Despite years of innovation, rising gasoline prices, and concerns around sustainability, the rate of EV adoption in the US has been slow. While Europe and China have close to 20 to 25% electric share in new vehicles sold, the number is only 5 to 7% in the US. That might change soon, courtesy Inflation Reduction Act (IRA).

The US currently relies heavily on lithium-ion battery imports from China and South Korea to fuel its growing electric vehicle industry. According to data sourced from S&P Global, China contributed 73.5%, South Korea 7%, and Japan 9.3% to lithium-ion battery imports into the US, with the country importing 148,323 metric tons of lithium-ion batteries in the second quarter of 2022.

Read more: Inflation Reduction Act (IRA) Puts Spotlight on CleanTech

The IRA – considered the most meaningful climate legislation in US history – proposes to offer around $369 billion of investment in energy security and climate change efforts. Among others, EV battery makers are expected to be key beneficiaries of the legislation. The law states that consumers who buy electric vehicles assembled in the US may be eligible for tax credits worth up to $7,500. Additionally, the raw materials/components used in EV batteries should mandatorily be extracted, processed, or recycled domestically. As part of its "advanced manufacturing production credit," the Act also provides a production tax credit of up to 10% for businesses that process battery minerals and materials and 35 $/kWh for businesses that make cell manufacturing equipment.

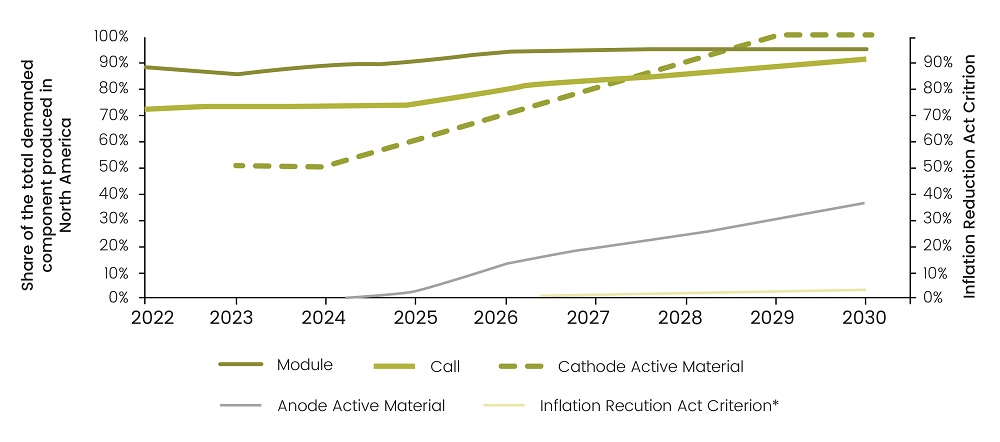

Figure 1: Effect of the Inflation Reduction Act on the North American Supply Chain

Notes: Left Y-axis: Only the batteries used for the light-duty battery electric vehicles produced in North America are considered. The percentage is based on the associated vehicle volume whose companies are produced in North America. Right Y-axis: IRA “component” criteria necessitates the value of the components of the battery packs, including the modules, cells, and electrode active materials manufactured or assembled in North America, to be above the percentages shown on the graph

Source: S&P Global Mobility, High Voltage Battery forecast data as of August 2022

As a result of this act, many major manufacturers of electric vehicle batteries have announced plans to invest in the United States for local manufacturing of batteries to comply with the provisions of the Act. In October 2022, Panasonic unveiled plans to build a new battery plant in Kansas, with mass production likely to start by March 2025. In the same month, Hyundai broke ground on its planned $5.5 billion electric vehicle factory in Bryan County, Georgia. BMW also said it would invest $1.7 billion in its factory near Spartanburg, South Carolina, to build EVs and EV batteries.

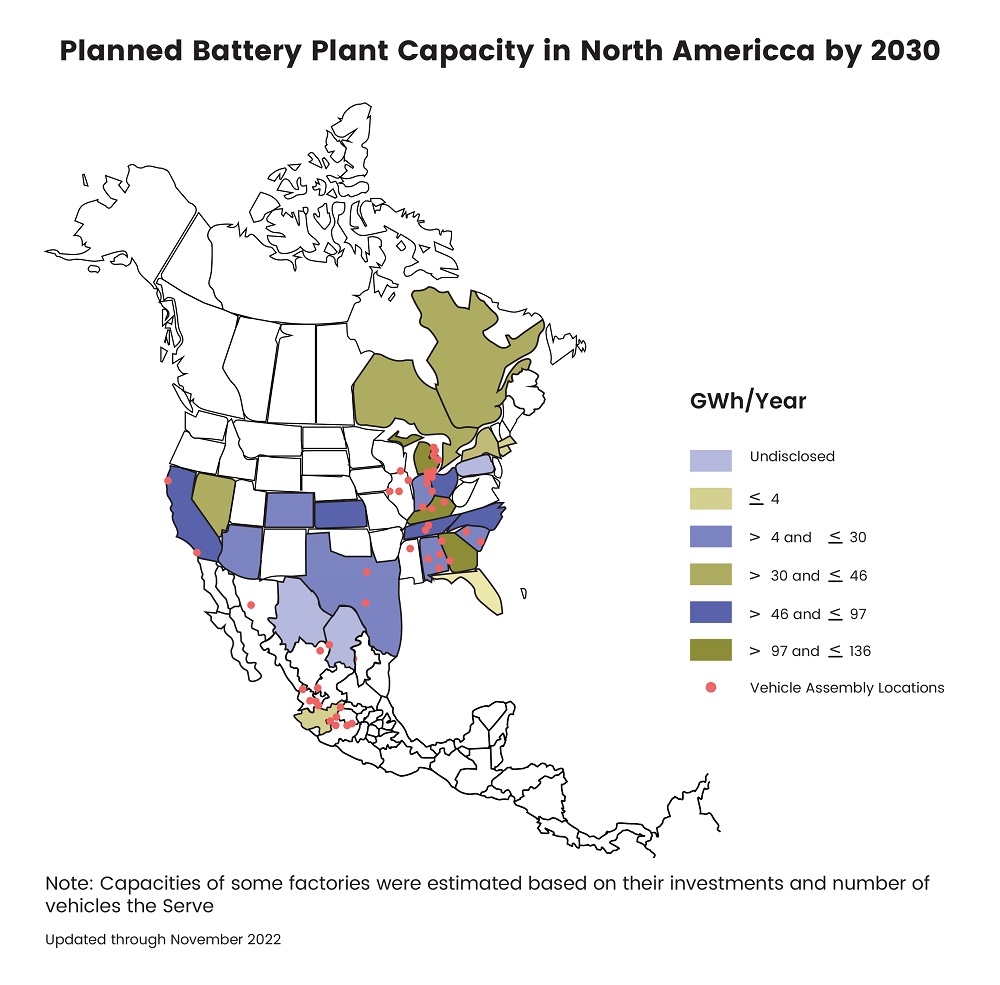

Figure 2: Planned Battery Plant Capacity in North America by 2030

Source: US Department of Energy, Argonne National Lab, CNBC

While the traditional battery manufacturers have benefitted from the IRA, it is also a massive boost to new start-ups working for alternates to lithium-ion batteries. Redwood Materials, a Nevada-based VC-backed start-up, is focused on building a circular supply chain to power a sustainable world and accelerate the reduction of fossil fuels. The company aims to fill a particular gap in the battery supply chain by recycling and processing expensive anode and cathode materials now made almost exclusively in China. The company is investing $3.5 billion in a new South Carolina recycling and manufacturing campus that will produce enough components to power a million electric vehicles. Our Next Energy, which recently raised a $300 million Series B round, is another start-up creating innovative energy storage solutions. The company focuses on finding low-cost, highly available materials for its battery chemistries.

Read more: Spotlight on EV Battery Technology as the US looks to Challenge China’s Dominance

“We’ve seen an absolute increase in the momentum of investment after the Inflation Reduction Act,” – Deeana Ahmed, VP of strategy, policy, and sustainability at Our Next Energy

While lithium-ion batteries are going to remain the first choice for automakers, other technologies are coming to the mainstream. Solid state batteries, for instance, offers a variety of benefits over li-ion batteries, including no worry of electrolyte leaks or fires (provided a flame-resistant electrolyte is used), extended lifetime, decreased need for bulky and expensive cooling mechanisms, and the ability to operate in an extended temperature range. Solid-state batteries can build off of the improvements made in other types of batteries. For example, Sakti3 is trying to commercialize solid-state LIBs with funding from General Motors Ventures. Other auto manufacturers, such as Toyota and Volkswagen, are also looking into solid-state batteries to power their electric cars. Aluminum-ion batteries are similar to lithium-ion batteries but have an aluminum anode. They promise increased safety at a decreased cost over lithium-ion, but research is still in its infancy. Lithium-sulfur batteries offer a higher theoretical energy density and a lower cost than lithium-ion batteries. NASA has invested in solid-sate Li/S batteries to power space exploration, and Oxis Energy is also working to commercialize Li/S batteries. Finally, metal-air batteries have a pure-metal anode and an ambient air cathode. As the cathode typically makes up most of the weight in a battery, having one made of air is a major advantage.

Read more: How are Impact Investors Tackling the New Opportunities in Climate Investment?

Estimates suggest that the level of support offered by the IRA could direct nearly $100 billion to the US EV battery industry. This will put the US close to what China spends on EV battery development and ultimately end the US’ reliance on China for lithium imports. In addition, the IRA will play a key role in increasing the annual battery manufacturing capacity in North America from 55 GWh in 2021 to almost 1,000 GWh by 2030.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.