Environmental, social, and governance (ESG) criteria can empower investors to screen eco-friendly and inclusive enterprises. It also guides businesses in modern workplace development and risk management. This post will explore several ESG reporting frameworks integral to sustainability accounting, impact investing, and corporate transformation.

What Are ESG Reporting Frameworks?

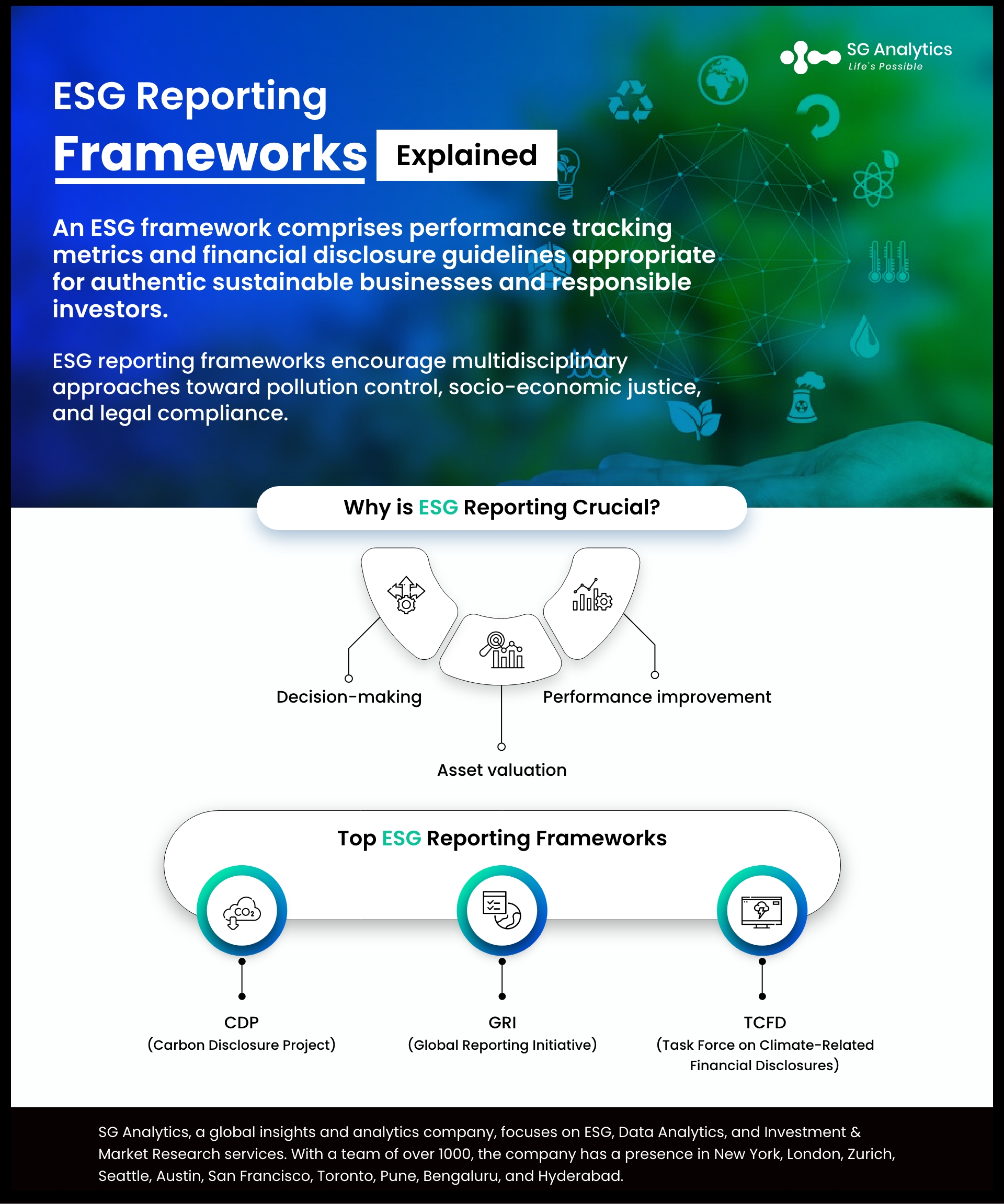

An ESG framework comprises performance-tracking metrics and financial disclosure guidelines appropriate for authentic, sustainable businesses and responsible investors. Driven by scientific integrity and accounting transparency, ESG reporting frameworks encourage multidisciplinary approaches toward pollution control, socio-economic justice, and legal compliance.

For instance, the standards, consultation papers, research references, and policies or visions enshrined in these frameworks assist stakeholders in standardizing critical disclosures. Standardization facilitates ease of comparative analysis involving more than one organization.

Therefore, investors and corporate leaders gain data-backed insights into how each brand enhances its operations. Some investors will use these insights to select renewable energy projects, while others will assess the target firm’s resilience to controversies. Likewise, managers will benchmark their compliance metrics and conduct strategy revisions to improve them.

Also Read: How is Corporate Philanthropy Accelerating ESG Journey for Businesses?

Why is ESG Reporting Crucial?

Today, stakeholders encounter multiple sustainability guidelines and standards. The lack of a universal policy ensuring reporting consistency has resulted in a mismatch between what different brands disclose through documentation. So, auditors, regulatory authorities, and global corporations juggle with region-specific legal, ethical, and financial challenges.

The ESG criteria is an opportunity to consolidate compliance metrics, enabling a more straightforward peer analytics environment for fund managers and company owners. After all, the stakeholders seek evidence-based reporting concerning a business’s ESG goals, on-ground impact, and periodic performance metrics.

Simultaneously, ESG risks, like greenwashing or geopolitical differences, highlight the growing importance of ESG reporting, compliance initiatives, and standardized disclosures. They matter to increase stakeholder trust in your brand, products, services, and corporate vision.

What is ESG Data?

ESG data includes how a company, a country, or an industry performs on the environmental, social, and governance metrics based on the sustainability accounting guidelines. It will encompass an organization’s carbon emissions, waste disposal processes, workplace hazard prevention, and anti-corruption policies.

All the metrics in the ESG reporting frameworks for your organization will fall under one of the three top-level pillars or sections, as explained below.

1| The Environmental Metrics in the ESG Data

Water scarcity is a global issue, and ESG reports hold corporations accountable for how much water they consume. Similarly, these documents evaluate whether a brand’s activities increase deforestation and endanger wildlife.

Beyond the deforestation and biodiversity considerations, the environmental pillar in the ESG reporting landscape focuses on greenhouse gas (GHG) emissions. Some GHG emission scope designations also examine an enterprise’s compliance level by monitoring how its suppliers contribute to human-generated pollution.

Other ecological risk factors involve plastic usage and mining operations. Besides, the ratio between a company’s reliance on non-renewable fuel and renewable energy resources is vital to a professional ESG data provider.

Related: Is ESG an Investment Strategy or a Path to Creating a Sustainable World?

2| ESG Criteria’s Social Pillar

While the United Nations has specified sustainable development goals (SDGs), they overlap with ESG requirements. The most prominent area proving this overlap is socio-economic inclusivity. From upholding labor rights to preventing child exploitation at workplaces, the social pillar in ESG data addresses the multi-generational problems worldwide.

As a result, all the ESG reporting frameworks prioritize analyzing each business’s anti-harassment policies, affirmative actions, and employee insurance coverage. Moreover, brands cannot stop at opposing communal discrimination or gender stereotyping in principle. They must actively enforce what they promise in those policy drafts.

The social compliance metrics celebrate cultural differences and encourage business leaders to invest in crafting positive employee engagement strategies. When the workers realize their employer cares for them, they strive to perform better. Therefore, empowering employees leads to increased return on investment and efficiency, the two components of financial performance.

3| The Governance Pillar in ESG Reporting Frameworks

Corruption and cybersecurity threats prevent you from accomplishing your ESG performance goals. Other governance risks relate to legal confusion and accounting inaccuracies. These obstacles might be purely human mistakes or the results of technological vulnerabilities in an enterprise’s IT ecosystem.

This reporting pillar has long-term financial consequences since digital and regulatory integrity is at the core of business-government relationships. Organizations also risk losing reputation, trade secrets, and policymakers’ goodwill through corporate espionage or unencrypted data pipelines.

Furthermore, each governance compliance failure alienates your present consumer base and makes acquiring new clients more arduous. Organizations must watch out for controversial media coverage using automated technologies in this situation. Finally, governance metrics involve combating fake information and incomplete investor disclosures.

How to Select an ESG Reporting Framework for Maximum Impact?

The ever-evolving ESG reporting landscape demands a comprehensive approach toward determining a framework, optimizing its integration, and monitoring compliance. Remember, each company follows a unique business model. Besides, ESG-related risks and strategy requirements vary according to the reporting context.

For instance, do you communicate the metrics to public regulators, investors, business partners, consumers, or employees? Each stakeholder has a particular technical proficiency. So, you want to customize how you document your compliance initiatives, benchmarks, and ESG goals. To be sure, consumers do not expect the reporting insights that your company’s investors demand.

Consider the following environmental and social factors while choosing an ESG framework to address the issues across the three reporting categories and related performance metrics.

Read Also: ESG Score - Definition, Process, Implications & Purpose

Factor 1 – ESG/SDGs Impact Potential

Materiality in ESG reporting frameworks concerns whether improving sustainability performance will increase or decrease your business resilience. It primarily focuses on the real-world outcomes associated with each compliance initiative.

For instance, if you make a green claim to reduce plastic-based packaging, how will this SDG or ESG initiative affect your company? The effects related to financial, legal, ethical, and reputational “ESG risks.” By conducting a materiality assessment, you can determine a feasible strategy to fulfill your green claim or sustainability promise.

-

Internal materiality audits hold organizations responsible for their financial and sustainability performance irrespective of market conditions, geopolitical business norms, or social circumstances.

-

External materiality concerns include macroeconomic and socio-political uncertainties to help you find the best approach to deploying a competitive ESG strategy.

Factor 2 – What Do the Stakeholders Expect of Your Enterprise?

Customers and employees are more familiar with the United Nation’s policies. So, they will ask businesses to offer compliance insights according to SDGs’ requirements. However, banks, lenders, investors, auditors, and regional governments will demand corporations provide disclosures compliant with the following institutions’ guidelines.

-

Sustainability Accounting Standards Board (SASB),

-

Task Force on Climate-Related Financial Disclosures (TCFD),

-

Global Reporting Initiative (GRI),

-

CDP ( formerly Carbon Disclosure Project),

-

Streamlined Energy and Carbon Reporting (SECR),

-

And country-specific legal bodies.

Depending on where your company operates and who requests the sustainability accounting data, you must change the ESG reporting framework. Therefore, leveraging solutions that can help you comply with multiple guidelines is essential.

Factor 3 – Target Industry and Market

A nuclear energy project exhibits ESG-related issues differing from the risks in bridge construction. Likewise, agricultural trades uniquely affect the environment and community. Each industry and sector can consume Earth’s resources differently, affecting the relevance of ESG performance metrics.

Therefore, selecting an ESG framework indicates managers must consider industry relevance. For instance, GRI has independent standards for the coal businesses and petrochemical companies. Other frameworks also permit disclosure flexibility according to an organization’s target industry and market.

Some ESG reporting frameworks avoid a generalized approach and offer guidelines suitable for one or two related industries. Think of the global real estate sustainability benchmark (GRESB). Its application has a finite scope covering the infrastructure space. It can influence relevant financial services, but ESG data specific to real estate is its exclusive focus.

Read Also: Building a Robust ESG Reporting Framework with Intelligent Automation

What Are the Top ESG Reporting Frameworks

The following frameworks help enterprises, investors, and regulators communicate ESG performance and sustainability accounting compliance insights with stakeholders.

1| CDP (Carbon Disclosure Project)

It has three surveys focused on climate change, forests, and water. CDP’s scoring methodology varies across these inquiries. Formerly the carbon disclosure project, CDP has positioned itself as a non-profit charity, enabling corporations, urban local bodies, and investors to make informed decisions about environmental disclosures and responsible investing.

It has served compliance scoring facilities for over two decades. CDP also maintains a physical presence across 50 geopolitical territories through its regional offices. Today, businesses in more than 90 countries leverage CDP’s disclosure guidance. Its corporate environmental action trackers allow investors to screen green investment opportunities concerning multiple indices.

2| Global Reporting Initiative (GRI)

GRI offers “modules” that let brands customize their disclosure according to their liabilities. Simultaneously, GRI Standards streamline reporting, benchmarking, and compliance change detection for specific industries.

The global reporting initiative prioritizes estimating financial materiality risks in the ESG reporting landscape. You can categorize the related inspections into economic, social, and environmental reporting elements.

-

The GRI Standards 1 to 3 lay the foundation of what it stands for and how it will ensure compliance across intergovernmental and multisectoral bodies.

-

From standard no. 11 onwards, you will find sector-related disclosure and ESG reporting guidance.

-

GRI 201 and beyond elaborate on “financially material topics” to empower investors, regulators, and company owners.

Related: Is ESG & Sustainability the Next Big Thing in the Finance Industry?

3| Task Force on Climate-Related Financial Disclosures (TCFD)

Focusing on the E of ESG reporting data, TCFD became the recognized environmental sustainability compliance framework. Since its inception in December 2015, it has had four financial disclosure requirements.

TCFD expects the corporate world to self-regulate and overcome climate-related business risks. Its governance and strategy requirements direct organizations to include the connection between environmental problems and financial systems during decision-making.

The related framework offers insights into determining ESG performance metrics and risks. Using TCFD’s recommendations, a business can optimize its compliance strategy to achieve its ESG goals efficiently.

Conclusion - ESG Reporting Frameworks

Several ESG reporting frameworks can overwhelm corporate leadership and investment advisors. However, addressing the threats of climate risks, socio-economic instability, and financial malpractices is non-negotiable to sustainable development.

From consumers to investors, all stakeholders want businesses to be more responsible about how they consume Earth’s resources. Accordingly, many governments and global institutions have crafted robust guidelines to help brands deliver reliable disclosures. Investors and business leaders can comply with and benefit from multiple ESG reporting frameworks if they employ appropriate technological solutions.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in ESG Services, SG Analytics offers bespoke sustainability consulting services and research support for informed decision-making. Contact us today if you are in search of an efficient ESG (Environmental, Social, and Governance) integration and management solution provider to boost your sustainable performance.

About SG Analytics

SG Analytics is an industry-leading global insights and analytics firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media and entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company and has a team of over 1100 employees and has presence across the U.S.A, the U.K., Switzerland, Canada, and India.

Apart from being recognized by reputed firms such as Analytics India Magazine, Everest Group, and ISG, SG Analytics has been recently awarded as the top ESG consultancy of the year 2022 and Idea Awards 2023 by Entrepreneur India in the “Best Use of Data” category.