In today's rapidly evolving global landscape, organizations cannot dismiss sustainability as just an industry trend. The growing focus on ESG and all aspects of sustainability implies that businesses must recognize its tangible impact on their bottom line.

But how do sustainability and profits interlink?

And why do businesses need to invest in environmentally and socially responsible practices?

Redefining ROI in Terms of Sustainability

The return on investment (ROI) in sustainability is more complex than ever before. Standard ROI metrics often overlook critical sources of value that shape a company’s future growth trajectory. This shortcoming leads to an ill-assessment of the true benefits of sustainability investments.

Most publicly listed companies with brand equity recognize the notion that the single-minded pursuit of profit and shareholder return at the expense of society and the environment is a business standard ready for reinvention. By redefining the tools used to make financial decisions, organizations can incorporate data that underscores the value of long-term strategic initiatives. This shift in focus will help recognize the significant benefits of sustainability, including more efficient value chains and prevention of potentially catastrophic costs due to climate inaction.

Read more: The Importance of Sustainable Data Centers in the Age of AI

Key ROI metrics organizations need to adopt to prove the value of sustainability to their brand and accelerate their progress.

- Companies are recognizing the value of sustainability for the communities they serve and for the environment. They understand the role of sustainability in promoting innovation, competitive advantage, long-term brand value, and corporate profitability.

- Measuring the ROI of sustainability is essential because what is measured can be managed and funded. Measurement is the key to a long-term commitment to sustainability.

- Measuring the return on sustainability investment is substantially the same as measuring the ROI of any business activity. This involves demonstrating how undertaken initiatives are effective against intended strategic goals.

Effective measurement is within the reach of all organizations that value information as a driver for business insights and growth. They can adopt a conceptually simple framework of measurement to leverage or extend their existing measurement tools. This involves:

- Measuring the return on Brand through the impact of consumer preference

- Measuring the return on Talent through the impact on employee retention

- Measuring the return on Reputation when the program receives recognition and promotes positive sentiment

- Measuring the financial return from the cost of investing in the sustainability program against strategically chosen key indicators

Read more: Making Progress in Sustainability: Setting Realistic Paths for Growth

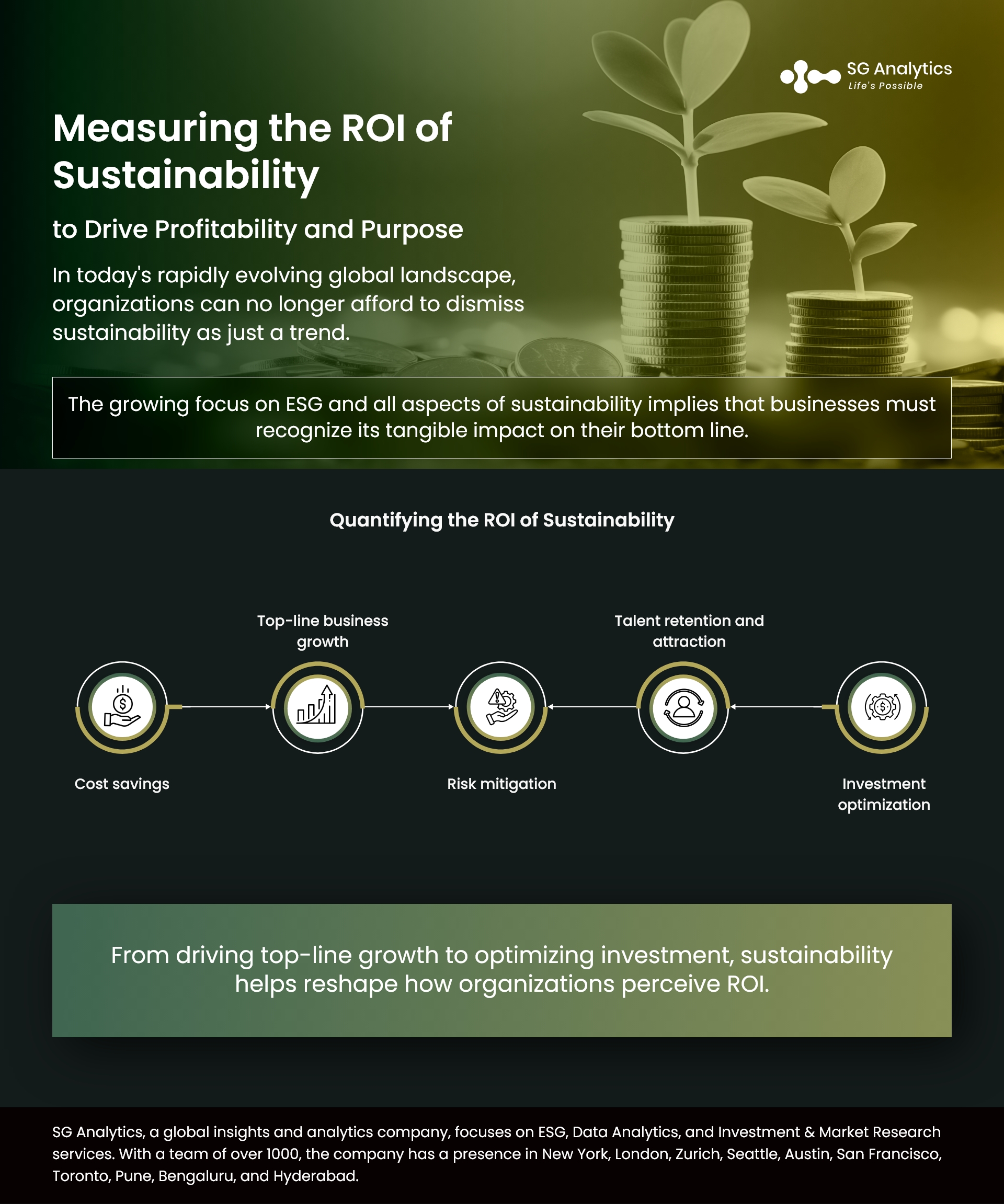

Quantifying the ROI of Sustainability

Embracing sustainability does not imply sacrificing profitability. Beyond financial returns, the ROI of sustainability encloses reputational value, brand loyalty, enhanced productivity, increased resilience, and improved employee satisfaction. These intangible returns help significantly contribute to an organization’s overall value, thus demonstrating the far-reaching benefits of sustainability investments.

-

Cost Savings

Sustainable organizations have a lower unit-cost structure. By adopting sustainable practices, they can directly translate them into significant cost reductions across different departments, such as:

- Waste reduction by highlighting waste management.

- Promoting energy-efficient buildings and green maintenance practices.

- Optimizing production and logistics processes.

- Adopting green technologies.

- Reducing business travel footprint by prioritizing virtual meetings.

-

Top-line Business Growth

Sustainability is not just about saving but about earning, too. Sustainable brands grow faster as they appeal to consumers’ growing demand for responsible products, leading to heightened customer loyalty. Championing green initiatives further helps boost brand reputation, prioritizes sustainability, and enables the organization to differentiate itself in crowded markets.

-

Risk Mitigation

Addressing ESG concerns proactively can help reduce the risk of disciplinary outcomes and reputational damage from related incidents. Sustainability is a form of risk mitigation that helps reduce the chances of litigation and provides proactive solutions to future regulatory challenges. Routine sustainability reporting also assists in revealing otherwise overlooked issues and provides valuable insights for long-term strategic planning.

-

Talent Retention and Attraction

Sustainability initiatives have a profound impact on employees. Today, younger generations demand purpose in their work, emphasizing the significance of a strong ESG proposition. Recent research highlighted that the younger population is rejecting job offers due to the employer’s weak ESG commitments. Organizations that offer meaningful roles anchored in sustainability are more likely to attract a talent pool, leading to higher productivity and engagement.

Read more: Digital Transformation is Navigating Sustainable Business Growth. How?

-

Investment Optimization

Holding onto unsustainable assets related to the fossil fuel industry can be risky. This also has a rising potential in ESG-related investments. A recent Gartner study predicted that by 2026, sustainability metrics in investment plans will become a standard for CFOs. They anticipate that 60% of public organizations will integrate sustainability metrics as a pivotal component of their ROI analysis.

How to Approach the ROI of an ESG Strategy?

Given the expansive benefits of sustainability, businesses need to develop effective strategies for maximizing their return. Let's explore some key considerations when creating your ESG strategy:

- Focusing on managing risk: Anticipating external events will likely negatively impact finances.

- Thinking long-term: Sustainability is an investment in the future; immediate returns are not always evident.

- Measuring the impact of projects to identify and understand cost savings and efficiency gains.

- Accepting the upfront costs: The return on investments, such as materiality assessments and target-setting, can be challenging to quantify but help in laying the groundwork for future gains.

- Acknowledging ambiguity: Certain benefits, such as enhanced working conditions leading to employee satisfaction, may not have direct numeric value but are still crucial.

- Proactively responding to external pressures from consumers and investors by integrating those factors into organizational priorities.

Read more: Exploring ESG Investment Options: Ways Your Business Portfolio Can Save the Planet

In Conclusion

Embracing sustainability is not just morally right; it is imperative for strategic business.

For environmental efforts to pay off financially, organizations need to take into consideration a long-term view and invest in cost effective sustainable approaches that lead to lower costs and better returns. By adding ESG ratings, organizations can further improve their relationships with shareholders, boost investments, achieve lower costs of capital, and make more effective strategic decisions.

There is a widespread understanding that sustainability and profitability can coexist to move towards a greener world, which will create new business opportunities and redistribute capital flows. With a strong ESG proposition in place, businesses can enter new markets and expand into existing ones. This will further help improve the return on investment by allocating capital to more promising and sustainable opportunities.

From driving top-line growth to optimizing existing as well as new investments, sustainability helps reshape how organizations perceive ROI. With the ESG metrics becoming more transparent and integrated into investment evaluations, the business world will undoubtedly witness more green, both environmentally and financially.

A leader in ESG Services, SG Analytics offers bespoke sustainability consulting services and research support for informed decision-making. Contact us today if you are searching for an efficient ESG (Environmental, Social, and Governance) integration and management solution provider to boost your sustainable performance.

About SG Analytics

SG Analytics (SGA) is an industry-leading global data solutions firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company with a team of over 1200 employees and a presence across the U.S.A., the UK, Switzerland, Poland, and India.

Apart from being recognized by reputed firms such as Gartner, Everest Group, and ISG, SGA has been featured in the elite Deloitte Technology Fast 50 India 2023 and APAC 2024 High Growth Companies by the Financial Times & Statist.