Industry experts have estimated that the novel coronavirus will cost the luxury retail industry approximately $40 billion. Luxury retailers across the world are scrambling as companies brace themselves for the adverse impact of COVID-19 on business. The new strain of coronavirus has colossally affected the international luxury retail industry, which is highly dependent on the Chinese market. As businesses grapple with the short-term disruption triggered by the pandemic, decision makers are devising new strategies by analysing the amount of damage perpetrated by the deadly human-to-human transmitted disease. In this mode of crisis, companies are formulating operational checklists for their emergency response teams, with safety of their customers and employees staying paramount, they are envisioning an eventual recovery.

Watching China succumb to the rippling effects of the novel coronavirus, striving to meet the demands of both the customers and workers, is proving to be a learning curve for other countries such as Italy, France, Spain, South Korea, Japan, the US and UK etc. The onset of the pandemic has led the luxury goods and retail stocks to slip drastically in China. The footfall in the retail stores has dramatically decreased all over the world, forcing companies to close most of their stores. This is tremendously impacting the sales and in-turn the revenue of luxury brands.

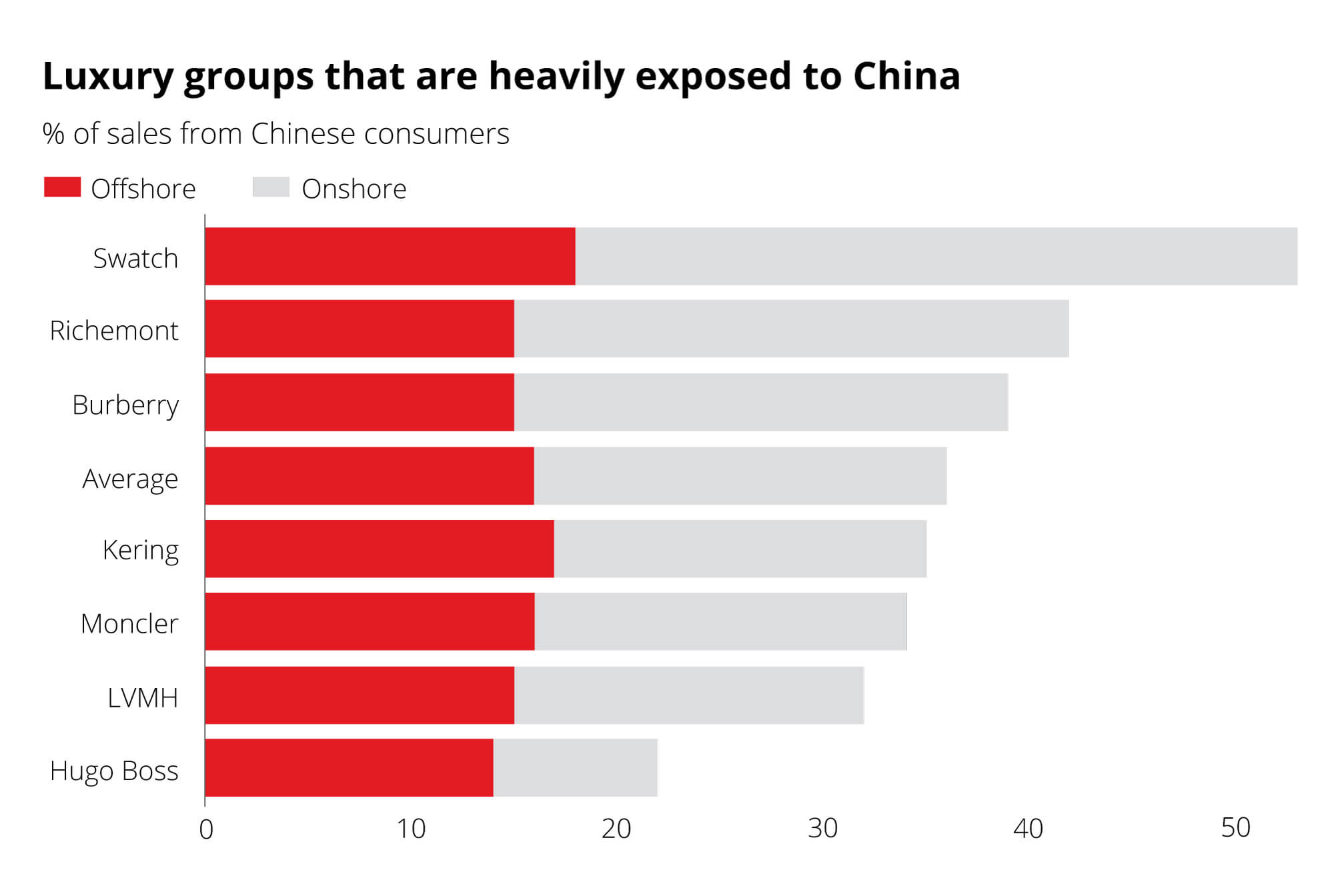

As most countries start to practice social distancing and embracing lockdowns, the luxury retail market continues to lurch miserably. According to luxury retail industry experts, the sector is facing its worst crisis since the global recession of 2008. Jefferies, an investment bank, estimates that 40 per cent of the 281 billion euros spent on luxury products globally last year was generated by the Chinese buyers, driving over 80 percent of sales’ growth in the sector. This makes the Chinese market a hot spot for the luxury retail business.

Source: RBC Capital

Coronavirus has definitely taken a toll on the New York, Paris, Milan and London fashion weeks. With celebrated designers cancelling their fashion shows, the sales of the luxury brands have gone for a toss. Retailers are compelled to deal with unprecedented situations which are pushing the luxury retail segment into a dark phase. A survey estimates that products worth approximately 15 million will go unsold in China, forcing companies to reroute the products to other parts of the world. Since most of the countries are experiencing nationwide lockdown, it can be estimated that the products will remain unsold until the situation comes under control.

Chinese tourists enjoy spending on luxury goods and are huge contributors to sales in the fashion capitals of the world such as Paris, NY city, Tokyo etc. Travel restrictions have gravely affected the dynamics of the luxury retail industry. Companies having products which have longer in-store life such as watches, handbags will recoup from their losses but seasonal products like clothes would lose their sale permanently.

Impact on China

People are calling coronavirus a “disaster” for the luxury brands as the Chinese tourism has evaporated drastically.

- A sudden halt in the sales of luxury goods.

- Sales became either zero or slipped below 80 percent.

- Coincidence of the outbreak with the Lunar New Year festival resulted in manufacturing come to a standstill.

- High end footwear and apparel brands are reliant on China for their supply chain. Increase in logistics cost and order backlogs added to the threat to global trade.

- With exports worth more than $280 billion a year makes China the world’s largest textile producer. Analysts have predicted that retail stores might soon start to show shortages, even though the fashion industry keeps its stock well in advance.

Impact on Italy

As coronavirus cases continue to rise in Italy, the country has gone into a complete lockdown, shattering the equity of the luxury retail industry to an all time low. Below are some impacts due to the lockdown:

- Big names such as Louis Vuitton and Stella McCartney depend on Milan, Italy for the manufacturing of their products. With the whole country subsuming to lockdown, it will be impossible to continue the production.

- Northern Italy is the hub for over 60% of the textile and cloth manufacturers in the country while, the southern part is famous for its leather goods and jewellery. Leather is one of the best performing luxury brands, having the capability to single-handedly save a brand from losses.

- Luxury brands are perplexed about both manufacturing and sale issues.

- Cancellation of orders from across the globe has impacted the entire supply chain.

- Most designers showcased their Summer/Spring collections before the scale of coronavirus was known. Brands have spent millions of dollars on the inventory but, no sale yet.

Impact on the US

For the western luxury retailers, the impact won’t be seen immediately but, since most high-end brands rely heavily on Chinese imports, the stores will have a month less of inventory in their pipeline. The impact on the shelves will mostly be seen sometime over next month to six months. Market in the United States has now started to decelerate given that people are resorting to social distancing. Now that people are afraid to step out of their homes, the retail stores are having scarce walk-ins which is resulting in low sales.

Some prominent fashion groups in the United States have also slashed their profit forecasts last month. The parent company of Michael Kors, Versace and Jimmy Choo – Capri Holdings, announced that its sales outlook for the quarter was reduced by $100 million after the closure of 150 of its 225 stores in mainland China. Similarly, Tapestry, the owner of Kate Spade, Coach and Stuart Weitzman stated that it was expecting its sales to drop by $250 million.

How are luxury brands coping?

To curb the outbreak, major luxury brands have clamoured to publicly donate money. Louis Vuitton Moet Hennessy LVMH recently stated that it contributed $2.2 million to the Red Cross Society of China recently. After a few days, Richemont donated $1.4 million while, Kering donated $1.1 million to the same cause. Britain’s Burberry was prompted to scrap its previously announced outlook due to the coronavirus crisis. It had to close 24 of its 64 stores in mainland China while, the remaining stores operated at reduced hours. Due to nationwide lockdown, the traffic coming into the store fell tremendously. With restrictions imposed on travel, the sales of Burberry worsened over the weeks. Similar challenges were faced by all the luxury brands where they lost business very steeply. Shares of LVMH Moët Hennessy – Louis Vuitton SE plunged approximately 2.49% during the initial phases of coronavirus. A quarter of Ralph Lauren products are made in China, declining the rate of manufacturing.

Conclusion

The economic disruption caused to the luxury retail industry due to the novel coronavirus is devastating. The regions which are majorly directly dependent on the Chinese market and tourists are the most affected ones. Due to the proliferation of technology and globalization, retail industry – like other industries is connected more than ever now. Hence, we can say that, in the case of luxury retail, if China sneezes, the whole world catches a cold! The luxury industry is vulnerable to any slowdowns in China. About one third of the spending on luxury goods globally, both local and foreign purchases, is accounted by the Chinese shoppers. Some believe that businesses might not get back to normal even by the end of 2020, the surveyed luxury executives were sanguine about their prospects long-term. Most companies expect to bounce back to their previous sales targets by next year.

Some non-luxury brands have also faced the wrath of coronavirus such as Adidas. It recently shared that it lost over 85 percent of business in China. Sports apparel brand, Under Armour, predicted that it could lose up to $60 million in sales. Analysts are trying to predict the timeline of this crisis. Questions like when will this disruption end and when will the people be able to get back to their businesses and lives safely are boggling our minds. Facing this crisis for a month with no sales is always better than suffering for indefinite months. The luxury industry will face the burns of COVID-19 but hopefully, recover from it soon enough.