The US retail industry is undergoing significant shifts in 2025, with evolving consumer behavior, technological advancements, and macroeconomic changes redefining the landscape. From AI-driven automation to omnichannel expansion, retailers adapt to new challenges while seizing growth opportunities. Here are five major trends that will shape the industry this year.

AI and Automation Are Transforming Retail Operations

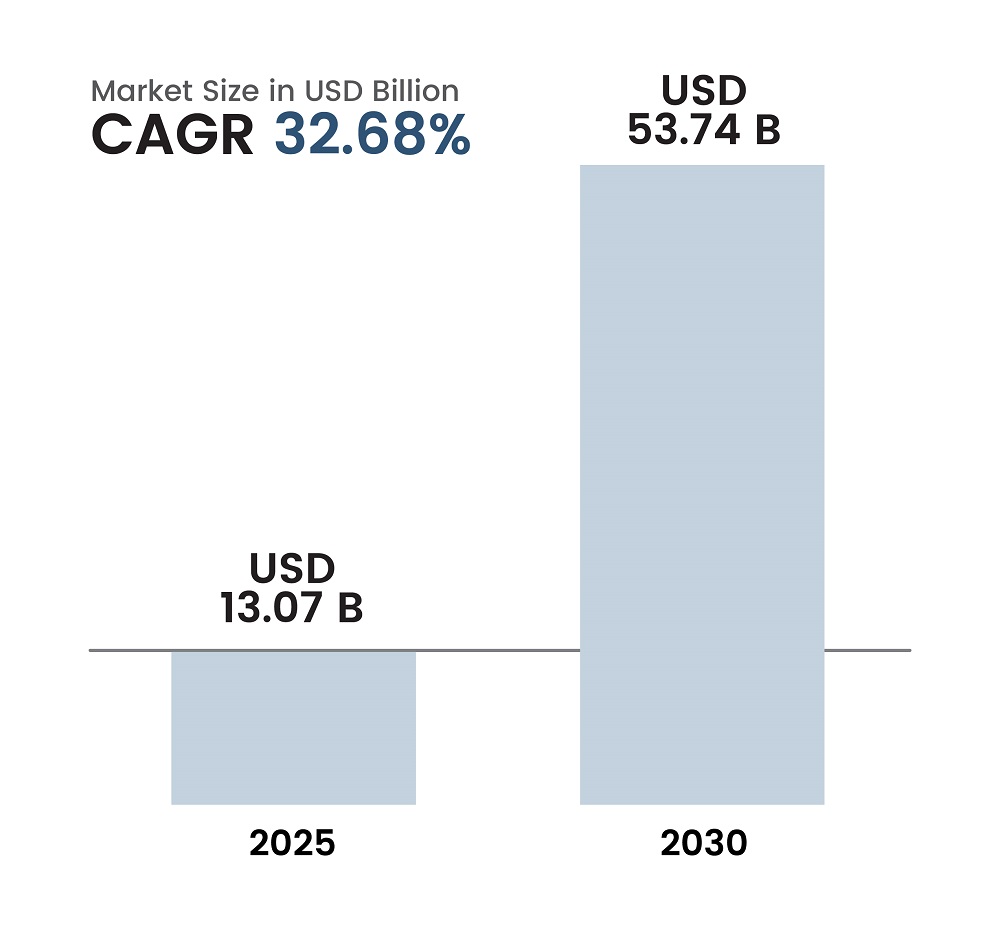

AI will revolutionize the retail industry in 2025, moving beyond experimentation to become an essential tool for optimizing operations. The AI in the retail industry is expected to grow from $13.07 billion in 2025 to $53.74 billion by 2030, at a CAGR of 32.68%, as per Mordor Intelligence. Retailers use AI-driven demand forecasting, inventory management, and automated customer service tools to reduce inefficiencies and boost sales. Additionally, AI-powered chatbots deployed during the 2024 holiday shopping season helped increase conversion rates by 15%.

Figure 1: AI in the Retail Industry

Source: Mordor Intelligence

Automation also improves efficiency in supply chain and store operations. AI-powered checkout systems and RFID-enabled inventory tracking are streamlining logistics. Retailers like H&M leverage AI to optimize store layouts and track product movement. In warehouses, robotics and AI are reducing fulfillment times and labor costs, setting new standards for efficiency in retail logistics.

Read more: DeepSeek Takes on the Silicon Valley

Consumers Demand More Value Amid Economic Uncertainty

American consumers are expected to remain highly price-sensitive in 2025. According to Deloitte's baseline forecast, while the US economy is likely to expand at a moderate pace of 2.4%, household budgets are still strained by rising grocery prices. Shoppers are prioritizing value, shifting to private-label brands, discount retailers, and bulk purchases. Moreover, promotional shopping is becoming more common, with events including Black Friday and Cyber Monday driving record participation.

Two-thirds of retail executives expect price-conscious consumers to shop more frequently but with smaller basket sizes, as per the 2024 Deloitte US Retail Buyer survey. Retailers are revamping loyalty programs and leveraging AI-driven analytics to optimize pricing and offer targeted deals to retain such cost-conscious customers. The challenge for retailers is balancing affordability with profitability while ensuring they do not compromise customer experience.

The Rise of RMNs and Alternative Revenue Streams

Big retailers like Amazon, Walmart, and Instacart are expanding their ad platforms and increasingly turning to advertising as a key revenue source through retail media networks (RMNs). In 3Q24, Amazon generated $14.3 billion in revenue from its advertising business with 18.8% y-o-y growth. Its move to provide ad tools as a service has increased competition for smaller players such as Criteo. Moreover, Walmart’s acquisition of Vizio highlights how retailers invest in digital advertising infrastructure to drive growth.

With traditional retail margins under pressure, retailers are exploring alternative revenue streams, such as subscription models and third-party logistics services. In August 2024, Walmart started offering its logistics to sellers outside their marketplace. Those who successfully integrate retail media and data monetization into their business models will gain a competitive edge in 2025.

Read more: Data Center Outlook 2025

Omnichannel Retail has Become the Standard

The distinction between online as well as offline shopping is disappearing as omnichannel strategies become the norm. Consumers today demand a seamless shopping experience across physical stores, mobile apps, and e-commerce platforms. Digital-first brands are launching brick-and-mortar locations to build stronger customer engagement, while traditional retailers are integrating advanced technology into stores to improve personalization and convenience.

Walmart has integrated technology to connect in-store and online shopping. Geo-fencing detects customers' loyalty accounts when they arrive for online order pickups, and the ‘Scan & Go’ feature allows Walmart+ members to scan items with their phones for faster checkout. Similarly, PetSmart integrated physical stores with its online platform by using brick-and-mortar locations for online order fulfillment.

Shrink Reduction and Retail Security Take Center Stage

Retail shrink continues to be a major challenge for retailers in 2025. Organized retail crime and self-checkout theft have increased, pushing companies to invest in security measures like AI-powered surveillance, RFID tracking, and dynamic shelf replenishment. The rise of cashless stores and frictionless checkout systems has also led to businesses adopting predictive analytics to detect suspicious activity in real time. Some retailers are using facial recognition and biometric authentication to enhance security. As shrink-related losses eat into profits, retailers that invest in cutting-edge security solutions will protect their bottom line while fostering consumer trust.

Read more: Tech Industry Outlook 2025: What’s on the Horizon?

Partner of choice for lower middle market-focused investment banks and private equity firms, SG Analytics provides offshore analysts with support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals most efficiently.

About SG Analytics

SG Analytics (SGA) is an industry-leading global data solutions firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company with a team of over 1200 employees and a presence across the U.S.A., the UK, Switzerland, Poland, and India.

Apart from being recognized by reputed firms such as Gartner, Everest Group, and ISG, SGA has been featured in the elite Deloitte Technology Fast 50 India 2023 and APAC 2024 High Growth Companies by the Financial Times & Statista.