Corporate sustainability is an ever-evolving field, and the goalposts are constantly growing. Today, more and more businesses are undertaking climate action to fulfill their part in the fight against climate change. They are earning significant business benefits like improving their brand equity and attracting and retaining employees. Businesses with the best intentions are also finding themselves unintentionally greenwashing. Greenwashing, even if unintentional, can lead to severe consequences for organizations.

As companies embrace sustainability and consumers seek out ethical brands, there is rapid growth in firms trumpeting their green credentials. However, this can only be accompanied by a proliferation of claims of greenwashing. For businesses willing to let their consumers know about their good work, it can be confusing to identify ways to communicate it. And with these benefits comes the incentive to try to exploit them. This greenwashing practice occurs when organizations spread misinformation to project an environmentally friendly public image and earn the associated rewards. However, not all greenwashing is done on purpose.

Read more: Sustainability Trends that Will Shape Corporate Priorities

Why is Greenwashing so Controversial?

Greenwashing has been a hot topic for the past decade. But it has really been put under the spotlight over the last couple of years. Through making misleading or unsubstantiated claims, greenwashing causes consumers to believe that an organization or individual is generating a greater environmental benefit than it is.

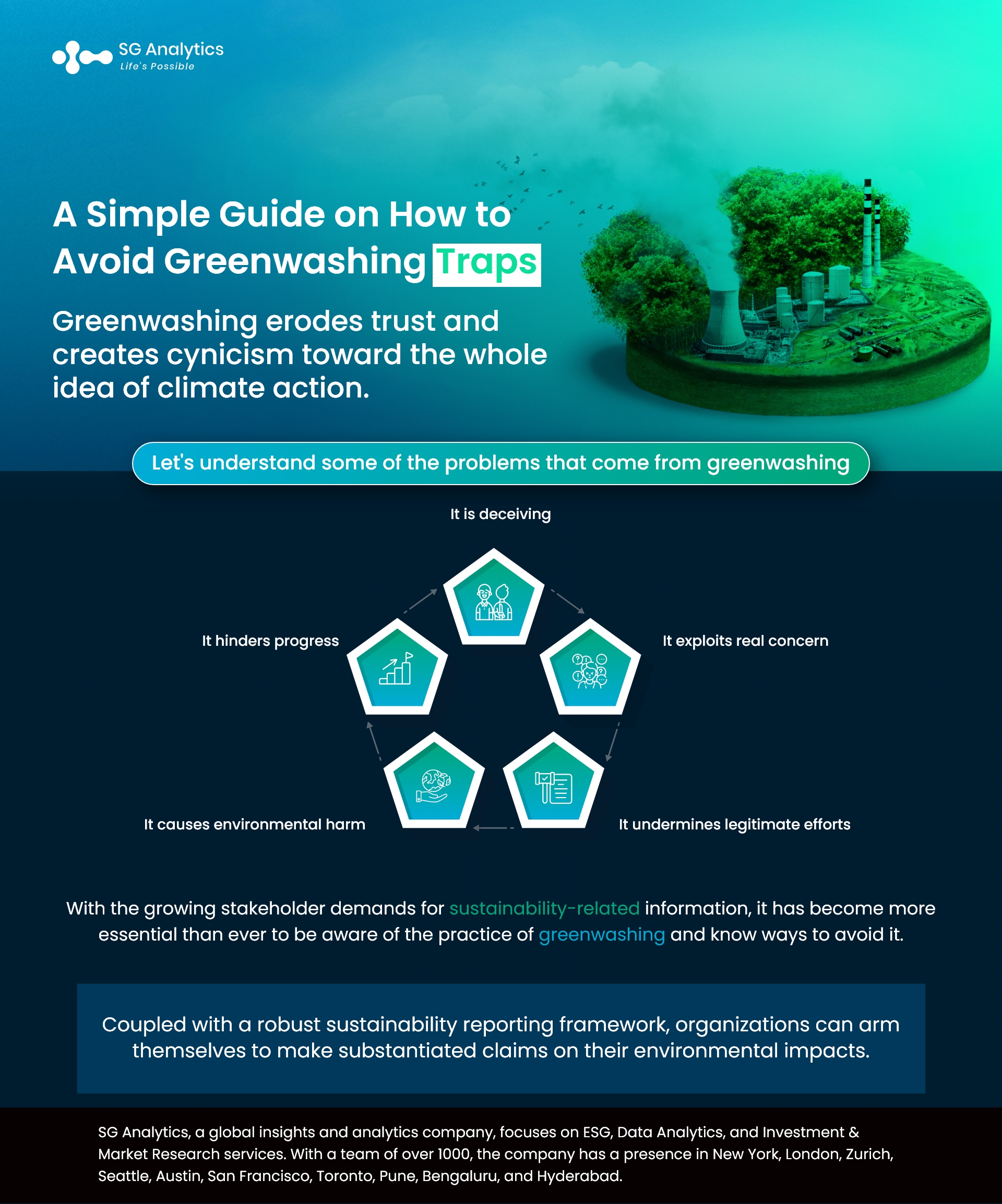

Greenwashing erodes trust and creates cynicism toward the whole idea of climate action, which is likely to have real consequences for the environment. Let's understand some of the problems that come from greenwashing:

- It is deceiving: When businesses and other organizations make false claims about their sustainability efforts, the deception can mislead consumers and undermine their trust in the business.

- It exploits real concern: Greenwashing takes advantage of consumer's growing concern for the environment. Many individuals often want to support eco-friendly products, and greenwashing takes advantage of this.

- It undermines legitimate efforts: Greenwashing diverts attention from businesses committed to sustainability. This leads to creating an unfair advantage.

- It causes environmental harm: When companies falsely claim their products are sustainable, consumers make choices that aren't that great for the environment.

- It hinders progress: By creating a false sense of achievement, greenwashing is likely to hinder the environmental efforts of organizations. It gives businesses and consumers a sense they are doing enough when much more is needed.

Read more: Investing in the Green Revolution: A Comprehensive Guide to Sustainable Development

How can Businesses Avoid Misleading Environmental Claims?

Pursuing sustainability goals through investments is emerging as an increasingly popular commitment with private and institutional investors. However, greenwashing erodes consumer trust and poses significant financial and reputational risks.

With the growing stakeholder demands for sustainability-related information, it has become more essential than ever to be aware of the practice of greenwashing and know ways to avoid it. Asset managers are responding to this growing demand through many new investment products with sustainable characteristics. While not all these products aim for the same sustainability goals, regulatory restrictions help prevent certain products from being offered to private investors. It is, therefore, vital for organizations to reflect their intentions in their investment products and their portfolio holdings.

Regulators are now focusing on greenwashing and are insistent on transparent, verifiable data to ensure and establish trustworthy communication. To help businesses stay greenwashing-resistant, here are a few traps businesses should avoid:

-

Setting Inadequate Goals

It is crucial for organizations to align their goals with the latest science. To mitigate climate change’s most harmful effects, it is vital for businesses to limit their carbon emissions and closely monitor their net-zero targets.

-

Ignoring What They Can’t See

To set and achieve targets, organizations need an accurate inventory of their full greenhouse gas emissions. Many companies are focusing on the emissions that are more easily observed, such as electricity usage or vehicle fleet. However, in doing so, they often neglect the upstream and downstream emissions originating from their value chain.

-

Lack of transparency

Organizations need to provide the context in which they report emissions and their emissions results to be verifiable. Emissions reports should include:

- The time frame in which the emission was measured

- The legal entities included in the calculations

- A breakdown of emission sources

To ensure businesses are removing carbon, they must avoid ineffective offsets and aim for high-quality climate investment.

Read more: How to Spot Greenwashing: 2024 Outlook

The Need for a Robust Sustainable Investment Process

Today, companies misleading consumers is a growing trend, as is the number of potential products or services falling into the greenwashing trap. Incorporating ESG criteria enables businesses and investors to pursue different sustainable investment goals. In addition, sustainable investments serve further purposes and different investor objectives.

A robust and diligent investment process helps incorporate sustainability aspects while offering sustainable investment products to clients. For sustainable investment, product features and client expectations need to be aligned. The end investor needs to have a clear understanding of the sustainability-related product. At the same time, the asset manager should ensure that the chosen approaches are implemented in a diligent way and that adequate knowledge of them is disclosed to create transparency for all market participants.

For any sustainable investment approach to be credible, the overall governance of the operational as well as investment processes should embed clearly defined sustainability features. It is also important to anchor the principles of a sustainable investment process in an overarching investment policy. These can be distinguished into three main goals:

- Financial performance goals to improve the risk or return profile generated by the investments.

- Values alignment goals to align the investments with the investors’ personal values.

- Positive change goals contribute to a positive change in the economy, society, and environment.

While these three goals are not mutually exclusive, it is important to implement specific sustainable investment approaches in a credible fashion and report the sustainability parameters in a transparent manner.

Read more: Authenticity Over Greenwashing: How Brands Are Engaging with Customers and Building Trust?

Final Thought

Greenwashing has many negative consequences for organizations, including legal, financial, and reputational risks. However, it is important to note that greenwashing is not always done intentionally. Often, organizations risk suffering severe consequences by failing to set sufficiently ambitious targets or by measuring their carbon footprint inaccurately.

When considering communications related to environmental performance or impacts, it is crucial to consider different environmental drivers that act as a powerful marketing tool. Ensuring all sustainability-related activity aligns with an organization’s overall purpose and strategy will further help ensure the authenticity and alignment of the company’s goals.

With a comprehensive and accurate overview of greenhouse gas emissions, organizations can ensure that they have the critical data required to address their full climate impact and thereby avoid greenwashing while embracing new business insights. Coupled with a robust sustainability reporting framework, organizations can arm themselves with the information to make substantiated claims on their environmental impacts and improvements over time.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose, merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

A leader in ESG Services, SG Analytics offers bespoke sustainability consulting services and research support for informed decision-making. Contact us today if you are searching for an efficient ESG (Environmental, Social, and Governance) integration and management solution provider to boost your sustainable performance.

About SG Analytics

SG Analytics (SGA) is a global data solutions firm that harnesses data with purpose across the data value chain - from origination, aggregation, management, modernization, and analytics to insights generation to create powerful business outcomes for its customers. Through its research and data analytics consulting services, SGA marries content with context to provide bespoke solutions to its customers, enabling them to improve efficiency, scale, and grow. The company has a presence in New York, London, Zurich, Seattle, Austin, San Francisco, Toronto, Pune, Bangalore, Hyderabad and Wroclaw. The firm serves customers across the banking financial services and insurance (BFSI), technology, media and entertainment (M&E), and healthcare sectors amongst others, including Fortune 500 companies.

Apart from being recognized by reputed firms such as Analytics India Magazine, Everest Group, and ISG, SG Analytics has been recently awarded as the top ESG consultancy of the year 2022 and Idea Awards 2023 by Entrepreneur India in the “Best Use of Data” category.