The Los Angeles wildfires, with damages and economic losses exceeding $250 billion according to AccuWeather, mark a turning point for the insurance industry. This single event surpasses the total losses from the entire 2020 wildfire season, exposing critical gaps in risk models and policy structures. As climate risks escalate, insurers face mounting pressure to adapt or risk being overwhelmed by the financial fallout of an increasingly volatile environment.

An Unprecedented Loss for Insurance Companies

The LA wildfires have forced the evacuation of 200,000 residents and caused extensive destruction, with over 17,000 structures lost. Major fires, including the Palisades and Eaton Fire, have burned tens of thousands of acres, creating a dire situation. While saving lives remains the top priority, property insurers face immense challenges. As of January 17, 2025, Moody’s projects insured losses from these wildfires to be between $20 billion and $30 billion, highlighting the significant financial strain on the insurance industry.

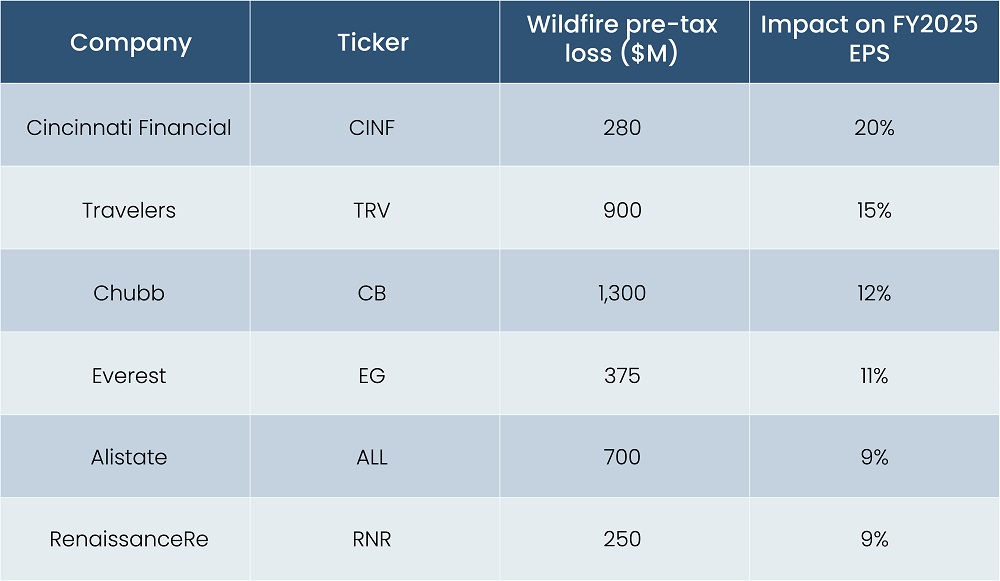

The extent of economic losses underscores the urgency of rapid response measures and long-term strategies to mitigate future wildfire impacts. BofA also estimated the impact of wildfires on the EPS of life insurers. The worst hit in terms of percentage decline will be Cincinnati Financial, with a 20% decline. In absolute terms, Chubb will experience the highest.

Read more: US Venture Capital (VC) Outlook 2025

Figure 1: BofA Estimate of LA Wildfire Impact on EPS

Source: Bank of America

Historical Impact of Wildfires on the Insurance Industry

Wildfires were historically viewed as secondary perils by insurers, posing less financial risk than storms or earthquakes. This changed after the 2016 Fort McMurray wildfire caused $3 billion in losses. In 2017, California wildfires caused $14.6 billion in losses, and the 2018 Camp Fire added $12.5 billion. Since 2017, wildfires have caused $67 billion in insured losses. The LA wildfires are expected to rival the financial and industry impact of the 1992 Hurricane Andrew, a Category 5 hurricane.

Insurer Withdrawals from the LA Market

Even before these devastating fires, California’s property insurance market, serving 40 million residents, faced challenges from growing wildfire risks, rising construction costs, and regulations limiting rate hikes. Major insurers have been withdrawing and halting new policies and renewals. This latest disaster will likely hasten the exit of insurers, drive up premiums, and further complicate access to affordable coverage for homeowners in the state.

Two of California’s largest home insurance providers, State Farm and Allstate, stopped issuing new policies in the state, citing high reinsurance costs and rising construction expenses. Insurers have consistently argued that California’s regulations hinder premium adjustments to cover escalating losses. To address this, insurance commissioner Ricardo Lara introduced rules in December allowing reinsurance costs to be passed to consumers. However, the changes have to take effect.

Low Reinsurance Rates Fuel Coverage Gaps

California’s insurance system faces critical challenges, as gaps in coverage for the LA fires will likely result in widespread losses. Despite their role in spreading risk, reinsurance companies are largely unaffected, with Citi analysts estimating they will absorb less than 3% of insured losses from the blazes. Over recent years, reinsurers have scaled back their exposure to natural catastrophe risks by increasing coverage thresholds and raising prices. This shift has pushed major insurers out of the California market, leaving many homeowners reliant on the state’s last-resort insurance program.

Read more: Healthcare Trends to Watch Out for in 2025

As a result, many homes destroyed in this month’s fires were left uninsured. The retreat of insurers and reinsurers forced numerous homeowners to rely on California’s state-backed Fair Plan, which offers coverage of up to $3 million per residential property, which is a modest amount given the high real estate values in these areas. Rebuilding costs are expected to surge due to heightened demand, and once rebuilt, new insurance premiums will likely become unaffordable for many homeowners as more companies adjust policies to account for the increased fire risk.

Start-ups Step in Amid Persistent PE Interest

The coverage gap created by the exit of legacy insurers and the devastation from the LA fires led to an accelerated demand for insurance, increasing business for a startup called Stand by 5−10x. Founded by Dan Preston, Stand leverages AI and physics-driven insights to provide property-specific wildfire mitigation recommendations, such as pruning trees or replacing wood fencing. It aims to make high-risk properties insurable and affordable by encouraging proactive risk reduction measures from homeowners. The company launched its first product and announced a $30 million funding round in mid-December 2024.

Though there has been a scale-back by insurers and reinsurers alike in the LA insurance market, it is unlikely to deter private equity (PE) firms from investing in the property and casualty (P&C) sector. This is primarily because their investments often target areas such as insurance brokers and managing general agents, which remain unaffected by the wildfires. According to Pitchbook, at the end of 2024, PE firms held 14 P&C platform companies, while investments in P&C insurance providers accounted for only a small fraction of overall PE deal activity.

Read more: Why Willow is the Next Big Thing in Tech?

Final Thoughts

Efforts to contain the wildfires continue, with Governor Newsom announcing on January 19 the deployment of additional personnel, engines, and aircraft to swiftly combat new outbreaks as extreme weather persists. As the wildfires subside, LA faces a pivotal moment in rebuilding. Insurance costs will skyrocket, leaving the market unattractive for private providers, prompting calls for innovative public-private partnerships involving insurers and mortgage lenders. The state must step in as a financial backstop, funding stricter rebuilding standards and retrofitting surviving properties. Governor pledging of billions and streamlined rebuilding efforts are steps in the right direction. However, this disaster is a stark reminder that political leaders, public authorities, and businesses must accelerate climate adaptation before the next crisis strikes.

Partner of choice for lower middle market-focused investment banks and private equity firms, SG Analytics, provides offshore analysts with support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.

About SG Analytics

SG Analytics (SGA) is an industry-leading global data solutions firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company with a team of over 1200 employees and a presence across the U.S.A., the UK, Switzerland, Poland, and India.

Apart from being recognized by reputed firms such as Gartner, Everest Group, and ISG, SGA has been featured in the elite Deloitte Technology Fast 50 India 2023 and APAC 2024 High Growth Companies by the Financial Times & Statista.