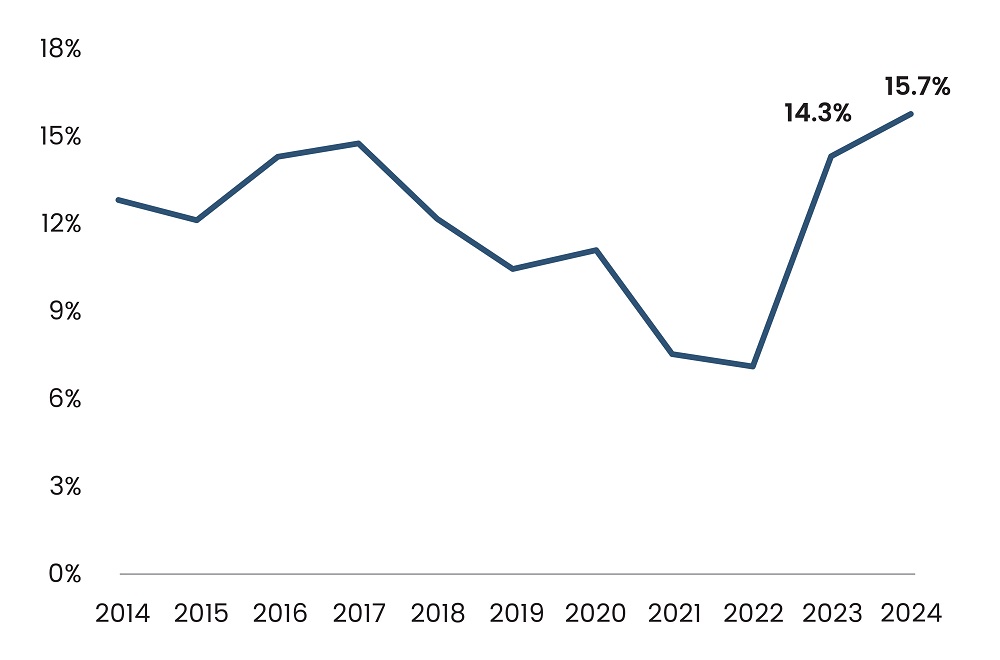

In 2024, nearly 30% of venture capital deals in the U.S. were conducted as down or flat rounds — the highest percentage in a decade, according to PitchBook. While AI startups continue to secure premium valuations, the broader startup ecosystem is grappling with stagnant capital flows and a pronounced shift in investor expectations.

Figure 1: Down Rounds as a Percentage of VC Rounds

Source: PitchBook, data as of December 31, 2024

The era of easy money and rapid valuation jumps, fueled by zero interest rates, has left many startups locked into artificially inflated prices. Companies that raised funds during the 2020-2021 boom now face a stark reality. Securing fresh capital at those lofty valuations has become increasingly difficult. Many investors have shifted their focus toward sustainable revenue growth and profitability, making it harder for startups to justify high price tags without strong financial performance. This has forced numerous startups into down rounds.

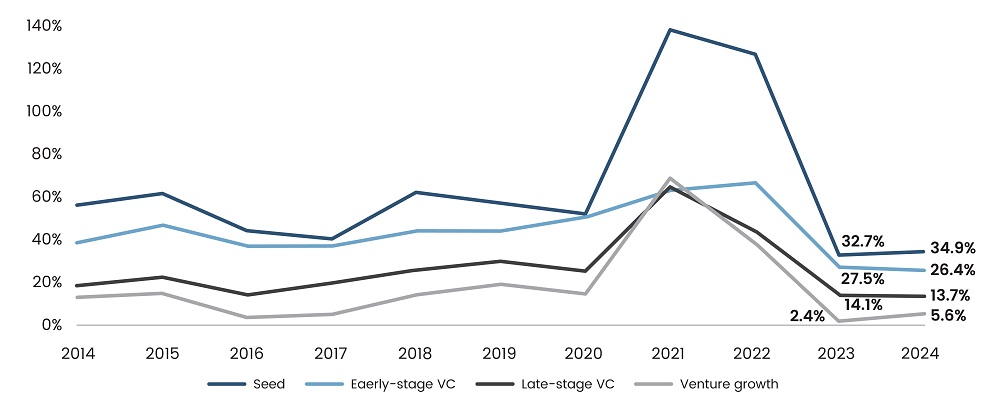

One of the key indicators of market slowdown is the Median Annualized Valuation Growth between Rounds (RVVC), which has seen a sharp decline since its peak in 2021, as per PitchBook. This metric, which tracks the speed at which startup valuations increase between funding rounds, has been plummeting since 2023, reflecting the struggles startups face in justifying valuation increases. Even though some startups have managed to hold their valuations steady, their real valuation growth has been muted compared to previous years. The overall sentiment among investors is that while some top-tier companies will likely continue to command high valuations, most startups will need to adjust expectations.

Read more: Key Trends Reshaping the US Retail Industry

Figure 2: Median RVVC between Rounds

Source: PitchBook, data as of December 31, 2024

Another key factor significantly contributing to this trend is liquidity pressure. According to PitchBook, the total value of private startups locked in venture portfolios has surged past $4 trillion in 2024, more than doubling from $1.7 trillion in 2020. With limited exit opportunities via IPOs or acquisitions, venture firms cannot recycle capital into new investments. Many limited partners (LPs) who fund VC firms hesitate to commit fresh capital, leading to a funding crunch. Without exits, startups are forced to stay private longer, often delaying or restructuring their fundraising plans to accommodate tougher market conditions.

AI, however, remains an outlier in the funding landscape. According to PitchBook, the technology sector dominated 46% of the total VC deal value in 2024, with top AI firms like OpenAI, xAI, and Anthropic raising multiple rounds at premium valuations. The median Series D+ valuation step-up for AI startups was 1.7x in 2024, compared to 1.2x for non-AI startups, as per PitchBook. This disparity highlights the widening gap between AI and other sectors, where investor appetite remains strong for AI-driven innovation while capital remains scarce elsewhere.

Despite the challenges, there are some positives. Investors now focus more on quality over hype, pushing startups to demonstrate profitability and operational efficiency. Gone are the days when startups secured massive funding rounds based on growth projections. Instead, venture firms seek measurable financial performance, clear monetization strategies, and sustainable unit economics. This change will ultimately lead to a healthier venture ecosystem, where capital is deployed more efficiently and startups are built on stronger financial foundations.

The broader macroeconomic environment is also set to play a role. While investors welcomed three interest rate cuts in 2024, they did little to jumpstart venture funding. Market expectations for two additional rate cuts in 2025 are cautiously optimistic, but it will take more than monetary policy adjustments to revive the VC market. The fundamental issue remains overvaluation and liquidity constraints, which are unlikely to be resolved in the short term.

Read more: M&A Outlook 2025: What Big Banks Are Predicting

Final Thoughts

Looking ahead, we can expect more down rounds and flat rounds as startups that have been delaying fundraising run out of options. More companies will be forced to adjust their valuations to attract funding, leading to a further correction in the venture market. Additionally, IPOs and M&A activity will play an important role in defining the pace of recovery. If more companies accept lower valuations, we are expected to see an uptick in liquidity events that would unlock fresh capital for the venture ecosystem.

However, if startups continue to hold out for unrealistic valuations, the funding bottleneck is likely to persist, leading to further stagnation in VC dealmaking. The reality is that the venture market needs a reset, and 2024 was just the beginning of that process. As we move forward, the companies that adapt to this evolving environment will be the ones that thrive. Founders and investors alike must embrace the shift toward rational valuations, strategic capital allocation, and long-term sustainability if they want to succeed in the evolving VC landscape.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, ISG, and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.