Donald Trump’s election victory raises critical questions about the balance between US clean energy progress and a renewed push for fossil fuels. Known for his skepticism of climate science and his administration's withdrawal from critical agreements like the Paris Accord, Trump’s return to power raises pressing questions about the future of coordinated global strategies.

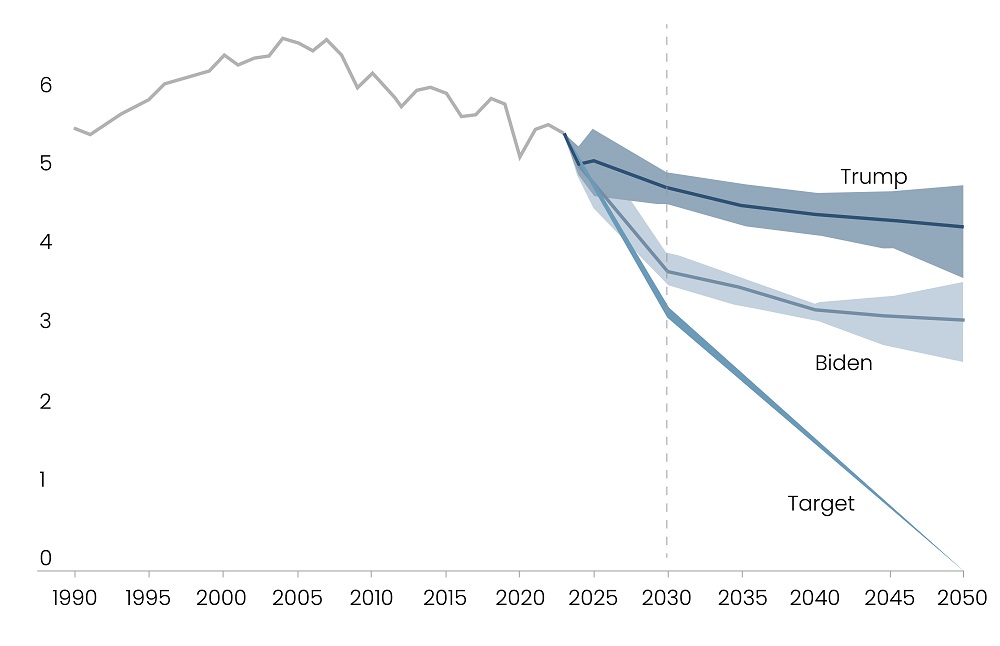

In early 2024, a Carbon Brief analysis revealed that Trump’s re-election in November will likely increase US emissions by 4 billion tons by 2030, compared to Biden’s plans. These extra emissions amount to climate damages worth $900 billion. This is due to Trump’s proposed expansion of fossil fuel production, which includes reopening restricted federal lands for drilling, approving new LNG export terminals, and reducing methane emission regulations. His stance has already created uncertainty for companies like Heliene and Princeton Nuenergy, which have paused U.S. investments until policy clarity emerges.

Figure 1: Greenhouse Gas Emissions (billion tons of CO2)

Source: Carbon Brief

Trump's election triggered a sharp sell-off in renewable energy stocks, with major companies like Sunrun, Sunnova, and First Solar falling by 27%, 43%, and 12.5%, respectively, amid fears of policy rollbacks and slowed decarbonization.

Project 2025, a conservative roadmap linked to Trump, outlines extensive sweeps in environmental safeguards, including cutting emission standards, eliminating pollution monitoring, and dismantling critical climate research agencies. Although Trump has distanced himself from the plan, its goal aligns closely with his push for fossil fuel expansion and deregulation. Advocacy organizations like the NRDC are gearing up for legal battles to combat these measures, which threaten to undermine US climate initiatives and hinder the transition to clean energy.

Read more: Dividend Recapitalization Pick up in 2024

Threats to IRA

Enacted in 2022, the Inflation Reduction Act (IRA) allocates billions in grants, loans, and tax incentives for clean energy transition. Trump has often criticized the IRA and promised to revoke unspent funds and roll back Biden's clean energy initiatives, potentially stalling progress in the sector.

Along with combating climate change, the IRA has created over 300,000 clean energy jobs in the US. In the two years post-IRA, US clean energy investments surged to $493 billion, a significant increase from $288 billion in the previous two years, according to an August 2024 report by Rhodium Group and MIT. The IRA’s integration into red-state economies and the Senate’s limited Republican majority make a full repeal unlikely. Trump is expected to target specific provisions by modifying parts he sees as unfairly favoring renewables over fossil fuels.

According to a 2024 report by the Net Zero Industrial Policy Lab at Johns Hopkins University, Trump’s proposed reversal of these policies will likely cost the US billions, leading to the closure of factories, job losses, reduced tax revenue, and up to $50 billion in forfeited exports. The report also highlights that nations with advanced clean technology industries are poised to seize US market opportunities if domestic production weakens.

COP29 and The Paris Agreement

During his first term, Trump withdrew the US from the Paris Agreement, which Biden re-entered in 2021 after he came into power. This is expected to repeat in the second term, making the US lose its credibility and hindering global efforts toward climate resilience.

Trump’s election also casts uncertainty over the 29th UN Climate Change Conference (COP29), which began on November 11, 2024, in Azerbaijan. This conference brings nations together to address climate finance and global credit standards, raising concerns about US commitment to climate action.

Read more: Unlocking M&A Potential: The Impact of Fed’s Rate Strategy

Potential Roadblocks to EV and Offshore Wind Projects

Trump plans to end the Electric Vehicle (EV) mandate and tax credit, risking setbacks to the booming US EV industry. In comparison, in early 2024, Biden’s Environmental Protection Agency passed regulations to boost EV sales while reducing emissions. Previously critical of EVs, Trump shifted his stance after Elon Musk’s endorsement, now supporting limited adoption. Musk’s influence and investments in EVs and clean energy are expected to moderate Trump's approach.

Additionally, Trump intends to halt offshore wind projects, end new lease sales, and roll back environmental rules. He has criticized offshore wind as expensive and harmful to wildlife, reversing Biden’s efforts to boost renewable energy through lease auctions and subsidies. Experts warn that reversing Biden-era policies could weaken US competitiveness against China, a global leader in clean energy technologies.

The global transition to clean energy is advancing, with renewable investments nearly doubling fossil fuels by 2024, according to the IEA June 2024 report, signaling an irreversible trend. In early November 2024, states like California passed Proposition 4, a $10 billion climate resilience bond, while voters in Washington upheld laws requiring companies to cut carbon emissions and fund climate initiatives. These actions demonstrate states' steadfast adherence to climate goals despite Trump's election. Further, long-term investors like CalSTRS remain committed to renewables, ensuring this growth persists regardless of federal policies.

Partner of choice for lower middle market-focused investment banks and private equity firms, SG Analytics provides offshore analysts with support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.

About SG Analytics

SG Analytics (SGA) is an industry-leading global data solutions firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company with a team of over 1200 employees and a presence across the U.S.A., the UK, Switzerland, Poland, and India.

Apart from being recognized by reputed firms such as Gartner, Everest Group, and ISG, SGA has been featured in the elite Deloitte Technology Fast 50 India 2023 and APAC 2024 High Growth Companies by the Financial Times & Statista.