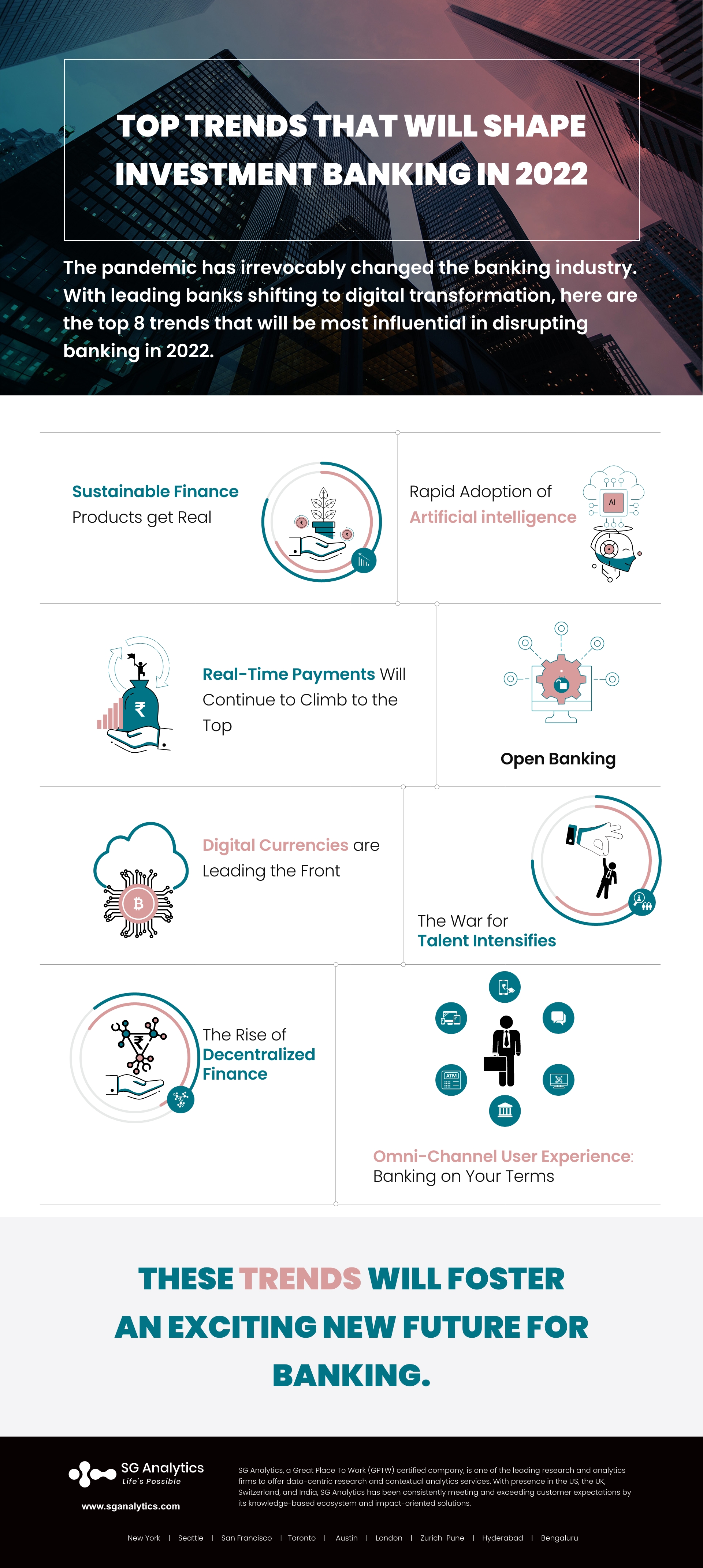

The onset of COVID-19 has irrevocably changed the banking industry. While 2020 and 2021 were the years that the pandemic forced banks to embrace digital change, 2022 will be the year that will see that change institutionalized, leading to the emergence of a new normal.

Investment Banking: Marching Towards Divergent Growth

The investment banking industry saw a notable surge in activity after the reopening of global markets. To mitigate the effects of the pandemic, investment banks have started following the hybrid roadshows strategies and are utilizing the latest technology to revamp their origination strategies.

For most leading banks, the inclination for incremental change and cautious experimentation is leading the way to a faster digital metabolism. Leading banks are shifting to digital transformation and focusing on building more secure financial systems.

What initiatives are worth the attention in 2022?

Here we have identified the top 8 trends that will be most influential in disrupting banking in 2022, thus fostering an exciting new future for banking.

1. Sustainable Finance Products get Real.

Sustainable finance refers to investment decisions made by considering environmental, social, and governance (ESG) considerations. Finance and sustainability are predicted to go hand in hand. Owing to this reason, sustainable finance is being ranked among the top trends in the BFSI sector.

Banks are willing to sacrifice their short-term bottom line to stay one step ahead of regulators and environmental groups.

Together with fintech, banks are exploring the perfect opportunity to adapt to these new requirements to create future-oriented, sustainable finance products.

2022 will likely notice more social impact initiatives, offering access to environment-related investment opportunities and finance guidelines that align with net-zero goals and other sustainability-linked bonds.

2. Rapid Adoption of Artificial intelligence

Although still in an evolutionary stage, AI will make significant progress in 2022, positioning itself as the most influential wave of technology that will transform the world. With every major industry leveraging AI and increasingly intelligent machines to complement their work or replace it by providing a superior level of competency.

The banking and finance sector is slowly catching up with the trend. Chatbots are helping customers to sort their financial affairs, and banks are using machine algorithms to detect cybercrime patterns.

The rapidly evolving diverse AI technologies are impacting the banking industry. Organizations are increasing investments in AI to uncover their potential in assessing critical data and improve business efficiency. The development and effective implementation of AI will likely guide the investment banking industry in 2022, thus creating opportunities to invest in more transformative and consequential technology themes.

Read more: Fixed Income Outlook 2022

3. Real-Time Payments Will Continue to Climb to the Top

When it comes to payment, speed and accuracy are of utmost importance. People working in the gig economy want to get paid at the end of their shift, and employers can meet these needs by sending the funds through a real-time payment network connecting them directly to their bank account.

Real-time payment space lets corporate & investment banks send the payments digitally to active customers by authorizing the payment, thus cutting down on the cost and time it takes. It's not just companies that are benefiting from this service. It is also enabling consumers to receive their bills directly into their bank's app or website, thereby authorizing the bank to pay them instantly, irrespective of weekends or holidays.

2022 will likely see a surge in the employment of real-time payment authorizations, thus creating a smooth and secure banking experience.

4. Open banking

The trend that was supposed to take off in early 2020 is now experiencing a promising curve in 2022. Open Banking is looking more optimistic than ever in terms of its collaborative approach and connectivity between banks, fintech vendors, and regulators.

Open banking is a vision that obligates financial institutions and banks to provide regulated third parties access to customers' financial data. Such access is provided only with customers' permission and is employed for the development of new apps and service platforms. Open banking offers better transparency to the consumer and more opportunities for investors ready to revive the BFSI sector.

This emerging trend will enable financial organizations to deliver full-spectrum, client-centric banking capabilities and remain competitive.

5. Digital Currencies are Leading the Front

Digital currencies, till now, have been considered the teenager of money: one that can be easily swayed by a stray tweet, ready to break the rules of the well-established market. But 2022 is experiencing a growth in digital money, and banks are learning to take them seriously. Central banks are launching digital currencies. These are accompanied by developing regulations around cryptocurrencies and a recognition that many of the core concepts of crypto trust will have enduring value. In years to come, more financial institutions and government agencies will be sharing data and ideas on ways to incorporate elements of this new type of currency into the global financial system.

Read more: Global IPO was record-breaking in 2021; Should we be preparing for headwinds in 2022?

6. The War for Talent Intensifies

With technology becoming a critical enabler for banks, a publicized shortage of engineering, data, and security talent is throwing light on the stark reality. Banks aren't as attractive as they were to prospective employees. There is an unmet demand for technical workers, but these roles are a small fraction of the talent the banking sector requires.

The younger talent particularly needs flexibility and wants to be valued in their jobs. They see the banking culture as rigid, hierarchical, and overly formal, leading to a disproportionate share leaving the sector.

Forward-thinking banks are developing integrated plans to holistically address their employment issues. They are mapping the skills required in the future and are using a variety of approaches to recruit and retain young talent. They are also reassessing their work structure, culture, and practices to enhance their appeal among employers as well as employees.

7. The Rise of Decentralized Finance

Today, the financial services industry is buzzing around Decentralized Finance or DeFi.

DeFi is a system that uses blockchain and similar technology to provide secure, programmable, real-time transactions directly between digital asset holders. DeFi is often referred to as bank less finance as there is no centralized entity regulating these transactions. This indicates increased risk, but it also signifies more control and fewer processing fees for participants.

Many of the biggest banks, like Goldman Sachs, are beginning to leverage bitcoin and other cryptocurrencies. Others in the investment banking spaces are speculating how blockchain will disrupt the industry. However, one thing is for sure: DeFi is still in its early days, and hence it is impossible to understand how it will cause technological disruption in banking.

One way for banks to stay ahead of DeFi is to focus on developing proprietary market intelligence. Leading firms are setting up data warehouses, integrating data from multiple sources, and developing models to uncover meaningful insights. Reliable market predictions, precise scoring systems, and other proprietary resources will be the guiding force in winning business in the future.

8. Omni-Channel User Experience: Banking on Your Terms

Today, great customer experience is everything. Brands are taking excessive measures to better understand their customers' needs to form a deeper bond with them. When accomplished right, an omnichannel experience provides consumers with increased flexibility and convenience.

With technology continuously bridging the gap between physical and digital experiences, the investment banking industry is engaging more digitally with its customers than ever before.

While the pandemic forced our everyday activities to be conducted online, the users have continued to rely on personal connections with their bankers and advisor. But many consumers and small business owners are willing to do things on their own, which is why the self-serve option in banking will continue to evolve, giving consumers the ability to confidently attain their goals by using the mobile app features. AI, machine learning, and voice biometrics will play a key role in helping professionals authenticate a customer and address their questions more efficiently.

Read more: What will the economy look like in 2022? 6 trends to watch out for!

Key Takeaways:

- The convergence of trends is reshaping the banking industry.

- The COVID-19 pandemic has led to banks becoming proactive by challenging their long-held assumptions and becoming more adaptive.

- Banks today are looking forward to the opportunities that lie ahead of them.

Time to Employ a Different Approach

The banking sector is reshaping its businesses to continue to cater to the needs of customers, employees, and other stakeholders.

While they once relied on their size and regulatory protection, these factors may also be obstacles in today's environment. Banks are now navigating these waters successfully and will be doing things differently.

Banks are now working towards delivering more than the return on equity and identifying opportunities to innovate efficiently. With the pandemic subsiding, the coming years will start to see the emergence of new normal in the banking industry.

2022 is likely to bring incremental modifications to the digital banking landscape. With demand at an all-time high, the need to delight the customers with practical digital features and seamless experiences will be the driving key for banks in maintaining an edge on their competitors.

With offices in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in Investment Banking services, SG Analytics helps ensure seamless integration with the client’s strategy across the value chain by providing advisory and valuation support services globally. Contact us today if you are looking for investment banking outsourcing to leverage advanced technology tools and best practices of the industry to enhance your investment portfolios and make strategic decisions.