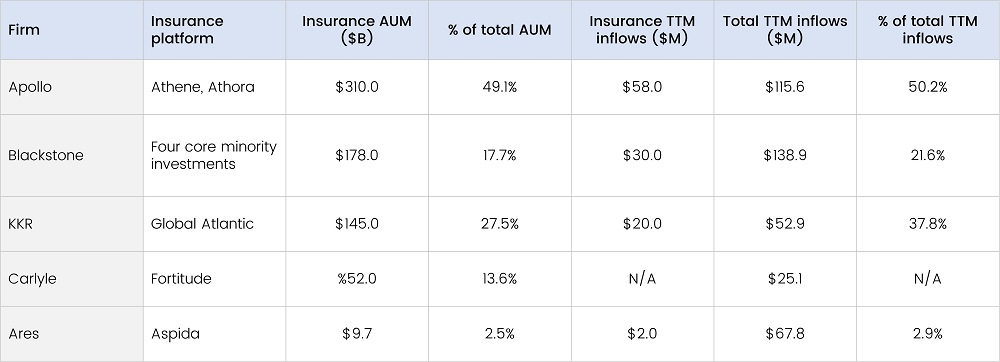

Despite an industry-wide fundraising slowdown, assets under management (AUM) for private equity (PE) firms have experienced steady growth. Mergers, acquisitions, and partnerships with insurance companies have emerged as a crucial source of funding because of a shift in PE strategies to focus on the expansion of perpetual capital. In the past year, approximately a fifth of funds raised by seven of the largest publicly traded PE firms have come from the insurance industry, according to Pitchbook.

As of 2Q23, large PE firms own nearly 9%, or about $774 billion, of the US life insurance industry’s assets, up from just 1% in 2012, according to AM Best. Apollo, a New York-based PE firm, merged with Athene, a Bermuda-based insurance company, in 2021. KKR, another New York-based PE firm, acquired General Atlantic, which serves over two million policyholders through its retirement and life insurance products. Blackstone announced a strategic partnership with Resolution Life late last year with plans to raise $3 billion in new equity capital commitments.

Read more: Investment Outlook: Private Equity Market Trends 2023

Figure 1: Insurance Platforms Acquired by PE Managers

Source: Pitchbook (*As of September 30, 2023)

Traditional fundraising strategies require PE managers to periodically raise funds which not only eats into firm resources but also adds additional pressure to increase internal rates of return. The balance sheets of insurance companies are particularly attractive to alleviate the burdens associated with traditional fundraising and offer a source of permanent capital and a reliable revenue stream for long-term positions. PE firms access the large asset pools of insurance companies they acquire, which, until future payout, have the potential of generating returns significantly higher than the cost of servicing the liabilities. Additionally, the potential to scale from investments in the insurance industry is significantly large for PE players. According to a McKinsey report, life and annuity insurers in the United States carry $4.5 trillion of assets on the general account. Despite several acquisitions in recent years, there is a large supply of under-tapped assets within the insurance industry primed for PE managers to leverage.

This strategy, with straightforward advantages for PE firms, is mutually beneficial. Insurance companies can expect higher returns with diversified portfolios because of their acquisition or partnership with PE firms. According to a report published by AM Best, in the first year of PE ownership, 38% of companies reported increases of over 20% in capital and surplus, rising to 43% in the second year and 50% in the third. Compared to the industry average, these companies generated an overall higher investment yield of approximately 62 basis points.

Read more: From Recovery to Reliability: Technology's Impact on Supply Chains

The growing closeness of the two industries has, however, drawn scrutiny from regulators. A paper published by the University of Pennsylvania acknowledges the improvement in the performance of the insurers but also highlights the increase in asset risk. PE-backed insurance companies increase their holdings of asset-backed securities by two-thirds of the industry average or 16 percent of their overall portfolio, compared to 10 percent for traditional insurers. In the year 2022, the National Association of Insurance Commissioners outlined similar concerns. It highlighted the necessity for an inquiry into whether PE’s traditional short-term focus clashed with the insurer’s long-term obligations, the need for greater transparency of deal structures, and the requirement for establishing a framework for such partnerships. Possible regulatory changes might emerge in the form of increased transparency and setting guardrails soon. Regulators aren’t averse to the entry of PE firms within the market and acknowledge the mutual growth in the industries through collaboration.

In conclusion, in recent years, PE firms have observed a shift in fundraising strategies to incorporate the life and annuity capital of insurance companies. On one hand, PE firms can leverage the asset pools from their partnerships to access scalable, long-term permanent capital. On the other hand, insurers unlock higher returns with diversified portfolios. Despite a regulatory gap in the space, the road ahead looks positive and promising.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.