The Fed’s recent decision to cut rates, its first reduction since 2020, signals a positive revival in M&A activity by reducing borrowing costs and boosting dealmaker confidence. With inflation nearing the Fed’s target, further cuts are expected, though the timing remains uncertain, adding complexity to the M&A outlook.

Policymakers had anticipated a cut of 25 bps, but the Fed opted for a more aggressive stance by reducing the rate cut by 50 bps. The cut was imminent as inflation in the US eased towards the central bank’s target of 2% and unemployment rose to a three-year high. The trajectory of the future rate cut is evident; however, the timing and extent of reduction are still unclear. J.P. Morgan Research expects the Fed to cut rates by another 50 bps at its next meeting in early November.

For the past couple of months, there was a divergence between the Fed’s and other central bank policies. The European Central Bank (ECB), which started reducing its interest rates in June 2024, temporarily benefitted the European sponsors with lower debt costs and boosted M&A activity. Consequently, the gap in deal-making between Europe and the US started to close. The impact of monetary easing is already evident in Europe, where the ECB, Swiss National Bank, and Sweden’s Riksbank reduced interest rates in 2Q24. This policy shift contributed to a 17% increase in European M&A deal value compared to the previous quarter, as reported by PitchBook.

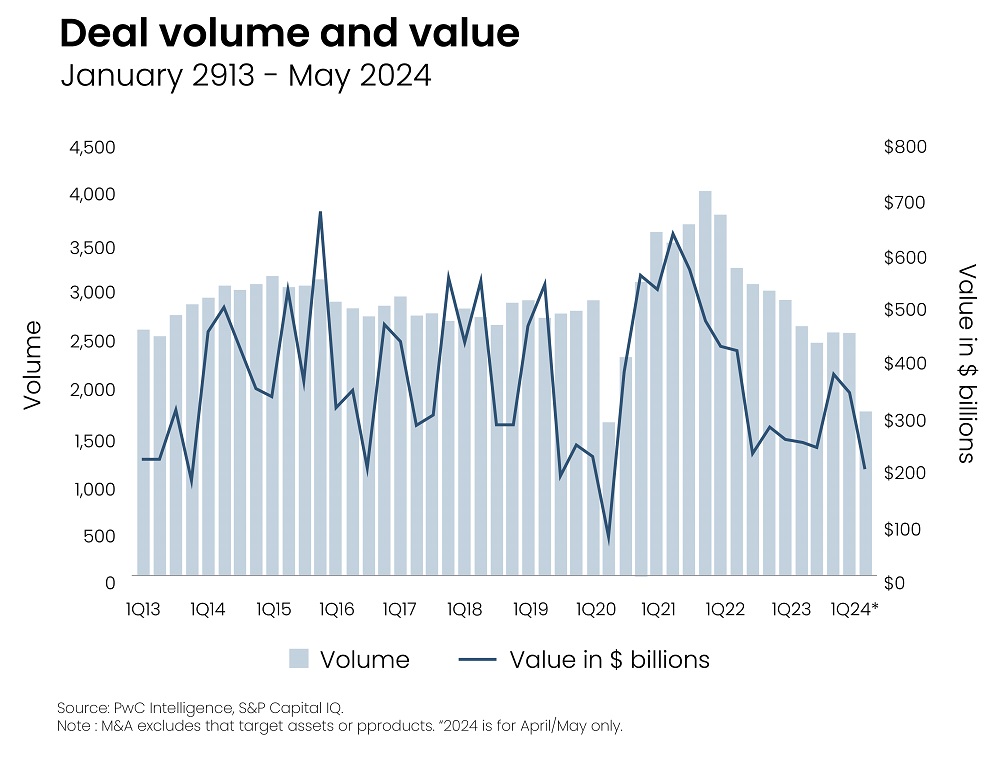

Figure 1. US Deal Volume and Value

Source: PwC

Note: M&A excludes deals that target assets or products. *2Q24 is for April/May only

The total US deal value for the first five months of 2024 reached $535 billion, marking an increase of nearly 30% compared to $412 billion during the same period last year, according to PwC. In the 1H24, the technology services sector in the US dominated the M&A activity, both in terms of number of deals and transaction value.

Read more: US Merger and Acquisition (M&A) 2H24 Outlook

Strategic buyers use leverage more conservatively than PE, focusing on unlocking greater synergies from the combined entity, especially in the case of mergers of equals, where they can avoid significant cash or debt financing. Historically, corporate US M&A deal volumes have been relatively stable, with around 1,000 deals exceeding $100 million annually. The PE-related deal flow, on the other hand, being rate-sensitive and mostly debt-driven, lagged in dealmaking owing to costly debt-financing and fundraising challenges until 2Q24. General Partners (GPs) used several strategies to overcome the exit bottleneck, such as outright sales with minority roll-overs, continuation funds, and partial exits, according to Pitchbook. Despite some recovery, with the US M&A deal involving financial buyers reaching its highest level since May 2022 in April 2024, further rate cuts are expected to provide additional momentum, helping financial buyers emerge from their two-year dealmaking slump.

Significant dry powder is expected to ramp up the M&A activity for strategic and financial buyers, according to Pitchbook. As of early May, PE firms in the US hold over $1 trillion in dry powder, according to Preqin. Strategic buyers also have significant cash reserves for growth and are well-positioned to act decisively when market conditions are attractive.

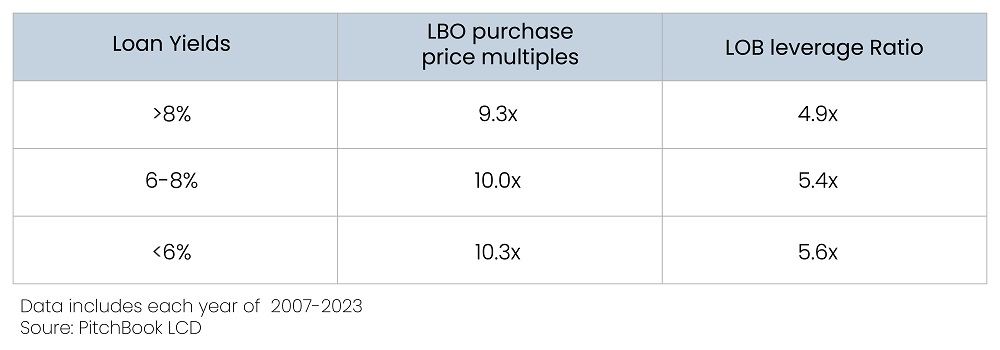

Valuation Multiples and Leverage Dynamics

Figure 2: Annual Averages for LBO Valuation Multiples and Leverage Ratios in the U.S.

Source: Baird

Statistically, there is a strong relationship between valuation multiples (for example, EV/EBITDA) and leverage ratios (for example, Total Debt/EBITDA), i.e., higher debt levels are associated with a rise in valuation multiples. Consequently, the new loan yields are expected to fall dramatically as the Fed reduces interest rates. High purchase multiples indicate robust earnings potential and the company’s ability to service large amounts of debt. On the flip side, acquirers using high leverage will offer more competitive bids without increasing the amount of equity they contribute, driving the valuation of the target company.

Read more: Impact Fund Opportunity: Spotlight on Emerging Managers

Macroeconomic Landscape

Although Fed rate cuts typically trigger a surge in M&A, a looming fear of recession could curb this expected uptick. Historically, rate cuts often precede recessions; some would take years to follow, and others occur immediately after the cut. The Fed has had six cutting cycles since 1990, excluding the rate cuts in the pandemic. On average, the economy has entered a recession 18 months after the Fed began cutting interest rates. In such a case, companies will be reluctant to indulge in M&A activity and prefer organic growth to safeguard themselves from economic downturns.

The economy would experience inflated asset prices, and some companies would overpay for the targets, which would hamper their returns in the long run. On the other hand, consumer-driven industries would face liquidity issues in a slowing economy with higher unemployment due to low consumer demands and reduced disposable income. They would seem unattractive as targets, but financially stronger firms will see this as an opportunity and buy these distressed firms at a discounted valuation.

Conclusion

In the foreseeable future, companies with significant debt will pursue deleveraging before pushing acquisitions. Additionally, there will be a flux in M&A in the technology sector, especially AI, as it will create opportunities, bring innovation, and pace the M&A activity. In the long term, cheaper financing will lead to strategic expansions as companies focus on acquiring the right capabilities and divesting the non-core assets for the sustainability of their business, leading to a surge in M&A deals as economic uncertainty declines. Finally, higher corporate valuations are anticipated following the overall economic recovery after the rate cuts.

Partner of choice for lower middle market-focused investment banks and private equity firms, SG Analytics provides offshore analysts with support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.

About SG Analytics

SG Analytics (SGA) is an industry-leading global data solutions firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company with a team of over 1200 employees and a presence across the U.S.A., the UK, Switzerland, Poland, and India.

Apart from being recognized by reputed firms such as Gartner, Everest Group, and ISG, SGA has been featured in the elite Deloitte Technology Fast 50 India 2023 and APAC 2024 High Growth Companies by the Financial Times & Statista.