Of all the components contributing to the bright future of fintech, data analytics has a significant role to play. It authorizes fintech companies to make quick and accurate decisions in order to serve their customers better.

Today, data analytics has become a vital tool for the financial industry. The combination of big data and analytics, machine learning, and artificial intelligence is transforming how financial institutions operate. Data analytics is emerging as a critical component of the financial industry, especially in fintech. Fintech companies are leading the development and presenting new and innovative ways to integrate data analytics and improve their services. From creating hyper-personalized social media campaigns to boosting customer engagement, fintech, and big data analytics are working in harmony to create power relationships with customers.

Fintech enterprises are exploring exciting applications of big data analytics to disrupt established financial institutions with a customer-orientated approach. They are incorporating big data insights into their operations to create personalized customer experiences. This increasing emphasis on big data analytics in the financial industry is presenting new possibilities for growth.

Read more: Web 3.0 Marketing Trends 2023: Everything You Need to Know

Use of Data Analytics in Fintech

Fintech enterprises are integrating data analytics to enhance their services in several ways. One of the vital benefits of data analytics in Fintech is the proficiency to personalize services. By analyzing data on customer behavior, Fintech enterprises can design tailored products that meet the customer's specific needs.

Data analytics is also being integrated to mitigate risk in the industry. Fintech organizations offering lending services use data analytics to assess the creditworthiness of the applicant. By analyzing data on a borrower's financial history, along with their credit score, income, and employment status, the lender can predict the likelihood of the borrower repaying the loan.

Fintech companies are also making use of data analytics to identify new market opportunities. By scrutinizing consumer behavior and new trends, they can identify the gaps within the market and design new products and services to fill the gaps.

Data Analytics Benefits

Data analytics presents a plethora of benefits to Fintech companies.

-

First and foremost, it enables financial organizations to design more personalized services and products for their consumers. By analyzing data on customer behavior, enterprises can gain insights into the customer's needs and preferences and develop tailored solutions to meet those requirements.

-

Data analytics is also assisting fintech organizations to strengthen their risk management practices. By using data, they can assess creditworthiness and other risk factors, thus enabling fintech lenders to reduce their exposure to bad debt and other losses.

-

Another significant benefit of data analytics in fintech is improved fraud detection. Fintech enterprises offering digital payment services and other financial solutions are vulnerable to fraud. By integrating data analytics into their operations, they can identify patterns of fraudulent behavior and take proactive measures to prevent fraud, thereby protecting their customers' assets.

-

Data analytics is helping fintech organizations to explore and identify new market opportunities. By examining consumer behavior and market trends, they can identify the growing demands for new products and services. This can further aid in driving growth and revenue for the firm.

Read more: Is ESG & Sustainability the Next Big Thing in the Finance Industry

Data Analytics Reshaping the Fintech Ecosystem

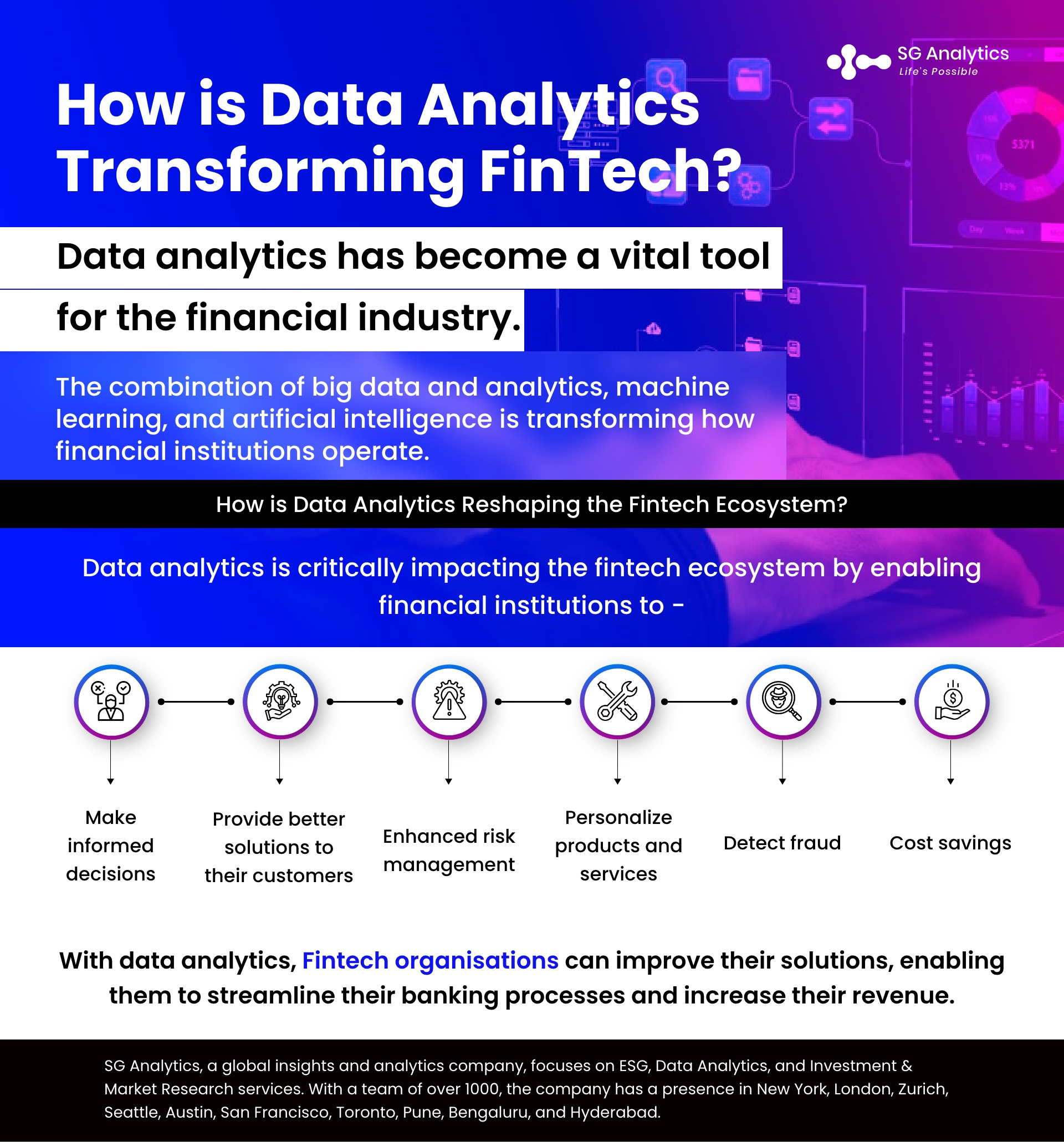

Data analytics is having a critical impact on the fintech ecosystem, enabling financial institutions to make informed decisions and provide better solutions to their customers. Let's explore a few ways in which data analytics is reshaping the future of fintech:

-

Enhanced risk management: With data analytics, financial institutions can assess risk and make more accurate predictions about future trends. This further equips them to make more informed decisions as well as manage their portfolios effectively.

-

Personalization of products and services: By analyzing customer data, fintech enterprises can tailor their products and services to meet the preferences of their customers. They can offer personalized investment recommendations along with customized insurance policies and credit offers.

-

Fraud detection: Data analytics is empowering financial institutions to identify and prevent fraud in real-time by analyzing patterns in transactional data. This further helps in preventing losses due to fraudulent activities.

-

Cost savings: By automating data analysis tasks, fintech organizations can reduce their cost of operation and improve efficiency. This can prove beneficial for smaller fintech startups with limited resources. Data analytics plays an integral role in the fintech ecosystem and is set to reshape the industry in the coming years.

How is Data Analytics Influencing the Customer Experience in FinTech?

Emerging fintech organizations are unlocking the power of data analytics to predict customer behavior and design sophisticated risk assessments. The velocity of real-time data offers disruptive fintech the agility to adapt to changing market trends. This ability to process large data sets enables fintech enterprises to make smarter decisions and create personalized customer experiences.

More and more Fintech platforms are incorporating data analytics to study and understand consumer behavior and market trends with new advancements in technology. It is assisting them to improve their services and thereby better meet customer requirements.

Read more: Will Big Tech be the Ultimate Financial Services Disruptor?

-

Data Security Improvements

Fraud is a growing cause of concern for the banking industry, especially with mobile banking gaining more traction. However, Fintech enterprises are using big data and machine learning to build fraud detection systems to detect unwanted anomalies and illegal activities like suspicious transactions and logins in real-time.

-

Personalization with Chatbots

The fintech industry is using the power of data analytics to personalize chatbots for customer service. AI chatbots have access to raw data, authorizing them to answer customer queries accurately.

-

Securing a Frictionless Multi-channel Experience

Changing consumer preferences and the growing market share have enabled financial institutions to embrace multi-channel delivery. FinTech enterprises have access to real-time data, enabling them to interact with users about their products and features. To ensure consumers have a satisfactory experience, fintech enterprises are using data analytics to fine-tune their services and meet the customer's needs. They are also using historical and real-time data to identify potential customer issues.

-

Risk Assessments

Data analytics companies in the fintech sector can combine information from multiple sources to ensure no stone is left unturned. Improved risk assessments allow fintech to operate with more financial certainty, manage cash flow, and offer customers competitive rates. Predictive analytics is also changing the way financial institutions think about risk.

-

Enhanced Customer Service

Big data analytics is helping fintech enterprises in creating a digital log of a customer's banking activities to identify potential errors as well as to offer seamless support. Data and forecasting are also enabling fintech to recommend the right solutions based on their customers’ spending behavior.

Read more: Innovation in Defense Tech: Private Funding Opportunities on the Rise

Final Thoughts

Data analytics, due to its technological foundation, is presenting profit-generating opportunities and challenges for the fintech sector. It empowers innovators to advance hundreds of digital and technology industries, creating new sources of profit and better customer experiences, thus shaping the way we live. Data analytics in fintech has helped incubate the sector and is continuing to expand.

As a fast-growing industry, fintech is absorbing all the insights and approaches that assist in offering an additional boost to its digital ecosystems. The architecture of digital banks is flexible, enabling them to integrate their operations with modern services and use the latest data mining solutions. With data analytics, fintech organizations are able to organize and improve their solutions, enabling them to streamline their banking processes and increase their revenue.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A market leader in the BFSI space, SG Analytics assists businesses with insightful, relevant research along with sophisticated technology solutions. Contact us today if you are in search of a BFSI firm that helps in driving value-accretive decisions and executing efficient processes to enhance the efficacy of your investments.