There is a shift in paradigm in the adoption of technology in the financial sector. The inculcation of digital habits in everyday operations is onsetting new challenges as well as opportunities across all sectors, including banking. While digitization in the banking sector has been initiated already, it is finally picking up the pace as the new wave of competition among banking service providers is on the rise. Banks are now facing unprecedented challenges from non-bank competitors as well as digital-only banks due to the growing significance of digital payments. By 2025, 71.7% of all payments in India are set to become digital.

-

But how are financial institutions responding to changing digital transformations, and how are they impacting all components of banking?

-

Will digital payments and banking transformation shape the industry in 2023 and beyond?

-

What obstacles will stand in the way of success for banks?

In order to get on board with the rapidly changing banking landscape, banks must deal with the existing challenges and offer active customer experiences through innovative strategies and frameworks.

Read more: 7 Trends That BFSI Industry Cannot Ignore Anymore- Get Ready for 2023

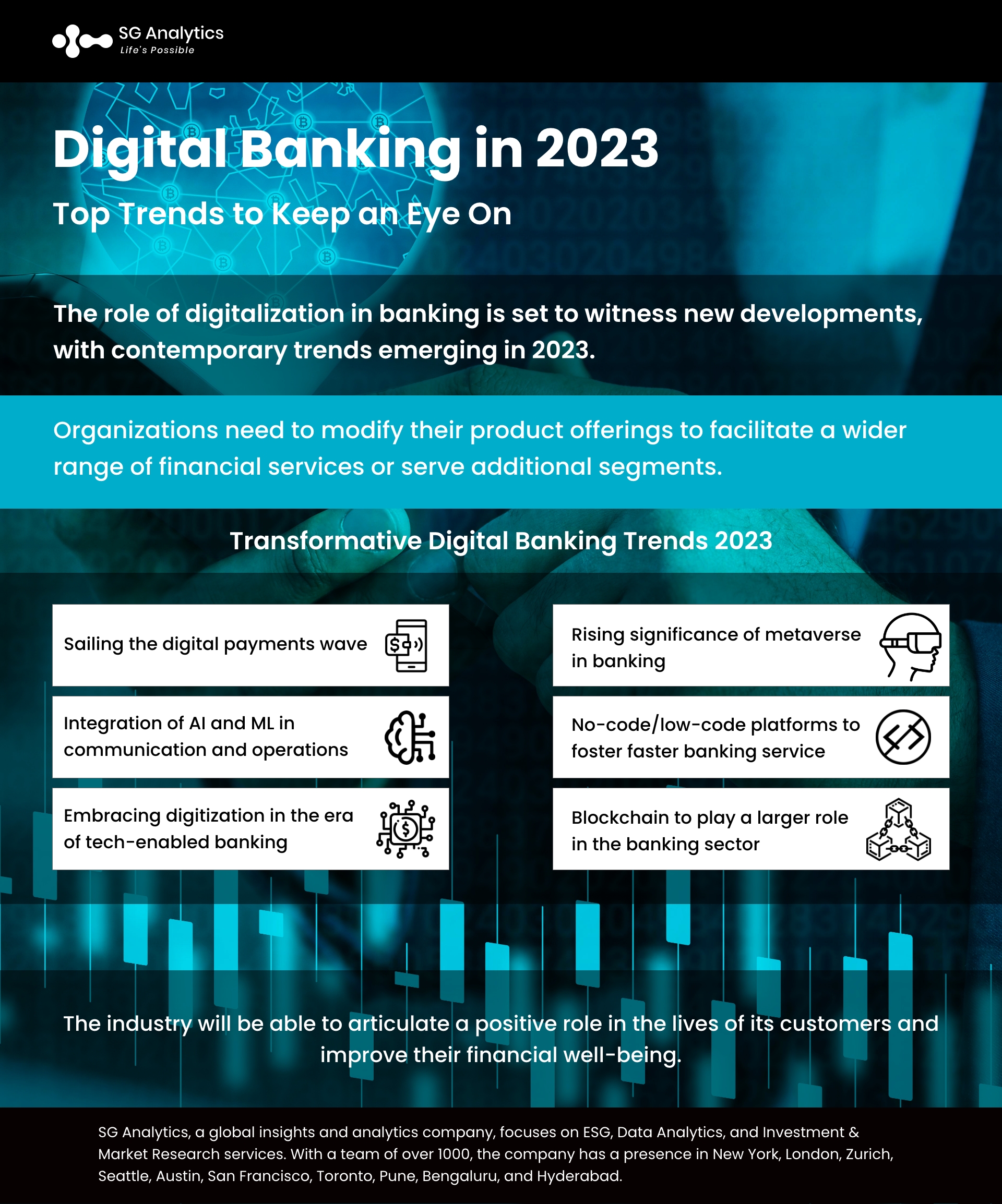

Transformative Digital Banking Trends 2023

2023 is set to witness an increase in the usage of advanced technologies such as artificial intelligence (AI) along with machine learning (ML) that will equip banks to deal with their clients easily. Moreover, the growing demands of consumers to pay for digital commodities in the metaverse are some of the upcoming trends in the banking sector. With the rapidly growing pace of digital payment, some of the crucial trends to look forward to in 2023 are as follows:

-

Sailing the Digital Payments Wave

With the demand for cashless as well as contactless transactions surging, the banking sector is preparing itself to invest and adopt new technologies to facilitate digital payment. 2023 will allow banks to transition into a fully digitized service module by integrating digital banking tools. To get accustomed to changing consumer behavior, banks must ensure that customer solutions are easy to use and engaging. And the growth of online transactions digitally is also initiating quick payment options for performing transitions from anywhere and everywhere.

-

Embracing Digitization in the Era of Tech-enabled Banking

Traditional banks regard fintech startups as their competition due to the rise in the integration of digital technology to offer agility and the ability to transform data. In 2023, the sector will witness banks collaborating with other fintech in reshaping their operations. These associations will not only offer banks with proven tech-enabled banking services, but they will also assist fintech in gaining access to a much broader customer base.

Read more: Investment Banking - Overview, Guide, What You Need to Know

-

Integration of AI and ML in Communication and Operations

The banking sector can benefit from the latest technologies, including AI and ML. While communication across operations has already been simplified with the integration of chatbots and automated responses, banks are now gearing up to use real-time AI-based tools to curate data about their customers. Moreover, AI and ML are enabling the banking industry to identify the requirements of their clients and recognize the problems in the banking landscape. In 2023, banking sectors will be leveraging data collected through new tools and implementing digital strategies for swift business transitions to offer efficient solutions.

-

Blockchain to play a Larger Role in the Banking Sector

With financial activities becoming inclusive through blockchain banking, banks are integrating KYC and other measures that require verification, along with contract execution and data protection. Integration of blockchain enables the banking sector to not allow alteration or deletion of their existing data but also assist in increasing the rate of efficient task completion without intermediaries. In 2023, banks will be able to include measures to regulate and standardize cryptocurrencies mandatory for blockchain technology. Users will be able to trade, exchange, and borrow from their digital currency wallets, which are also emerging as alternate digital currencies.

-

No-code/low-code Platforms to Foster Faster Banking Service

Customer-centric products integrate cutting-edge technology such as no-code or low-code platforms. With technology making it possible for organizations to complete the development of user-friendly programs, it is enabling them to offer their customers significant solutions and easier access, making it simple to handle. No-code/low-code platforms are paving the way for banks to become self-serving instead of relying on external agencies to help them fulfill the role of digitalization. They also offer unprecedented speed, thereby boosting faster and scaled use cases and assisting in rapid application development and deployment.

Read more: Top Trends That Will Shape Investment Banking in 2022

Rethinking Existing Financial Models and Framework

Digital transformation today remains a high priority for the banking industry for a plethora of reasons. The primary one is that it enables them to enhance their efficiency as well as the effectiveness of their operations. By streamlining their operations and automating tasks, financial institutions are able to gain the ability to be future-ready while improving customer experiences.

The rise in digital banking transformations has enabled financial institutions to consider changing their traditional operational framework to meet the changing marketplace's requirements. With new players entering the marketplace, financial institutions need to incorporate the ongoing transition to remain competitive.

The biggest change is the reduction of organizations that perceived themselves as the universal player. The presented decline is estimated to be 60% today to 42% in 2030. This shift in business framework deployment is expected to increase, creating new opportunities for open platform players. Digital payment transformation can result in the diversification of product offerings by banks and other credit unions. Therefore, organizations need to modify their product offerings to facilitate a wider range of financial services or serve additional segments.

With financial institutions prioritizing digital payments and incorporating transformation initiatives, they need to take into consideration the integration of the following megatrends as well-

-

The growing significance of mobile devices and the adoption of e-commerce.

-

The impact of social media on marketing and customer engagement.

-

The threat of cybercrime and the need for cybersecurity.

-

The benefits of big data, artificial intelligence (AI), and machine learning (ML).

-

The potential of cloud computing to enhance speed and scalability.

-

The changing nature of work for employees and customers.

-

The future of emerging technologies like the internet of things, virtual and augmented reality, and Web3.

Read more: Biggest BFSI Trends to Watch out for in 2022

Final Thoughts

The role of digitalization in banking is set to witness new developments, with new trends emerging in 2023. Customers are getting attuned to digitalization in banking, as it is helping them to enhance their banking experience.

But will it help in building a better retailer journey as well as attracting customer loyalty with embedded financial options?

Will fintech digital banking assist in cutting costs for small businesses?

Once the banking industry can find the answers, they will know exactly how to integrate this part of the digital transformation, which will equip businesses to grow and make significant transitions into their banking operations.

In 2023, the ability to anticipate evolving customer needs and design customized user experiences will help in effectively driving intrinsic human behavior and promoting financial well-being. The key to successfully rethinking a banking business model today lies in staying attuned to customers' changing requirements and preferences. The industry will articulate a clear vision for playing a positive role in their customers' lives, improving their financial well-being and driving sustainable behavioral changes. However, they need to explore new opportunities and technologies, thereby enabling businesses to stay competitive and relevant.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A market leader in the BFSI space, SG Analytics assists businesses with insightful, relevant research along with sophisticated technology solutions. Contact us today if you are in search of a BFSI firm that helps in driving value-accretive decisions and executing efficient processes to enhance the efficacy of your investments.