RBI – Raghuram Rajan surprises by not surprising in monetary policy

Indian Finance Minister Arun Jaitley had been sowing the seeds of low interest rates by unveiling the Union Budget 2016-17. Thus, the financial markets were expecting a cut in repo rates following right on the heels. Most analysts had forecasted a 25bps rate cut as part of the Reserve Bank of India’s (RBI) first bimonthly monetary policy of FY2016-17. Since surprises are not a surprise with RBI governor Raghuram Rajan, some participants predicted even a 50bps cut. However, as it turned out, the RBI surprised by focusing on rate transmission rather than being a market cheerleader.

RBI’s macroeconomic assessment: Domestically balancing the effects of global imbalance

Both emerging markets economies (EMEs) and advanced economies (AE) are dealing with sluggish growth. Although the risk to recovery has eased in some AEs, the major EMEs continue to face various issues. Weak demand growth and inflation pressure are continuously dragging the EME sector.

On the other hand, the RBI’s assessment implied that India looks fundamentally strong on the domestic front. The recently softening CPI inflation moderated gross value added (GVA) in agriculture and allied activities. Further, the manufacturing and the expanding services sectors continue to boost economic sentiment.

On the trading front, the rate of contraction in exports improved in addition to the reduced imports. The RBI data suggested that the foreign portfolio investors, who were net sellers in debt and equity till February 2016, resumed their net investment position.

‘Aye Aye Captain’, the Indian Banks’ reply to RBI Governor’s ‘Deep Surgery’ command

The RBI governor has focussed on a ‘deep surgery’ of Indian banks with a thorough clean-up of their assets. The profitability of the banking sector has been hit over the past nine months and is expected to remain affected in the current financial year. Rajan reiterated the importance of a ‘deep surgery’ in his speech and also appreciated the efforts undertaken till date.

The RBI introduced the marginal cost of lending rate (MCLR) in order to facilitate a quick transfer of policy rate changes in changes of lending rates. Banks are mandated to follow the MCLA from April 1, 2016.

However, the RBI did not only increase the pressure on the banking sector. It also eased some regulations. The daily mandated requirement of CRR has been reduced from 95% to 90% effective April 16, 2016. This CRR reduction should help banks manage their CRR cash balances more dynamically and have more than adequate liquidity for lending.

RBI’s balancing act for the Indian bond market

The Union Budget boosted Indian bond market sentiment. The confirmation of the fiscal deficit targets indicated low government borrowing. This increased the chances of the RBI maintaining the buoyant mood through a rate cut. Furthermore, the government’s 10-year generic bond has been tightening since the Union Budget announcement and continued to do so after the monetary policy announcement.

Additionally, the introduction of interest rate futures should bring a smile on the faces of Indian bond market traders. The bond purchase of INR150bn in April 2016 through open market operations was aiming to ease market liquidity, although a fresh supply of central and state government bonds and issuances from UDAY schemes will partly balance this initiative. However, for now, the positive bond market sentiment should continue on the back of RBI’s open market operations. It is plausible to expect a further tightening in yields in the coming months.

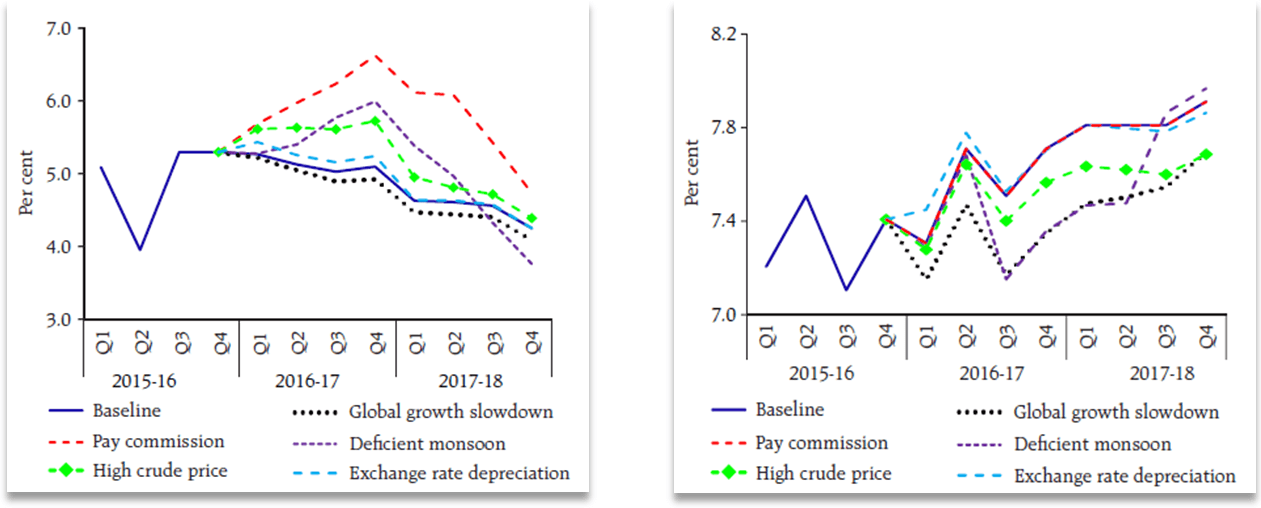

Source: RBI’s Monetary policy document

What’s Next? Rajan looking at external factors to guide him for policy decisions

Despite recent activities, the markets are asking for more from the RBI Governor, who has not ruled out additional easing. However, he has also specified that any further rate cut depends on this year’s monsoon. The RBI will also consider the trajectory of the CPI, and actions initiated by various banks to pass on previous RBI rate cuts. This indicates that the ball is currently not in RBI’s court.

After two consecutive years of monsoon deficit, the stakes are even higher this year. If the rain deficit persists this year, then there is a higher probability of CPI inflation taking an upward trajectory. As per the RBI’s estimate, inflation could rise 80-100bps from the baseline.

The RBI’s macroeconomic assessment is that the main risk to high CPI inflation stems from the effects of the 7th pay commission and the implementation of One Rank One Pension (OROP) – see the chart. The markets expect a further 25-50bps rate cut in the remainder of FY2016-17. Although it is not going to be easy for the RBI to execute such a rate cut, we are well aware that the RBI governor is famous for springing surprises.