The US Venture Capital (VC) outlook for 2025 is stronger, driven by rising exits, IPO activity, and stabilized dealmaking. However, challenges like lower valuations and liquidity constraints persist, shaping a cautious recovery.

VC is expected to rebound in 2025, driven by AI advancements, recovery in IPOs, a resulting surge in liquidity with LPs, and valuations aligning with historical trends. We expect increased exit activity. Historically, the longest gap between US IPO peaks has been three years, with 2024 marking the end of this cycle. IPO activity is also 39% higher in post-election years, suggesting 2025 will see a resurgence in market activity, as per Wellington Management.

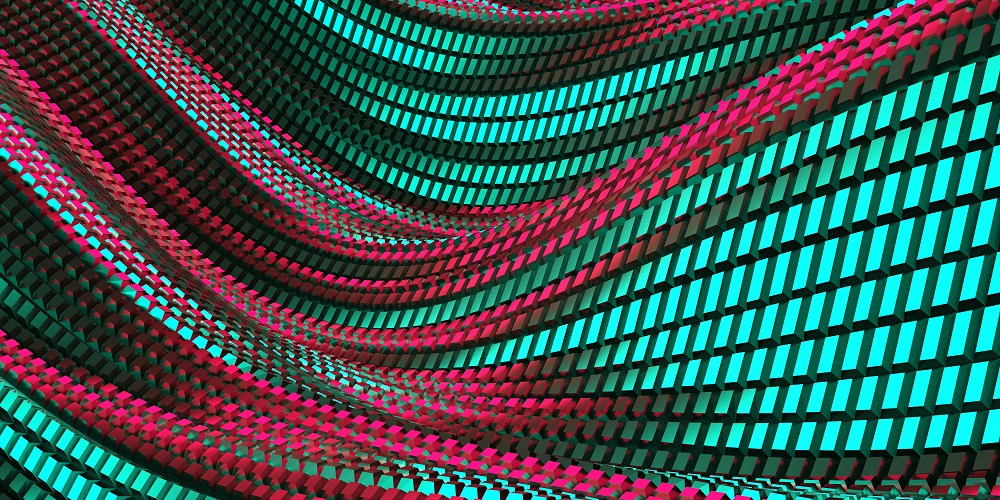

Figure 1: Median VC Pre-Money Valuation Increase Across Series (in $millions)

Source: PitchBook, data as of September 30, 2024

A Year of Normalization for IPOs

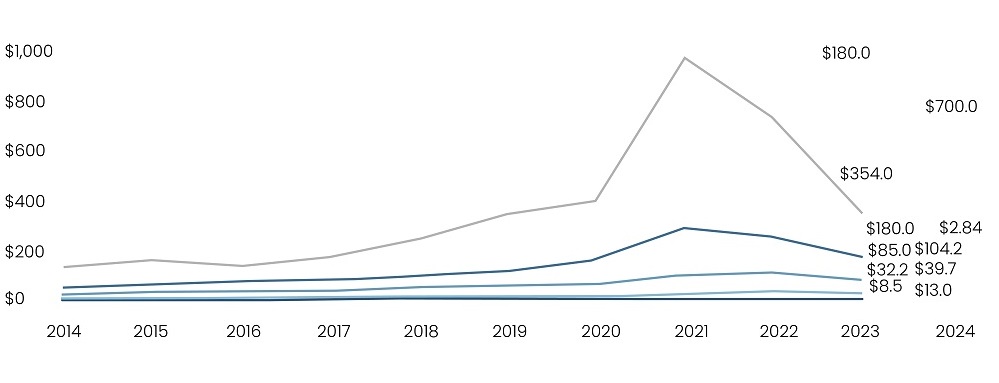

The IPO market for VC-backed firms in 2025 is set to gain momentum, fueled by a record inventory of 57,674 private companies in 3Q24, according to PitchBook. Among these, late-stage and venture-growth startups, ideal candidates for public listings, make up 32.4% or over 18,000 firms. A significant subset of these companies, over 1,000, has not raised another funding round since 2021, indicating readiness to transition to public markets. Additionally, the aging of US unicorns is a critical factor driving this trend.

Figure 2: Inventory of VC-Backed Companies Exceeds 57,000

Source: PitchBook, data as of September 30, 2024

Read more: Why Willow is the Next Big Thing in Tech?

According to PitchBook, around 40% of unicorns, collectively valued at over $1 trillion, have been in portfolios for nine or more years, reflecting growing pressure on VC firms to secure exits. These dynamics, combined with a backlog of firms previously unable or unwilling to go public during uncertain market conditions, set the stage for a surge in IPOs. Investors’ appetite for liquidity and the maturity of the VC ecosystem suggest that 2025 will mark a pivotal year for public market activity.

Favorable macroeconomic conditions further bolster this resurgence. Recent interest rate cuts by the Federal Reserve, driven by easing inflation, and the pro-business policies of President-elect Donald Trump’s administration, which are expected to lower taxes and regulations, are encouraging. IPOs by companies like AI chipmaker Cerebras Systems and Swedish payment processor Klarna will serve as indicators of investor confidence. If these firms perform well post-IPO, they will likely pave the way for other mature, VC-backed businesses to enter the public markets.

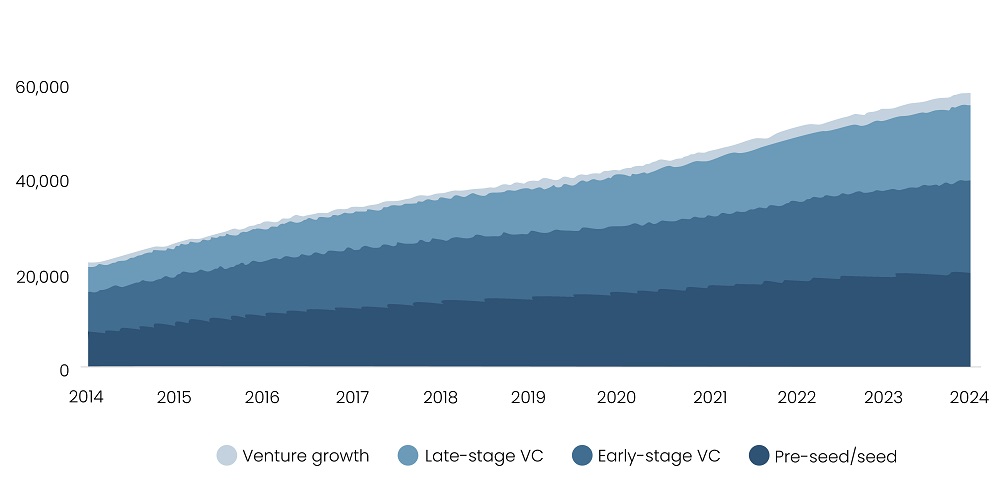

VC Financing Will Exceed 2024 Levels in 2025

2025 US VC fundraising is expected to surpass 2024 levels, though low distribution yields and limited LP liquidity remain key challenges. Low distribution rates have led to elongated fundraising cycles, with smaller and midsized funds delaying new capital. Larger managers have secured commitments but at reduced sizes, such as Tiger Global’s $2.2 billion fund in 2024. A recovery in M&A and IPO will likely improve LP liquidity, easing fundraising difficulties for smaller and first-time funds, as 77 first-time funds were raised in 2024 compared to 215 in 2023, as per PitchBook.

Figure 3: VC Fund Capital Raised with 2025 Estimates

Source: PitchBook, as of November 16, 2024

Cautious capital deployment in 2022 and 2023 funds has left startups struggling for funding while maintaining an investor-friendly environment. In 2025, new capital and uncalled commitments will likely alleviate pressure on capital-starved startups, according to PitchBook. However, delayed distributions and liquidity constraints are expected to hinder recovery. Established players like a16z, General Catalyst, and Accel, having raised significant funds earlier, will likely contribute less to 2025 fundraising momentum. Despite these risks, a gradual recovery in exit opportunities will boost LP liquidity and new fundraising cycles.

Read more: AI in National Security: Protector or Threat?

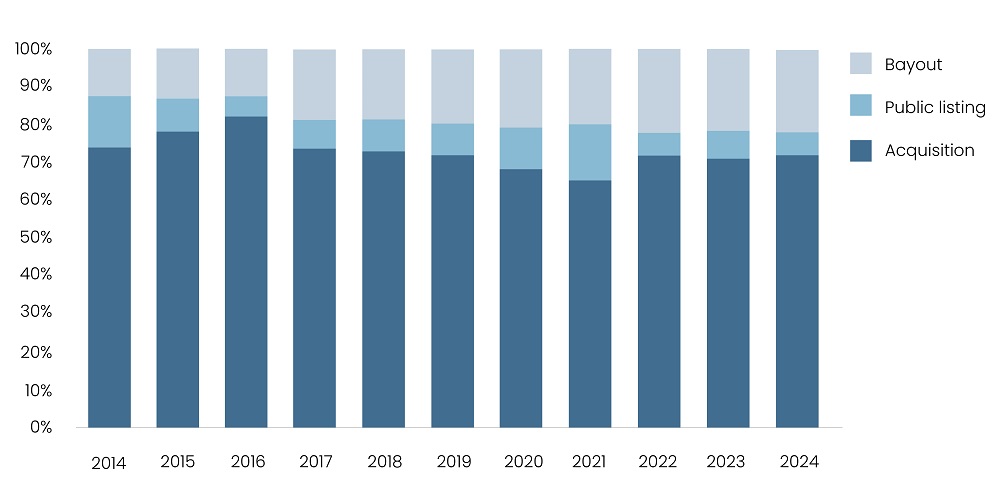

Liquidity Pressures to Drive a Surge in Acquisitions

Over the past two years, M&A activity for venture-backed startups has remained sluggish, with 699 acquisitions recorded as of November 15, 2024, according to PitchBook. This annualized figure is projected to fall below 2023 levels, a year marked by slow exits. Regulatory scrutiny and economic uncertainty dampened large deals, with notable exceptions in healthcare. Roche’s $3.3 billion acquisition of Saunet Therapeutics topped the charts, followed by Genmab’s $1.8 billion acquisition of ProfeundBie. A pro-business policy shift is expected to spur larger M&A activity in 2025.

Figure 4: Share of VC Exit Count by Type

Source: PitchBook, as of November 15, 2024

Increased urgency for liquidity is expected to drive VC-backed acquisitions in 2025. Narrowing price expectations between buyers and founders and businesses seeking inorganic growth will fuel activity. Attractive valuations and strong corporate cash reserves give strategic acquirers leverage, while projected rate cuts will support the deals by lowering borrowing costs. However, challenges persist, including cautious dealmaking due to integration costs and retention concerns. Smaller acquisitions will likely remain constrained despite reduced antitrust oversight, limiting widespread consolidation opportunities.

Read more: Charting New Horizons in Private Credit

Partner of choice for lower middle market-focused investment banks and private equity firms, SG Analytics provides offshore analysts with support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.

About SG Analytics

SG Analytics (SGA) is an industry-leading global data solutions firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company with a team of over 1200 employees and a presence across the U.S.A., the UK, Switzerland, Poland, and India.

Apart from being recognized by reputed firms such as Gartner, Everest Group, and ISG, SGA has been featured in the elite Deloitte Technology Fast 50 India 2023 and APAC 2024 High Growth Companies by the Financial Times & Statista.