After a prolonged slowdown, the US IPO market is set for a strong comeback in 2025. With improved market conditions and a robust pipeline of companies ready to go public, analysts predict a surge in IPO activity.

A Resurgent IPO Market

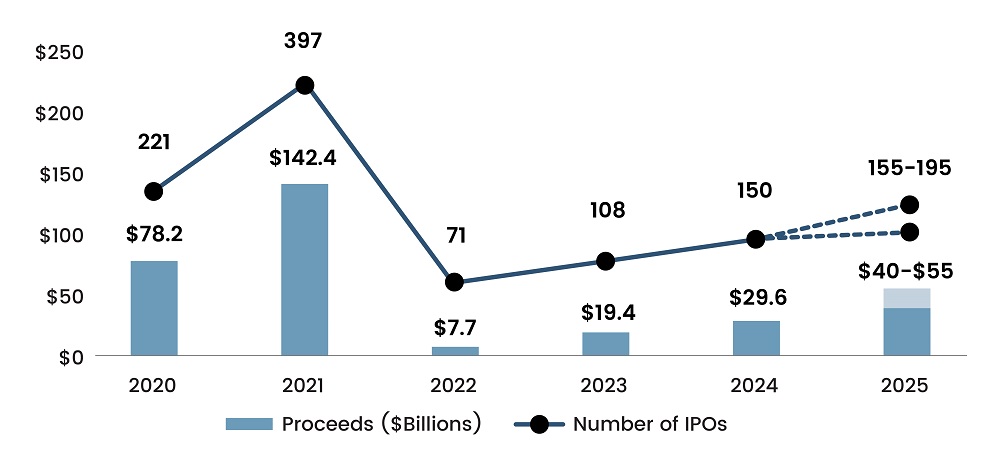

The US IPO market has struggled in recent years due to the growing economic uncertainty along with rising interest rates. However, 2024 marked a turning point, with investor sentiment improving and IPO volumes picking up. Market analysts anticipate a sharp uptick in IPO volume in 2025, with Renaissance Capital projecting 155–195 IPOs, raising about $40–$55 billion in total proceeds. Deloitte’s outlook similarly expects around 160 deals raising $45–$50 billion, making 2025 a slightly above-average year for IPO fundraising.

Figure 1: IPO Activity to Improve in 2025

Source: Renaissance Capital

The growth will be driven by the return of investors’ enthusiasm as IPO returns expand. According to S&P Global, investment in every single US IPO share issued last year led to a price increase of about 38.4% after weighing everything by the total value raised at issuance. Reddit is a prime example, where its share rose by 48% on debut. This positive momentum and rise in valuation have renewed optimism among both issuers and investors going into 2025.

Sector Leading the IPO Boom

One of the key drivers of this resurgence is the backlog of companies that postponed IPOs in previous years. Renaissance Capital counts 170+ firms in the public IPO pipeline who have submitted filings, with many more unicorn start-ups on confidential filing watchlists. These firms have been waiting for favorable conditions to enter the public market. As valuations recover and market volatility subsides, these firms are expected to capitalize on investor appetite. This backlog includes tech giants, fintech disruptors, and life sciences firms, all poised to tap into the growing demand for public equity offerings.

Technology and artificial intelligence (AI) are expected to dominate 2025 IPOs. Companies specializing in AI infrastructure, cloud computing, and data analytics are in high demand, reflecting investor enthusiasm for transformative tech. Firms like Databricks, CoreWeave, and Cerebras Systems are among the most anticipated IPO candidates. The AI boom, fueled by advancements in machine learning and enterprise adoption, is likely to drive strong interest in these listings, positioning tech as a major growth sector in the IPO market.

Read more: Why CVCs Struggle to Turn Investments into Acquisitions

Beyond tech, the life sciences sector is also set for a breakthrough year. Biotech and medical technology companies that delayed IPOs during the downturn are now looking to raise capital. Genomics, gene therapy, and digital health advances have positioned these firms for successful market debuts. Sionna and Odyssey are among the biotech companies that have revealed their plans to launch IPOs. Investor appetite for innovative healthcare solutions remains strong, making 2025 an opportune time for biopharma companies to go public.

Fintech is another sector poised for significant IPO activity. Digital banking, payments, and lending firms such as Stripe, Klarna, and Chime are widely expected to go public in 2025. The demand for fintech solutions continues to grow, with companies leveraging technology to improve financial services. Investors are particularly interested in profitable and scalable fintech firms that have established strong user bases. FinTech IPOs would generate substantial market interest and command high valuations with the right timing.

Private equity (PE)-backed companies are also preparing for a wave of IPOs. Many PE firms have been waiting for the right moment to exit their investments, and 2025 presents a favorable opportunity. Firms such as Medline Industries and SailPoint Technologies will likely go public as sponsors seek to monetize their holdings. This trend aligns with the broader rebound in corporate deal-making as private capital looks to cash in on rising public market valuations.

Macroeconomic Factors and Risks

Macroeconomic factors will play a critical role in determining the success of the 2025 IPO market. The Federal Reserve (Fed) is expected to cut interest rates, lowering the cost of capital and encouraging equity investments. A stable inflation environment and strong stock market performance will further support IPO activity. Additionally, political clarity following the US presidential election has provided confidence for companies considering public offerings. These factors create an environment conducive to a steady stream of new listings.

Read more: M&A Outlook 2025: What Big Banks Are Predicting

Despite the positive outlook, challenges remain. A resurgence of inflation or any delay in Fed rate cuts might cool investor enthusiasm. Furthermore, geopolitical shocks will likely reintroduce volatility and risk aversion, closing the IPO window. However, well-positioned firms with scalable business models and proven revenue growth are expected to perform well. Selectivity will be key, with investors focusing on businesses demonstrating resilience and long-term growth potential.

In summary, 2025 is shaping up to be a pivotal year for the US IPO market. IPO activity is expected to accelerate with a strong pipeline of companies, improving economic conditions, and investor enthusiasm returning. While risks remain, the overall sentiment is optimistic, signaling a much-needed revival in public market listings.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, ISG, and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.