The unprecedented market and policy momentum in 2021 for ESG led to raised expectations of the investors, corporate boards, and government leaders for progression on climate pledges in 2022. Alongside climate, other social and environmental concerns like diversity, equity, and inclusion garnered the spotlight and are now being woven into broader ESG discussions.

In 2022, corporate boards and government leaders are facing the rising pressure to demonstrate that they are equipped to understand and supervise ESG issues, ranging from climate change to human rights. This rising demand for action is increasing the pressure for more accountability, better regulatory scrutiny, and credible disclosure supported by better data.

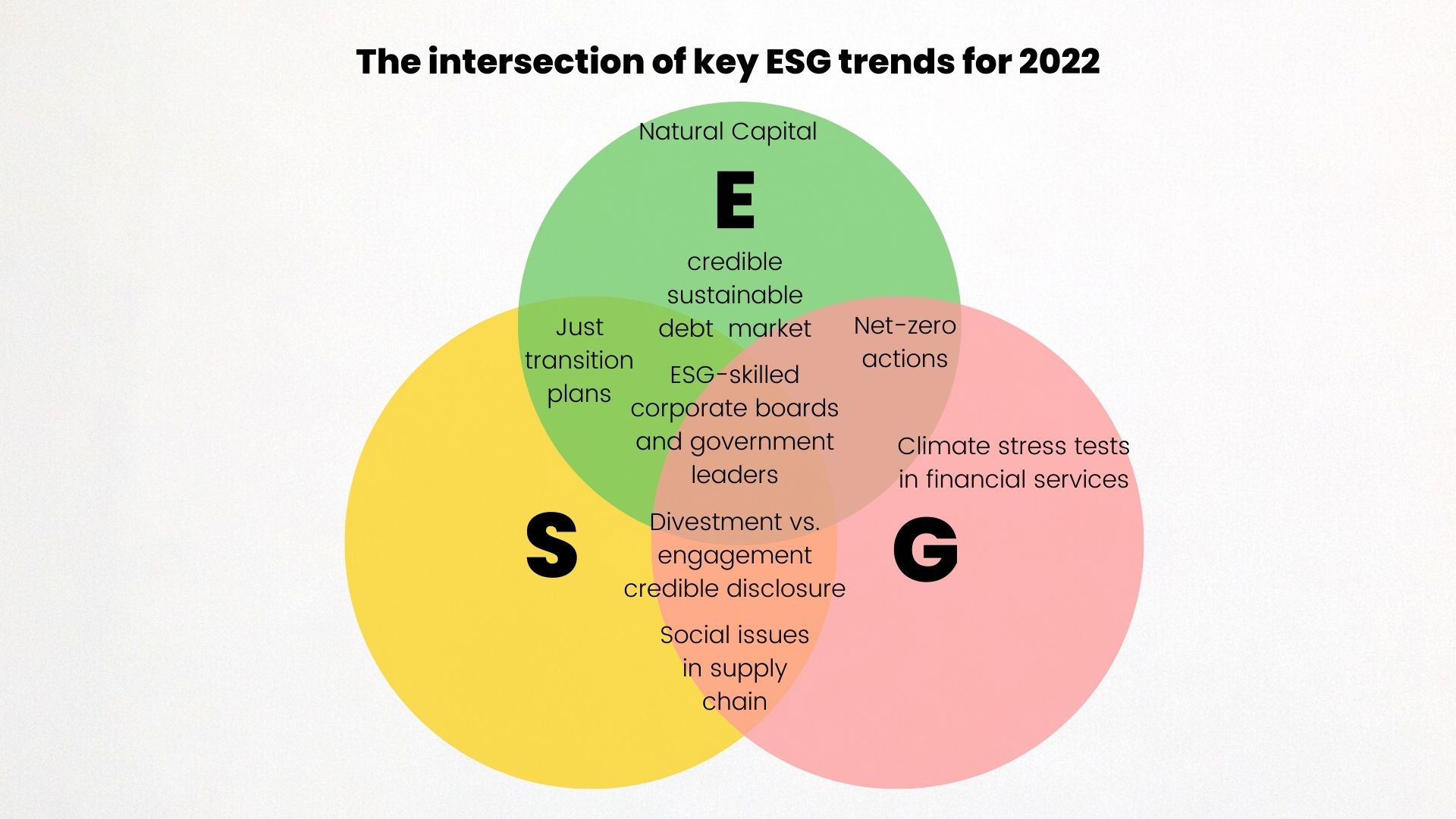

The key ESG trends that will drive the conversation in 2022 will exhibit interactions and have a direct effect on the prospects for meaningful progression of the ESG issues.

The top trends that will drive the ESG in 2022 are-

-

Growing pressure on corporate boards and government authorities to enhance their ESG skills

-

New regulations and reporting standards for more credible corporate disclosures

-

Accelerated global efforts to align sustainability goals and capital markets

-

Governments and organizations may face the challenge of fulfilling net-zero emissions pledges

-

Climate stress testing to gain prominence in the finance industry

-

Supply chain social issues will require more attention

-

Growing sustainable debt market will have to prove their integrity

Read more: Tech Stocks Slump is Triggering the Withdrawn of ESG Funds: Here's Why

-

Growing Pressure on Corporate boards and Government authorities to Enhance their ESG Skills

In 2022, due to the rising demands for action, corporate representatives and government authorities will likely pressure for more accountability to exhibit that they are adequately equipped to oversee ESG issues. This broadening of the scope of corporate board responsibilities will also require more focus and time commitment to meet their duties. The mounting pressure on board members to streamline their ESG credentials is set to grow as investors are demanding better accountability and a heightened focus on sustainability.

Government and corporate leaders are feeling the pressure to strengthen their ESG skills and integrate sustainability policy planning. The activism of shareholders and stakeholders will increase in this area in 2021. And this trend is set to gain momentum in 2022. With efforts to diversify boards and design policies that foster diversity, equity, and inclusion, organizations will continue to evolve and follow a holistic approach to how differences in identities, expertise, and leadership can drive growth.

-

New Regulations and Reporting Standards for more Credible Corporate Disclosures

Due to the growing demand, investors and regulators are now exercising greater scrutiny of corporate sustainability efforts and calling out organizations practicing greenwashing. This skepticism is based on the concern that organizations may be utilizing disclosures and sustainability-related labels to market their products and services in order to appear more proactive on the ESG issues.

The new global ESG-related standards are expected to evolve in 2022, as global standard-setting bodies are addressing what may be the largest obstacle to accountability: the lack of a common baseline for disclosure standards that are uniform across jurisdictions and industries. 2022 is expected to bring increasing convergence on the data, metrics, and reporting requirements for social issues.

-

Accelerated Global Efforts to Align Sustainability Goals and Capital Markets

ESG regulations are no longer about the 'what if' questions; today they are more about ‘when’ and ‘to what extent.' Along with ESG, Sustainable Finance standards and regulations are exerted to experience rapid progress in 2022. While jurisdictions differ in the exact approach, progression is expected across the following:

-

taxonomies of sustainable activities that define how a company or investment can be deemed sustainable

-

sustainability disclosures for organizations as well as their financial products

-

sustainable finance benchmarks and certifications

While the application of these regulations may be jurisdiction-specific, their impacts will likely be felt globally.

Read more: Why Should Companies Develop Women Leadership to Influence Corporate ESG Operating Models?

-

Governments and Organizations may face the Challenge of Fulfilling Net-Zero Emissions pledges

In 2021, government authorities and large companies began setting goals to reach net-zero emissions by 2050. However, these commitments lacked interim emission reduction targets or a plan to curb indirect emissions arising from the supply chain.

In 2022, organizations will feel pressure from shareholders and stakeholders to develop concrete plans to start implementing these promises addressing emissions. Moving forward, investors will likely demand stronger long-term climate commitments. Governments and companies will have to develop credible and achievable signposts on their path to decarbonization. This spotlight will further extend on how organizations manage the exposure to physical climate risks, along with adaptation and resiliency planning. These expectations will assist in holding enterprises accountable for their commitments and will further help in addressing the market perceptions of greenwashing.

-

Climate Stress Testing to Gain Prominence in the Finance Industry

Investor pressure concerning climate change is concentrated on energy sector corporations. Major enterprises and policymakers are beginning to realize the long-term threat associated. They also recognize the role finance plays in facilitating low-carbon transition and ensuring climate resiliency.

Central banks are now beginning to perceive as well as incorporate climate risk issues as a stress testing feature for banks and insurers. In 2021, the European Central Bank’s economy-wide climate stress testing highlighted the need for banks to improve their assessment of the exposure to both climate transition risks as well as physical risks to proactively manage them. In 2022, stress testing is being considered as a starting point for companies to measure their climate risk.

-

Supply Chain Social Issues Will Require more Attention

With the onset of the pandemic, companies became aware of their dependency on as well as the fragility of supply chains. In 2022, this trend is expected to persist as the global economy is still recovering from the pandemic, and the management teams are focusing on strengthening their supply chain costs and the risk of disruption.

With this resilience of supply chains, social issues in supply chains will gain greater attention, as measures to curb human rights abuses and improve labor conditions are being viewed in the spotlight. The proposed legislation will make the traceability of social risk management in the supply chain more important.

-

Growing Sustainable Debt Market will have to prove their Integrity

The total sustainable debt insurance reached a record high of about $960 billion in 2021, as estimated by the Environmental Finance Bond Database. This estimate includes green, social, and sustainability linked bonds that represented a 61% increase in just a year. But there is still room for continued growth. With companies and governments seeking to finance the transition to a net-zero economy, the acceleration in 2022 is estimated to slow down.

A key challenge for the market participants will be to supervise this growth to preserve the legitimacy of these financing instruments. Businesses are also combating the rising concerns about greenwashing. While diversification and innovation in sustainable debt instruments are likely to continue, there is a greater risk of fragmentation across sectors and standards. For sustainability linked instruments to achieve strong growth in 2022, market participants should remain vigilant and ensure that issuers are setting ambitious performance targets and maintaining transparency. Efforts to further establish and encourage clear standards and frameworks and being taken, and hence 2022 is being perceived as a critical year to guard the integrity of the sustainable debt market as it readies to reach newer heights.

Read more: Sustainability Tech Innovations that will power 2022

Establishing a Baseline

Stimulated by investors, shareholders, governments, policymakers, employees, and customers, businesses are addressing the ESG issues and opportunities to grow. There is a heightened understanding of the risks that are required to be identified and managed.

Considering the growing sense of huge opportunities offered and the scale of the transformation, businesses are embarking on this journey as a response to the new reporting requirement or top-down strategies. With the effects of climate change on ESG emerging as a topic being discussed at large, organizations need to be able to assemble, prepare and present climate-related statements that are credible and all-inclusive and meet the regulatory stakeholder expectations.

Strong ESG policies and procedures are becoming important. With the demand for ESG investments and ESG continuing to grow, businesses are showing interest in sustainability and building strategies that will highlight their support for ESG-driven policies. This is leading to a pervasive reappraisal of operations, activities, and outcomes for the business. It is also creating opportunities to identify and realize significant sources of value creation.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in ESG Consulting services, SG Analytics offers bespoke sustainability consulting services and research support for informed decision-making. Contact us today if you are in search of an efficient ESG integration and management solution provider to boost your sustainable performance.