From the revival of cryptocurrency markets to increased adoption of robotics, 2025 is set to redefine technology. These trends will transform industries, drive innovation, and pave the way for a more connected future.

Resurgence in Crypto VC Investments

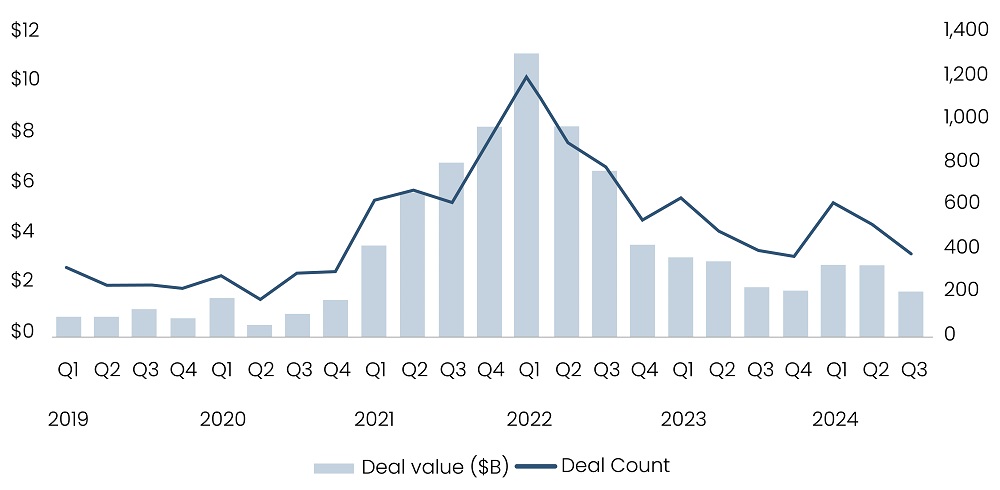

The cryptocurrency market is set for a resurgence in 2025, with venture capital (VC) investments projected to exceed $18 billion annually, as per PitchBook. Quarterly funding levels are expected to surpass $5 billion, doubling the average in the last two years. This uptick comes after a prolonged slowdown, during which annual funding stagnated between $9 billion and $10 billion, as per PitchBook. This is due to regulatory challenges, macroeconomic uncertainty, and notable collapses like FTX. In 2025, the involvement of established financial institutions like BlackRock and Goldman Sachs is expected to restore investor confidence, drive mainstream adoption, encourage other institutional players to invest in crypto startups, and position crypto as a key layer for digital transformation.

Figure 1: Crypto VC Deal Activity by Quarter

Source: PitchBook, as of September 30, 2024

Read more: AI in National Security: Protector or Threat?

Traditional VCs, which largely retreated during the bear market, are anticipated to return, focusing on startups that offer measurable traction and clear profitability pathways. The stabilization of markets, the approval of regulated products like Bitcoin ETFs, and emerging use cases in decentralized finance and Web3 are expected to fuel this shift. Late-stage deals will likely dominate, with increased competition driving larger funding rounds and valuations. Coupled with macroeconomic tailwinds like declining interest rates and improved liquidity, the alignment between public token prices and venture funding is expected to create a virtuous growth cycle, propelling the crypto ecosystem into a new era of innovation.

Rise in M&A Activity Expected in RegTech

According to Pitchbook, regulation technology (regtech) is the least-funded segment of enterprise fintech, securing just $325.9 million in VC funding in the trailing 12 months as of Q324, only 1.9% of the $16.9 billion allocated to the sector. Despite rising compliance and risk management needs, fueled by banking-as-a-service (BaaS) failures and AI integration, regtech’s limited market size and constrained profit pools continue to deter investors. However, regtech is poised for increased M&A activity in 2025.

This will be mainly driven by corporates and bank tech firms seeking to enhance capabilities in areas like fraud prevention and accelerate AI-driven compliance solutions. Companies such as Visa, Mastercard, and Plaid are likely acquirers, following recent deals like Visa’s $925 million purchase of Featurespace and Mastercard’s $2.7 billion acquisition of Recorded Future in December. According to Pitchbook, in the first three quarters of 2024, regtech accounted for 13.6% of enterprise fintech VC exits by count, with disclosed values totaling $2 billion. This signals a growing appetite for regtech M&A, which will further accelerate as fintech dealmaking recovers.

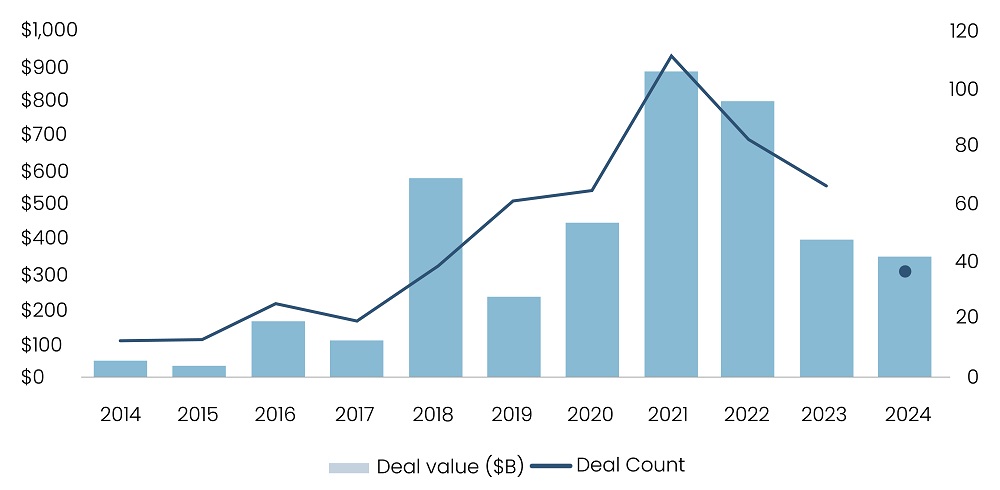

Adoption of Sustainable Packaging to Drive Growth in Foodtech

The food tech outlook for 2025 highlights a significant shift toward sustainable food packaging, driven by corporate commitments and technological advancements. Major food companies are pledging to make packaging recyclable, compostable, or reusable by 2025, fueling innovation in materials science and packaging technologies. Biodegradable polymers and compostable materials are becoming more prominent as companies like NatureWorks develop cost-effective, eco-friendly alternatives. Smart packaging solutions that enhance food freshness monitoring and reduce waste are also gaining traction, addressing both environmental and functional needs.

Figure 2: Sustainable packing VC deal activity

Source: PitchBook, as of September 30, 2024

Read more: Charting New Horizons in Private Credit

Precedence Research projects the global eco-friendly food packaging market to grow at a 7.6% compound annual growth rate (CAGR), reaching $505.4 billion by 2034. This growth reflects increasing investments in sustainable materials and packaging designs, fueled by the rise in e-commerce and food delivery demand.

VC Mega-Exits to Drive Growth in Application Security and Security Operations

The information security sector is poised for a major shift in 2025, with application security and security operations expected to generate high-profile mega-exits exceeding $1 billion, as per PitchBook. Historically, these segments have lagged behind others, such as endpoint security and identity management, which saw significant exits in past years. Companies like Arctic Wolf, Armis, and Sayk are strong IPO candidates, with Arctic Wolf leading in revenue scale and Armis making strides with an expanded product suite. These developments are likely to attract robust VC interest and drive IPO activity.

Acquisitions remain a key trend, with legacy vendors and private equity (PE) firms continuing to eye promising startups. However, challenges like slowing revenue growth, failed exits, and integration issues, as seen with Lacework, will likely temper enthusiasm. Despite these risks, a more business-friendly regulatory environment and broader investor confidence will likely create opportunities for transformative exits across application and security operations in 2025.

Increased Warehouse Robotics Adoption to Drive Industry Growth

According to PitchBook, warehouse robotics witnessed significant VC inflows in late 2024. Notable investments included Pickle Robot's $50 million Series B of November, fueling the deployment of over 30 robotic unloading systems in 2025. Additionally, Dexory raised $80 million in October 2024 for its AMRs (autonomous mobile robots) for automated data collection and inventory tracking. Companies are increasingly adopting robotics to address labor shortages and accommodate rising order volumes. The sector shows strong promise for startups specializing in collaborative robotics and AI-powered solutions. Furthermore, collaborations between startups and established companies are becoming more prevalent, facilitating the integration of robotics into existing operations.

Read more: Trump’s Tariff Threat: Will it Strengthen the US or Strain the World

Open-Source Models to Lead the Commoditization of LLMs

The commoditization of large language models (LLMs) is poised to gain momentum in 2025, fueled by the growing popularity of open-source models like Meta’s Llama 3.1, which matches the performance of closed models such as OpenAI’s GPT-4. Open-source models empower enterprises with greater control, enabling on-site deployment and customization. This shift is expected to reduce reliance on costly closed-source models and drive significant price drops. As enterprises increasingly adopt open-source solutions, cloud providers will face mounting pressure to lower inference costs, making AI development more accessible and cost-efficient for businesses worldwide.

Trade Barriers to Boost Supply Chain Tech Solutions

The decline of the free-trade regime shapes the outlook for supply chain technology in 2025, with rising trade barriers and tariff threats driving significant shifts. The US has increasingly turned to tariffs and trade restrictions as policy tools, impacting global trade flows and supply chain stability. Companies reliant on global supply chains will face growing uncertainty and need enhanced visibility and tracking solutions to adapt. Tools to trace product provenance, optimize sourcing, and manage alternative partners from companies such as project44 and Fourkites will see heightened demand in 2025 amid these challenges.

Partner of choice for lower middle market-focused investment banks and private equity firms, SG Analytics provides offshore analysts with support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.

About SG Analytics

SG Analytics (SGA) is an industry-leading global data solutions firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company with a team of over 1200 employees and a presence across the U.S.A., the UK, Switzerland, Poland, and India.

Apart from being recognized by reputed firms such as Gartner, Everest Group, and ISG, SGA has been featured in the elite Deloitte Technology Fast 50 India 2023 and APAC 2024 High Growth Companies by the Financial Times & Statista.