The surging demand for generative AI is fostering intense competition among major tech players striving for dominance in this lucrative sector. Noteworthy investments underscore this trend, with Microsoft injecting $10 billion into OpenAI and Amazon recently announcing a $1.25 billion investment in Anthropic. Under this strategic alliance, Amazon's cloud unit, AWS, is set to become Anthropic's primary provider for critical workloads. Google is also actively developing its generative AI chatbot, Bard. Moreover, key players like Databricks and Snowflake are strategically acquiring startups to bolster their own generative AI stacks.

Beyond direct investments in pioneering generative AI companies, major tech entities are channeling funds into promising start-ups through their corporate venture capital arms. M12, Microsoft's venture capital fund, has made significant contributions to Typeface's Series A and B rounds, as well as Hazy's $9 million Series A round this year. Google Ventures has invested in Typeface, Lightmatter, Cognosys, and Moonhub. Intel Capital has thrown its support behind startups like MatrixSpace and Alkymi, while Salesforce Ventures has provided funding for Anthropic, Cohere, and Simpplr. Recognizing the pivotal role these concentrated resources play in scaling AI development, it's evident that establishing symbiotic relationships with generative AI startups is a strategic imperative for big tech players.

Read more: US VC Landscape: Navigating Change and IPO Momentum

In addition to financial support, these collaborations extend into strategic partnerships and knowledge exchange, fostering innovation and growth for both parties. Generative AI startups gain access to the vast technological resources, including cloud capability, infrastructure, and expertise of big tech companies. This empowers them to scale their operations, enhance their models, and accelerate research and development.

Big tech companies are known for crafting expansive ecosystems that transcend traditional boundaries. Whether it be the dominion of search engines, smart devices, cloud platforms, or e-commerce, these tech giants excel in creating interwoven services. This connectivity forms the bedrock for the smooth assimilation of AI applications. In the context of generative AI, this interconnected landscape opens up a direct avenue to users, seamlessly reaching them through a multitude of touchpoints.

In return, big tech companies gain access to cutting-edge innovations and breakthroughs that emanate from the nimble and specialized efforts of generative AI startups. With generative AI expected to become a $1.3 trillion Market by 2032 – per data from Bloomberg Intelligence, supporting the growth of the generative AI ecosystem aligns with the long-term interests of big tech companies.

"To build AI at any kind of meaningful scale, any developer is going to have core dependencies on resources that are largely concentrated in only a few firms, - Sarah Myers West, managing director at the AI Now Institute, a research institute studying AI’s social implications.

This trend may extend throughout the entire generative AI value chain. Startups operating in the AI hardware space, including startups like Groq, Sambanova, and Cerebras, are strategically positioned to capitalize on their pivotal role within the hardware infrastructure. Given the highly consolidated nature of the AI chip market, leaders like NVIDIA and AMD may undertake substantial investments in AI chip startups to facilitate inorganic growth.

Read more: Transforming the World of Finance with Generative AI

Corporates Need to Place Bets Quickly as Valuations Surge

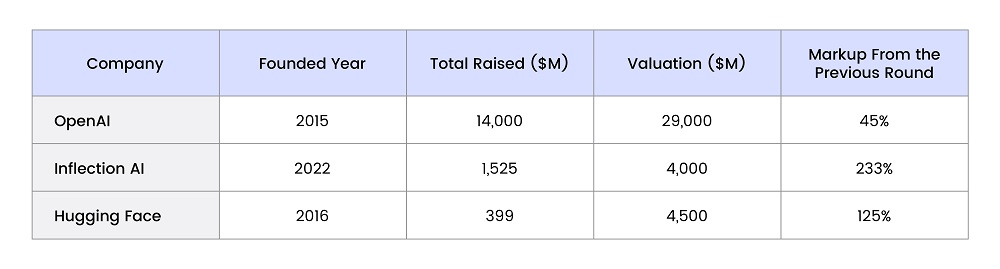

Investments in generative AI start-ups have reached unprecedented heights, marked by soaring valuations and heightened competition. Between its Series A round in May 2022 and Series B round in June 2023, Inflection AI saw a valuation surge of 230%. Similarly, companies like Hugging Face and OpenAI also grew their valuation by 125% and 45%, respectively, in their latest rounds.

As the demand for transformative AI solutions intensifies across diverse sectors, big tech giants are strategically eyeing stakes in generative AI startups at lower valuations. This calculated move serves multiple purposes—providing them with strategic entry points into a rapidly evolving market, mitigating risks associated with the sector's inherent uncertainties, and fostering influence over the startups' trajectories. Lower valuations offer big tech both negotiation power and the potential for collaborative ventures, aligning with their broader business strategies. Recognizing the enduring growth potential of generative AI, these companies position themselves to benefit from future value appreciation as the sector continues to mature.

Figure: Valuations Surge in Generative AI Startups

Source: CB Insights

Read more: The Evolving Business Landscape and Future of Generative AI

In a swiftly transforming tech landscape, the pioneer in introducing a product tends to secure a lasting advantage. Microsoft is actively incorporating AI-assisted co-pilots into Windows, Office, and its Edge browser. Both Google and Amazon are strategizing comprehensive improvements for their digital assistants through generative AI enhancements. These moves underscore the pivotal role of generative AI in shaping the future of digital ecosystems. As these tech titans vie for innovation supremacy, the incorporation of advanced AI technologies emerges as a decisive factor in shaping the competitive landscape, setting the stage for a new era of intelligent and intuitive computing experiences.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose, merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.