As the COP28 summit proceeds into its second week, the instrumental role of private investments in sustainable climate finance has emerged as a central theme. Public investments alone are insufficient to combat the growing environmental challenges as the world falls behind in attaining its climate change goals. To tackle funding challenges and bridge the investment gap, multilateral development banks (MDB) and other international financial institutions are looking to create incentives and remove operational barriers to attract private funds.

The ongoing COP28 is witnessing substantial progress in terms of deals and pledges. For instance, the first four days saw more than $57 billion in pledges and declarations. Despite such promising commitments, there’s still a major gap in the funding needed to implement technologies for combating the climate crisis. For instance, the stark disparity between the annual commitment of $100 billion from donor countries and the imperative requirement of over $2.4 trillion per year by 2030 underscores the huge deficit in funding for the climate transition, as reported by the World Bank.

A formidable solution is concerted efforts with the private sector to reform the current global financial architecture to better align with the world’s climate goals, as highlighted by the President of COP28. Private sector funding to combat climate change has faced several obstacles, partly in the form of a lack of recognition and action from MDBs to remove barriers and mobilize capital and partly due to the risk-averse nature of MDBs. Historically, MDBs have maintained a private capital mobilization ratio of approximately $0.6 per dollar of their commitment, which should ideally increase to $1.5-2 per dollar per Independent Expert Group at the G20 summit this year. Recognizing the crucial need for private financing, MDBs and financial institutions are creating incentives and removing regulatory and operational hurdles for private financiers to step in.

Read more: Investment Outlook: Private Equity Market Trends 2023

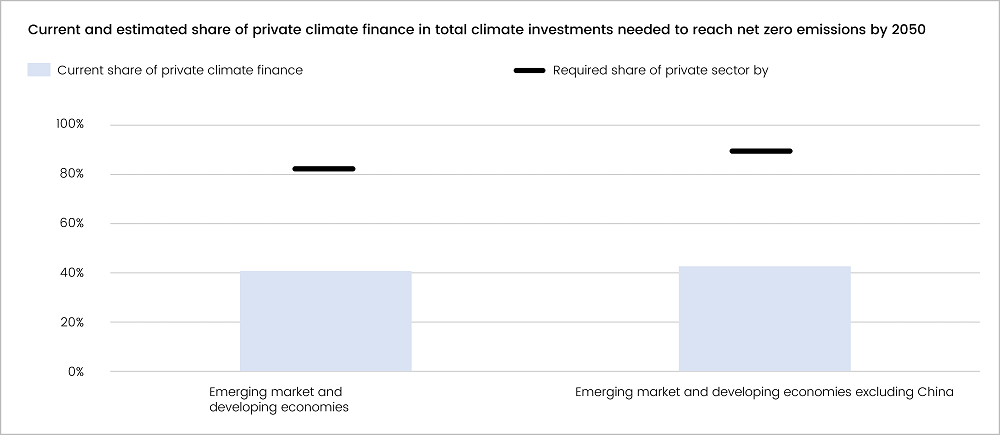

Figure 1: Estimated Increase in Share of Private Finance Required to Achieve Net-Zero by 2050

Source: IMF

Incentivizing Private Finance for Climate Change

A focal point in the summit has been blended finance, the strategic deployment of public development financing, and private capital to emerging and frontier markets. The solution provides concessional public funds to de-risk investment projects and mobilize private capital. Financial institutions hedge the private investors’ risk by favorable senior-junior positions, securing equity claims, offering swaps and forwards to minimize currency risk, and providing guarantees in case of default. At COP28, the Green Climate Fund, Allied Climate Partners, and Allianz Global Investors collectively announced the mobilization of $5 billion through several unique blended finance structures. This commitment is poised to unlock more than $20 billion, a step forward on the path toward climate transition. Blackrock partnered with the UAE’s private investment climate vehicle to invest $2 billion in climate opportunities. Nordic countries and the United States launched the Investment Mobilization Collaboration Arrangement, a new blended finance collaboration seeking to raise $500m in private capital for climate adaptation with a particular focus on Africa.

Green Bonds, bonds sold to raise funds exclusively to finance environmental projects, are another avenue availed to stream in private funding. To incentivize purchases, issuers, typically federal bodies, provide tax incentives in the form of tax credits, direct subsidies, and tax exemptions. The US Federal Government Clean Renewable Energy Bonds and Qualified Energy Conservation Bonds program allows the issuance of taxable bonds where 70% of the coupon from the municipal is provided by a tax credit or subsidy to the bondholder. By the end of 2023, their issuance is estimated to reach $1 trillion, per S&P Global.

At COP28, the US government, including USAID and the US Presidential initiative Prosper Africa, unveiled a strategic investment in a public-private partnership, giving rise to the Green Guarantee Company (GGC). This marks the inception of the first privately operated guarantee company dedicated to propelling green bonds and loans in partner countries, with a specific focus on Africa, Asia, and Latin America. Pending final documentation, the United States, through USAID, the State Department, and Prosper Africa, in collaboration with the UK’s Foreign Commonwealth and Development Office, the Green Climate Fund, Norfund, and the Nigerian Sovereign Investment Authority, is poised to contribute to GGC's initial balance sheet, starting at $100 million. Armed with this substantial financial foundation, the Green Guarantee Company is anticipated to unlock an estimated $1 billion in new mainstream private capital for climate finance by 2024.

Read more: The Evolving Business Landscape and Future of Generative AI.

Looking Ahead: The Future of Private Investments to Facilitate Sustainable Change

Climate tech venture funding saw a year-over-year increase of 89% in 2022, per Bloomberg. In spite of a dip in 2023, the strategic initiatives being discussed in COP28 are poised to propel climate and clean tech investments in the upcoming years. Recognizing the inadequacy of public finance in executing requisite projects to address escalating climate concerns, the COP28 summit underscores the pivotal role of partnerships with private financiers. This imperative is being actively incentivized through the provision of blended financial instruments, the issuance of green bonds, and the formation of GGC. The systematic and structured channeling of private capital through these initiatives signifies a significant leap forward in achieving net-zero goals.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.