A nation’s socioeconomic well-being and influence rely on local industrial developments because they facilitate career opportunities, innovation, and import-export businesses. Industries excel at efficiently balancing traditional jobs, manufacturing goods, and delivering services. Therefore, developed countries like the United States encourage entrepreneurial endeavors and support businesses.

This post will describe the fastest-growing industries in the US.

Brief Overview of the Current Economic Landscape in the US

The United States’ yearly gross domestic product (GDP) has increased from 20,657 billion USD in 2018 to 25,744 billion USD in 2022. Simultaneously, the population has surpassed the 334 million mark. Meanwhile, export and import data show promising growth.

Public debt and inflation remain challenging for the stakeholders to manage. Nevertheless, ethical and impact investments have increased, empowering the most sustainable companies in the US. Non-agricultural industries have added more than 336,000 professionals to the workforce, a number higher than the preliminary estimates from previous quarters.

Read Also: World’s Most Congested Cities 2022: The Pandemic Effect on Environmental Imbalance

Understanding Industry Growth Factors

1| Government’s Policy Research and Implementation

If regulatory bodies create a business-friendly environment, more enterprises thrive in the market, and the economy steadily grows. Therefore, job creation, stakeholder lifestyle improvements, and corporate innovation happen more often.

On the other hand, if policymakers and law enforcement officers fail to protect businesses’ interests, they alienate brands and investors. For instance, countries performing poorly on the ease of doing business (EoDB) index by the World Bank Group attract less investments.

Some regulatory strategies can seem beneficial as a concept but implementing them can be arduous due to legal and financial technicalities. So, politicians, strategists, auditors, and business leaders driving the booming industries in the US must work together to combat the policy-to-implementation challenges.

2| Environmental Risks and Infrastructure

Companies handling hazardous chemicals, nuclear technology, and tall structures must avoid operating in a region in the earthquake zone. A fishing company must optimize its activities to protect coral reefs and maintain an adequate fish population in the area. Similarly, agriculture, construction, automobile, tourism, and hospitality industries need to consider the environmental risks before opening their next branch offices.

Ecological dynamics and infrastructure availability also influence the global supply chain. So, sourced material will be more expensive in specific corners of the world, adversely affecting industries’ efficiency and competitiveness in that region. As a result, organizations prefer working in the most sustainable cities in the USA to ensure business resilience against infrastructural issues.

3| Social, Cultural, and Demographic Factors

Social components of industrial growth explain how individuals spend their hard-earned capital resources. If the community experiences a reasonable income hike linked to the rising lifestyle-related expenses, it is more likely to possess disposable income. This situation favors brands offering recreational activities, leisure, entertainment, and luxury goods.

Therefore, consumers have more choices to determine where their money goes, the production quality they enjoy, and the brands that best serve them. Still, industrial progress depends on demographic metrics like age and literacy rates.

Furthermore, the local culture must encourage professionals to prioritize honesty, work-life balance, reporting ethics, straightforward communication, and punctuality. Otherwise, recruiters will have to coordinate unprofessional workers and suffer financially due to several human errors.

Read Also: What is Carbon Footprint: How to Reduce and Calculate Carbon Footprint?

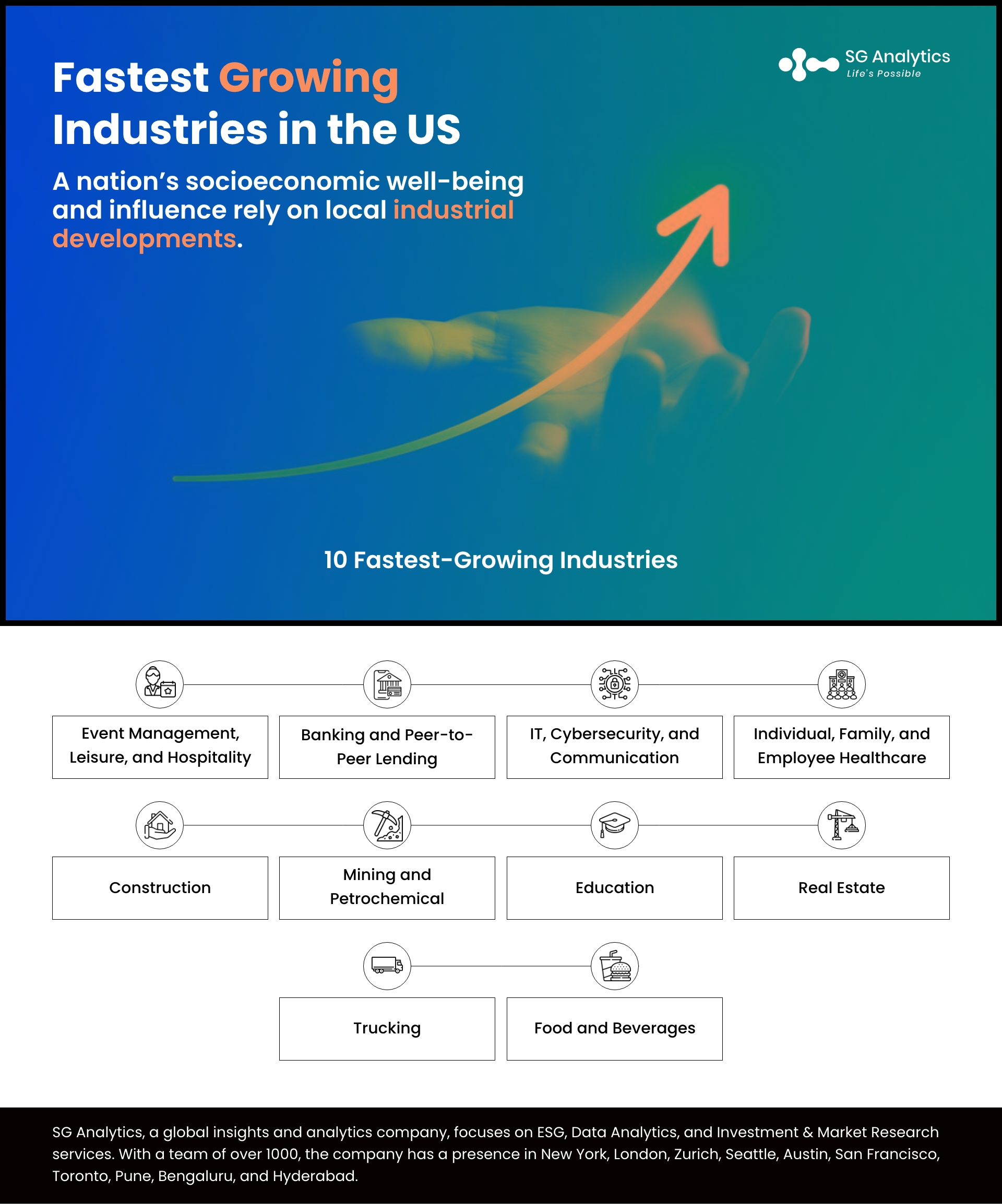

Top 10 Fastest-Growing Industries in the US

The United States of America has been “the land of opportunity” for the world. It has growth-hacked economic prosperity by leveraging talent from Mexico, China, India, the Philippines, El Salvador, Guatemala, and Vietnam. More nations are sending brilliant minds to the US, exchanging technological and cultural knowledge.

This nation, its democratic processes, judicial review standards, and affirmative actions allow individuals of all backgrounds a chance at a more fulfilling life. So, industrial growth is both – the cause and the effect – of this melting pot.

The diversity in the US also extends to the industries booming in this land of opportunity. However, their ranks vary based on employment change, annual revenue, global presence, consumer statistics, production scale, sustainability performance, and investor support.

Fastest Growing Industries Ranking

1| Event Management, Leisure, and Hospitality

Criterion: Employment growth and global scale.

Event organizer job opportunities in the US will grow by 38 to 40% when 2031 begins. Likewise, hospitality service providers will witness business expansion as the global slump in 2020 and 2021 no longer impacts them. With the reopening of theme parks, tourist destinations, museums, and art galleries, more customers seek high-quality hospitality facilities. So, considering employment change or workforce requirements, this industry ranks at the top.

2| Banking and Peer-to-Peer Lending

Criteria: Consumer statistics, global presence, and employment change.

Financial service providers let companies raise funds, complete projects, plan expenses, borrow capital, and report according to regulators’ accounting requirements. Although an expected economic slowdown has affected conventional banks, more stakeholders have moved toward peer-to-peer (P2P) lending platforms and private creditors.

Moreover, mobile and networking technologies have increased retail customers’ “cashless” transactions. Today’s US banks must explore new revenue models considering these trends. They will also continue hiring more technology specialists to tackle related implementation obstacles.

3| IT, Cybersecurity, and Communication

Criteria: Innovation, global reach, sustainability performance, and sales growth.

Many of the fastest-growing cities in the US are tech hubs attracting engineers, biotechnologists, and product designers worldwide. After all, American gadgets and inventions serve a global consumer base while mitigating the environmental risks of outdated systems.

Most IT services provider company in the US also comply with social and governance standards. So, they can tap into impact investors’ resources to increase capacity and boost production. Besides, tech-enhanced tools have modernized how other industries operate their business workflows. The work-from-home (WFH) work models have also increased cybersecurity risks and more organizations collaborate with security experts and data vendors to reduce them.

4| Individual, Family, and Employee Healthcare

Criteria: Consumer statistics and employment potential.

Managed care services (MCS) and established medical facilities in the US and abroad witnessed historical challenges in 2020. That crisis proved how much the global healthcare system requires more investment and comprehensive insurance strategies. Meanwhile, patients have experienced the cost of poorly planned health and life science facilities. So, healthcare businesses have expanded their workforce. Likewise, insurance providers explore how modern technologies can help predict risks more accurately.

5| Construction

Criteria: Investor support, sustainability compliance, scale, and employee intake changes.

More than 900,000 registered construction organizations contribute to the US citizens’ public and private infrastructure needs. According to Associated General Contractors (ACG) of America, construction works of 2.1 trillion US dollars are completed each year. This industry employs more than 8 million workers with an increased focus on green buildings, efficient transportation, renewable energy projects, and workplace safety.

6| Mining and Petrochemical

Criteria: Employment and production scale.

Cars, heavy machinery, railways, and airplanes need fuel to fulfill the US citizens’ demands. Also, corporations require several metals, nonmetals, and synthetic plastics for production and innovation. Despite sustainability concerns, the mining and petrochemical industry thrives because all manufacturing and construction activities still depend on it. It is one of the fastest-growing industries in the US, with more than 12,700 active mines and many more mining positions opened. Southern Copper and FMC Corporation are two examples of American mining companies.

7| Education

Criteria: Innovation, scale, and employee statistics.

The education industry’s total revenue can increase by 11.69% compound annual gross rate (CAGR). That suggests its domestic market will likely grow from 2.39 billion in 2022 to 4.42 billion USD in 2027.

Simultaneously, the learn-from-home (LFH) platforms expect considerable revenue growth from in-app purchases. Homeschooling, private educational units, and remote learning tools have gained momentum. On the global side, US education technologists have a revenue potential of trillions. The US education industry also employs more than 15.4 million individuals in 2023.

8| Real Estate

Criteria: Operational scale, revenue, investor support, and employment growth.

This industry comprises over 350 thousand firms, employing 3.9 million professionals in several commercial roles. While the top 50 organizations generate 20% of the entire US real estate industry’s revenue, this fragmentation does not discourage small players. They focus on regional stakeholders, and agents help individual homeowners rent out their properties.

As return-to-office (RTO) mandates increase, commercial real estate involving office buildings will witness a more substantial revenue boost.

Related: Data Analytics in Media & Entertainment Industry: 2023 Trends

9| Trucking

Criteria: Employment and scale.

American trucking industry hires more than 3.5 million truckers through 1.1 million carriers. More than 750,000 managed at least one tractor. Most trucking associates operate less than six trucks. Additionally, this industry allows grocery stores, pharma counters, bank ATMs, and fuel stations to refill their inventory.

It earned 875.5 billion US dollars in 2021 and 940.8 billion USD in gross freight revenue in 2022. Shipments requiring roadway transportation reach their destinations thanks to the trucking industry.

10| Food and Beverages

Criteria: Employment and global presence.

More than 8,700 craft breweries and major players like Amazon, Walmart, Kroger, Costco, Safeway, Walmart, and Alibaba serve the US food and beverages market. While pet food generated 28.88 billion USD in revenue in 2020, it has increased to 57.38 billion USD in 2023.

Soft drinks, chocolate, and ice-based recreational edibles continue to attract US buyers. The companies in the food and beverages industry also adjust their inventories to respond to changes in tourism, dietary habits, and climate conditions. The food market will likely grow at 3.79% to 6% CAGR.

Fastest Declining Industries Ranking

Like the growing industries, the US has the following sectors consistently losing market share, employee headcounts, and investor support.

-

Coal mining adversely impacts the environment due to the air quality and carbon risks. This industry has shrunk while renewable energy projects evolve to support the most congested cities in the US. However, coal-based projects have a long service life. So, demolishing or replacing them is challenging. The Energy Information Administration (EIA) believes coal usage will decrease by half by 2050.

-

The tobacco manufacturing industry has a decreased workforce. According to the Federal Trade Commission (FTC), fewer consumers are purchasing cigarettes. Long-term public health improvement initiatives and the refusal of ethical investors to include tobacco companies in portfolios are some reasons for this trend.

-

Portable data storage has affected the need for CD and tape manufacturing. Besides, several subscription-based online streaming platforms have made access to multimedia content more affordable. Artists, movie producers, video game companies, and educators can build recurring income flows leveraging cloud storage and streaming. So, physical memory is becoming increasingly irrelevant. Hardware vendors have also abandoned optical disk drives for more compact design approaches.

Read Also: The Science of Music: How Big Data is Transforming the Music Industry?

Common Trends Among Fastest Growing Industries

1| Collaborative Environment

Industries relying on multi-stakeholder feedback are less likely to endanger their products and services through irresponsible decisions. They listen to their critics and address issues before it is too late. Collaboration can also extend to cloud-powered virtual office experiences.

2| Tech Innovation

Businesses in an industry adopting the latest technologies can reduce risks, inefficiency, controversies, and carbon emissions. Therefore, they succeed in fundraising. Consumers are also more likely to support brands focused on incremental innovation and green tech integration. This situation hints at the significant role of creativity in the fastest-growing industries over the next 5 years.

3| Sustainability-First Strategies

Complying with the demands of investors, regulators, and customers concerning workplace safety or environmental responsibility helps the brand become more resilient. Simultaneously, most polluted cities in the US require enterprises that employ sustainable development and problem-solving strategies to address regional issues.

Fastest Growing Industries in the Next 5 Years

-

Repairing and maintenance jobs will increase as population growth pressures old infrastructure to accommodate more individuals. Since repair tasks require domain-specific skills, large-scale projects will depend on specialist teams for maintenance. General maintenance workers must differentiate themselves through specialization to prepare for the future.

-

Digital marketing and media have become universal, individual-centric, and automated. However, monotonous over-information plagues the industry. So, genuine expressions independent of standard marketing templates must assist US businesses in accomplishing their objectives. In the next 5 years, only those marketers with exceptional storytelling and communication skills will financially thrive.

-

With the advent of ChatGPT and BARD, conversational artificial intelligence (AI) and interactive chatbot development services will become a disruptive industry. Furthermore, specialist trainers and consultants will educate the stakeholders on business-focused chatbot management. Fast multi-lingual AI chatbots will lead the way.

Additional Growing Industries to Watch

Fake news checkers, biased media detection, and identity theft prevention will be potentially the fastest-growing industries in the next decade. This statement relies on the rise of AI content identifiers that claim to allow universities and media publishers to distinguish organic expressions from synthesized ones. They currently focus on text, but more sophisticated tech is necessary for checking the unethical use of AI-generated deepfake videos.

Recycling corporations in the US also seem promising because more stakeholders seek circular economy solutions. They employ 757,000 career job seekers each year. Moreover, the recycling industry in the United States had a revenue of 91 billion USD in 2022. Given the inevitable rise of sustainability reporting and circular economy, this industry will be more valuable this decade and beyond.

Conclusion - Fastest Growing Industries

The industrial revolutions have changed societies, human aspirations, and countries’ relationships. The world went from farming and manual work to the service sector and automation after leveraging the lifestyle improvements from manufacturing jobs.

Therefore, the US must focus on the fastest-growing industries’ future. However, while education, construction, P2P lending, and hospitality are thriving, companies in the energy sector must seek professional and innovative solutions to accomplish carbon reduction and inclusivity goals.

Aside from sustainability compliance, workplace environment and technological advancements affect corporate activities. Likewise, factors like government regulations, demographic trends, and resource availability can hurt or help industries’ resilience. If the stakeholders, especially the leaders in policy-making and business, leverage data-driven decisions, they can support those sectors.

SG Analytics, recognized by the Financial Times as one of APAC’s fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose, merging content and context to overcome business challenges. With our Brand Promise of “Life’s Possible,” we consistently deliver enduring value, ensuring the utmost client delight.

A leader in Market research services, SG Analytics enables organizations to achieve actionable insights into products, technology, customers, competition, and the marketplace to make insight-driven decisions. Contact us today if you are an enterprise looking to make critical data-driven decisions to prompt accelerated growth and breakthrough performance.

About SG Analytics

SG Analytics is an industry-leading global insights and analytics firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media and entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company and has a team of over 1100 employees and a presence across the U.S.A., the U.K., Switzerland, Canada, and India.

Apart from being recognized by reputed firms such as Analytics India Magazine, Everest Group, and ISG, SG Analytics has been recently awarded as the top ESG consultancy of the year 2022 and Idea Awards 2023 by Entrepreneur India in the “Best Use of Data” category.

FAQs - Fastest Growing Industries

Q1 – Which States in the US Are Hubs for Specific Growing Industries?

Answer: Utah, California, and Washington are the states hosting the fastest-growing sectors like information technology or digital communication. Meanwhile, the management industry thrives in Texas and Florida. New York provides robust career pathways across retail trade, education, manufacturing, and finance industries.

Q2 – Is Education a Crucial Factor in the Development of These Industries?

Answer: America’s fastest-growing industries utilize cutting-edge technologies to maximize productivity and reduce human errors. Therefore, higher education is non-negotiable if professionals want to contribute to these industries. Besides, even agricultural tasks involve complex equipment in a developed country like the USA. Still, inconsistencies between university lectures and field experiences highlight a need for vocation-oriented training programs.

Q3 – What is the Significance of Research and Development in These Growing Sectors?

Answer: Research and development (R&D) ensures a brand can leverage the latest trends in the market to surpass competitors. Since intellectual property rights (IPR) create additional revenue sources through licensing, pioneering an invention has long-term gains. R&D empowers agile firms smaller than the established industry leaders to make breakthrough discoveries. As a result, continuous corporate research and product development is essential for industrial growth in the US.

Q4 – What Are the Key Indicators of a Growing Industry?

Answer: When an industry thrives, its collective revenue will exhibit a double-digit increase in year-on-year (YoY) performance disclosure reports. It will also have several standardized workplace safety protocols and effective governance mechanisms. Although employee strength is an excellent indicator of a fast-growing industry in the US, it can decrease due to modern tech adoption.

Such fluctuations do not indicate the industry has declined. Instead, they imply it has become more efficient, utilizing smaller teams to complete the same tasks without worker burnout risks. Other growth indicators include global reach, extensive consumer base, improved funding, high sustainability rating, and product innovation.