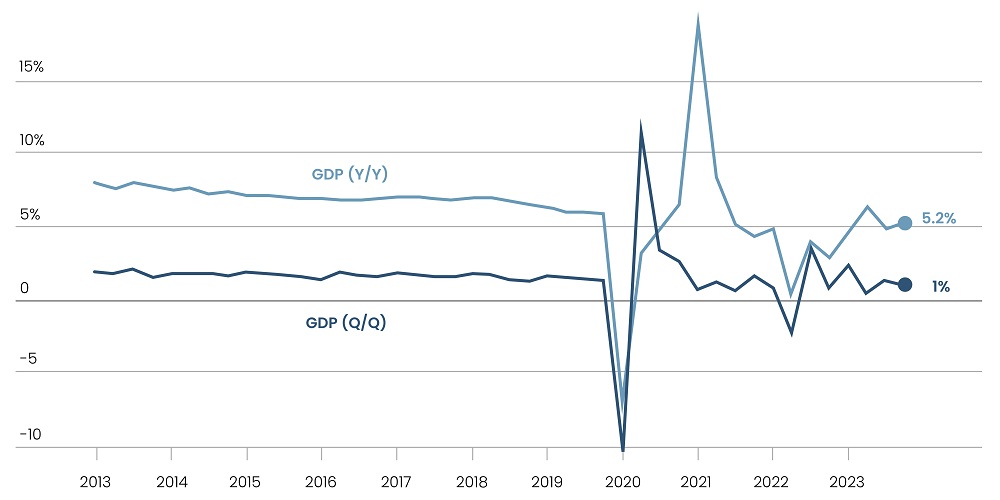

In 2023, China experienced a 5.2% increase in gross domestic product (GDP), meeting the government's official target. This growth, however, masks underlying vulnerabilities that cast a shadow over the 2024 outlook with issues such as a prolonged real estate crisis, diminishing confidence among consumers and businesses, and sluggish global growth. As the world's second-largest economy as well as the largest among emerging markets, China's economic performance in the upcoming year will significantly impact the global market as it navigates these challenges.

At first sight, the 2023 growth rate appears commendable, particularly when compared with the bleak 3% growth recorded in 2022 and the global market’s projected 3% growth for 2023, as indicated by the International Monetary Fund. However, upon closer examination, it became evident that China operated under Zero COVID regulations in 2022, establishing a lower baseline for comparison. Coupled with gloomy economic signals like a 4.6% drop in exports – the first decline in eight years –, enduring deflationary pressures reflected in an average Consumer Price Index of 0.2%, and a diminishing population marking the second decrease in 62 years, China’s recovery following the pandemic might be perceived as feeble at best. Looking ahead to 2024, the economy’s growth is projected to slow further. According to the latest insights from the World Bank, growth is expected to decelerate to 4.5% in 2024.

Read more: Key Takeaways from Consumer Electronics Show (CES) 2024

Figure 1: China’s Slowed GDP Growth

Source: Reuters

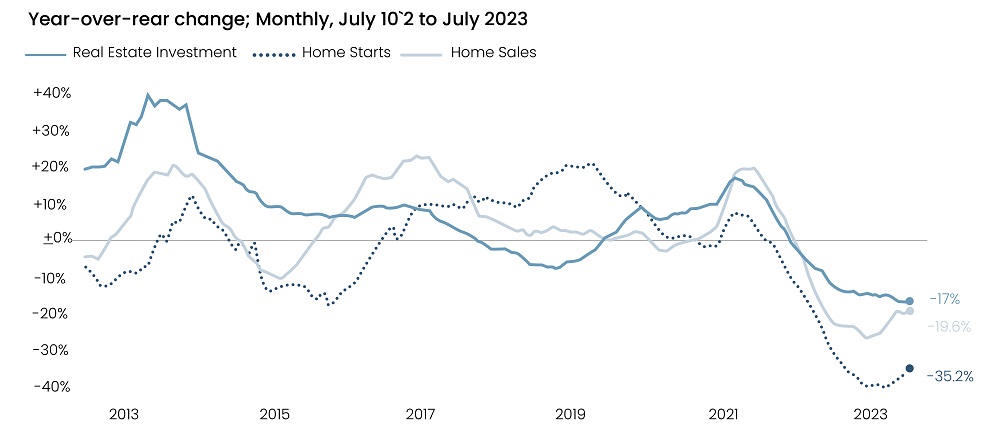

The deepening real estate crisis poses a significant concern for the economy as it grapples with the challenges of slowed growth. The recent court order for liquidation of Evergrande has triggered widespread uncertainty, affecting investors, employees, and awaiting homebuyers amidst China's real estate crisis. Nationwide property sales, which reached a peak of 18.2 trillion yuan or $2.5 trillion in 2021, plummeted in 2022 by 4.9 trillion yuan, marking a 27% decline – the most significant slump since 1998, according to Bloomberg. A housing bubble that emerged before 2020 was a result of debt-driven development, limited investment alternatives for households in a socialist market economy, a modest social safety net, and supportive government policies for the housing sector. To engineer a gradual slowdown, the government implemented the "Three Red Lines" regulations in August 2020, mandating developers to reduce their liability and restraining banks from extending further loans. The ensuing credit crunch, coupled with slower economic growth after the pandemic and established price floors, has contributed to the current crisis. S&P Global predicts that sales could drop to around 10 trillion yuan, reverting the sector's activities to 2015 levels when China's economic output was half its current size.

Figure 2: Percentage Annual Change in Key Real Estate Metrics

Source: Axios

Read more: App Store Monopoly Contested: Value Shifts Towards Application Layer

Moving forward, another challenging aspect is the crisis of youth unemployment and the consequent decline in consumer confidence. In June, the unemployment rate for individuals in the age range 16 to 24 reached a record high of 21.3%, followed by the temporary suspension of data release. Although there has been a notable decrease to 14.9% in December, the rate remains considerably high. According to Wikipedia, the percentage of young adults holding a higher diploma increased from 15% to 54% between 2002 and 2020. Despite more young residents obtaining university and graduate degrees, job creation has slowed down as businesses continue to struggle to recover from three years of stringent COVID-19 restrictions. Furthermore, a regulatory crackdown in the education and technology sectors, which primarily employed millennials and Gen Z workers, has resulted in layoffs that disproportionately affected younger individuals. While policymakers attempt to boost youth employment by providing additional subsidies for companies offering apprenticeships to young, prolonged high unemployment has severely affected domestic demand and economic output.

Weakened domestic demand and escalating geopolitical tensions have contributed to a slowdown in trade. Recent data from China's General Administration of Customs reveals a 4.6% year-on-year decline in exports and a 5.5% drop in imports. The value of goods imported from major partners such as Taiwan, the US, South Korea, and Japan recorded a 12.8% year-over-year decrease in June, narrowing from the 34.1% year-over-year drop in January, per S&P Global. Rising tensions with the US have contributed to this decline significantly. Under the Biden administration, around $360 billion worth of tariffs, along with numerous restrictive sanctions from the previous administration, have been maintained. Additionally, unprecedented export controls, including those affecting the semiconductor industry, have been introduced. Further, in August 2023, President Biden issued an executive order limiting outbound investments to China, Hong Kong, and Macau, specifically targeting industries crucial to US national security, including advanced computing chips and microelectronics, quantum technology, and artificial intelligence.

Read more: Private Investments to Bridge the Climate Funding Gap

As the world's second-largest economy, China's economic performance holds global significance. As per the analysis by the International Monetary Fund, an increase of 1 percentage point in China's growth rate correlates with a 0.3 percentage point boost in global expansion. However, this impact has been twofold. On one hand, the ripple effects have detrimentally affected markets globally by disrupting the flow of goods and services – reducing demand, productivity, and imports. An MSCI index tracking global companies with substantial exposure to China experienced a 9.3% retreat in August of the previous year, nearly twice the decline seen in the broader measure of world stocks. Companies in the luxury goods sector, reliant on a significant consumer base in China, have been particularly susceptible to fluctuations in Chinese demand. Conversely, disruptions have also been observed in capital flows. The appeal of the Chinese bond market to investors has diminished due to interest rate cuts, leading to disturbances. Furthermore, overseas holdings of Chinese sovereign notes now represent the lowest share of the total market since 2019, as reported by Bloomberg.

Nevertheless, this deceleration also carries positive implications for certain economies. The anticipated slowdown in China is projected to exert downward pressure on global oil prices, and the deflationary trend within the country results in a decline in the prices of goods being transported worldwide. This development proves advantageous for nations like the US and the UK, which are grappling with elevated inflation rates. Additionally, emerging markets, such as India, stand to benefit from foreign investment that might be redirected away from China.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.