INVESTMENT RESEARCH

October 21, 2021 - It has long been known by data scientists, researchers, engineers, and economists that traditional data alone cannot help investors forecast the price of a stock.

However, the fact never caught on with investors until recently. Today, not only is non-traditional or alternative data widely used, but a large chunk of investors thinks of it and not traditional data as their primary source of information to make investment strategies.

We have already covered alternative data in a previous post, and you should really give it a read. Here is a summary: alternative data is primarily qualitative, not quantitative. It provides a more nuanced measure of what the market 'feels'. Therefore, its insights are broader, going beyond the numbers.

But what is the difference?

The rise of qualitative data

Qualitative data is the practice of collecting and analyzing information that explains the dispositions — the needs and wants — of customers. But that is only the concern of market research. From the point of view of investment research, qualitative data reflects the dispositions of all stakeholders involved. Not just customers. But also analysts, credit rating agencies, competitors, and employees, low or high-level, and so forth.

As the name suggests, this information is non-numerical. It lacks structure and therefore presents a challenge to drawing statistical trends or insights. That is because opinions and views are broad and therefore extremely hard to reduce to data points. But investment researchers actively look for qualitative answers because what they convey is far deeper and more nuanced than numbers can. Qualitative data allows investors to penetrate market sentiment more deeply than quantitative data.

And it also makes sense from the perspective of a data scientist. By collecting both quantitative and qualitative data, investment research firms widen their net, learning far more, and therefore making more informed investment strategies.

“Qualitative data allows investors to penetrate market sentiment more deeply than quantitative data allows.”

“Qualitative data allows investors to penetrate market sentiment more deeply than quantitative data allows.”

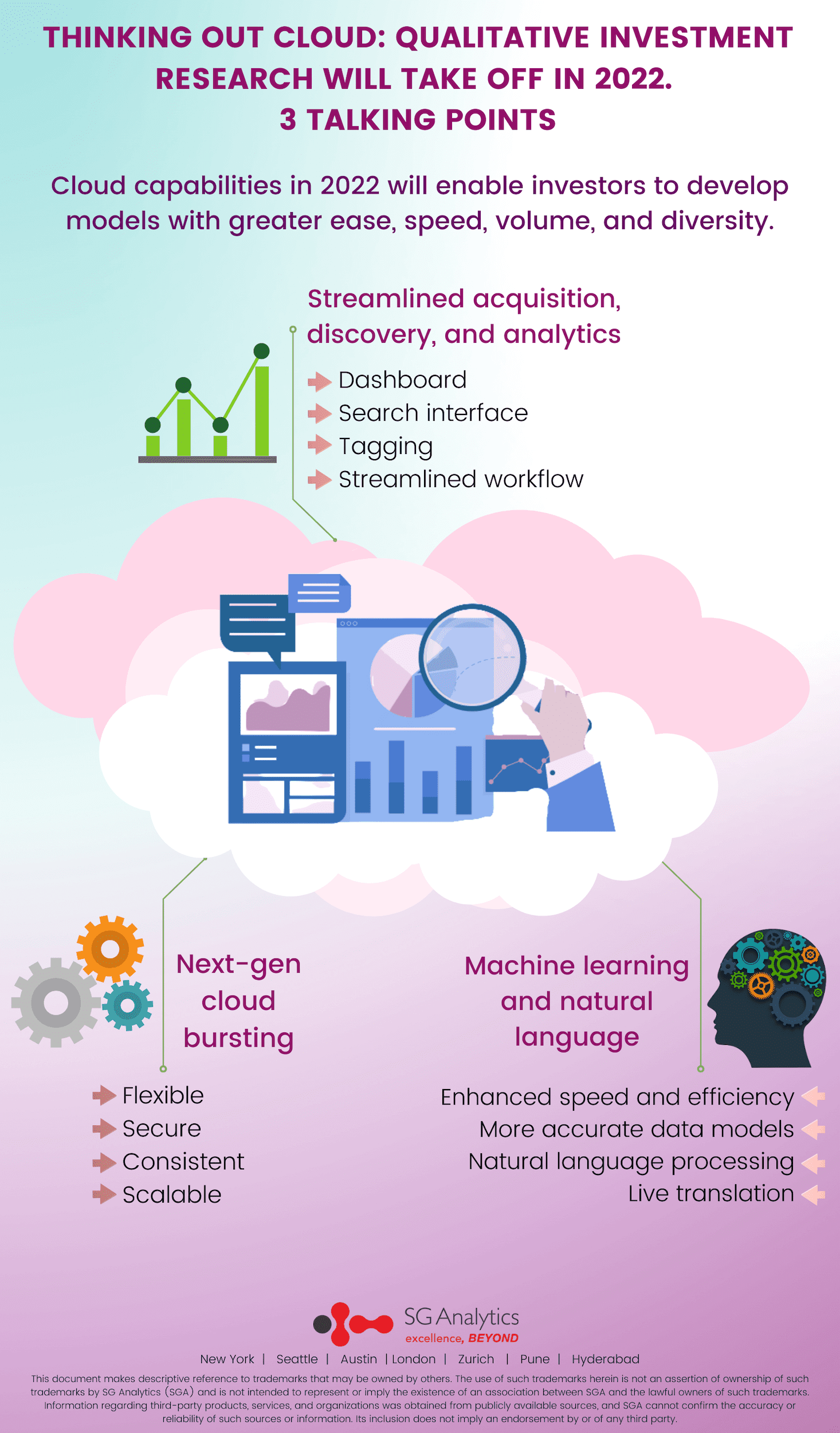

More volume will enable investors to aggregate large and differentiated datasets. High-performance engines will crunch data at breakthrough speed. And a dashboard and search interface will make tagging old insights and discovering new ones remarkably easy. A more streamlined workflow will emerge.

More volume will enable investors to aggregate large and differentiated datasets. High-performance engines will crunch data at breakthrough speed. And a dashboard and search interface will make tagging old insights and discovering new ones remarkably easy. A more streamlined workflow will emerge.