The credit market is potentially facing one of its toughest periods since the 2008 financial crisis. With more companies struggling to pay off their debts, losses are starting to mount, especially for non-investment-grade companies. Traditional bank lenders have pulled back from lending to the lower-middle market in the US. Against this backdrop, private credit providers such as asset managers, private equity (PE) funds, and insurers are turning their attention to private credit as an alternative.

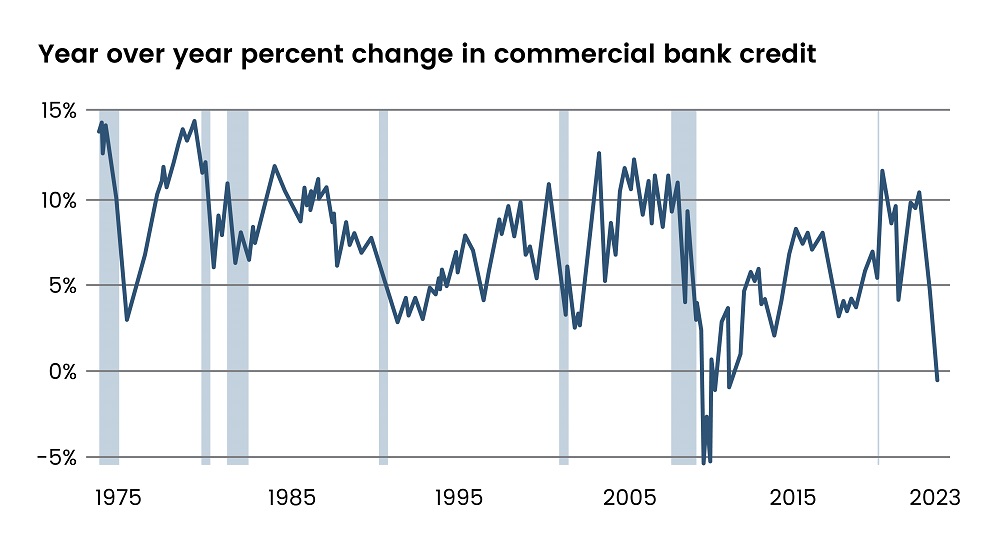

Commercial bank credit has seen a pronounced dip since 2Q23, as Federal Reserve data reveals negative growth rates in bank credit. The hike in the Fed’s interest rates and the fallout from the US regional bank failures this year have directly resulted in tightened standards for lending and higher interest rates to compensate for the higher interest paid out to depositors. Additionally, regional banks have been struggling with deposits. US commercial banks’ deposits are currently at the level of $17.28 trillion, down from $17.80 trillion a year ago - a fall of 2.90%.

Read more: US VC Landscape: Navigating Change and IPO Momentum

Figure 1: Slowdown and Contraction of Bank Credit Growth

Source: Reuters

The financing landscape for middle-market firms has evolved, with a notable shift from traditional bank loans to alternative funding sources. Where 74% of such firms once relied on traditional bank lending in 2015, that figure has since dropped to 56%, per a survey by RSM US. Additionally, 56% of the executives expressed a growing reluctance to secure funding from commercial banks, with 60% now engaging with private lenders for capital.

With global PE dry powder of $2.49 trillion, as reported by Preqin in July 2023, and the highest interest rates in 22 years, private lenders are primed to step in and address this trillion-dollar market. Private lending to the middle market has emerged as a key avenue for investment opportunities for several reasons.

Surging Demand for Private Credit

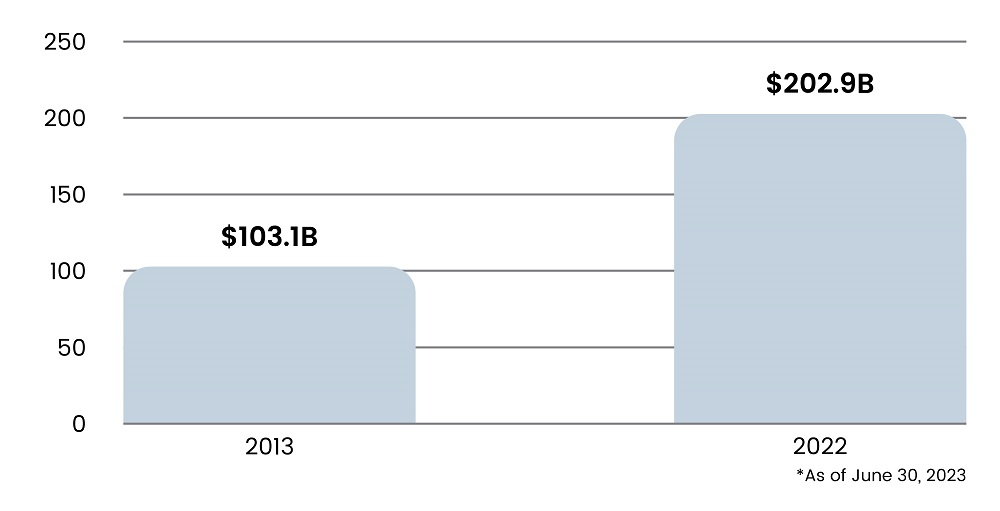

According to Voya, $4 trillion in middle-market loans are set to mature by 2027, creating strong demand for refinancing. Additionally, debt financing continues to gain popularity as startups look to remain private longer in a climate of struggling valuation. The median age for a company at its IPO increased from 6 years in 1980 to 11 years in 2021, as reported by Nasdaq. The resulting surge in capital demand relative to supply enables private lenders to command greater risk premiums and set favorable terms. Total capital raised through private debt fundraising has gone up from $103.1 billion in 2013 to $202.9 billion in 2022, according to Pitchbook. Private debt in just the first six months of 2023 has attracted $94.9 billion in committed capital and is projected to exceed $200 billion.

Read more: Key Takeaways from Biden’s Executive Order on AI

Figure 2: Increase in Private Debt Fundraising Activity

Source: Pitchbook

Opportunities for Risk Mitigation

The traditional notion that lending to lower-middle market firms implicates a high degree of credit risk isn’t necessarily the case. An analysis published by Moody’s demonstrates that a company’s overall financials matter more than its size when estimating risk, highlighting that overemphasis on a company’s size can lead to missed investment opportunities. A risk assessment model based on financial ratios identifies riskier large firms and safer smaller firms, allowing investors to diversify and, consequently, mitigate risk. The Proskauer Private Credit Default Index reported a decline in the default rate of companies with EBITDA under $25 million from 2.1% in Q322 to 0.7% in Q323, highlighting the resilience of private credit in a turbulent economy.

Avenues for Portfolio Diversification

With a slowdown in private equity, there is a growing need for portfolio diversification. A study showed that 71% of study participants stated that the primary driver to invest in private credit was portfolio diversification. This was particularly true for financial advisors whose clients were seeking returns uncorrelated to public equity and fixed-income markets. Since 2000, middle market loans’ correlation to the S&P 500 and US Treasury Bonds have been 0.34 and 0.19, respectively.

Additionally, lower-middle market loans carry a significant yield premium due to their comparative illiquidity, lenders’ flexibility to tailor loan terms, and structure deals to meet the specific needs of the borrower. As reported by Blackrock, private senior and unitranche loans typically deliver a premium of between 150bps and 300bps, significantly higher when compared to publicly traded loans. The benefit of this yield premium is amplified by the loans’ floating rate structure.

Read more: Big Tech’s Big Generative AI FOMO

For these three primary reasons, various companies are trying to capitalize on this unique market opportunity. For example, LongWater Opportunities, a lower-middle-market PE firm, recently expanded its business to provide private debt. Preqin reported that new funds in North America raised $36.4 billion in the second quarter of 2023, including Comvest Partners’ $2 billion fund and Proterra Investment Partners’ $500 million.

The middle market in the United States, with over 200,000 companies, constitutes about one-third of the US private sector gross domestic product. With traditional lenders stepping back, demand for private financing increasing, and opportunities for portfolio diversification and risk mitigation abounding, the market is ripe for private credit providers to step in.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.