The global healthcare industry is entering a transformative era in 2025, driven by innovation, strategic investments, and evolving market dynamics. The industry is poised for growth across key submarkets like HealthTech, MedTech, and Pharmatech. A Deloitte Center for Health Solutions survey reveals that nearly 60% of industry leaders have a positive outlook for 2025, up from 52% the previous year.

Consolidated Investments and Focused Growth

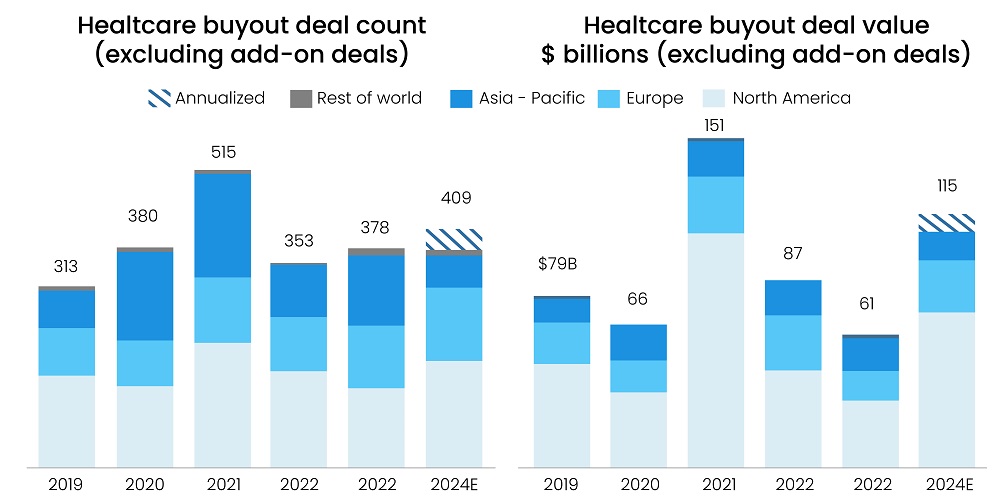

According to Bain & Company, the global healthcare private equity (PE) deal activity reached an estimated $115 billion in 2024, marking the second-highest deal value on record, driven by a surge in large-scale deals. In 2025, this trend is expected to persist, with fewer but larger deals dominating the market. Investors will likely focus on late-stage, capital-intensive opportunities with strong clinical validation and clearer commercialization pathways, channeling resources into ventures with high potential. Macroeconomic pressures, including rising interest rates and tighter credit markets, have amplified the shift toward larger deals, as constrained funding pushes investors to prioritize lower-risk opportunities.

Figure 1: Deal Activity in Healthcare Surged in 2024

Sources: Dealogic; AVCJ; Bain Analysis

Read more: US Venture Capital (VC) Outlook 2025

Healthcare’s Growing Share in PE

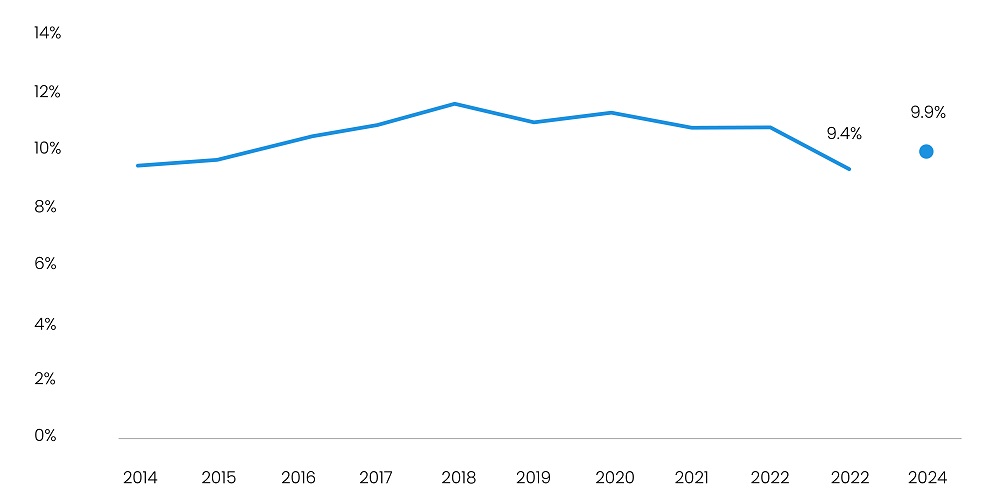

In 2025, the healthcare industry's share of global PE deal activity is expected to grow, supported by declining interest rates, easing labor costs, and policy shifts favoring PE in healthcare under a new US administration. The sector is positioned for further recovery after rebounding to 9.9% of global PE deals in 2024 from a decade-low of 9.4% in 2023, as per PitchBook. Submarkets like medspas, outpatient mental health, and infusion services continue to attract strong PE interest, alongside accelerating activity in pharma services, signaling sustained growth, even though levels are unlikely to reach the 2018 peak of 11.5%.

Figure 2: Healthcare PE Deals as a Share of the Total PE Deal Count

Source: Pitchbook, as of September 30, 2024

VC Healthcare Industry Activity to Remain Stable

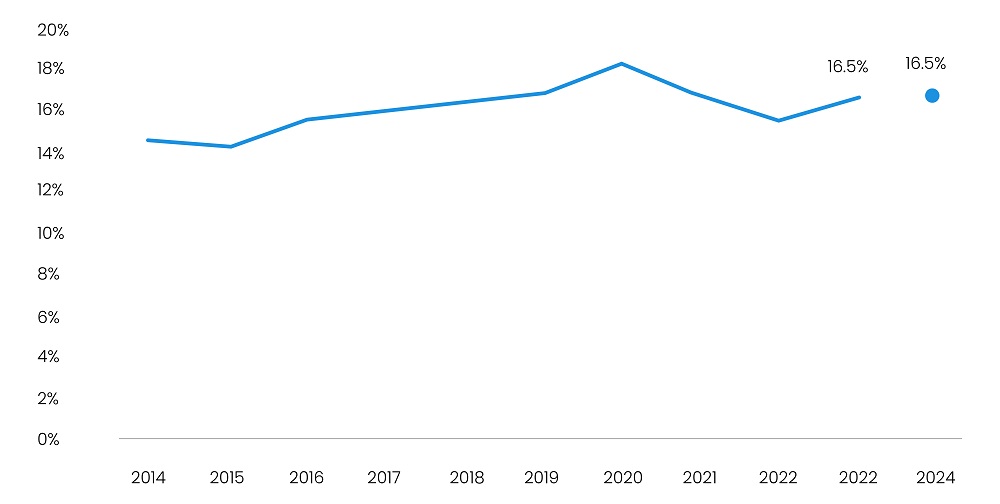

Healthcare’s share of global venture capital (VC) deal activity is expected to hold steady at 16.5% in 2025, consistent with its 2023 and 2024 levels, as per PitchBook. While emerging trends in metabolic health and AI-driven innovations continue to attract funding, challenges such as limited M&A exits and cautious reinvestment persist. Sector-specific consolidation has heightened competitive pressures, restraining new entrants. Despite headwinds in health tech and early-stage life sciences, resilient public markets and increased IPO activity will maintain VC interest, maintaining healthcare’s position in VC funding in 2025.

Read more: AI in National Security: Protector or Threat?

Figure 3: Healthcare VC Deals as a Share of the Total VC Deal Count

Source: Pitchbook, as of September 30, 2024

More than 100 Million VC Rounds Predicted in Medtech

The brain-computer interface (BCI) space is set for a breakthrough year in 2025, with at least two startups projected to secure VC rounds exceeding $100 million, as per PitchBook. Leading players like Neuralink and Synchron are advancing toward pivotal stages with ongoing clinical trials and commercialization plans. Neuralink, having raised $323.2 million in 2023, will likely seek additional funding in 2025, following its two-year fundraising pattern. Similarly, Synchron, following its promising COMMAND study results, appears well-positioned for a substantial funding round next year.

Investor interest in BCI technologies is fueled by advancements in the field and broader market dynamics. Initiatives like DARPA’s Neural Engineering System Design program have accelerated innovation, while tech giants such as Meta, Alphabet, and Apple are exploring BCI integration with AR and VR platforms. These developments, coupled with major exits like Tether’s $200 million stake in Blackrock Neurotech, highlight the growing appeal of BCIs as a transformative medtech frontier for VC investment.

Regional Expertise to Advance Pharmatech Innovation

The global pharmatech landscape is increasingly defined by regional specialization, fostering collaboration while creating funding challenges for companies outside these niches. According to PitchBook, North America dominates with over 70% of global pharma VC deal value in 2024, driven by AI-led drug discovery and mRNA technology. Europe focuses on sustainable biomanufacturing and rare diseases, supported by Horizon Europe initiatives. Meanwhile, Asia continues to lead in generics and biosimilars despite a funding dip. This regional focus aligns investment with competitive strengths but widens funding gaps for less-aligned firms.

Read more: Future of Patient Monitoring: Healthcare Trends and Innovations in 2025

Increased M&A and IPOs to Drive Exits in Healthtech

The health tech sector is poised for a wave of exits in 2025, with late-stage startups primed for M&A and IPO opportunities. After years of rapid growth, many companies in subsegments like chronic disease management, digital therapeutics, and personal care management have matured into attractive targets for strategic buyers. Consolidation trends are expected to drive significant M&A activity. Meanwhile, improving macroeconomic conditions and rising investor interest are fueling IPO readiness, with startups like Omada Health and Hinge Health making strides toward public markets.

The number of digital health unicorns, steady at 48 since 2023, will likely decline as exits outpace the emergence of new unicorns, as per PitchBook. A robust pipeline of near-IPO-ready startups, including Oura, Zocdoc, and Ro, signals strong exit activity, while challenging funding conditions will likely hinder new unicorn creation. Some late-stage startups are expected to face closures due to cash runway challenges, as seen with Forward’s shutdown in 2023. Together, these dynamics underscore a transformative year ahead for HealthTech.

Partner of choice for lower middle market-focused investment banks and private equity firms, SG Analytics, provides offshore analysts with support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.

About SG Analytics

SG Analytics (SGA) is an industry-leading global data solutions firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company with a team of over 1200 employees and a presence across the U.S.A., the UK, Switzerland, Poland, and India.

Apart from being recognized by reputed firms such as Gartner, Everest Group, and ISG, SGA has been featured in the elite Deloitte Technology Fast 50 India 2023 and APAC 2024 High Growth Companies by the Financial Times & Statista.