Despite the high inflation, a spate of layoffs across the country, and an overhanging risk of recession, Cyber 5 sales volumes were better than market expectations (Adobe Analytics data). While this is an encouraging sign for the retail sector, with the holiday season ahead, retailers used deep discounts, promotions, and flexible payment options, including BNPL, to pull cautious consumers to digital/offline stores.

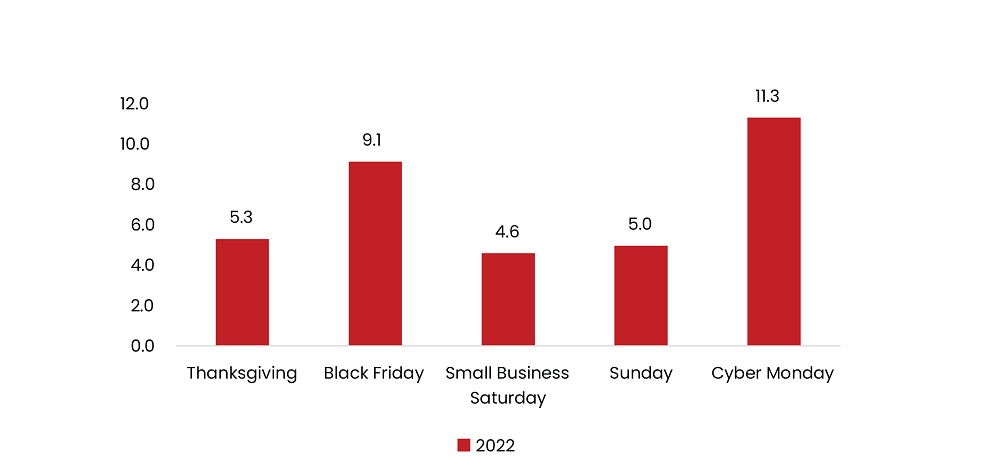

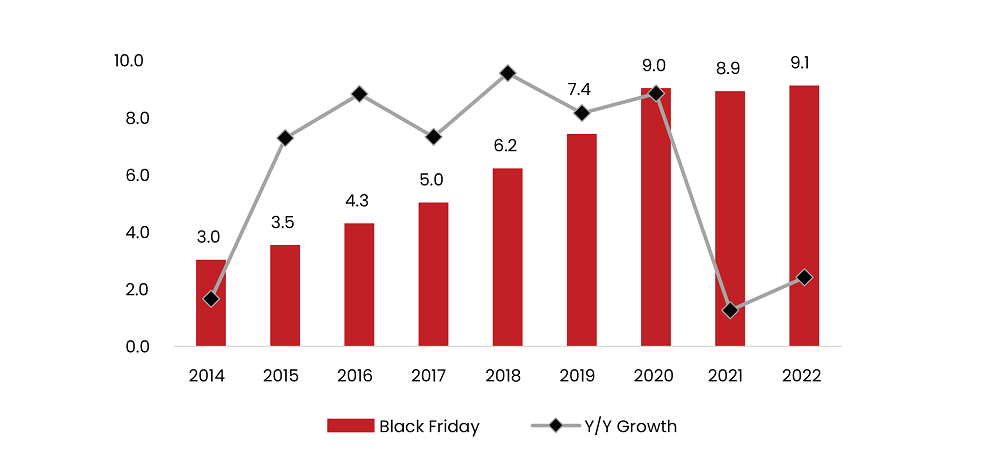

In sharp contrast to tepid consumer spending during the year, online sales during the five-day, Cyber 5 period grew over 4% year-on-year to $35 billion. Cyber Monday lived up to its billing, creating another record of $11.3 billion in online sales, up 5.8% year-on-year. Black Friday e-commerce sales grew 2.3% year-on-year, going past the 2020 record of $9.03 billion, per data from Adobe Analytics.

Read more: Black Friday 2022: Will Inflation Impact Holiday Shopping for Consumers?

Figure 1: E-commerce Sales Across the Cyber 5 ($Bil)

Source: Digital Commerce360

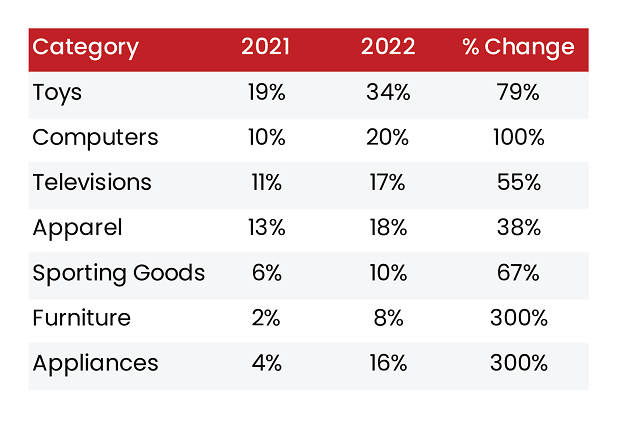

While customers were waiting for holiday season discounts, consumer spending expectations were lower on account of tight budgets and lower discretionary spending power due to raging inflation. Retailers responded by amping up discounts across a range of categories. While in the toys category, discounts were as high as 34%, in the furniture and appliances categories, discounts rose steeply by 300%.

Figure 2: Deep Discounts Catalyse Higher Consumer Spending

Source: Digital Commerce360

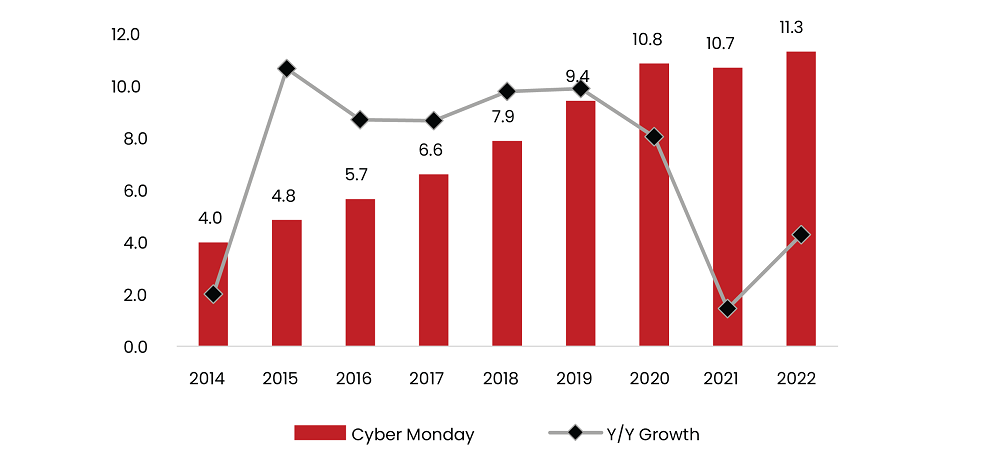

In addition to macroeconomic uncertainty, there was also a looming fear of a repeat of the decline in spending in 2021. However, increased adoption of BNPL and an end to the supply chain issues fuelled the much-awaited discounts and consequent higher spending.

Read more: Sustainability Outlook: Top Emerging Trends in 2023 and Beyond

Figure 3: Cyber 5 Sales Reach Record Levels ($Bil)

Source: Digital Commerce360, Adobe Analytics

Additionally, Inventory buildup over the last few quarters forced retailers to go for clearance sales, especially when the interest rates are expected to go higher, which is expected to further dampen the demand going ahead. Additionally, the fear of excess inventory overwhelming consumers also fuelled bigger discounts to pull in demand.

Read more: A Critical Overview of Big Data and Bigger Dilemmas for Enterprises

Key Beneficiaries of Cyber 5

Walmart's excellent run continues post strong 3Q22 results. It was one of the big beneficiaries, racking up the highest number of online searches for Black Friday discounts, a 386% year-on-year growth. Target, with its constant focus on strengthening the supply chain and amplifying customer experience, and Kohl's were in second and third place, respectively, followed by Amazon, as per the Captify ranking.

In addition to the retail sector, the BNPL emerged as a big winner driving enthusiastic consumer participation despite the macroeconomic headwinds. BNPL order volumes and order values surged 85% and 88%, respectively in the holiday period compared to the previous week.

There has also been a strong shift towards mobile commerce as digital penetration has surged across a wider retailer base. Customers are increasingly using smartphones in search of the best prices/deals. During Cyber 5, 51% of sales happened on mobile devices vis-à-vis 46% in 2021.

Read more: Global Business Trends Outlook 2023

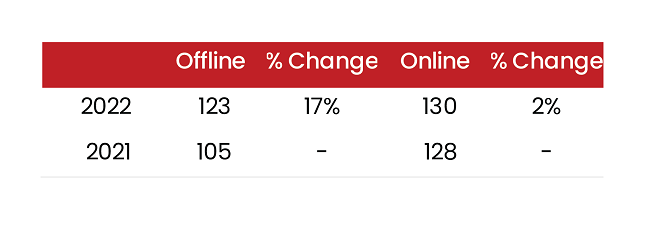

Another trend this year, Cyber 5, was the rebound in footfall at offline stores, a promising sign of continued spending activity during the holiday season. According to the National Retail Federation (NRF), nearly 123 million customers went to physical stores during the cyber 5 periods compared to 130 million online shoppers.

Figure 4: Offline Footfall Rebounds

Source: Digital Commerce360

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.