to purchase from enterprises whose mission and values are aligned with their own. The investors are showing their interest in investing in companies that are socially and environmentally responsible.

Identifying, understanding, engaging, and creating value for stakeholders mandates a paradigm shift in leadership thinking as well as mindset. It requires systems that span the entire enterprise and ecosystem to guarantee that the goals and commitments are aligned and integrated into the company’s strategy and culture. With a disciplined approach, organizations can truly understand the expectations of their stakeholders as well as leverage the acquired understanding for innovation.

Ways to Initiate Stakeholder Value

Stakeholder value must be authentic to the company through its core business and culture. But it is equally important to identify the corporate purpose. These elements likely impact the materiality of the organization's ESG operations, policies, as well as programs.

But what are the risks as well as the benefits of these ESG policies?

While some may assert that there is a natural conflict between creating shareholder and stakeholder value and that it is a zero-sum game, others believe that by taking the multi-stakeholder approach, businesses will be able to succeed if there is a commitment to make changes and better align the decision-making strategies with their larger impact on society.

Read more: The ESG Rating Phenomenon: A Guide to Understand ESG Ratings

Setting the Corporate Stage for Success

When it comes to organizational strategies for success, there is no 'one size fits all' framework that works. It all boiled down to how a company approaches its ESG policies and values. Each organization has its own sets of challenges and opportunities and its own ESG maturity journey. While some are just starting out on their ESG journey, others have experimented with mixed results. Some have advanced on their journey by incorporating some invaluable practices and lessons. Many organizations start their ESG journey from a risk mitigation and compliance perspective. The most advanced, however, can change their ESG efforts from risk mitigation and managing the risks while simultaneously creating a long-term sustainable advantage.

But regardless of where an organization is on its ESG journey, there are many principles that can help guide you. By establishing systems and processes designed to achieve those goals, businesses can clearly define their desired outcome.

It is equally important to define the organization's purpose and commitment to creating stakeholder value:

-

Aligning the board, CEO (Chief Executive Officer), as well as senior leadership.

-

Leading a multi-stakeholder assessment to identify and understand stakeholders’ expectations.

-

Ensuring purpose and supporting it by offering a strong commitment, budget, and resources.

-

Working within the annual planning process ensures those operating plan objectives and performance incentives properly align with the outcomes.

-

Keeping all employees and partners updated with the changes. And creating and implementing an enterprise-wide culture and change initiatives.

-

Acknowledging the changes by providing considerable time to adapt to them.

For organizations to build and evolve their ESG program, they need to start listening to society's voice as well as ensure governance clarity and the ESG narrative. Determining these factors to prioritize the level of commitment is imperative to establish a corporate strategy that aligns with the values and goals.

When developing diverse ESG programs for the company, it is vital to understand that this is a journey. Communicating the wins, best practices, and lessons learned internally and externally will aid in improving the existing framework within the organization. Develop an effective communication plan that supports the company's initiatives. Capturing the critical and significant milestones and communicating them to the employees will help in establishing the enterprise as a thought leader in ESG, thereby motivating employees at all levels. Explore opportunities to support external pledges that are authentic to the company's goals and form partnerships with credible external organizations.

Read more: Aligning ESG with Corporate Strategy to Gain a Competitive Advantage

Key Highlights

-

Amid the rising stakeholder scrutiny of sustainability practices, organizations are facing challenges in linking their ESG commitment to long-term organizational value.

-

Mainstream investors are diverting their attention to long-term investment opportunities and ESG integration within an organization.

-

Companies must avoid greenwashing their corporate strategies, embrace ESG principles, and incorporate them into business practices.

-

Corporate Sustainability Assessment (CSA) enables organizations to capitalize on their sustainability efforts through proactive communication and linkages between ESG and financial performance.

-

Investor Relations (IR) professionals are employing Corporate Sustainability Assessment (CSA) to tailor their communication and resolve issues that matter most to stakeholders as well as investors.

-

By leveraging the appropriate long-term value creation metrics, organizations will be better able to demonstrate their company’s ESG commitment to stakeholders.

Shifting the ESG focus on Maximizing Benefits

The ESG approach has exposed companies to reputational and brand equity risks with increased consumer, regulatory, and capital market scrutiny. It also increasingly exposes them to shareholder pressures, resulting in a very real erosion of shareholder value.

However, despite the overwhelming evidence available in favor of incorporating ESG into the corporate framework, the stimulus to prioritize sustainability is proving challenging for many corporate strategists as ESG considerations are wide-ranging and demand trade-offs that can be hard to quantify. Hence the topic of ESH is often considered complex, contradictory, and confusing.

At the same time, multiple studies have highlighted that investors look for focus. Companies that direct their efforts in a concerted manner to various ESG aspects for their sector have demonstrated a higher alpha than their competitors as well as peers.

Read more: ESG and Sustainable Investing: A Guide for ESG-Focused Investors in 2022

But companies also need to provide a clear picture to their stakeholders about their level of ESG commitment. While handling ESG trade-offs is not easy, going on board the ESG focus wave can be worth it. Again, this depends entirely on the company’s individual parameters. Today, achieving such results is not just a matter of investment but also of competent communication of the company’s ESG commitment and goals with the stakeholders, including capital markets.

By identifying and leveraging long-term value creation metrics, businesses can better demonstrate to their stakeholders their contributions toward sustainable, long-term growth across the full ESG strategy development process - from vision definition to implementation.

It is equally important to understand that for this long-term value; companies must have a strategic lens to define how their business creates, delivers, and measures value across the planet, people, prosperity, and governance.

No matter how an organization chooses to look at ESG, it is critical to follow an authentic approach that addresses all stakeholders' requirements for long-term, sustainable value creation. By understanding the drivers of future long-term value, businesses will be able to offer valuable outcomes in their corporate ESG journey.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in ESG services, SG Analytics offers bespoke sustainability consulting services and research support for informed decision-making. Contact us today if you are in search of an efficient ESG integration and management solution provider to boost your sustainable performance.