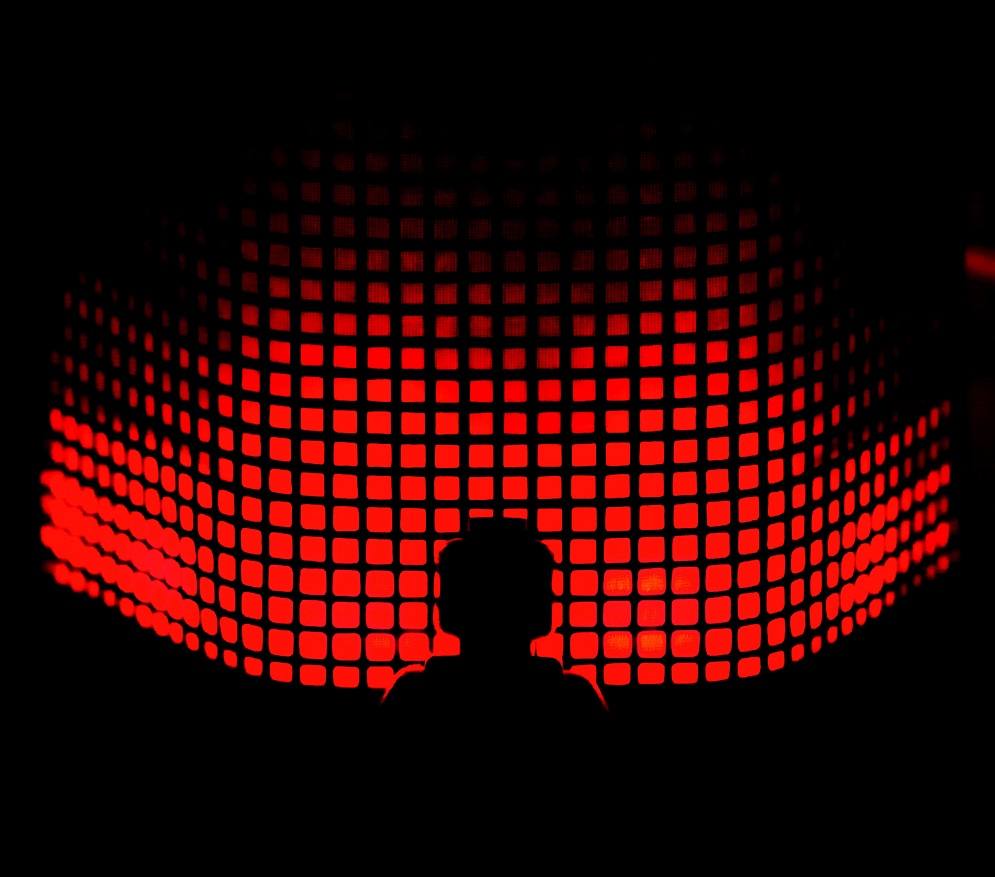

With an evolving geopolitical landscape and the relationship between defense and technology becoming increasingly intertwined, the sector is witnessing an influx of VC funding. In the first three quarters of 2022, VC-backed firms injected $7 billion into aerospace and defense companies, per Pitchbook, a massive growth that stands in sharp contrast to the relative sluggishness in other sectors.

Fig 1: VC Funding in Defense Tech Remained Strong in 2022

Source: Pitchbook

Read more: Investment Outlook: Private Equity Market Trends 2023

The surge in VC funding in the defense technology sector has created a thriving ecosystem for innovation and development, enabling startups to bring their products and services to market faster. This shift towards investing in the defense industry can be attributed to several structural tailwinds. Firstly, rising geopolitical tensions between nations have created a heightened sense of urgency to enhance military capabilities, spurring investment in defense technology. Secondly, the advancement of emerging technologies such as artificial intelligence, robotics, and cybersecurity has created new opportunities for defense technology startups to provide cutting-edge solutions.

Moreover, the current global economic climate has also played a role in driving investment in defense technology. The defense industry is perceived as a reliable source of revenue, given the constant demand for military technology and equipment. Investors are seeking out opportunities to invest in the sector, not only for the potential financial gains but also for the stability that comes with investing in an industry that is less susceptible to economic downturns.

Read more: Deploying Technology to Cultivate a Digital Transformation Strategy that Delivers

The Changing Nature of the Defense

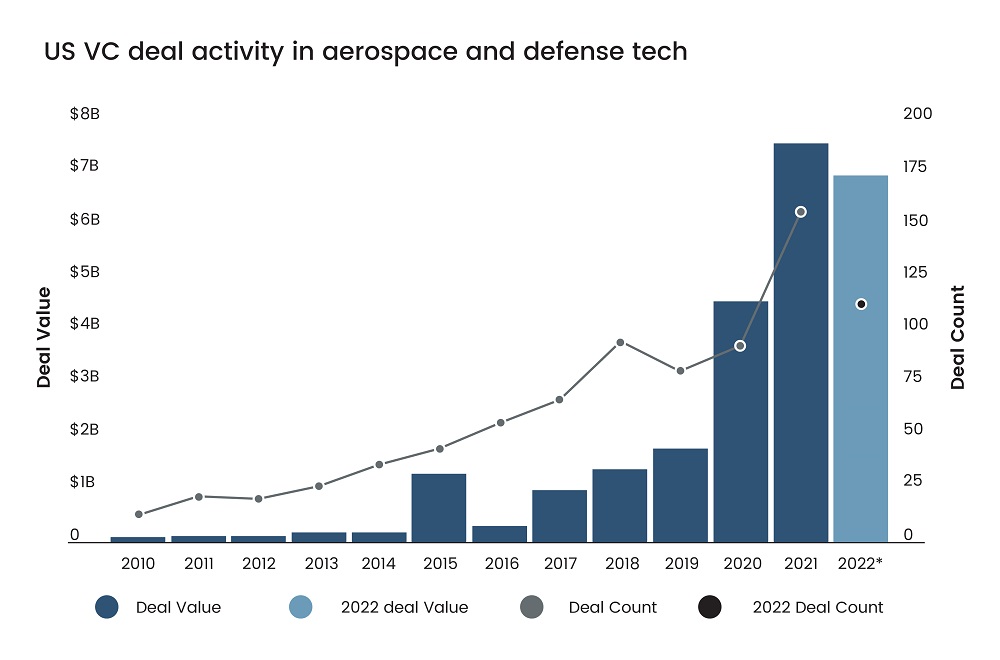

The evolution of defense has undergone a significant transformation with the emergence of cutting-edge technologies such as AI/ML and robotics. A glimpse of this sea change was seen in the current Russia-Ukraine conflict, where satellite imagery played a key role. It is also expected that future warfare will become even more technology-driven and potentially less violent, with more focus on the quality of each side's automation, artificial intelligence, cybersecurity, and space-based technologies.

Fig 2: Defense Tech Innovation Map

Note: The figure represents the impact these technologies will have on defense

Source: StartUs Insights

These advanced tools will revolutionize the way military strategists approach combat scenarios and will enable them to optimize their decision-making process with unparalleled precision and accuracy. Accordingly, modern defense forces are equipped with a new generation of intelligent machines that can rapidly adapt to changing circumstances, providing an agile and responsive defense posture.

Read more: National Cybersecurity Strategy: Net Positive for the Cyber and Cloud Security Sector

DoD Looking at Silicon Valley

The current geopolitical landscape, characterized by increasing tensions with Russia and China, has prompted the U.S. government to foster stronger collaboration with private start-ups in order to accelerate the pace of technological innovation and adoption. To that end, the US Secretary of Defense, Lloyd Austin, established the Office of Strategic Capital to build “an enduring technological advantage by partnering with private capital providers.”

"We are in a global competition for leadership in critical technologies, and the Office of Strategic Capital will help us win that competition and build enduring national security advantages," – US Secretary of Defense Lloyd J. Austin III.

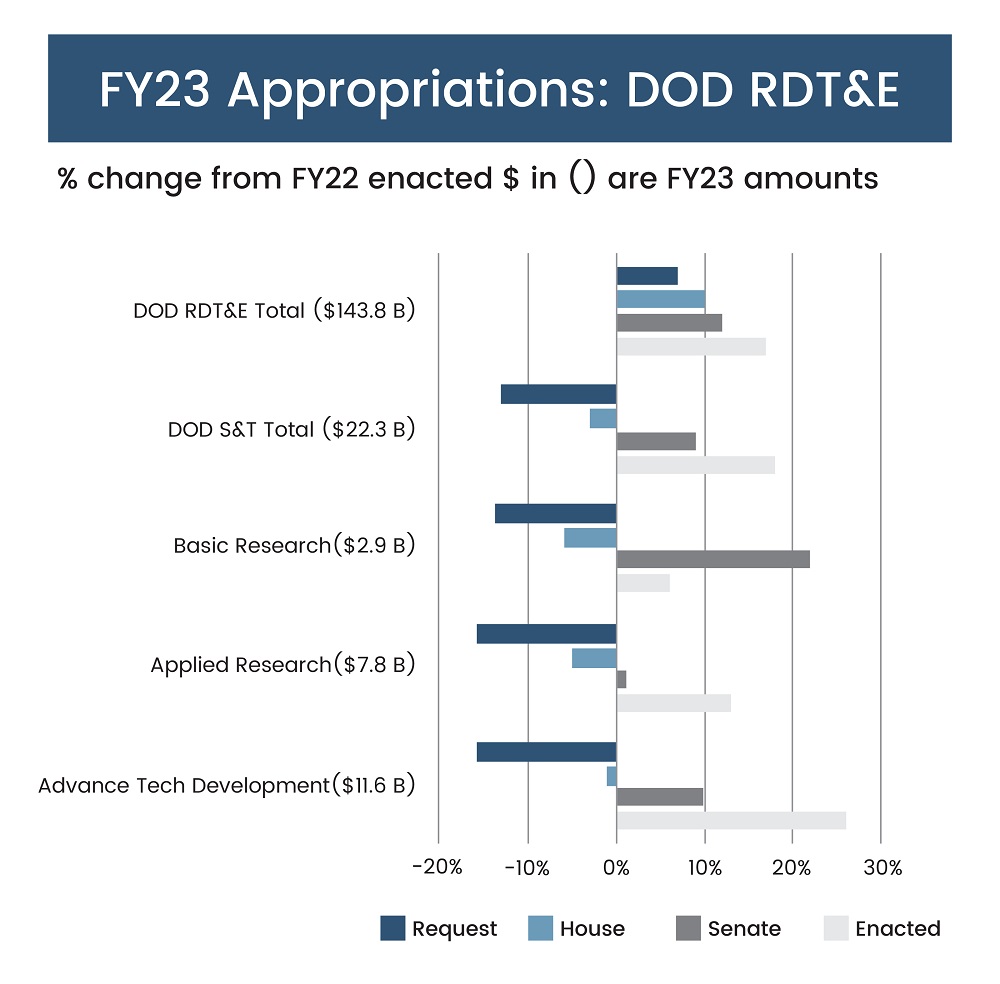

The DoD’s focus on incorporating AI and ML into the country's defense system is creating opportunities for startups in this field to benefit from government initiatives aimed at addressing operational challenges with emerging technologies. In its FY2023 budget, the department increased its allocation to Research, Development, Test, and Evaluation by 17% to $144 billion, including $11.6 billion for advanced tech development. The sector's complexity and extended investment horizons have VCs and founders away from the defense for a long, but the government initiatives are expected to attract VC investment and foster a robust startup ecosystem.

Fig 3: DoD Increases Budget for Innovation in Defense

Source: American Institute of Physics

Read more: A Way Forward: Cybersecurity Trends to Watch Out for in 2023

Key Start-ups

Data from StartUs Insights reveals that there are currently over 1,000 military tech startups in the world, with a large majority of them in the US, including Anduril, Istari, and Shield AI. Anduril, launched by Oculus founder Palmer Luckey, specializes in developing AI-powered unmanned aerial systems and surveillance systems that can be used for military and border security purposes. Shield AI, on the other hand, is focused on creating autonomous systems that can operate in complex environments, such as urban combat situations. Epirus, which develops advanced technology to combat drones, raised a $200 million Series C round in February 2022. The funding highlights the company’s potential to revolutionize the US military's drone defense capabilities. The startup's innovative solutions have attracted significant interest from the US military, which recognizes the growing threat posed by drones in modern warfare. These companies have attracted significant government funding and contracts due to their innovative solutions that address critical military challenges. For instance, Anduril has won contracts with the US Air Force and the US Marine Corps to provide AI-powered drones for military applications, while Shield AI has received funding from the US Department of Defense's Defense Innovation Unit for its autonomous systems.

Against this backdrop, a slew of defense-focused VC funds – a rare breed so far – is also emerging. In September 2022, Razor’s Edge Ventures closed a $340 million fund that it plans to invest in companies helping the US maintain a technological edge in the defense sector. Shield Capital, which invests in security-focused start-ups, also raised its first $120 million fund in March 2022 and is looking to bet on the coming-of-age defense tech start-ups.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.