The world’s reliance on tech innovations has not lost any momentum. In fact, the COVID-19 pandemic accelerated digitalization and innovation, and it is only continuing. With the increase in investment in emerging technologies, organizations are identifying the global interconnectedness of technology and investment. Russia’s invasion of Ukraine in 2022 and a global economic downturn are still posing a major challenge to technological advancement in 2023.

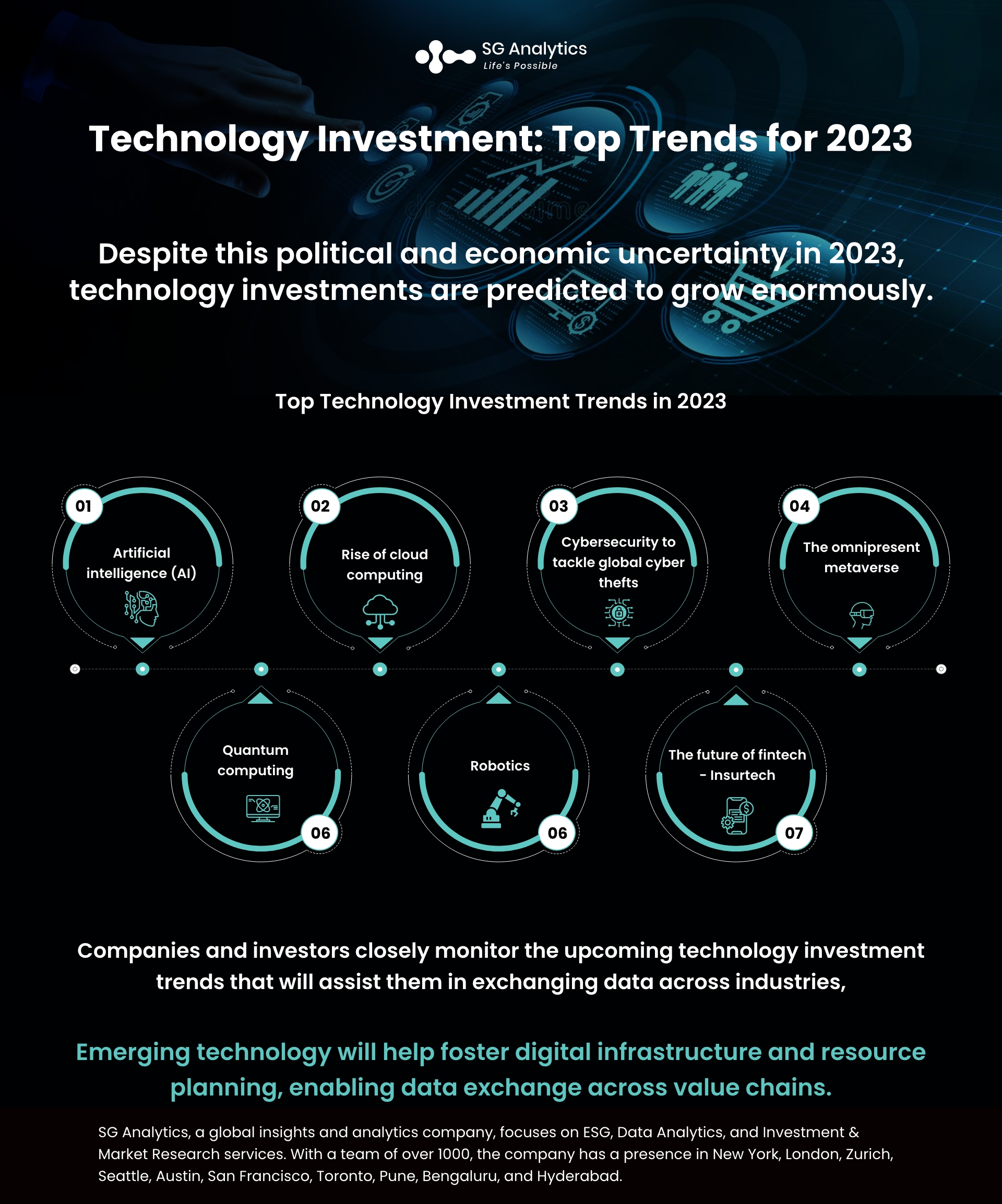

However, despite this political and economic uncertainty in 2023, technology investments are predicted to grow enormously, underlining a common belief that the greatest innovations across the globe will be born in times of great economic and political stress.

Owing to the current economic climate, business leaders are faced with an even greater challenge to plan and commit to critical strategies that imbibe key technology trends. These trends offer a necessary guide for organizations to sail through the unstable future and help them identify strategies to transition with the changing tides. The leading technology investment trends will revolve around AI, fintech, cloud, cybersecurity, metaverse, robotics, IoT, and quantum computing. Knowing which technology investments will benefit the enterprise will enable them to take strides toward substantial growth more confidently. Here are some of the top technology investment areas to keep an eye on in 2023.

Read more: Outlook 2023: Top Strategic Technology Challenges

Top Technology Investment Trends in 2023

-

Artificial Intelligence (AI)

The artificial intelligence (AI) market will be worth $93bn in 2023, up 12% from 2022, as per GlobalData’s 2023 TMT Predictions. As one of the most anticipated emerging technologies, artificial intelligence (AI) holds the potential to greatly accelerate and enhance other technologies, such as the internet of things (IoT), robotics, and quantum computing software. Artificial intelligence is predicted to live up to all its promises in 2023 and beyond.

While the US and China have been leading the AI market lead, based on the volume of AI patents filed from 2016 to 2022, the sector is facing an existential threat from an uncertain supply of advanced semiconductor chips. The AI industry can only develop if the semiconductor industry is able to resolve its global supply chain issues.

-

Rise of Cloud Computing

The global cloud computing sector is estimated to be worth $734bn by the end of the year 2023. Businesses are continuing to outsource their IT infrastructure to the cloud to achieve cost reduction along with greater flexibility. Due to its growing importance in enterprise operations, cloud computing is set to play a key driver, when coupled with AI, for emerging technologies, including robotics and IoT. However, organizations will have to facilitate continuous access to a large amount of data for smooth operations.

-

Cybersecurity to Tackle the Rising Global Cyber thefts

The global cybersecurity sector is likely to grow from $125.5bn in 2020 to $198bn by the year 2025 at a compound annual growth rate (CAGR) of 9.5%. But cyber professionals are reaching their breaking point. In 2023 and beyond, organizations will witness new challenges due to the rise in the number of cybercrime as well as the growing reliance on cybersecurity professionals.

Organizations are also likely to witness cybersecurity professionals taking an increasingly zero-trust approach to external data as cyber-attacks intensify. Artificial intelligence will aid in the fight against cyberattacks, along with offering stricter advice on paying ransoms. As per the data published by the EU’s Agency for Cybersecurity, the ransomware business model has been growing exponentially in the past decade and is set to cost more than $10trn by 2025.

Read more: Global Business Trends Outlook 2023

-

The Omnipresent Metaverse

Recent research has highlighted that the metaverse is estimated to be worth $376bn by 2025. With the metaverse still garnering all the limelight and enjoying its position as the top trend to watch in 2023, investor enthusiasm for the consumer metaverse is predicted to weaken throughout 2023 as economic conditions become more challenging.

The promised metaverse transformative effect will only be realized by organizations and investors when it becomes regulated and interoperable. But this will not occur in 2023. With the enterprise metaverse still in its initial stage and evolving to find utility in the concept of digital twinning, businesses are also exploring new avenues to include this technology trend for further collaboration as well as enterprise design, product simulation, risk assessment, and process optimization.

-

Quantum Computing

The quantum computing industry, by the year 2025, will be worth $5bn, with commercial quantum computing set to commence in 2027. With quantum computing technology still advancing in 2023 and technology standards being established, organizations will witness new momentum in the integration of quantum computing into their operations. Enterprises are unlikely to buy quantum computers. Instead, they will solely rely on the growing quantum as a service (QaaS) model. Tech organizations, government institutions, and defense companies will be making the purchase for QaaS commercialization, research, and development.

-

The Future of Fintech - Insurtech

Technology is in the further stages of development for the insurance sector. Referred to as insurtech, it offers the proliferation and use of software applications. With the fintech industry growing, they are experiencing a significant number of businesses emerging with meaningful revenue growth and profitability.

Investors are now expressing their interest in insurtech emerging as the next fintech. The Insurtech technology incorporates data analysis, the Internet of Things (IoT), and artificial intelligence (AI) and aims to facilitate cost efficiencies in processing claims, along with evaluating risks and policies. With the adoption of open banking and payments apps becoming mainstream, fintech is emerging as the poster child to offer the value of networks that enable organizations to connect and manage different data sources and forms. Fintech enterprises are also offering tailored technology solutions in verticals like insurance and are betting that apps and online platforms to catch on to the existing consumer banking and financial services.

Read more: The Next Tech Time Warp: How Will Artificial Intelligence Possibly Change the World?

-

Robotics

The robotics industry, which was initially valued at $45.3bn in 2020, is now expected to grow at a CAGR of 29% to $568bn by the year 2030, as per the reports issued by the GlobalData research. The estimate is inclusive of the current rising inflation, supply chain disruption, and the Russia-Ukraine conflict that are still fueling the automation revolution. The service robot market is likely to generate $55.2bn of revenue in 2023, the GlobalData report stated. With organizations integrating robotics into their everyday operations, new use cases will also include warehouse robots along with autonomous delivery robots and commercial drone delivery. The drone market globally is estimated to reach $24.5bn in 2023. With advances in technology like AI on the rise, organizations are experiencing a rise in beyond-visual-line-of-sight operations as well. But the underlying challenges include rising energy costs and supply chain fragility.

Key Highlights

-

Several industries are integrating tech solutions to facilitate widespread data exchange and create new opportunities for public and private M&A.

-

Industrial organizations are now investing in technology that helps in managing, digitalizing, and automating physical assets.

-

Technology developments in the insurance sector are also leading to the next fintech.

-

The healthcare sector is also integrating technology to seek innovative solutions to enhance productivity and patient outcomes.

-

Digital infrastructure is also evolving to support the growing data needs.

-

Artificial intelligence, cloud, and security are emerging as trends equipping organizations with enterprise resource planning and frameworks.

Read more: Tech-Related Ethical Concerns Businesses Should Address in 2022

Looking Forward

Interoperability, or a platform’s ability to communicate and share data, is emerging as the next frontier for technology innovation. Tech companies are expanding their customer bases with products and connecting disparate data for consumers to create a seamless experience. Companies and investors are closely monitoring the upcoming technology investment trends that will assist them in exchanging data across industries, including insurance, healthcare, digital infrastructure, and resource planning. Emerging technology is assisting organizations in fostering digital infrastructure and resource planning, enabling the exchange of data across value chains. Investors are also monitoring organizations that are connecting data across disparate sources.

With more innovative and advanced technology services coming up, existing players and larger companies along with private equity firms, are searching for new avenues to integrate the trends into their operational framework. Given the rising demand for these solutions, organizations are now on the hunt for acquisitions to expand their market share within their industry verticals in 2023 and beyond.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in the Technology domain, SG Analytics partners with global technology enterprises across market research and scalable analytics. Contact us today if you are in search of combining market research, analytics, and technology capabilities to design compelling business outcomes driven by technology.